When it comes to processing transactions and producing new blocks on the blockchain, proof-of-stake is a consensus method. In a distributed database, a consensus process is used to ensure the integrity of the database and to validate entries. Using bitcoin, the database is known as a blockchain, and the consensus method ensures the blockchain’s security.

Discover the difference between different proof of stake (POS) tokens as well as how they differ to proof of work (POW) and how they are both used in a cryptocurrency. Find out what Proof of Stake is seeking to solve in the bitcoin sector, as well.

Best Proof of Stake Coins – Top List

- Pepe Unchained – Layer 2 Crypto With a Pepe-Themed Concept

- Crypto All-Stars – Proof of Stake Token Blending Top Meme Coins

- The Meme Games – Olympic-Themed Proof of Stake Token

- Shiba Shootout – Shiba Inu-Themed Meme Coin With Staking Perks

- Base Dawgz – Exciting Multichain Memecoin with High Potential

- Mega Dice – Leading Crypto Casino Token With a Proof-of-Stake Mechanism

- Solana – A new blockchain-based open-source POS project implementing a new, high-performance, permissionless blockchain

- Cardano – A 5 year old project to build a platform for smart contracts and DApps with an aim for enhanced scalability and functionality

- Tron – POS token based on its own blockchain platform similar to the Ethereum Mainnet called TRC-10 or TRC-20

- Avalanche – Based on a platform for supporting DeFi, DApps and enterprise blockchain deployments in one interoperable, highly scalable ecosystem

- Polkadot – A token based on technology that allows the interoperability of unique blockchain networks known as parachains to increase scalability

- Polygon – Layer 2 scaling solution for Ethereum based on Plasma with Proof-of-Stake side chains aimed at providing considerable scalability benefits for decentralized applications

- EOS – One of the most ambitious initiatives on the blockchain, with an initial coin sale that garnered $4 billion at ICO

- Waves – An ICO that generated roughly 30,000 BTC for a platform with a matching currency of the same name, which debuted in 2016

Top Proof of Stake Coins to Buy – Full Analysis

Pepe Unchained – Layer 2 Crypto With a Pepe-Themed Concept

Pepe Unchained is a Layer 2 project that has been garnering popularity in the recent days. Originally built on the Ethereum chain, which itself transitioned to a proof of stake consensus mechanism, Pepe Unchained leverages these advanced features to offer enhanced transaction speed and efficiency.

By adopting Layer 2 solutions, Pepe Unchained not only inherits the robust security and decentralization of Ethereum’s PoS network but also significantly improves upon it. This strategic move reduces transaction costs and increases throughput, making the platform more scalable and user-friendly. These enhancements position Pepe Unchained as a formidable player in the PoS landscape.

The project’s compelling storyline, where Pepe the mascot breaks free from the limitations of its old blockchain to embrace the advantages of Layer 2, underscores its commitment to innovation and growth. This narrative has resonated with meme enthusiasts and crypto investors alike, contributing to its early success and growing popularity.

There is a staking facility as well, which is currently made exclusively for presale investors. The project offers a high APY rate, which is set to go down with every passing presale stage, which seems to also be the reason why many investors have been seen flocking to the project to get their hands on PEPU, the native token of the project.

Currently in its presale phase, Pepe Unchained has already raised over $400k, showcasing significant investor interest and confidence. Priced at just $0.008 per token, this affordable entry point presents a compelling opportunity for early investors to potentially realize substantial gains as the project develops and gains traction in the market.

Crypto All-Stars – Proof of Stake Token Blending Top Meme Coins

Crypto All-Stars is a proof-of-stake token that has taken the staking mechanic to its logical conclusion, by creating an ecosystem where most top meme coins can be staked to generate APY rewards.

As the name suggests, Crypto All-Stars necessarily stars most major meme coins that have taken the market by storm. The way these meme coin mascots have been presented on the homepage pays respect to their traits. Dogecoin, which is the “boss” of the meme coin space, is a muscled individual.

Floki Inu, a meme mascot with a warrior hat, stands with his eyes straight at the viewer, and Pepe, a suave token that went up quickly to become one of the best meme coins on the market, is seen sipping wine and thinking about life.

The layout of Crypto All-Stars further encapsulates the game-like feel of the project.

The tokens can be staked inside the world’s first MemeVault, to generate APY in terms of STARS tokens. There is also 3x staking rewards for STARS holders, and presale investors can get access to these rewards early.

