Cryptocurrencies have evolved from just financial solution providers to other sectors such as NFTs, gaming, Artificial Intelligence (AI), and the multi-dimensional metaverse.

Some of the best cryptocurrency projects to invest in are meme coins, AI projects, environmental-friendly projects, decentralized finance (DeFi), etc.

Diversifying investment across these sectors will likely yield positive results with proper management. A closer look at these sectors and projects will provide more guidance to investors and crypto traders.

Fastest-Rising Crypto Projects For Investment In 2024

These are some projects to consider if you want to diversify your portfolio by investing in different crypto sectors in 2024. To know more about these crypto projects, continue reading.

- Meme Kombat ($MK) – An Exciting Meme Project Featuring Some Of The Most Popular Internet Memes.

- yPredict ($YPRED) – An Innovative AI-Powered Trading Platform To Navigate The Fluctuating Crypto Market.

- Launchpad XYZ – A DeFi Project Providing A Transparent Approach To Fundraising.

- Compound Finance (COMP) – An Algorithmic Protocol To Calculate Interest Rates.

Best Crypto Sectors In 2024

In this session, we cover some of the best sectors in the crypto industry.

Meme Coin Sector

The meme coin sector in the cryptocurrency industry is being inspired by internet jokes. Projects that fall under this category have continued to leverage internet memes to build strong communities and drive innovations into the crypto world.

In recent years, this sector has garnered immense attention from crypto enthusiasts. The mother of all meme coins is Dogecoin, which started as a joke in 2013 and gained much success in 2021, according to TradingView.

Check our guide to discover if it is not too late to buy Dogecoin.

Apart from Dogecoin, there are several other exciting meme coins like Meme Kombat, and Floki Inu, Shiba Inu, amongst others.

Read our guide on the best meme coins to buy now.

Why And When To Invest In The Meme Crypto Sector

The meme crypto sector has the potential to yield great returns to early investors within a short period especially if its adoption rate increases, making it gain in price. This adoption rises when well-known companies and reliable YouTube influencers endorse the meme crypto project.

Recently, the PEPE meme crypto project left many investors smiling. It created excitement among investors in the meme crypto market that could trigger success for a new meme project due to Fear of Missing Out (FOMO).

Furthermore, the marketing efforts of developers, particularly on social media, have contributed wholesomely to the success of their meme coin projects. Likewise, most of these projects have the backing of well-established communities.

Meanwhile, it is imperative to note that the best time to invest in meme coins is during their presale. Meme Kombat, for instance, is currently on presale, thereby making it a great pick for investors looking to invest in the best under $1 coins with great potential.

Meme coins like Meme Kombat will surely help early investors maximize profit as the price will likely increase when listed on crypto exchanges.

Check out our guide to discover some of the most reliable crypto exchanges to buy meme coins.

Factors To Consider Before Investing In A Meme Crypto Sector

Before investing in a meme coin, here are some of the things you must do as an investor:

Consider the meme project’s goals: Research to understand the project and its essence. Consider how these goals can be useful and their chances of attracting investors. Again, check if the project team has long-term sustainable plans. Questions like, what is the utility of the project’s ecosystem? What is the common interest of the community should be asked.

Most importantly, you can acquire the answers to your question by joining the project community to get updates and reactions, going through the project’s roadmap, and reading its whitepaper.

Check if the meme project is audited: Search the internet to know if trusted auditing companies like Hacken, Certik, etc, have audited the project. Note these auditing companies perform security checks on a crypto project. Besides, an audited project gives a sense of safety to investors. It also presents the project team as transparent because the blockchain security auditors ensure that a crypto project does not have loopholes and plans of scams.

Ensure you do not invest in meme projects where developers have a large portion of the token: Do research and ask questions to ensure that the larger portions of the total token supply are not in the hands of a few. Check if the project has a liquidity pool and ensure it has most of the token allocated to it. A red flag is when a single individual individuals control more than 5% of the token’s total supply.

Consider if the community discussion is centered on hype: Carefully check what the community is always talking about and what the influencers post. If it is all centered on hyping the project, apply caution as the project will likely not last the test of time.

While there may be numerous meme coin projects, only a few like Meme Kombat stand out.

