Prior to the emergence of AltIndex, investors struggled to keep up with emerging trends in the stock, ETF, and crypto investment landscape. This dilemma was caused by the absence of a reliable tool or platform that could provide up-to-date data to help investors make informed decisions.

But, with the presence of AltIndex, investors can now make better investment decisions with alternative data. As the game-changer, it provides broad investment insights on three asset classes – stocks, cryptocurrencies, and ETFs. In this review, we will cover everything you need to know on AltIndex.

Overview Of AltIndex

By providing vast and timely insights on stocks, cryptocurrencies, and ETFs, AltIndex has demonstrated itself as a game-changer. This reputable platform gathers and dissects data from various non-traditional sources.

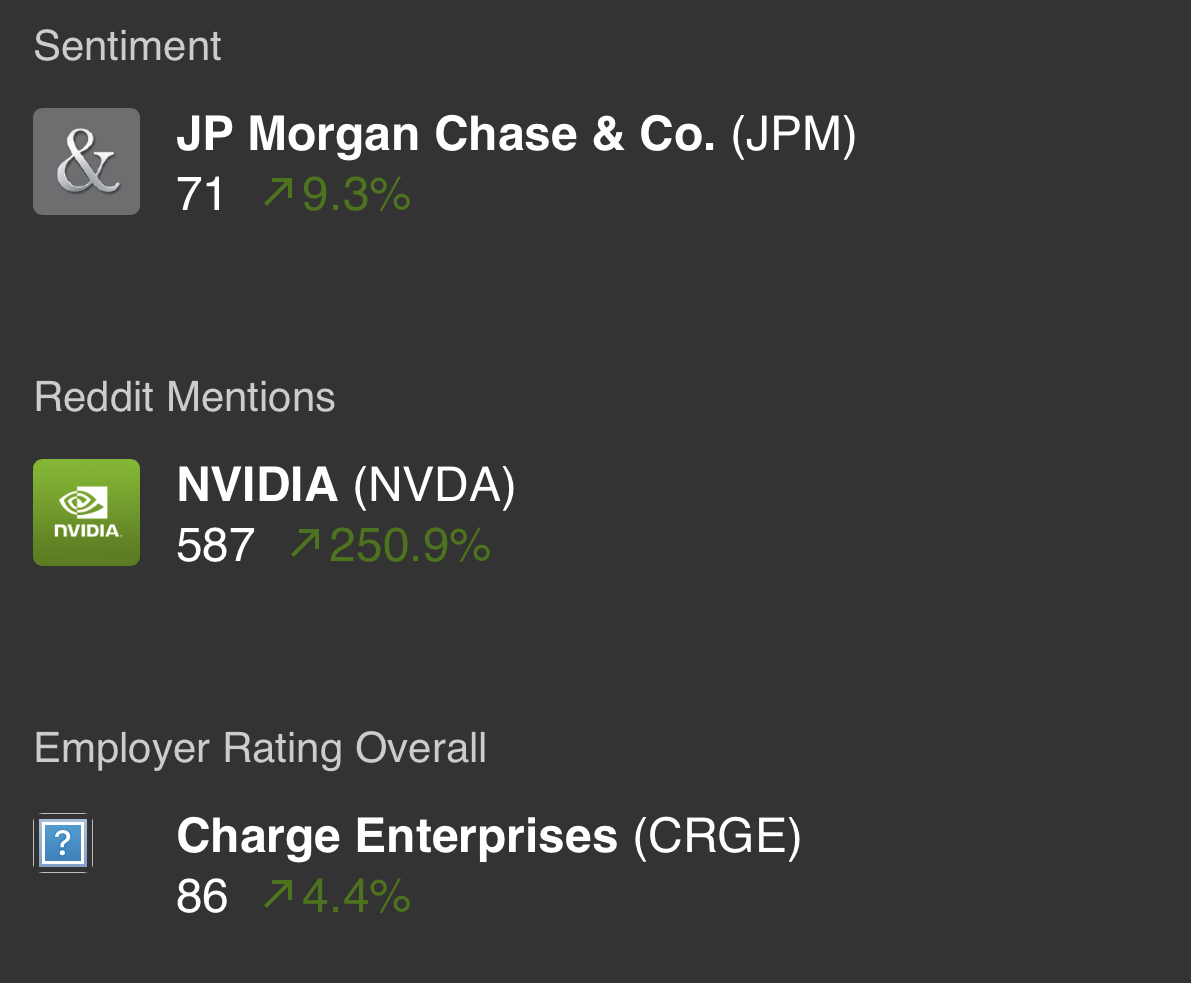

It leverages aggregated data gathered from sources like Facebook, Twitter, Reddit, Google Search, and News Mentions to help investors make informed investment decisions. Beyond social media sentiment analysis, AltIndex also explores other alternative data points to broaden its scope.

More so, the platform, through its Artificial Intelligence infrastructure, studies general opinions on a stock, ETF, or cryptocurrency through pointers like trends, followers, likes, comments, recruitment efforts, layoffs, expansion efforts, views, and shares. Guided by this broad data, AltIndex rates the investment potential of the stock, ETF, or crypto.

For instance, if the general discussion about a trending stock on Reddit is positive, AltIndex will rate it highly. More so, the provided rating will be based on a score point between 1-100, offering users a direct clue about which investment decision to take.

Here is another dimension to how AltIndex works. The platform can rate a publicly listed cryptocurrency exchange low if the firm embarks on a substantial layoff. In such a situation, it is understandable that a crypto exchange that is reducing its workforce by a noticeable ratio could be under market pressure.

There’s no doubt that this pointer is a negative one and implies that the stock value of such a company could dip. It is no rocket science that adding this kind of stock to your portfolio could inflict immeasurable losses.

After generating ratings on the investment potential of stocks using AI, AltIndex will send its recommendations to users through their mail. In addition, the analytics platform will help you track your portfolio keenly through its timely stock alerts.