Due to these reasons, Crypto All-Stars is one of the best proof-of-stake tokens on the market right now.

The Meme Games – Olympic-Themed Proof of Stake Token

Those who are looking for an interesting proof-of-stake investment should put their weight behind a meme coin that takes the latest Olympic trends to create a playing field where meme coins battle against each other at a blockchain-powered sporting event.

The Meme Games is analogous to The Olympic Games, and many degens have dubbed it the official token of the 2024 Olympic games. Presenting users with a multi-stage presale, The Meme Games (MGMES) offers many upsides that could boost its value in the short-term and make parabolic gains for early movers.

However, those looking for a more laid-back approach to earning can also stake their tokens and earn from The Meme Games’ staking module that offers dynamic APY of up to 2500%.

The core utility of this project, however, is more interesting. Presale investors can support specific meme characters, athletes who will take on the field and run a 169 metre sprint. Winners will reward backers with a 25% bonus.

Not only are the results randomized, investors will get a chance to gain unlimited entries based on the number of times they invest in this presale.

While the addition of gaming and staking mechanics is already enough to provide this project a leg up over other meme coin projects, The Meme Games ups the ante by making these meme athletes flagship characters of major meme coins. With players like Brett, Pepe, Dogecoin, Dogwifhat, and Turbo, investors will find it an appealing prospect.

The Meme Games can be described as a good unifying meme coin that’s specifically designed to entice those who are willing to become early adopters. Those interested in making short-term gains in the form of bonus perks should consider investing.

Shiba Shootout – Shiba Inu-Themed Meme Coin With Staking Perks

Shiba Shootout is one of the best staking coins on the market, featuring unique staking rewards for both late investors and presale buyers.

Those who invest in the project during the presale have a chance to buy and stake SHIBASHOOT tokens and earn upwards of 2000% APY if they do so today.

However, once the project is live and running, this staking model will transcend and add a visual appeal into the mix. Known as Cactus Staking, this approach will feature an image of a cactus on Shiba Shootout’s social media that will grow to represent the number of tokens being added to the staking pool.

In addition to staking perks, active profit seekers will be able to engage with multiple activities that Shiba Shootout has in store. These include engaging with the community through stories, participating in the DAO, and playing games. The P2E game has already been designed and is on its way to Android and iOS devices.

The simplified appeal of this project alone makes it a suitable investment for all. Therefore, those looking to make early bird gains and engage with the unique perks that this project will bring should visit shibashootout.com.

Base Dawgz – Exciting Multi-Chain Memecoin With High Potential

With its unique aesthetic, combined with the inclusion of popular project mascots, makes it stand out in the crowded memecoin market. The project’s bold and energetic theme not only appeals to a wide range of investors but also helps build a strong, community-centric ecosystem.

A cornerstone of Base Dawgz’s design is its focus on interoperability. By supporting multiple blockchains, including ETH, BSC, SOL, and AVAX, Base Dawgz sets a solid foundation for future utility integrations. This multi-chain support allows for seamless movement and interaction across various decentralized ecosystems, paving the way for innovative applications and use cases that could enhance the token’s value and utility.

Built on the Base Chain, Base Dawgz benefits from a proof-of-stake (PoS) consensus mechanism. This ensures efficient and eco-friendly operations, aligning with the growing demand for sustainable blockchain solutions. The PoS nature of the Base Chain also enhances the project’s security and scalability, making it a robust platform for further development.

The project’s commitment to transparency and security is evident through its thorough audit by a third party. This audit provides investors with the assurance that the project is built on a solid foundation, mitigating potential risks associated with investing in new cryptocurrencies.

The project’s thorough audit and ambitious roadmap further reinforce its credibility and potential for success. As a result, Base Dawgz presents a compelling investment opportunity for those looking to participate in a promising and innovative memecoin project.

Mega Dice – Leading Crypto Casino Token With a Proof-of-Stake Mechanism

Mega Dice isn’t just transforming the online casino experience; it’s also pioneering a new era of gaming with Solana’s proof-of-stake (PoS) model. By integrating PoS into its platform, Mega Dice ensures not only rapid transaction speeds and low fees but also a decentralized and secure gaming environment for its users.

The Mega Dice token, DICE, serves as the backbone of the platform, facilitating transactions, rewarding players, and enabling governance through staking. As a PoS token on Solana, DICE holders have the opportunity to stake their tokens and participate in network consensus, earning rewards while contributing to the platform’s security and stability.