Meme Kombat – An Exciting Meme Project Featuring Some Of The Most Popular Internet Memes

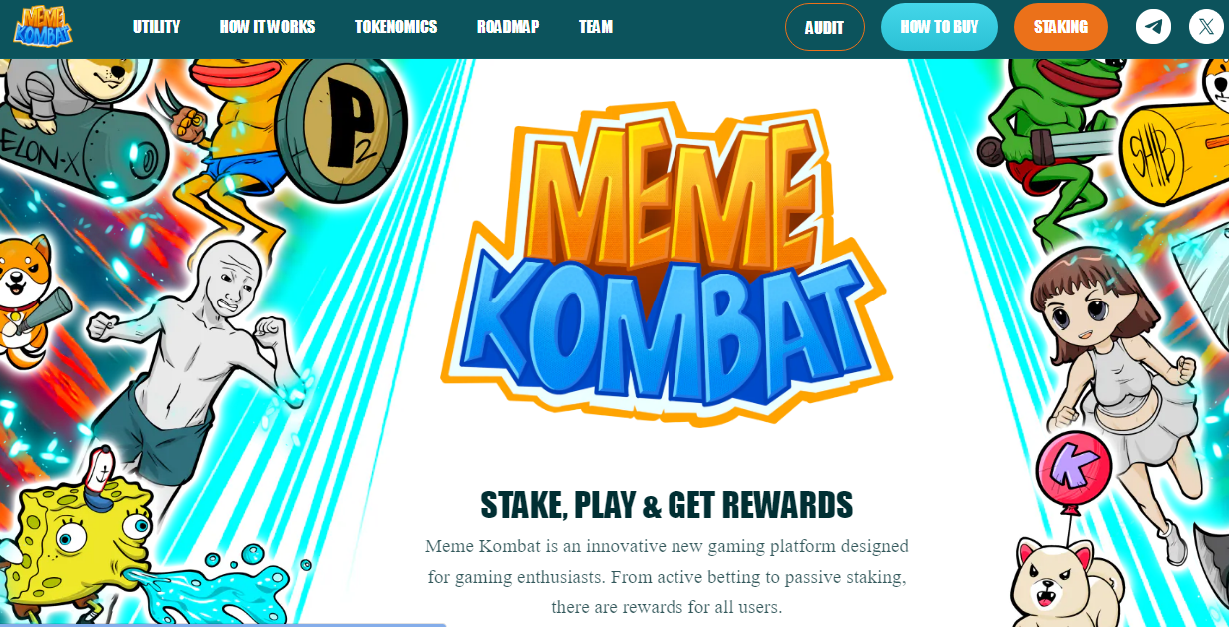

Meme Kombat is one of the latest meme projects in the industry that has shown early signs of greatness. The project, which comprises an interesting collection of popular internet memes has enjoyed significant relevance since its launching. Meme Kombat operates a play-to-earn staking initiative that allows gamers to bet on the results of a battle between various memes.

Another interesting information about this project is the mouthwatering APY it offers investors in its ongoing presale. Early buyers of $MK stand a chance to record 397% APY. However, the lucrative offer will decrease once the project proceeds to the next stage of its presale.

Analysts like Jacob Bury find potential in Meme Kombat, describing it as the next cryptocurrency to fly to the moon. So far, it has raised over $2.2 million as investors are taking advantage of the ongoing presale to gain early exposure to the asset.

Check out our Meme Kombat Price Prediction for more details.

With the growing popularity of this project, it will definitely be listed on tier-1 DEXs and CEXs upon the conclusion of its presale. To participate in this presale, we recommend that you read our guide on how to buy Meme Kombat easily.

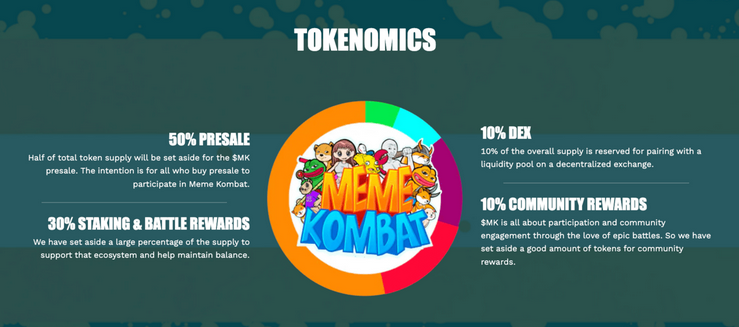

Tokenomics

$MK has an incredible token allocation that distinguishes it from its peers. 50% of the token allocation is committed to the presale. Also, 30% of $MK is earmarked to support and balance the ecosystem of the project through staking and battle rewards.

The project team also sets aside 10% of the total supply to pair $MK with a liquidity pool on a decentralized exchange. Gamers and users of the platform will receive 10% of the token in the form of community rewards.