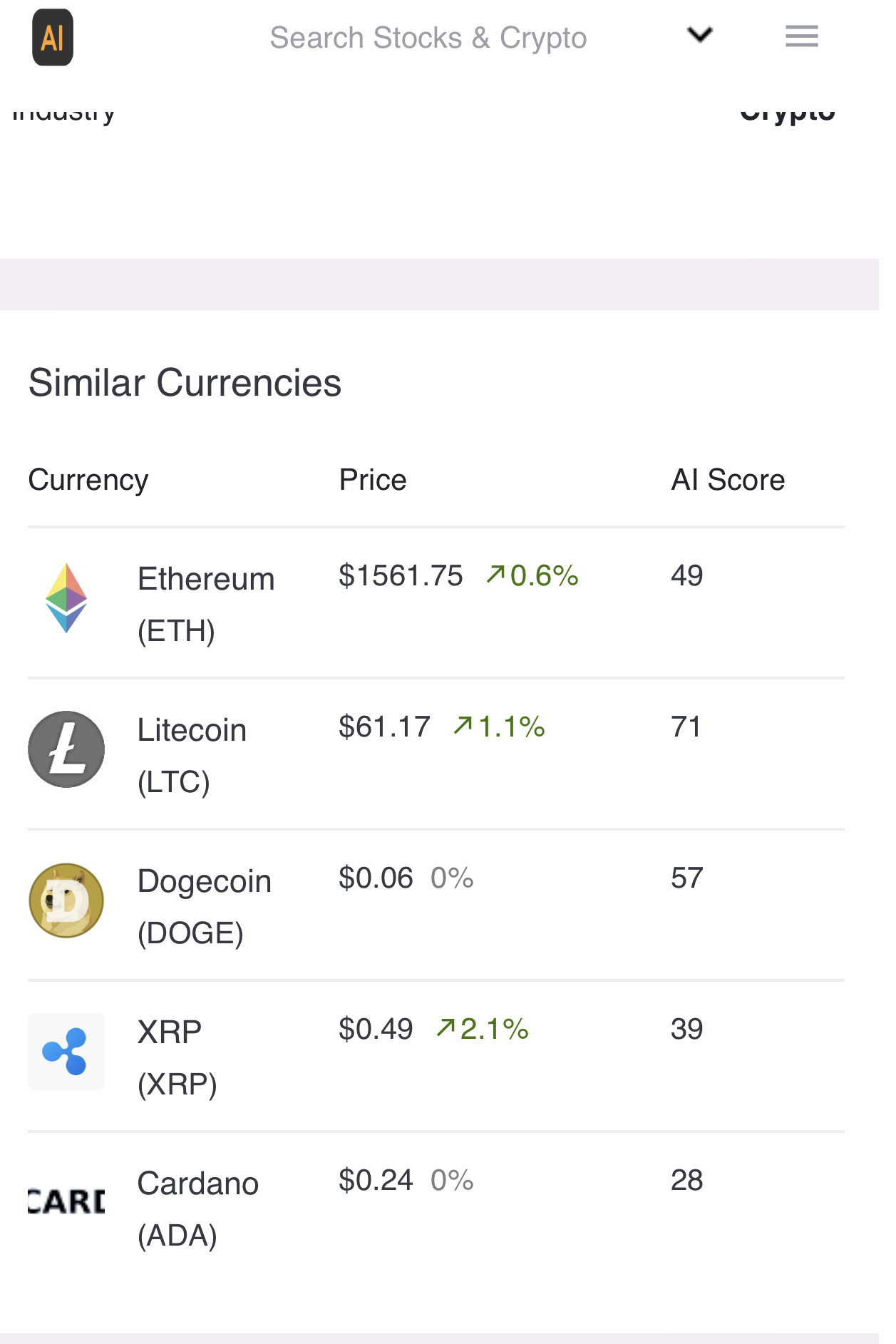

Through its exhaustive approach, AltIndex also helps you keep an eye on the best crypto assets to invest in. The crypto segment covers prominent cryptocurrencies like Bitcoin, Ethereum, Litecoin, Ripple, Binance Coin and Solana. Hence, you can get to realize the next cryptocurrency to record market success through its extensive insights.

Meanwhile, access to these amazing services comes through free and paid plans. AltIndex allows users to explore its features freely, providing them with enough time to decide on making a subscription or not. The free plan will provide users with the opportunity to explore some of the available services of the platform within a limited period of time.

Nonetheless, the non-subscription pathway to this innovative platform has numerous limitations that make the paid plans the best gateway to AltIndex. Later in this review, we’ll provide more insights into the available subscriptions on AltIndex.

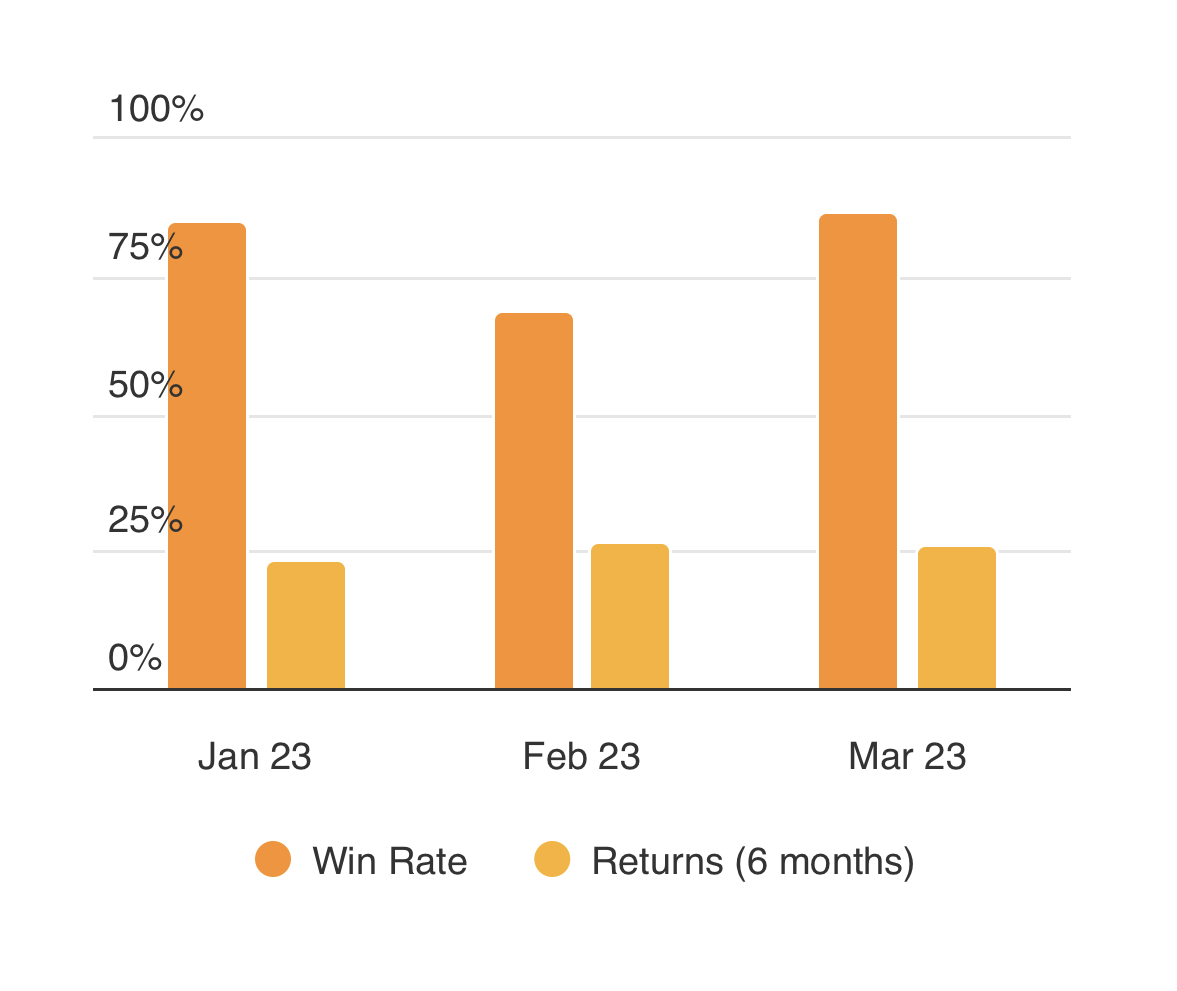

Without any doubt, AltIndex’s innovative approach to stocks, ETFs, and crypto price analyses have proven to be effective. Stock picks, as the major feature of the platform, has a 75% win rate for a six-month period. The projection indicates that AltIndex has continued to outperform some of the established traditional investment tools.