What sets Mega Dice apart is its commitment to transparency and fairness. Utilizing a provably fair algorithm, Mega Dice guarantees that every roll or bet placed on the platform can be verified on the blockchain, ensuring trust and integrity in the gaming process. This level of transparency, combined with Solana’s PoS infrastructure, sets Mega Dice apart as a leader in the online casino space.

For investors looking to capitalize on the growing trend of PoS-based cryptocurrencies, Mega Dice presents an enticing opportunity. With its innovative approach to gaming, transparent gameplay, and integration with Solana’s PoS model, Mega Dice is well-positioned to revolutionize the online casino industry while offering lucrative investment opportunities for its users.

Solana (SOL)

Solana’s cryptocurrency is known as SOL. In addition to being a means of trading value and securing the blockchain, Solana’s native and utility token provides a means of staking. SOL was one of the top ten most valuable cryptocurrencies as of March 2020, and the team has worked hard to get there.

In the same way that Ethereum tokens work, SOL Tokens do the same. PoS consensus is used by token holders of Solana, despite the fact that their tokens all fulfill the same functions Users may participate in governance and pay transaction fees at the same time by using the SOL token.

It is estimated that the overall supply of Solana tokens is 511 million, with the present circulating supply of Solana tokens accounting for little over half of this total supply. While the community has 38 percent of SOL tokens, its founders and the Solana Foundation have 60 percent.

If you’re looking for a place to buy Solana tokens, they’re available on a wide range of exchanges. Solana is home to a number of major cryptocurrency exchanges, including Binance, eToro, Coinbase, KuCoin, Huobi, and FTX.

Your capital is at risk

Cardano (ADA)

This proof-of-stake blockchain technology, according to Cardano’s website, intends to allow “changemakers, innovators, and dreamers” to create a positive effect on the globe. The open-source movement is also aiming toward making society more secure, transparent, and equal by “redistributing power from unaccountable systems to the margins to individuals.”

Since its formation in 2017, Cardano has been inspired by the name of Gerolamo Cardano, an Italian polymath who lived during the Renaissance. A 19th-century mathematician known as the first computer programmer, Ada Lovelace, is thought to have been the inspiration for the native ADA token. As a result of the design of the token, ADA holders will be allowed to participate in network operations. As a consequence, those who hold the cryptocurrency may vote on any proposed changes to the scheme.

The layered blockchain’s technology allows for modularity in decentralized apps and smart contracts, according to the team behind it.

After the Alonzo hard fork was announced by Charles Hoskinson in August 2021, Cardano’s price surged by 116 percent the following month. On September 12, 2021, Cardano’s first hard fork, Alonzo, will become live. Over 100 smart contracts were deployed in the first 24 hours following the launch.

Other Cardano-based applications allow for the safe preservation of educational credentials and the identification of counterfeit products by both retailers and agricultural organizations alike.

Your capital is at risk

Tron (TRX)

It’s possible to run smart contracts and decentralized applications on TRON’s blockchain (dApps). Both Ethereum and TRON have similar features, so TRON aims to be seen as a rival to Ethereum. TRONix is the name of the coin that is used to perform the most fundamental functions on the network (TRX).

Justin Sun, a Chinese entrepreneur, formed the TRON Foundation in 2017 to oversee the platform’s development. On June 25, 2018, the TRON mainnet became operational. While attempting to extend their technology and unite with the creators of the most popular peer-to-peer file sharing software, TRON Foundation made a purchase in 2018. The TRON project has just teamed up with Samsung to provide TRON-based dApps to the Samsung store as well.

As part of the Delegated Proof-of-Stake (DPoS) process, 27 Super Representatives are in charge of running the network. Users that participate in TRX staking have the opportunity to vote for these representatives on a regular basis (every six hours).

Blocks are verified every three seconds by TRON super representatives, who also propose and vote on Improvement Proposals in the TRON committee.

It is possible for content providers and dApp developers to establish their own tokens on the network, which may be used for a wide range of applications.

Your capital is at risk

Avalanche (AVAX)

Avalanche is a blockchain platform that aims to be lightning-fast, scalable, and completely adaptable to any use case. To construct decentralized apps and smart contracts, as well as to digitize physical assets and create bespoke blockchains, this platform makes use of smart contracts.

This network was created by computer science professor Emin Gün Sirer and implemented by blockchain development business Ava Labs and other companies. They received $18 million from well-known investment firms and $42 million from their public AVAX token sale before launching the platform in September 2020.