Gaming Ecosystem

The gaming ecosystem of Meme Kombat entails pitching eleven popular Internet memes against each other. More so, the battle will be powered by AI, thus offering investors the opportunity to stake in the contest.

Meanwhile, the project is still in its inaugural season and the Meme Kombat team intends to gather user feedback and improve the initiative. There are emerging pointers that the next season will feature more memes and lucrative rewards.

Why Should I Invest In Meme Kombat?

Meme Kombat is a promising project that offers early investors and adopters various ways of earning passively. You can place a wager on AI-controlled meme battles to reap massive returns. It also offers staking services so that investors can earn passively by committing their holdings to the ecosystem. Outside that, Meme Kombat rewards gamers’ loyalty by offering them perks based on their commitment to the platform.

All these exciting offerings position Meme Kombat as one of the best coins to buy now. Interested parties should not wait until it is listed on prominent exchanges before investing in it.

Artificial Intelligence (AI) Sector

AI technology has found relevance in cryptocurrencies with the creation of AI coins and platforms. AI gives investors leverage in the market and increases their chances for profit. Also, AI tokens have a wider use range than regular cryptocurrencies. Here are some interesting projects with exciting prospects.

yPredict – An Innovative AI-Powered Trading Platform To Navigate The Fluctuating Crypto Market

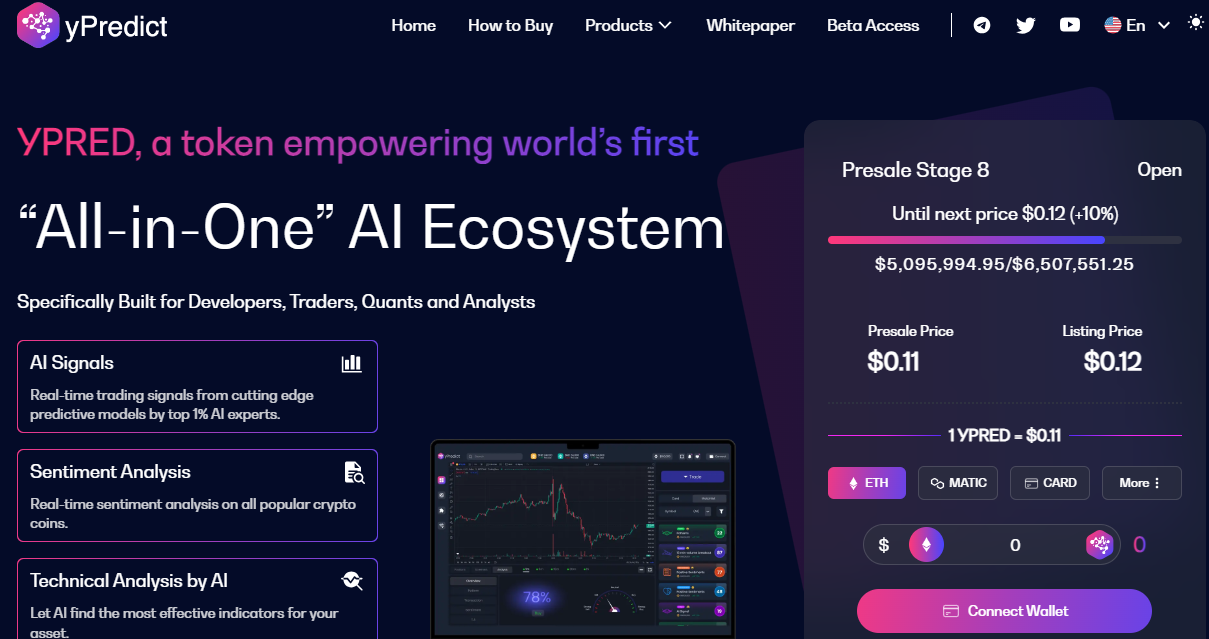

yPredict is an AI-powered crypto trading platform designed for traders and investors alongside developers. It provides deep insights for successful trading and a platform for developers to market their trading models.

The platform helps small-scale traders overcome the monopoly of the big players, such as institutions in the market, and safeguards against market manipulation.

yPredict uses Artificial Intelligence (AI) to solve complex trading issues while making the process easy for its users with its intuitive and accessible User Interface (UI). It is one of the crypto projects with exciting potential to reward investors this year.

Top Features

yPredict grants its users access to some interesting features. They include:

AI signals and predictive models: Signals are vital for successful trades. Although they are not 100% accurate, they provide users, especially beginners, with hints on the crypto tokens with the potential to succeed. Also, yPredict allows developers to market their predictive models backed by AI technology. These models are designed by the top 1% of AI experts worldwide, making them a potential channel for success.

