NFTs have taken the world by storm in 2021. Among the hype, have you ever wondered is it really worth investing in these promising (at least, claimed to be) NFTs? Are these collectibles really worth what they promise in the future? And, most importantly, if yes, then how is one supposed to smartly make money with them?

Well, without second opinions, it becomes integral that we dig deeper into NFTs and their role as investment sources to understand whether these are the next generation digital wonders or just another sham. Also, it is important to highlight how one actually makes money with NFTs. So let’s get started and take a roller coaster ride in the new-found world of NFTs. what you will actually learn – whether or not NFTs are a good investment.

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

What are NFTs

To understand the most recent introduction to the digital world, it is important to understand NFTs in complete detail. This will help to understand the increasing trend in favor of these newly emerging financial tokens.

Well, these can also be better understood by going by their literal meaning. “Non-fungible” literally means that something is ‘unique’ and possibly cannot be replaced with something else. To make things clearer, let us take the example of bitcoin. A Bitcoin is considered as being the opposite, i.e., fungible! This is because you can easily trade one Bitcoin for another bitcoin, giving you the exact same thing.

Now, ‘non-fungible’ is the opposite, i.e., a one-of-a-kind or unique trading card. So if you trade a non-fungible token for a different card, you will get something completely different and not the same NFT. A non-fungible token (NFT) is a ‘unique’ and ‘non-interchangeable’ unit of data stored on a digital ledger (i.e., a blockchain).

For instance, NFTs can be thought of as digital art files including photos, videos, audio, etc. using the blockchain technology. These NFTs are then given a public proof of ownership when someone buys a particular NFT. So put simply, NFTs are like ‘digital tokens’ which can be bought as certificates for physical or virtual assets.

Investing in NFTs – Things to Consider

1. The only thing to note here is, that copies of the original file do not get restricted to just the owner of the NFT. Instead, these can be easily copied and shared by other people like any file. What is important to understand is that, for instance, anyone can buy a famous artform or print, but only you (as the buyer of the NFT) can ‘own’ the original.

2. This basic difference – the lack of interchangeability or fungibility helps to differentiate the much hyped NFTs from other blockchain cryptocurrencies such as bitcoin.

How can you make money with NFTs

Making money with NFTs involves seeking deeper industry insights and gaining knowledge on their trading.

Logic indicates that investing in NFTs by buying them and selling them at a profit. This is exactly how things work out in the NFTs marketplace.

You can make money by buying and selling NFTs wisely and at the right time.

The NFT technology is most commonly seen being applied to tokenizing of collectibles from well known brands which are already involved in selling their physical collectibles.

For instance, the NBA allowed people to buy its NFT sports cards and trade licensed cards of footballers. Very easily, one can buy NFTs in the form of trading cards in their digital form. The thing to note here is that NFTs are often more valuable than their physical counterparts owing to their proven rarity currently.

Another reason making these NFTs a much sought after collectible form is the fact that as opposed to their physical counterparts which can get easily damaged, the digital trading cards (in the form of NFTs) can be securely stored (of course, on the blockchain). This way they do not lose their quality over time.

Your capital is at risk

Stake your NFTs right!

Staking’ implies storing digital assets as ‘stakes’ and then assigning them to people who are willing to maintain them. The person who uses these further is going to give you a share of the reward in return.

For this, you will first need to buy NFTs from a trusted NFT marketplace.

To understand how and where to buy these NFTs, think of each artwork in the digital collection as unique and valued differently. Just like the physical counterparts, the buying or ‘asset transfer’ of these pieces of art or individual ‘NFT’ gets recorded in the blockchain (same as cryptocurrency works).

This also holds true for anything else in the digital form, which can be easily converted into an NFT. For instance, popular tweets, famous facebook posts, favourite instagram pictures or videos, etc. are good examples. These are easily bought and sold as NFTs in the digital marketplace.

The easy processing of NFTs to make money

You can buy these NFTs using cryptocurrency (however, some platforms also allow the use of credit cards). Some popular platforms include Blockchain.com.

Once you have bought some NFTs, you must now look for a trusted auction site such as OpenSea, Rarible, SuperRare, and Foundation for easy trading. Ensure that your chosen marketplace supports the blockchain your NFT was initially built on.

For selling your NFTs, all you need is the original piece of media you own. Start off by selling a single file at an appropriate sale price for your item. In addition, you can also determine a ‘royalty’ (optionally) which will be paid by somebody who buys your file and then uses it elsewhere.

Keep checking the ‘sales page’ of your platform for any updated offers (since most platforms do not send you a traditional email). The next thing that happens is – your crypto funds get transferred to your wallet!

Thinking about what you can do with this amount made out of buying and selling NFTs?