At the sight of this remarkable success, AltIndex has managed to attract a host of users and investors. In July, PSY Ventures, a renowned venture capital company that invests in disruptive technologies made a seed investment in AltIndex. There is no doubt that this financial injection will further place AltIndex at the forefront of the alternative data industry.

Lately, the industry is enjoying a rapid boom. There is a projection that its global market value will hit $17.35 billion by 2027. According to analysts, the growing relevance of alternative data will help the industry to grow at a CAGR of 41.1% between 2020 to 2027. Consequently, we expect AltIndex to lead the charge of this projected growth as a result of widespread acceptance and adoption.

Services Offered by AltIndex

AltIndex has become a force to reckon with in the alternative data research and analytics landscape. Below are some of the available services on AltIndex:

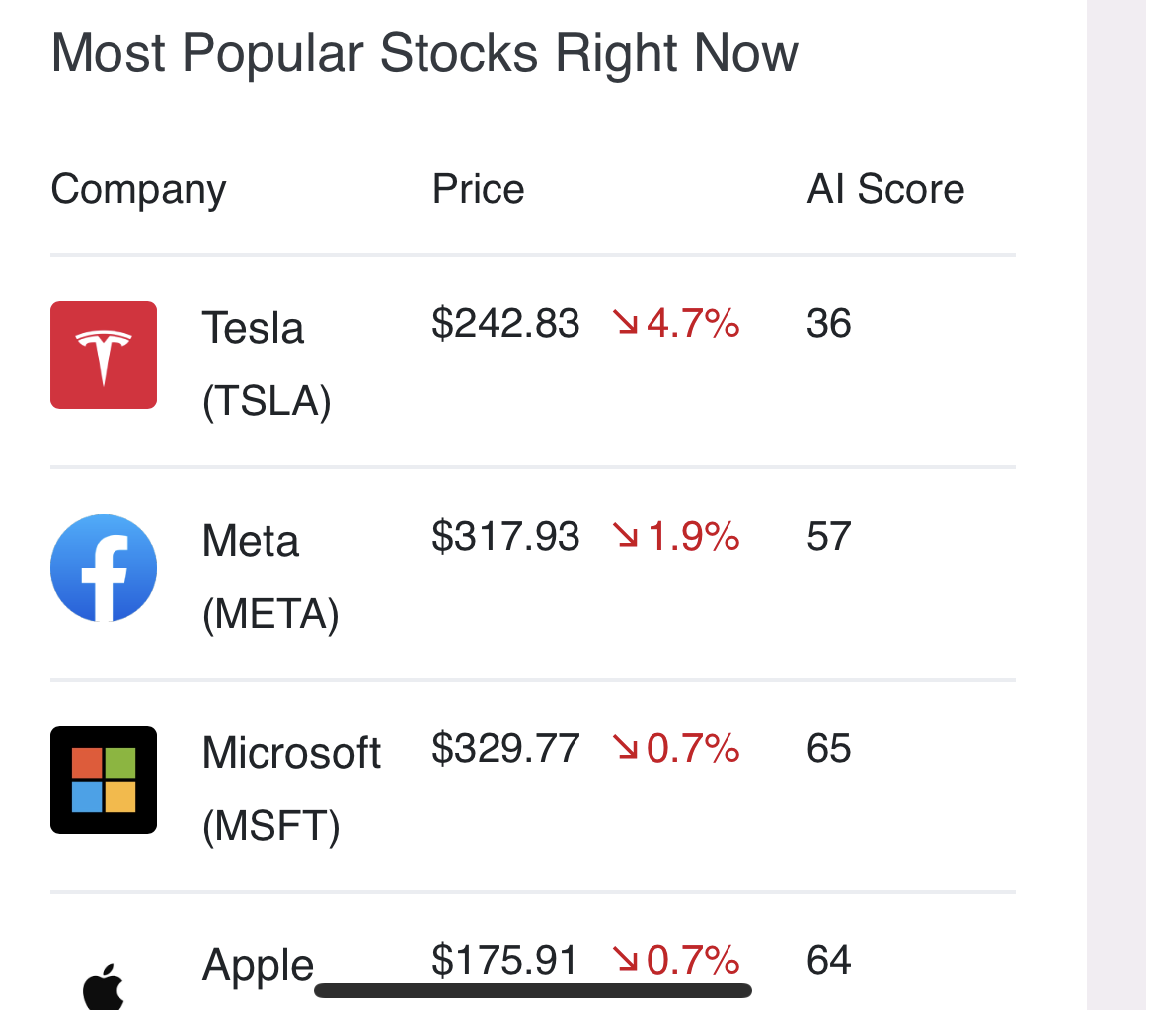

Popular Stocks

AltIndex has a “Trending Stocks” feature that allows users to keep tabs on market trends. Using this feature, users will get first-hand information about stocks that have been generating comments on top social media platforms and search engines.

Further, under the category, AltIndex bases its remarks on two pointers – mentions and overall sentiments. For instance, if a user decides to check trending stocks on WallStreetBets in the last 24 hours, AltIndex will provide data on the number of times each asset appeared in discussions on the subreddit within that time frame.

The number of times the stocks appeared in the community’s discussion will be represented as mentions. Therefore, AltIndex will rank trending stocks in the subreddit based on their mentions. More so, the overall sentiment doesn’t influence the ranking. Rather, it provides insights into why the stock is trending.

For example, participants on WallStreetBets could focus their discussion on two stocks in the last 24 hours. Consequently, discussion on the stocks can be positive or negative. Logically, the two stocks will appear at the top of the list. In fact, the one with negative comments may rank higher. Nonetheless, the sentiment label will indicate if the mentions are bullish, bearish, or neutral.

The sentiment label will aid investors in understanding why such a stock is trending and what the trend could possibly amount to. In the same vein, there is also a Meme Stocks segment under the “Trending Stocks” category.

In this segment, the attention focuses on top meme stocks that are dominating search trends, discussion, and mentions in meme-driven communities. AltIndex quantifies the hype generated by each meme stock over the last 24 hours to draw its insights. The list is usually updated at the interval of five minutes to ensure that it is up to date.

AltIndex also gathers data points from various investment-oriented subreddits. Emerging discussions across various communities on the platform help AltIndex to come up with its top “Reddit Stocks.” In this category, the analytical firm provides a ranking of some of the most discussed stocks on Reddit platforms.

Further, AltIndex supports investors in tracking firms that retail investors are commenting about the most. Consequently, the platform studies the nature of the comments about those stocks to determine if the hype is a positive or negative one.

Also, the analytics company monitors data points from the popular online platform; 4chan. AltIndex uses the data it aggregates on this platform to offer investment advice to investors.

To an extent, the manner in which AltIndex has extended its reach to 4chan has helped in enriching the firm’s data resources. In return, the vast pool of data has drastically enhanced the accuracy of its recommendations.

AI Stock Picks

The AI-driven stock picks segment is another standout feature of AltIndex. It is a fully automated service that is powered by machine learning and artificial intelligence. It analyzes data points and then offers investment advice to users based on the outcome of the analysis.