Crypto Analytics: It could be quite difficult for traders to go through trading charts and history to predict a coin or token’s performance based on past price behavior. yPredict offers sentimental analysis to protect users from rug pulls and projects with low liquidity or proper structure.

Also, its technical and fundamental analysis serves as tools for a reasonable profit margin. It provides vital insights on the best indicator suitable for a particular token or coin.

Chart recognition AI: The platform’s intuitive AI quickly identifies 25 cryptocurrency trading chart patterns. These charts also help users make better trade decisions backed by statistical data.

Backlink estimator and keyword tool: The backlink estimator helps to predict backlink count and gives traders an insight into the market competitors. Also, the yPredict editor generates vital keyword suggestions needed for crypto trading and analytics.

Earn as you learn: yPredict Learn-to-Earn (L2E) rewards users for learning vital trading information on the platform. These users earn rewards as YPRED tokens after going through educational modules. Staking is another earning opportunity available within the ecosystem. Users earn passive income from staked tokens and also play a part in controlling supply, thereby curbing inflation for the token and boosting its value.

Check out our list of the best crypto staking coins.

Ongoing Presale

YPRED, the platform’s utility token, is currently on presale. The presale is a success raising over $5 million so far.

Each token is worth $0.11 in its final stage presale stage and will list at $0.12 on exchanges when the event concludes. With the real buzz around this token, it is not surprising to see it among the top crypto presales.

YPRED operates on the Polygon network and is purchased with MATIC, USDT, BNB, or a bank card. For more details, read our guide on how to buy yPredict successfully.

YPRED’s total supply is 100 million tokens which are fast selling out at the presale.

ESG Crypto Sector

The crypto space witnesses an increasing emergence of innovative projects. Interestingly, Environmental, Social, and Governance (ESG) is one of the special sectors that have received considerable attention through technological advancement.

Just like the meme coin sector, several ESG crypto projects have emerged in recent years. To know more about them, read our guide on the top greenest crypto coins.

However, in this guide, we will provide you with a detailed insight into Bitcoin Minetrix as one of the most popular crypto projects that fall into this category.

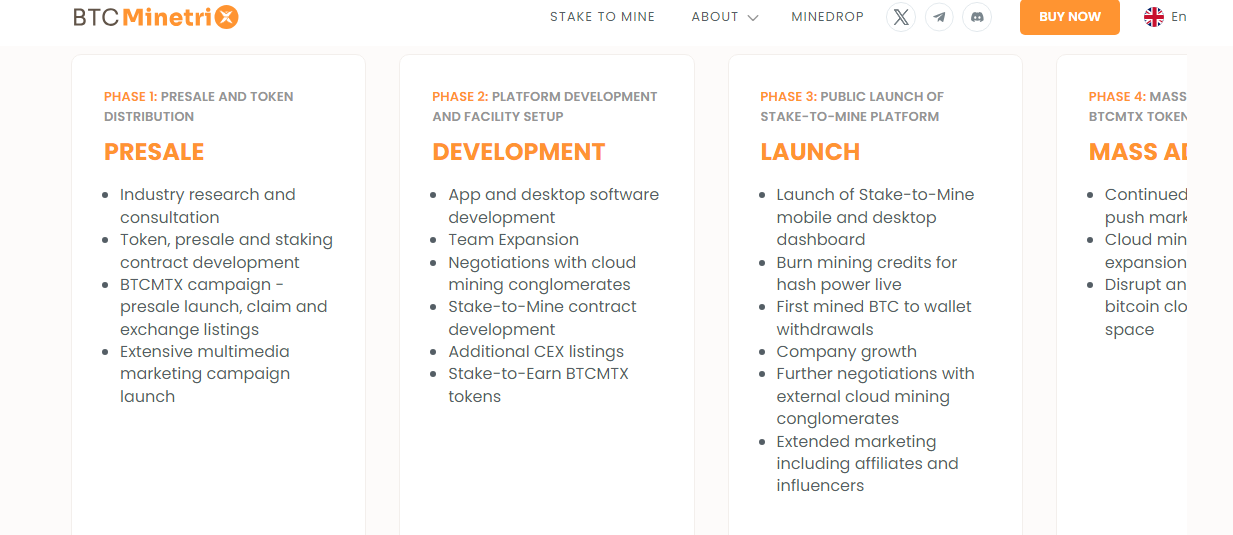

Bitcoin Minetrix – A DeFi Crypto Offering Stake-To-Mine Ecosystem

Bitcoin Minetrix has generated huge media hype owing to the remarkable success that is being recorded in its ongoing presale. Since the commencement of its presale, the token has netted over $4.5 million in early investments. This astonishing feat is enough evidence that investors are going all out to acquire the crypto.