1. You can now withdraw this amount for your use.

2. Or, you can use it to purchase other products.

3. Or, you can exchange it for cash.

What experts advise:

For simpler NFTs, you can indulge in this easy processing by yourself. In case you are trading in complex assets, we suggest you consult an experienced professional. Your dedicated expert will possess deeper insights into the NFT market and be knowledgeable in all cryptocurrency’s advanced tips. They can also guide you to invest in collectibles that will be worth a lot in the future.

Compare Ethereum Exchanges & Brokers

Binance

Buy EthereumAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Buy Ethereum74% of retail investor accounts lose money when trading CFDs with this provider....

Environmental and Technical Hurdles

The trend surrounding NFTs suggests that there is a rising preference towards buying, selling and investing in these digital platforms even more than the physical market. However, without a doubt, NFTs are just at their budding stage and they are still being explored as trustable investment sources. Facing serious environmental and technical hurdles is just obvious.

Their technical hurdles include threats of online frauds and cyberattacks. Hackers can attack the network and steal crypto in an instant. NFT theft can be a commonly occurring issue with smart contracts. The drawbacks and shortcomings in smart contracts can be misused by such hackers.

The possibility of fake NFT stores wrongfully indulging in selling NFTs which are not even actually existent is obvious. This way, there is a possibility that an investor can suffer great loss by literally witnessing their bought digital asset ‘disappear into cyberspace’ or lose access to their digital asset in case they do not store it securely.

Another major hurdle in the way of NFTs is their environmental impacts. Well, this relates to millions of tons of planet-heating carbon dioxide emissions that are generated by cryptocurrencies which are used to buy and sell NFTs. The most common ethereum cryptocurrency is blamed for leaving a significantly high and noticeable carbon emissions impact.

To put simply, it is claimed that a single piece of crypto art consumes as much energy as a physical studio consumes in about two years. The selling and reselling of these NFTs requires enormous amounts of energy, which sums up to be greater than the megawatt-hours of energy consumption of the studios selling them physically.

As a logical result, the digital registry reflecting the buying and selling of these NFTs showcased annual carbon emissions which were far greater than that of major small sized countries. This is one of the primary reasons why NFTs are receiving a major backlash from enthusiasts who call it environmentally unethical activity.

Even major dealers in NFTs who have gained immensely from their sales are concerned and recognize these environmental impacts of NFTs. For instance, the famous digital artist Mike Winkelmann, popularly named as Beeple after the selling of his digital artwork claimed it to be carbon “neutral” or “negative”. Basically implying that he will offset the carbon emissions caused by his NFTs by investing about $5,000 in renewable energy or conservation projects. These will be guided by technology that takes out carbon dioxide out of the atmosphere.

Such concerns have been recognized yet deemed to be ‘solvable’ by most artists, speculators, filmmakers, videographers, writers as well as collectors across the globe. Therefore, people have been reported to be highly interested in NFTs while also recognizing their environmental impacts.

Are we in an NFT bubble?

We are merely heading towards an NFT ecosystem with an increasing number of individuals and businesses getting interested in it. The major reason is that even today, most NFTs are simple images. This makes the NFT market still extremely undervalued and NFTs a good investment.

In fact, a rising need is felt for more complex NFTs to fully explore the maximum potential of this relatively new modern day technology. An NFT can be practically anything! The only condition is first, that it must be virtual and second, that it cannot possibly be touched physically.

Analysing the history of other such markets which turned out to be ‘fads’, there can arise certain doubts about NFTs too. The general trend is that if a product gets too much hyped and highly expensive but does not offer a solution to any real problem, it most probably turns out to be a ‘bubble’.

In the case of NFTs too, these are digital tokens which represent ownership of a virtual artwork used to make money. However, there is no physical manifestation of that product.