During this process, AltIndex examines data points from expansions, recruitment exercises, news mentions, social media sentiments, website visits, and customer and employee reviews. After finalizing its analysis of these stocks, the platform will communicate its recommendation to users through mail.

In the mail, AltIndex will explain how the data points indicate whether a user can drop or keep the stock. Consequently, AltIndex makes its stock recommendations leveraging its alternative data metrics.

Cryptocurrency Analytics

Also, AltIndex uses its vast alternative data resources to track trending cryptocurrencies. This feature works exactly like the stock segment. Since its emergence, AltIndex has proven to be an effective tool in identifying the next big thing in crypto.

You can streamline your search under this option by filtering the lineup based on data points like Google trends, Reddit mentions, hypes, and attention on Twitter, among many others.

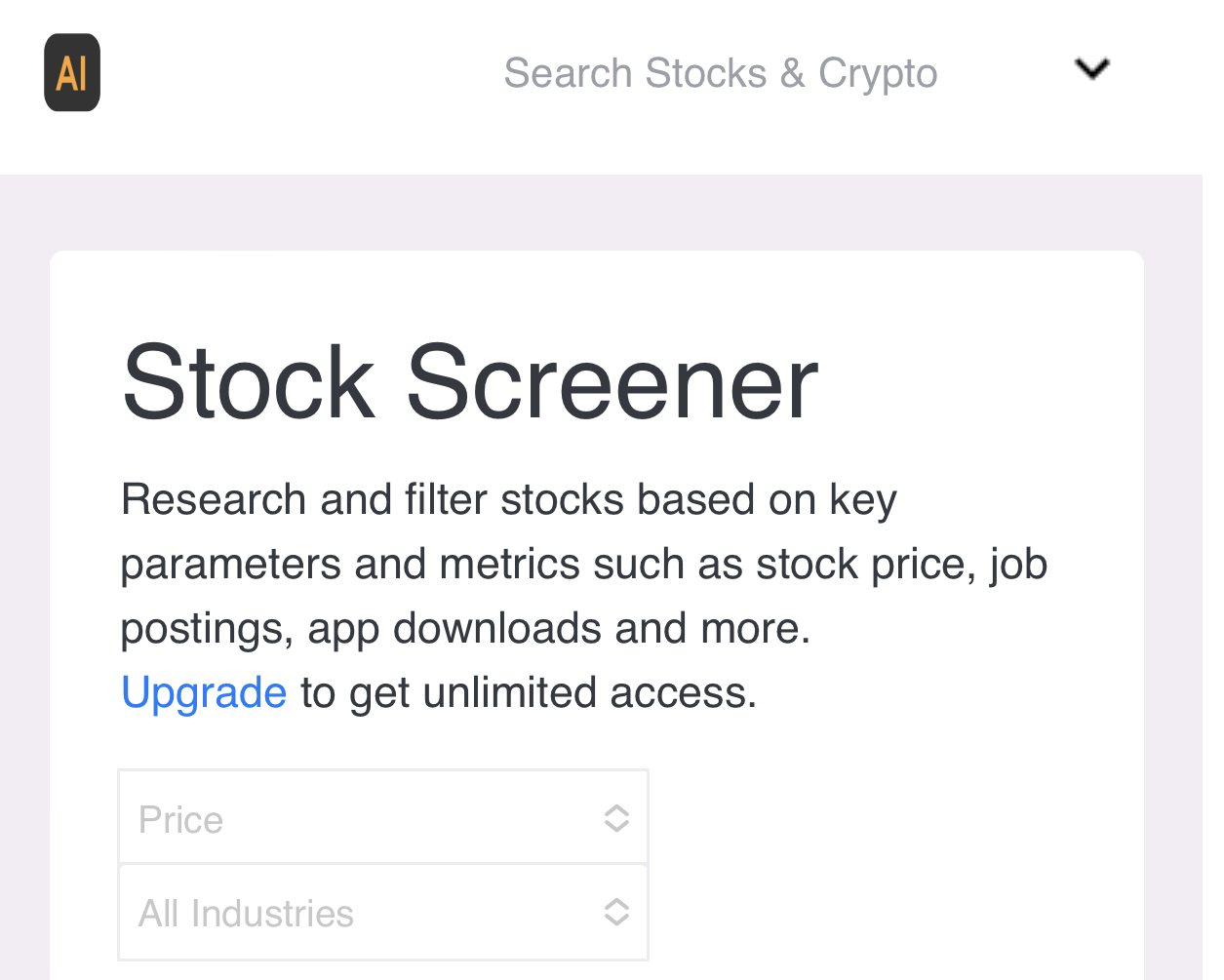

Stock Screener

In the stock screener option, AltIndex provides users with details relating to stocks that are similar to their portfolio. To find suitable stocks, you must first select your foremost data points. Thereafter, you’ll pick a particular industry that suits your preference.

With its stock screener service, AltIndex has continued to break down barriers of limiting investors to details about their portfolio. Accordingly, this exciting feature has helped investors keep up with stocks similar to their portfolios.

Exploring this amazing service on AltIndex can provide investors with insights into how stocks in their portfolio are performing compared to others within the same industry. Investors can leverage this opportunity to maintain a strong position while updating their portfolios to mitigate risks.