At the moment, the coin sells for $0.0119 and it is likely to increase as the presale progresses into the next round. However, investors are bullish about Bitcoin Minetrix because of its unique features. By allowing investors to earn through staking and mining, Bitcoin Minetrix is best described as one of the crypto projects with the most potential.

Check out our Bitcoin Minetrix Price Prediction.

Additionally, investors are convinced about the reliability of Bitcoin Minetrix. The project’s smart contract was recently audited by Coinsult. The result of the audit indicated that the platform doesn’t have any lapses that could affect its smooth running.

Ecosystem

Bitcoin Minetrix is an interesting project that offers staking and mining rewards. The project has proven to be effective in correcting the environmental implications of Bitcoin mining. As Bitcoin Minetrix focuses on simplifying the rigorous process of BTC mining, it has also helped to subdue the environmental implications of mining.

With the platform, investors no longer need high-energy-consuming gadgets to mine Bitcoin. However, Bitcoin Minetrix isn’t a traditional cloud mining platform and it shouldn’t be mistaken as one. In recent times, the efficiency of cloud mining has been marred by scams. On the flip side, Bitcoin Minetrix through its Ethereum-based proof-of-stake consensus mechanism has amended the shortcomings of cloud mining.

Now, investors can mine BTC by purchasing the native token of the platform; BTCMTX which will provide them with mining credits. Users can consequently burn the mining credits for BTC. With this system, investors can venture into Bitcoin mining with as low as $10 which indicates a cheap pathway to earning awesomely.

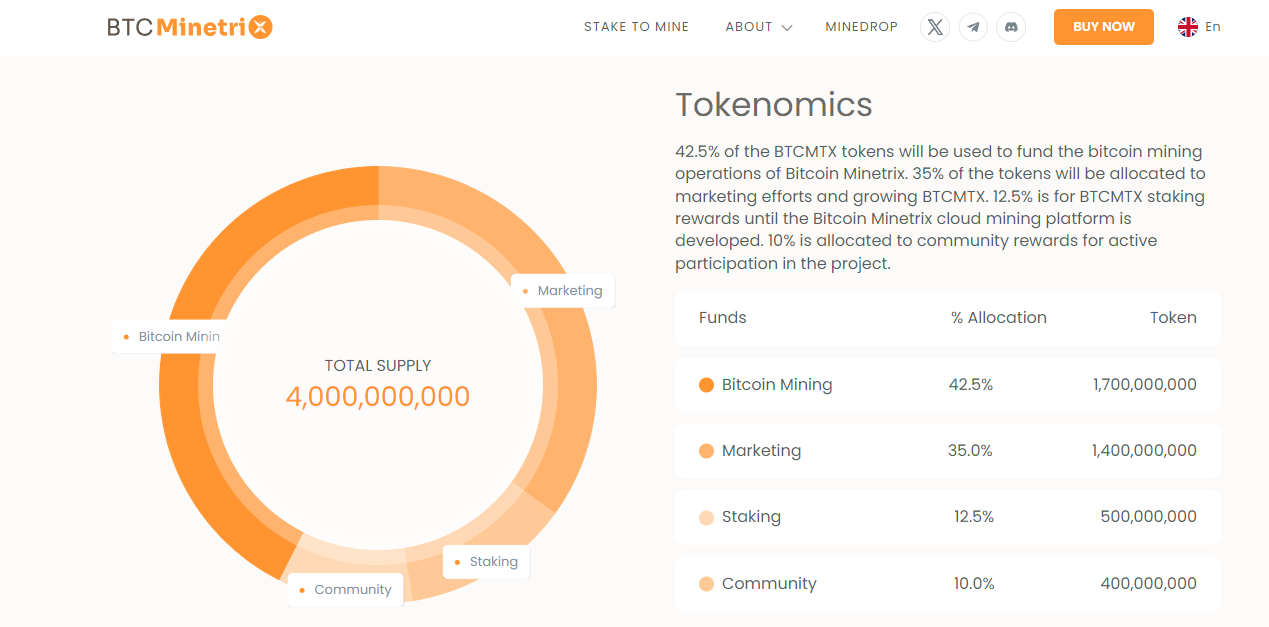

Tokenomics

The 4 billion total supply of BTCMTX is allocated into four major parts. While 42.5% of the total supply has been earmarked to finance the Bitcoin mining operations of the platform, 35% will be channeled toward various marketing efforts.