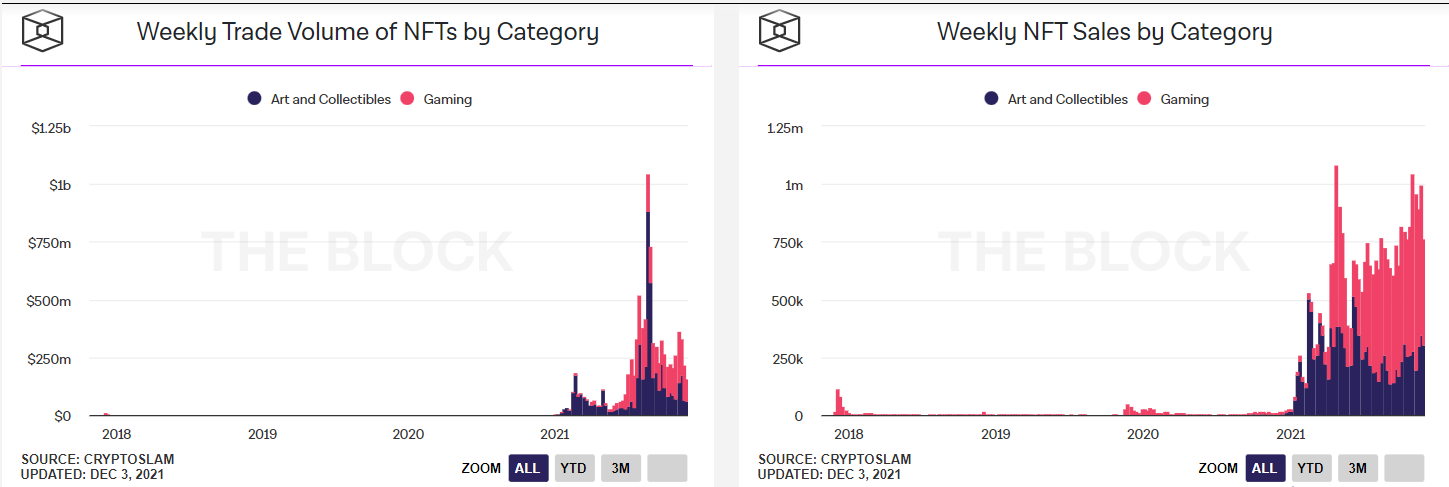

Source – The Block

However, just like several past inventions which were initially thought of having no value, later inspired a chain of other valuable things. Similarly, the much-hyped NFTs are without any doubt raising greater interests of people with a ‘new aesthetic’ towards different artforms.

This is surely transforming the physical art world to a great extent as well. There are more supporters claiming NFTs as the next big thing in the investment world deeming it as a profitable investment class, rather than speculating it to be a bubble ready to pop anytime soon.

Finally, are NFTs a good investment

The first question that arises so as to judge NFTs for their credibility is whether these are absolutely secure forms of investing?

NFTs are securitised digital arts including videos, paintings, memes, etc. Each of these tokenized artwork is assigned a ‘unique digital certificate of ownership’. This proof of public ownership can then be bought or sold online. As can be understood, just like our quite favourite cryptocurrency, NFTs also run on a secure blockchain technology.

This however, implies that there can be a possibility of forging these NFTs. The great news is that this is almost an impossibility! That’s because the much-discussed blockchain technology actually makes forging of records impossible.

If you are wondering why, then think about this – these records are actually stored in numerous computers across the globe, right? So, just like cryptos, any person can view these. However, in case of NFTs, the buyer has the privilege of owning the original item with a built-in proof of ownership! That makes forging a far off possibility.

These are the primary reasons why ‘Non-Fungible Tokens’ are rapidly emerging as one of the most popular trends across the crypto enthusiasts. In fact, most people involved in creating music or art forms are also thinking of launching their own NFTs as a great source of investment and making money.

In fact, it is not wrong to say that none will remain unimpacted by NFTs in the next 5 years given their rising popularity. There is a favourable trend towards NFTs in the likes of music, virtual land, art, sports, in-game collectibles, etc. NFTs are surely here to stay, and are no sooner going out of trend.

How to buy NFT tokens

Having given you background concerning NFTs and their importance, now it’s important to know how to buy NFTs. The first step to investing in NFTs and buying NFTs to trade is choosing the correct platform. We have written an in-depth article on the best NFT marketplaces present, you can read it here.

Though be aware that you’ll need two things to use marketplaces such as OpenSea: an Ethereum wallet and Ethereum coins. Read our full guide on how to buy NFTs.

Buy Ethereum for NFTs

After selecting the platform you will be required to first buy Ethereum.

As with any time you buy cryptocurrency, the easiest method for beginners is to use one of the well-known exchanges such as eToro, Binance or Coinbase. We recommened Toro as it is regulated by several national agencies – the FCA, ASIC, & CySEC. After buying Ethereum, you can transfer the ETH to a wallet to buy NFTs.

Make sure you have enough money to cover the price of your selected NFT as well as the Ethereum gas fee (a fee you must pay to have your transaction authorized on the Ethereum network).

Also, in case you choose to delay your plan of buying NFTs, holding some Ethereum in reserve on eToro would be beneficial as well, as eToro allows staking of Ethereum. This allows you to earn passive income on your holdings. Read more about crypto staking.

Your capital is at risk

Are NFTs a Good Investment – the Verdict

NFTs, or non-fungible tokens are a good investment if done in the right manner at the right time. They can be thought of as ‘digital tokens’ symbolising virtual certificates that are proof of digital ownership.

Buying and selling NFTs across purposefully-built marketplace (or platforms) can be highly profitable when done with prior knowledge or under expert consultation.

They are great business opportunities with unique characteristics of people enjoying their buying and selling. They definitely have a promising future as an investment vehicle.

Also, recognizing its online technology-related fraud threats and environmental impacts, these can be responsibly offset with steps such as indulging in conservative projects. All in all, NFTs are being rightly viewed as flag bearers of a modern day digital revolution.

Bitcoin

Bitcoin