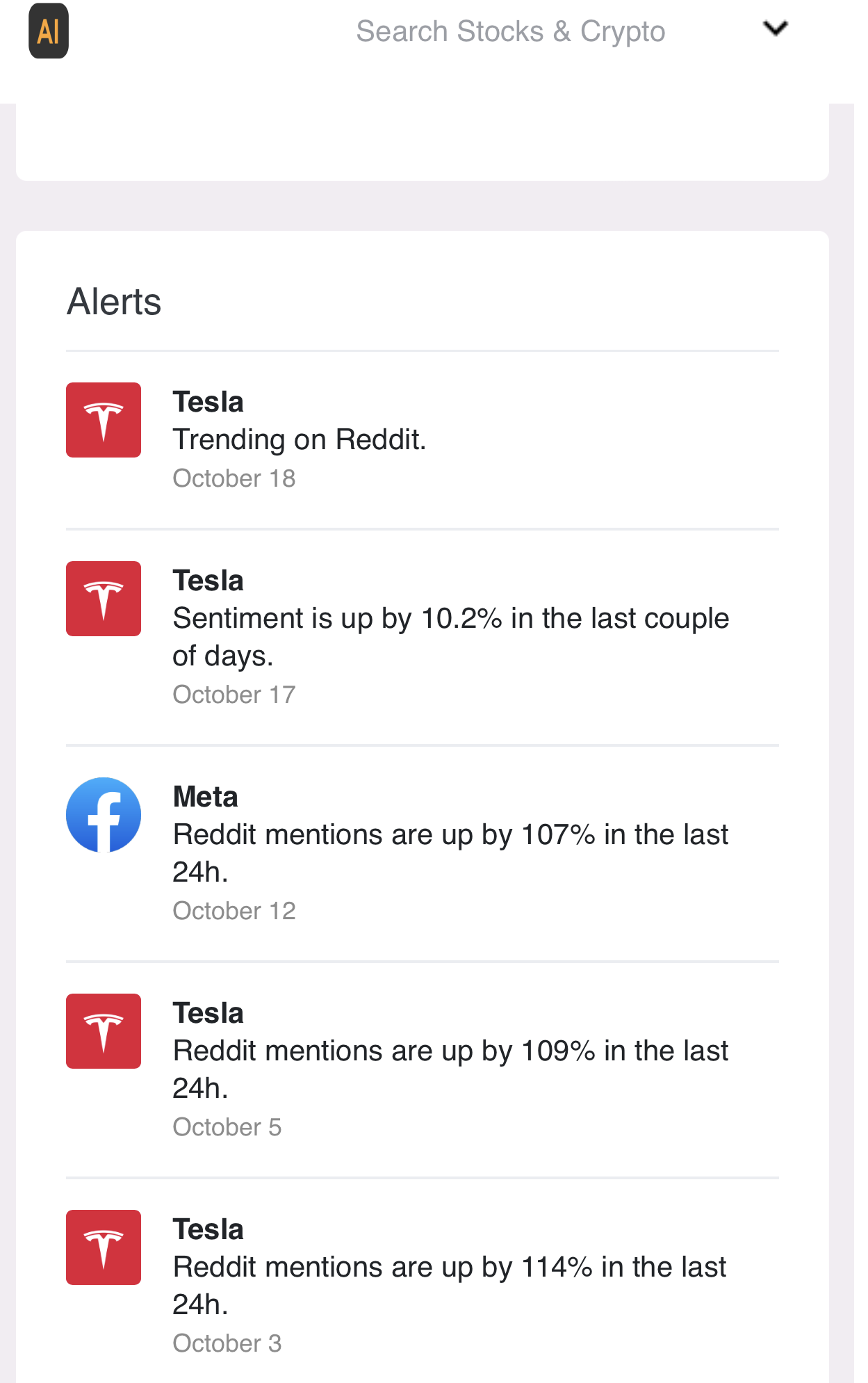

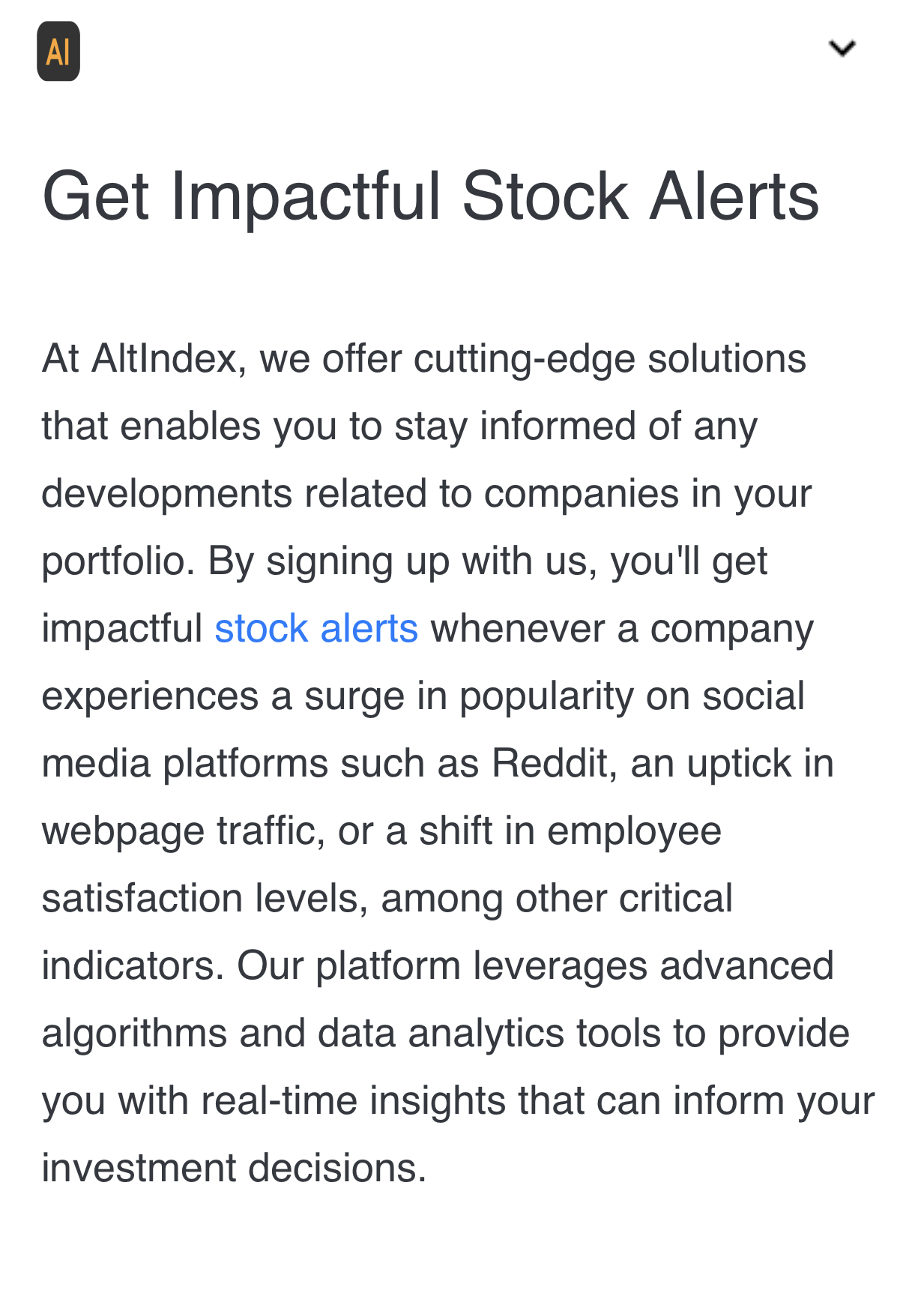

Alert Services

AltIndex provides users with timely updates through their email. These updates comprise a summarized list of top trending stocks and crypto assets.

In each email, AltIndex usually advises investors on the next line of action to take regarding their portfolio or other assets relating to it. It is safe to say that the alert service feature helps investors to make informed decisions. Meanwhile, provided details through the alert service vary, depending on the subscription plan.

Users with higher subscriptions will get more comprehensive details compared to their counterparts on lower or free plans. Irrespective of the subscription level, we register confidence in AltIndex to provide some of the best advice on stock and crypto investment.

Assets Tracked By AltIndex

The alternative data research and analytics platform offers insightful investment details about three major asset classes: stocks, cryptocurrencies, and ETFs.

In its stocks segment, AltIndex allows investors to monitor numerous stocks from the NASDAQ and NYSE. Despite its comprehensive approach, the innovative outlet is limited to the U.S. market alone. Thus, AltIndex only provides details on stocks within the U.S.

By focusing on the country’s market, AltIndex has helped ensure that users enjoy unrestricted assets to top US-listed ETFs. AltIndex alternative data on US-listed ETFs extends to even the ones tracking the S&P 500 Dow Jones.

Also, the all-around platform covers the crypto market. Here, AltIndex provides up-to-date data and insights into the next cryptocurrency to buy. With its AI infrastructure, the outlet provides price alerts and trends on some of the best cryptocurrencies in the market.

On the flip side, it can also provide details that can aid users to short on crypto assets that seem to be dip-bound. You can track top cryptocurrencies like Bitcoin, Ethereum, Ripple, Litecoin, Binance coin, and Solana.