Also, 12.5% of the allocation is for BTCMTX staking rewards. The project also makes provision for community rewards as it aims to incentivize users for their participation on the platform. Accordingly, the project team set aside 10% for community rewards.

Why Should I Invest In Bitcoin Minetrix?

As one of the fastest-rising DeFi 2.0 crypto projects, Bitcoin Minetrix is, without a doubt, an amazing investment opportunity. We urge investors to take up the opportunity to acquire the token because it offers a simplified way of mining Bitcoin. Holding the token comes with a return of mining credits which investors can burn for BTC.

You can participate in the ongoing presale by using the affiliate link provided in this guide. More so, you can read our guide on how to buy Bitcoin Minetrix easily.

Meanwhile, the BTC mining activity of this platform is eco-friendly and this explains why it has been able to earn the support of environmentalists.

Web3 Crypto Sector

The Web3 crypto sector refers to the next generation of internet technology that leverages blockchain and decentralized protocols to enable a more open and secure online experience.

Unlike Web 2.0, characterized by centralized platforms and data ownership by a few major tech companies, Web3 aims to give individuals more control over their digital identities, data, and online interactions.

Blockchain technology is at the heart of the Web3 sector, which provides a transparent and tamper-proof decentralized ledger to record transactions and information.

This allows for trustless interactions and eliminates the need for intermediaries, such as banks or social media platforms, to validate transactions.

Rather, smart contracts and decentralized applications (dApps) enable peer-to-peer interactions, direct value exchange, and user collaboration. Check out our guide to learn more about the application of smart contracts.

Web3 encompasses a wide range of applications and platforms. One prominent aspect is decentralized finance (DeFi), which offers financial services without the need for traditional intermediaries.

DeFi protocols enable activities like lending, borrowing, and trading digital assets permissionless and transparently. This opens up financial opportunities to a broader range of participants and reduces barriers to entry.

Another key aspect of Web3 is decentralized social networking and content creation platforms. These platforms aim to give users ownership and control over their data and content, allowing them to directly monetize their contributions without relying on centralized platforms that profit from user-generated content.

According to a recent release by Global Newswire, the global Web 3.0 blockchain market is projected to hit a significant level of $44.2 billion by 2032. Global Newswire added that this surge represents a compound annual growth rate of 44.13%.

However, it’s important to note that Web3 is not without its challenges. Scalability, user experience, and regulatory considerations are among the hurdles that need to be overcome for widespread adoption.

Nonetheless, the Web3 crypto sector holds immense potential to transform the way we interact, transact, and collaborate online, paving the way for a more decentralized and user-centric digital future.

In recent months, numerous Web3 projects have emerged to provide users with the true benefits of a decentralized ecosystem. The list is endless, hence we recommend you read our guide on the best Web3 projects to learn more about them.

Nevertheless, in this session, we briefly discussed Launchpad XYZ as one of the top Web3 projects that you can invest in this year.

Launchpad XYZ – A DeFi Project Providing A Transparent Approach To Fundraising

Launchpad XYZ is an example of a Web3 crypto platform that aims to revolutionize fundraising and token launches. It provides a decentralized launchpad for projects to raise capital and connect with investors transparently and inclusively.

Through its platform, Launchpad XYZ embraces the principles of Web3 to empower the next generation of innovative blockchain projects. Launchpad’s presale has gained traction among investors eager to participate in the program and capitalize on its potential gains.

Launchpad has garnered substantial interest and confidence as investors seek substantial returns, raising over $2 million in funds during its presale stage. Currently, the Launchpad XYZ token is sold at $0.0445 and is anticipated to increase in the upcoming stage.

Once the token goes live on exchanges, it is expected to reach $0.0565, providing further incentive for investors to participate in the presale.

Launchpad aims to provide aspiring projects and entrepreneurs with a platform to raise funds and gain exposure within the crypto ecosystem. By investing in Launchpad, individuals can support the growth of innovative projects and potentially benefit from their success.

Moreover, Launchpad XYZ aligns with the broader trends in the cryptocurrency sector, such as the rise of decentralized finance (DeFi) and the increasing demand for alternative investment opportunities. Without a doubt, Launchpad XYZ is one of the most amazing DeFi coins in the market.

The platform offers a decentralized and transparent approach to fundraising, empowering investors to participate in the early stages of potentially groundbreaking projects.

As the crypto sector evolves, investors are constantly seeking new opportunities with high growth potential. Launchpad XYZ’s presale presents an avenue for investors to get involved early, potentially benefiting from the token’s anticipated price appreciation.