There are three blockchains in the Avalanche network. For starters, the AVAX token is used in the Exchange Chain, which enables the production and exchange of assets. Following that, we have the Platform Chain, which allows for the development and tracking of subnets, which are simply customisable blockchains. The Contracts Chain is the last link in the chain, and it’s where smart contracts are created.

Avalanche, a novel method of reaching a consensus, is used by the Exchange Chain. The ‘Classical’ and ‘Nakamoto’ consensus models are the two most common consensus models, and this consensus mechanism combines the best of both worlds. In contrast to previous blockchains, where a single sluggish transaction might slow down the whole network, the consensus mechanism allows transactions to be processed in parallel.

As part of a “gossiping” consensus process, the nodes “speak” to each other to verify the validity of transactions on the network. Their faith in the legitimacy of their transaction rises.

According to how many tokens they have invested on the network, they are chosen as validators. It is more likely that they will be chosen if they stake a larger number of tokens.

For their respective chains, Platform and Contracts, an alternative consensus technique called Snowman is used. For smart contracts, Snowman is chain-optimized, unlike the Avalanche protocol.

Your capital is at risk

Polkadot (DOT)

One of the goals of Polkadot is to create a single, decentralized ecosystem of blockchains by sharding them together. It employs a Proof of Stake mechanism and a local currency called DOT.

One of Ethereum’s co-founders and inventors, Dr. Gavin Wood, created it in the early stages of Ethereum’s development. In late 2016, he published a white paper on Polkadot and established the Web3 Foundation, a non-profit organization dedicated to Polkadot’s advancement.

Kusama, Polkadot’s unpolished offshoot, was unveiled in August of this year. It was used to test the network’s boundaries in real-world settings. Phase 1 of Polkadot’s mainnet was released in May 2020 using the Proof of Authority protocol under the Web3 Foundation’s administration. In Phase 2, a few months later, the network converted to Proof of Stake, which allowed DOT owners to stake their currencies and claim validator seats.

The center of Polkadot’s network is a Relay Chain, which all other networks are linked to. As a result of the Relay Chain’s flexibility, developers are able to build the precise features they require, resulting in increased productivity and safety. Scalability is a major benefit of the Relay Chain, which can execute all transactions from all linked networks simultaneously.

In order to establish an extensive network of specialized organizations, Polkadot enables chains to interact with each other and exchange any form of data with each other.

Your capital is at risk

Polygon (MATIC)

It was once known as Matic Network until it changed its name to Polygon. In February of 2021, the project underwent a name change to reflect the new moniker. Their primary goal is to come up with solutions to the Ethereum blockchain’s many issues.

Jaynti Kanani, Sandeep Nailwal, Anurag Arjung, and Mihailo Bjelic launched the firm in 2017.

The native coin is still traded under the MATIC ticker despite the change in project name to Polygon.

Polygon is a platform for linking and organizing Ethereum-compatible blockchain networks. Because of the scalability challenges that Ethereum is experiencing, the firm views itself as the “internet of blockchains” it has to address.

This issue is being addressed in a variety of ways by the project. Using Plasma Chains and Layer 2 scaling, the first layer may now operate more quickly and without being overloaded with transactions. While Layer 1 only permits roughly 15 transactions per second, the second layer permits anything from 2,400 to 8,000 transactions per second. It’s a Proof of Stake sidechain that commits checkpoints to the Ethereum mainnet on a regular basis.

Your capital is at risk

EOS (EOS)

Smart contracts and decentralized apps are supported by EOS’s blockchain network (dApps). Scalability, transaction speed, and the absence of transaction fees are all important considerations. EOS, the primary token of the network, utilizes a Proof of Stake algorithm. Network management and development are the primary functions of the currency.

Dan Larmier, who invented Steem and BitShares, is the CTO of Block.one, which initially published it. The major goal of EOS was to produce a solution that could handle thousands of transactions per second while also functioning without charging any fees.

In June 2017, Block.one sold more than 200 million EOS tokens. The next year, 2 million coins per day were sold. Roughly $4.2 billion was made through the sale of around 900 million coins.

After the mainnet went online on June 6, 2019, Block.one held onto the final $100 million as development financing, with the funds being distributed in 10-year increments.

Proof of Stake is implemented via a delegated Proof of Stake (PoS) protocol, with 21 Block Producers (BP) elected by currency holders. A block producer may be anybody with a sufficient number of votes. Since the vote is continuous, it is also possible to change a BP at any moment.