However, the alternative data provider does not track commodities. The absence of investment advice on commodities, to an extent, has limited the popularity and embracement of AltIndex.

Key Features Of AltIndex

In this session, we will extensively discuss some of the key qualities of AltIndex. They are:

Al Ranking Score

The platform through its AI ranking saves users the workload of going through the exorbitant details behind the rationale of a rating. Rather, AltIndex leverages the support of Artificial Intelligence to give a simple ranking score of 1-100 depending on the alternative data point. Without much contemplation, one can easily decide to add a stock with a high AI stock to their portfolio.

As a foremost investment decision-making tool, it provides you the advantage of leveraging the relationship between ratings and price movements. For instance, a stock with a low rating due to poor reviews, declining patronage, and a recent layoff may not dip in value immediately. These negative pointers would definitely sum up for a while before amounting to a decline in the value of the stock.

Within this period, you can decide to go short on the stock and amass some profits before things go haywire. Therefore, through the vast insights provided by AltIndex, investors can make better investment decisions.

It Is Dependable And Effective

We can attest to the reliability and effectiveness of AltIndex. In the course of this review, we discovered that stock pick, as the major feature on the platform, has a win rate of 75% for a six-month period. This landmark height attests to why investors can journey through the stock, ETF, and crypto investment landscape, smashing huge returns.

Additionally, AltIndex doesn’t expose users’ details to third parties or the public domain. The platform prioritizes the protection of users and their data. It is mandatory that you register with the platform to access its top services. So, registering on AltIndex mandates that you provide your data. But be rest assured that your details are well protected.

Timeliness

Information is power. AltIndex recognizes the importance of a timely update in aiding investors to make some of the best decisions. Guided by this principle, the alternative data platform provides you with time-to-time alerts on stock, ETF, and crypto market performances.

As part of your subscription package on AltIndex, the analytics firm will also help you keep tabs on your portfolio. Likewise, AltIndex can provide you with details about stocks, ETFs, and cryptocurrencies that are not in your portfolio. The purpose of this service is to help you make new investment decisions and fine-tune your portfolio to a profit-maximizing position.

In the alert segment, you can also streamline the indicators you want the platform to notify you about. You can decide to receive updates on search engine results, trends, mentions, likes, comments, shares, and visits among many others.

Good Customer Support Service

In a bid to ensure a seamless user experience, AltIndex has a customer service that is accessible via email. The service provides support for users on any issue relating to their account.

To explore this service, you must first fill out the support ticket and then wait for a reply from the support service team.

Good User Experience

Overall, the AltIndex platform is equipped with outstanding features that are aimed at ensuring a good user experience. The alternative data research and analytics platform provides a comprehensive analysis of stocks, ETFs, and cryptocurrencies.

The focus on the three investment vehicles, confirms the status of AltIndex as an all-in-one analytical outlet. Without a doubt, AltIndex has proven to be efficient enough to suit the emerging demands of stock and crypto investors.

After thorough research, we recommend AltIndex for newbies and seasoned investors. All the features on the site are well-detailed so that users can navigate with ease. Similarly, AltIndex saves investors the stress of having to interpret data as it gives a direct guideline on what decision to take on a stock or crypto.

Pros And Cons

Amid the growing popularity and adoption of AltIndex, it is pertinent to equip you with its pros and cons.

Pros

- It covers three asset classes – cryptocurrencies, stocks, and ETFs.

- Accurate and timely stock alerts.

- AI ranking score.

- Diverse plans or packages.

- Automated stock recommendations.

- Tracks thousands of assets.

- Presence of a free plan.

- 24/7 customer service.

- Easy-to-use interface.

Cons

- It does not track commodities.

- Users cannot explore all the features on AltIndex with its free plan.

Subscription Packages And Plans On AltIndex

AltIndex features a plethora of plans so that users, regardless of their pockets can access its ecosystem. In this session, we are going to fully examine all the plans so that you can make the best pick.

Free Plan

As the leader of all alternative data providers, AltIndex offers a free welcome service to first-time users. Yes, this free plan is available to new users upon the success of their registration on the platform. With this, you can explore some of the services offered by AltIndex without paying a dime.

But, the offerings on this plan are limited to 20 monthly page visits, 2 stock alerts, and 1 stock recommendation. Hence, if you wish to enjoy full access to all the features on its stock screener, it is recommended that you subscribe to the starter plan.