However, investors must conduct thorough research, assess the project’s fundamentals, and understand the associated risks before making any investment decisions.

DeFi Sector

Decentralized Finance (DeFi) has emerged as one of the most exciting and rapidly growing sectors within the cryptocurrency industry.

By leveraging blockchain technology, DeFi aims to restructure traditional financial systems by providing users worldwide with open, transparent, and permission-less financial services.

Democratizing Financial Services

DeFi holds the potential to democratize financial services by removing intermediaries and enabling peer-to-peer transactions.

DeFi protocols, built on blockchain networks like Ethereum, offer individuals across the globe access to a wide range of financial services, including staking, lending, borrowing, trading, and yield farming.

This inclusivity and accessibility make DeFi an attractive sector for investors seeking to support financial inclusion and empower underserved communities.

Check out our list of the top yield farming platforms.

Automated And Efficient

DeFi protocols are designed to be autonomous and operate without the need for intermediaries.

Smart contracts, programmable agreements built on blockchain networks, execute predefined rules, enabling seamless and automated financial transactions.

This automation reduces costs, eliminates human error, and provides enhanced efficiency compared to traditional financial systems.

As DeFi protocols evolve and innovate, the sector is poised to disrupt traditional financial institutions by offering faster, cheaper, and more accessible financial services.

Yield Generation And Passive Income Opportunities

One of the key attractions of the DeFi sector is the potential to generate passive income through various yield farming strategies. DeFi platforms allow users to lend their digital assets or provide liquidity to decentralized exchanges and earn interest or fees in return.

Staking and liquidity mining are popular mechanisms that incentivize users to participate in network activities by locking their tokens and receiving rewards.

In 2020, Yield Farming was first considered to be a trading strategy with “Liquidity mining” on the Compound protocol. Investors utilized Compound, a decentralized finance (DeFi) platform, to deposit their cryptocurrency assets and generate interest or “yield.”

In the following two years, the practice of yield farming managed to draw over $150 billion into DeFi protocols, solidifying its position as a significant trend within the crypto industry.

Based on data from Nansen, the growth rate of this sector between 2020 and 2022 exceeded 6,900%, showcasing its rapid expansion and immense potential.

Community Governance And Token Economics

DeFi protocols are often governed by decentralized autonomous organizations (DAOs) where token holders have voting rights and can participate in shaping the platform’s future.

This community-driven governance model ensures that decisions are made collectively and transparently, providing participants a sense of ownership and accountability.

Additionally, many DeFi projects have native tokens that play integral roles within their ecosystems. These tokens can be used for staking, participating in governance, earning rewards, or accessing specific features.

Today, millions of individuals are holding DAO governance tokens. Meanwhile, some of the DAOs that have continued to stand out include Optimism Collective, Arbitrum One, BitDAO, Uniswap, Polygon, and Gnosis.

Check out our guide to discover some of the best DAO crypto projects.

Interoperability And Collaboration

Interoperability is a key focus within the DeFi sector, aiming to create a seamless integration between different blockchain networks and protocols.

This interoperability fosters collaboration and synergy between projects, allowing for the creation of more robust and innovative financial applications.

As DeFi matures, cross-chain solutions and interoperability protocols will bridge different blockchain ecosystems, enabling liquidity sharing, asset transfers, and the development of interconnected DeFi platforms.

This collaborative approach enhances the overall sustainability and growth potential of the DeFi sector.

Addressing The Pain Points Affecting Traditional Finance

Traditional financial systems are plagued with inefficiencies, slow settlement times, high transaction fees, and a lack of transparency.

DeFi aims to address these pain points by leveraging blockchain technology. Smart contracts facilitate instant settlement, reducing counterparty risk and eliminating the need for intermediaries.

Additionally, DeFi applications provide real-time transparency, allowing users to verify transactions and access auditable records. By addressing these pain points, DeFi can potentially disrupt traditional finance and attract significant capital inflows.

Risk Factors And Regulatory Challenges

Acknowledging the risks associated with investing in the DeFi sector is essential. The decentralized nature of DeFi protocols, while offering benefits, also poses risks such as smart contract vulnerabilities, potential security breaches, and regulatory uncertainties.

The absence of intermediaries and the reliance on user-generated code introduce new challenges that investors must carefully consider.

Regulatory frameworks surrounding DeFi are still evolving, and compliance with emerging regulations is crucial for the sector’s long-term stability.

Finder Key DeFi Statistics

According to Finder, the growth of DeFi has been substantial since its early days in 2019.

Quarter after quarter, it has experienced rapid expansion, with more than 6 million unique wallets engaging in monthly on-chain transactions.