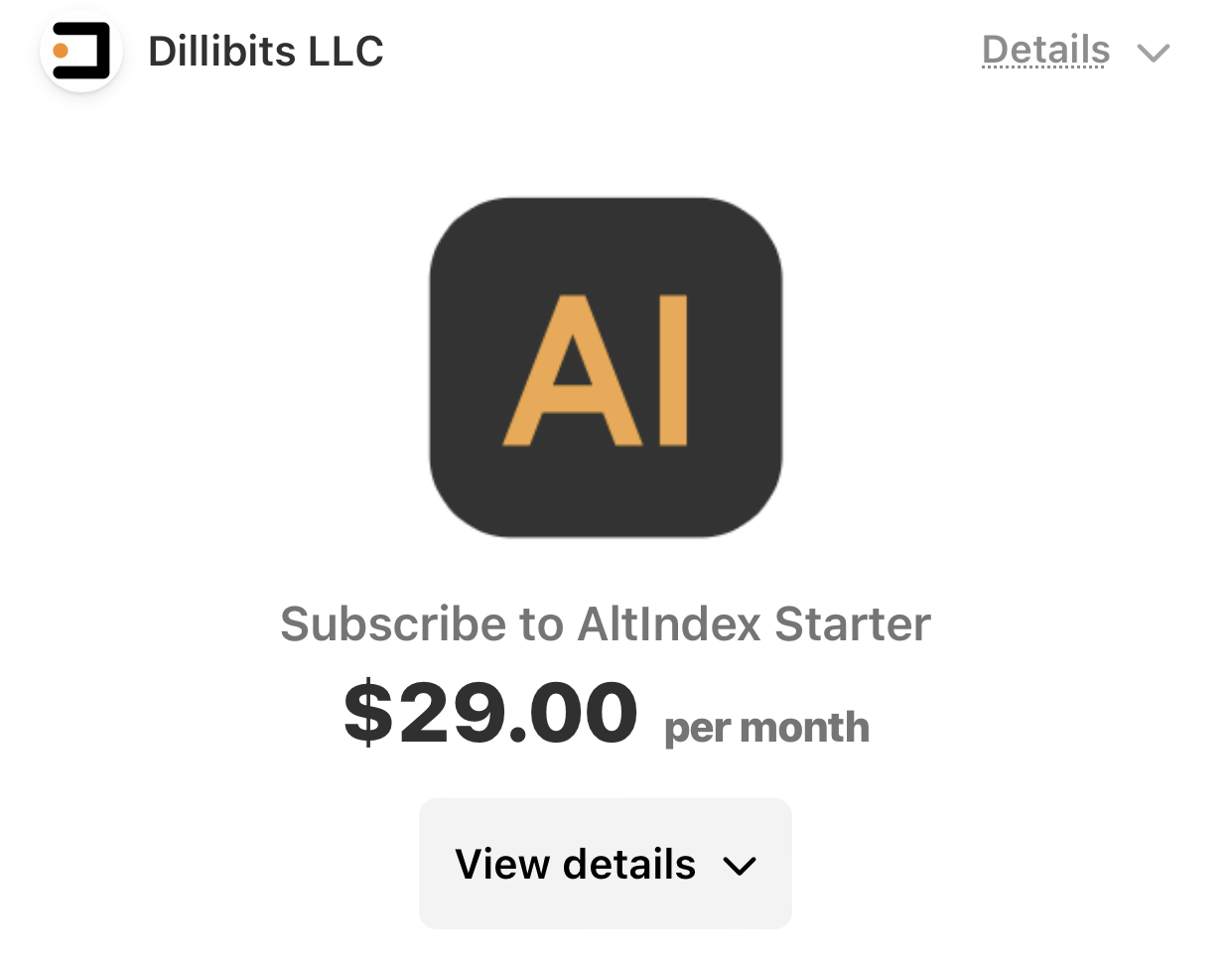

Starter Plan

Unlike the free package, the starter plan comes with unlimited page visits and many other features to enhance your experience on AltIndex. When you subscribe to this package, your monthly stock recommendations will also be increased from 1 to 10.

As the icing on the cake, this package unlocks limitless data in its stock screener so that you can discover stocks that suit your portfolio. To upgrade to the plan, users are only expected to pay $29 monthly. Therefore, it is not an overstatement that the starter plan is cost-effective, considering the kind of features enveloped in it.

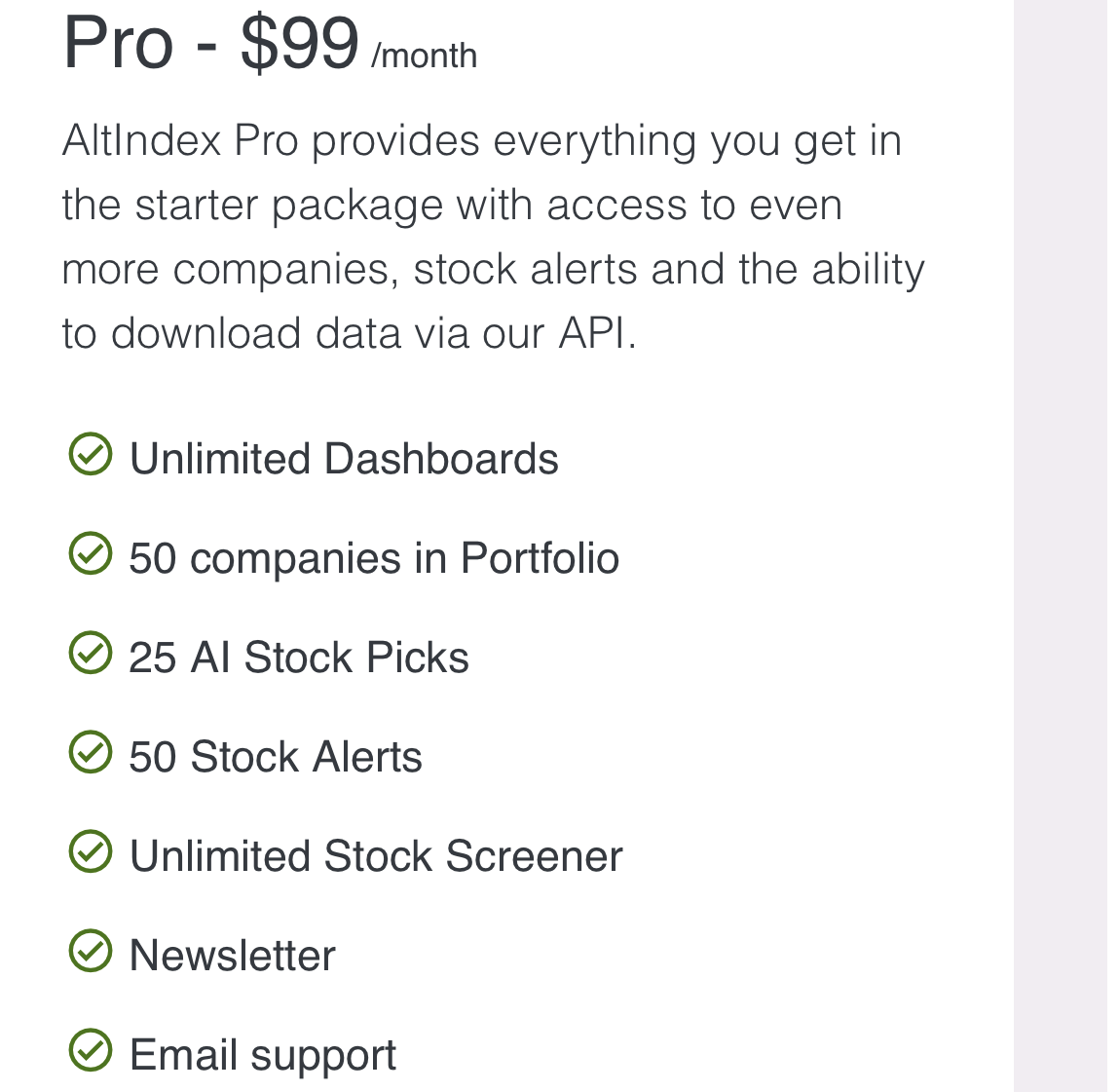

Pro Plan

If you seek additional services on AltIndex, we recommend that you try out its pro plan. Apart from enjoying unlimited page visits, the package also showers you with 50 stock picks and alerts every month.

More so, subscribing to this plan will qualify you for 25 monthly AI stock recommendations. Are you an active stock trader? Kindly note that this package is the best you can consider. It costs $99 per month.

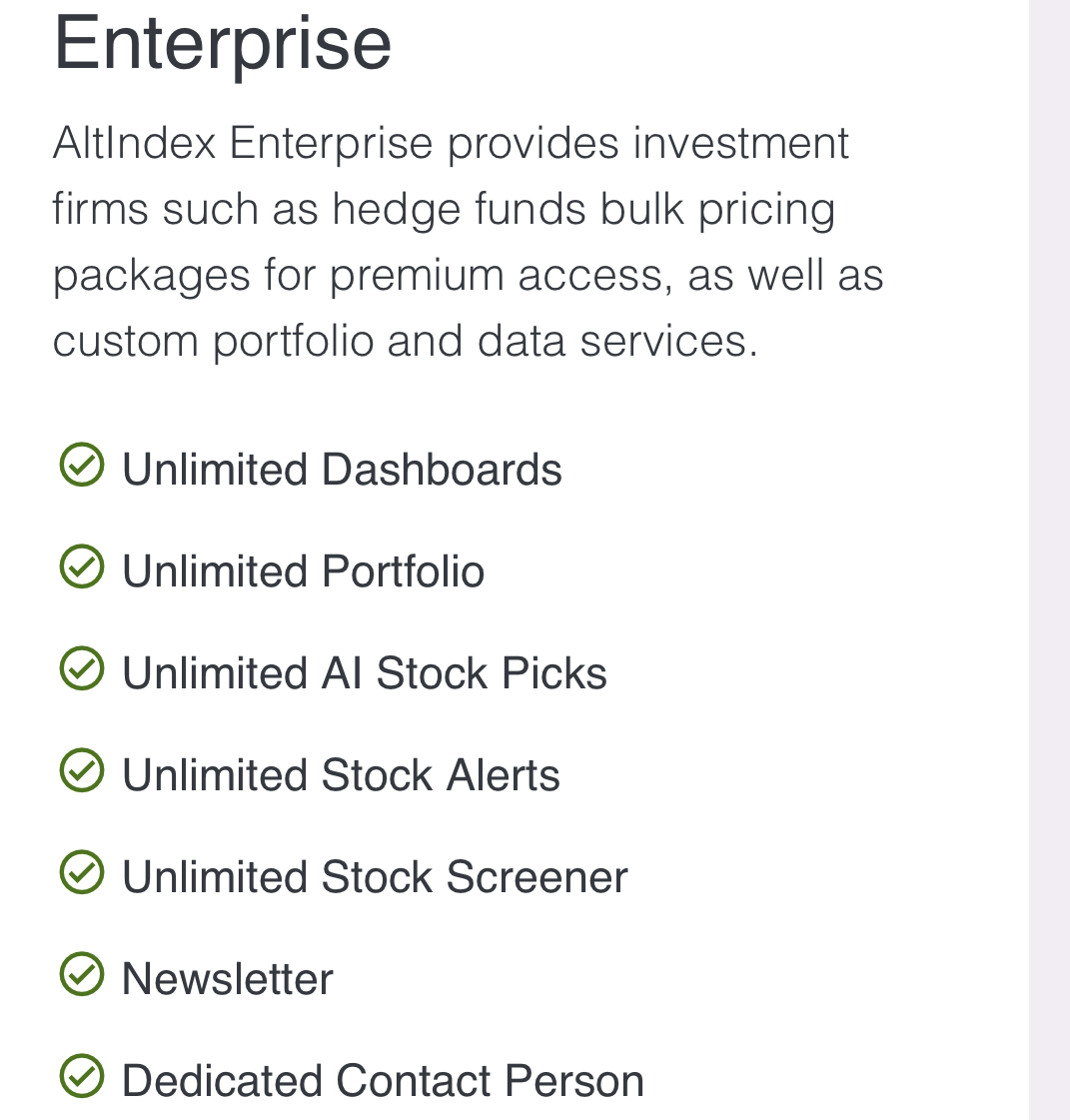

Enterprise Plan

Although AltIndex has chosen to conceal the actual price of this package, there’s no doubt that it is also cost-effective. The enterprise plan on the alternative data provider is mostly adopted by proficient traders and firms. All the features on this plan are unlimited, including its AI stock picks, alerts, and more.

Alongside these offerings, you will also get an ever-active support agent if you subscribe to this package. To know the actual cost of this package, you can contact AltIndex through any of the customer support channels on its website.

There’s no doubt that all the plans on AltIndex come with unique and flexible features. Therefore, users are advised to pick the one that aligns with their preferences. In addition, you can cancel your current package at any time you wish.

How To Get Started With AltIndex

In a bid to easily onboard new users, AltIndex has a straightforward and fast sign-up gateway. Hence, you do not have to be a professional before you get started on the platform. Nonetheless, this review will provide a guide for newbies to follow.

Although AltIndex has yet to launch its app, it hosts a site that is fully optimized for mobile experience. By virtue of this, you can access AltIndex through your mobile browser. When you visit the site, you will find its sign-up feature very close to its search menu.

Use the feature to register with the platform. You will only be required to provide your name, email address and password. The site will verify your email address before setting up your portfolio. As analyzed in the previous session, the success of your registration allows you to enjoy its free plan. With this plan, you can only track and receive alerts for 2 assets.

Is AltIndex A Top Pick For Traders?

We consider AltIndex as one of the best picks for traders because it fulfills certain criteria that will be fully analyzed below:

Usage Of A Wide Variety Of Data Sources

When it comes to exploring an extensive number of data sources, only a few data providers can compete with AltIndex. Unlike many others out there, AltIndex does not rely on social media sentiment analysis alone.

It usually combines the analysis from social media with other alternative data points to yield investment insight. For instance, if the real-time data or sentiment about a stock is good, AltIndex will give it a high score.

Presence Of Three Asset Classes

AltIndex hosts a vast ecosystem that covers three asset classes – cryptocurrencies, stocks, and ETFs. Without any doubt, these assets are popular and have continued to gain widespread adoption across the globe.

Therefore, by providing an ecosystem that tracks the combination of these assets, AltIndex has demonstrated itself as a great place to be. In the stock market alone, it covers thousands of stocks, particularly from NASDAQ and NYSE. Outside that, it tracks several US-listed ETFs.

As for cryptocurrencies, some of the popular assets in the market like Bitcoin, XRP, Ethereum, Binance Coin, Uniswap, and many more can also be tracked on AltIndex. You can read our guide on how to buy these cryptocurrencies safely.

Transparency And Security

AltIndex is also well known for its transparency in arriving at its investment insights and recommendations. The leading data service provider will not pick or recommend a stock for you without giving detailed information on how it arrives at that insight.

More so, AltIndex is a safe place to be. It boasts a strong security mechanism to ensure that the private data of users are concealed from third parties.

Outstanding Team

AltIndex also stands out due to the proficiency of its founding team. For the purpose of this review, we did a background check on some of the team members of the platform. Our investigation showed that they are all experts in their various niches. Let’s start with Carles Vives, the former CEO and co-founder of the firm.

As a professional in the finance world, Vives has contributed immensely to the growth of AltIndex. Apart from executing business plans and strategies for AltIndex, he also helped the firm maintain good relationships with investors and partners. Other founding members of AltIndex are Sergi Nos (Co-founder), Vincent Nos, and many more.

We also consider AltIndex as a top alternative data provider because it has the following features:

- Diverse plans or packages.

- Easy-to-use interface.

- Straightforward registration process.

- AI ranking feature.

- 24/7 customer support service.

AltIndex Review: Our Verdict

Since its emergence, AltIndex has attracted a good number of individual and institutional users across the globe. Traders trust the platform due to its ability to use a wide range of data points to generate broader insights. These data points are usually analyzed through its AI-driven mechanism so that stocks can be ranked and recommended to users through email alerts.

We consider the stock picks as its major feature, boasting a 75% win rate within 6 months. AltIndex supports a free plan, meaning you can explore some of its services without making any payment.

Nonetheless, there are limits to what you can access while on this package. Hence, to fully experience the full prospects enveloped in AltIndex, users are advised to subscribe to any of its paid packages.

Based on our review, the major flaw associated with AltIndex is that it does not track commodities. Therefore, a 4.7/5 rating score is perfect.

FAQs

Can you track cryptocurrencies, stocks, and ETFs on AltIndex?

Yes, AltIndex covers cryptocurrencies, stocks, and ETFs. This simply means you can track each of the aforementioned asset classes while using AltIndex.

Is there a free plan on AltIndex?

Yes, there is a free plan on AltIndex and it is available to every new user. With this package, they will be able to explore some of the features of the alternative data provider.

What's the price of the starter plan on AltIndex?

The starter plan costs $29 monthly. When you subscribe to this plan, you will be able to get limitless page visits, 10 stock recommendations, and many more.