The DeFi market is witnessing rapid expansion, with notable growth observed between 2018 and 2020, where it surged by almost three times from US$1.2 billion to US$3 billion.

This growth has remained steady, nearly doubling on an annual basis. Experts in the industry forecast the market to reach US$67.4 billion by 2026.

Compound Finance: Pioneering Decentralized Lending And Borrowing

In the world of decentralized finance (DeFi), Compound Finance has emerged as a pioneering platform that revolutionizes lending and borrowing.

Built on the Ethereum blockchain, Compound allows users to lend and borrow digital assets decentralized and transparently.

In this segment, we will explore Compound Finance as a prime example of a DeFi coin, delving into its features, mechanisms, and potential for investors.

Overview Of Compound Finance

Compound Finance is a decentralized lending protocol enabling users to borrow various cryptocurrencies, including Ethereum (ETH), stablecoins like Dai (DAI), and other supported ERC-20 tokens.

The platform operates through algorithmic interest rate models and smart contracts, eliminating the need for intermediaries traditionally found in lending and borrowing processes.

Lending On Compound

Users can supply their digital assets to the Compound protocol and earn interest on their holdings. By depositing supported tokens into specific lending pools, lenders become liquidity providers and receive interest in real-time.

Interest rates on Compounds are algorithmically determined based on each asset’s supply and demand dynamics. This mechanism ensures that the lending pool is stable and fair, benefiting both lenders and borrowers.

Borrowing On Compound

Borrowers on the Compound can utilize their deposited assets as collateral to borrow other supported tokens. The amount available for borrowing is determined by the collateralization ratio, which ensures the safety of the protocol.

Borrowers can access liquidity without requiring credit checks or approval from a centralized authority. The interest rates for borrowing vary based on the supply and demand of the borrowed asset, allowing borrowers to benefit from market-driven rates.

Interest Model And Governance

Compound utilizes an interest rate model known as the “cToken interest rate model.” This model adjusts interest rates based on the utilization rate of each asset’s lending pool.

As the demand for a specific asset increase, the interest rate rises, incentivizing more users to supply that asset and balance the lending pool’s utilization.

Additionally, the Compound network has introduced governance through its native COMP token, allowing holders to propose and vote on changes to the protocol.

Check out our guide to discover some of the best places to buy COMP this year.

COMP Token And Governance

The COMP token serves multiple purposes within the Compound ecosystem. Firstly, it acts as a governance token, allowing holders to participate in the decision-making process regarding protocol upgrades, changes, and parameter adjustments.

Secondly, users who interact with Compound as lenders or borrowers can earn COMP tokens as a reward. These tokens incentivize participation and foster engagement within the protocol.

Holders of COMP tokens can also delegate their voting power to other addresses, further enhancing decentralization and community participation.

Compound Finance exemplifies the power of decentralized finance, offering a transparent and efficient lending and borrowing platform. As a prime example of a DeFi coin, Compound has gained significant attention and adoption within the cryptocurrency ecosystem.

Investors looking to engage with DeFi and explore the potential of decentralized lending and borrowing can consider Compound as a prominent opportunity.

However, conducting thorough research, assessing the risks, and staying updated on the evolving regulatory landscape is essential to make informed investment decisions within the DeFi space.

If you are a beginner, endeavor to read our guide on how to buy cryptocurrency safely this year before getting started.

Conclusion

Crypto investment could be challenging without proper knowledge of how to invest and where to invest.

Right now, the best sectors to invest in are meme coins, Artificial Intelligence (AI): DeFi, Web3, and Environmentally focused crypto projects.

These sectors are relevant at the moment and will likely gain more utility in the future. However, research and diversity remain key tools in any investment venture since the crypto market is often volatile.

To get started with any of these projects, particularly Bitcoin Minetrix, Meme Kombat, Launchpad XYZ, and yPredict, kindly ensure that you leverage the affiliate links provided in this guide.

FAQs

What makes Meme Kombat a unique project?

Meme Kombat is considered to be unique owing to its play-to-earn staking initiative that allows gamers to bet on the results of a battle between various memes.

Which of the crypto sectors can I invest in as a beginner?

There are numerous crypto sectors to invest in as a beginner. They include meme coin, ESG, Web3, AI, and DeFi sectors. Investors willing to make great dividends can check out all the projects that fall under the aforementioned sectors.

How can I get started with Meme Kombat?

You can get started with Meme Kombat by participating in its ongoing presale. In this guide, we have provided you with an affiliate link that will directly take you to the official site of the project.