One BP produces one block every 0.5 seconds. It is impossible to undo the effects of a block signed by 15 BPs.

Your capital is at risk

Waves (WAVES)

Users may construct and launch their own digital assets using Waves, a blockchain platform that allows them to do just that. Allowing a wide spectrum of people to participate, the method doesn’t need any coding knowledge. The Waves protocol’s native asset goes by the name of WAVES.

Full and lightweight nodes are used by Waves to execute its software. The full nodes are responsible for storing and verifying all of the network’s transactional data, while also allowing the lighter nodes to communicate with one other.

With their native WAVES token, users not only pay for transactions but can also lend their tokens to other mining nodes to generate a profit on the block reward.

A Waves wallet must be downloaded and set up before you can begin using the Waves network. Waves.Exchange and WavesFX are two of the greatest alternatives for managing your WAVES and Waves-based tokens, as well as creating your own tokens. With the Waves.Exchange program, users may exchange Waves, Bitcoin, Ethereum, Litecoin and more for fiat currencies. Be aware that in order to establish a token on the Waves platform, you will need some WAVES tokens.

Your capital is at risk

What are Proof of Stake coins?

With proof-of-stake, a cryptocurrency’s blockchain and transactions are more secure since less computational labor is required to validate blocks and transactions. Proof-of-stake introduces a new approach to block verification that relies on coin holders’ devices. As a kind of payment, the owners put up their coins as a form of collateral. “Validators” are coin holders who have staked their coins.

Randomly chosen miners are then chosen to “mine” or verify the block. As opposed to employing a competition-based process like Proof of Work, this approach uses a random allocation of “mining” time for all participants.

One must “stake” some quantity of coins in order to become a validator. For example, in order to become an Ethereum validator, a user must invest 32 ETH. In order for a block to be completed and closed, a certain number of validators must agree that the block is correct.

Although there are several ways to validate blocks, Ethereum will employ shards when moving to Proof of Stake in the future. As long as there are at least 128 validators attesting to the same shard block, the transactions are added to the shard by the validator.

In order for a block to be closed, two-thirds of validators must agree that a transaction is legitimate.

What is the best exchange for investing in Proof of Stake Coins

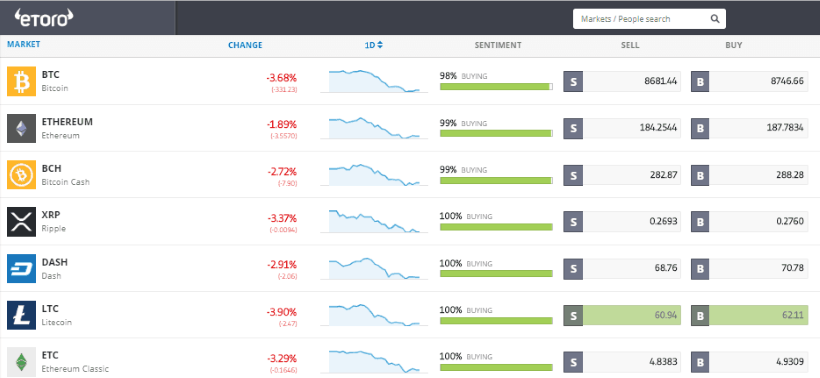

1. eToro

eToro is a well-known cryptocurrency and stock trading platform that is available online. In 2014, it became one of the first online trading businesses to allow Bitcoin (BTC) trading. Shortly after, Ethereum (ETH) and Ripple (XRP) were unveiled (XRP).

In 2007, Ronen Assia, David Ring, and Yoni Assia established eToro in Tel Aviv. The company’s CEO, Assia, has remained in her position to this day.

It used to be known as RetailFX, but it changed its name to eToro after expanding its portfolio to include commodities, indexes (such as the S&P 500), and stocks. A social trading feature that enabled participants to copy successful traders made it the world’s biggest social trading network when it was launched in 2010.

eToro introduced BTC support in 2014, enabling customers to trade CFDs on the most widely used digital currency in the world (to non-U.S. users). It has now been expanded to include a wider range of digital assets such as Ethereum and XRP in addition to Bitcoin (BTC). The business entered the cryptocurrency sector in 2018 with the introduction of eToroX and a crypto wallet.

In today’s extremely competitive crypto exchange industry, eToro is continually enhancing its crypto trading services in order to position itself as a market leader.

Your capital is at risk.

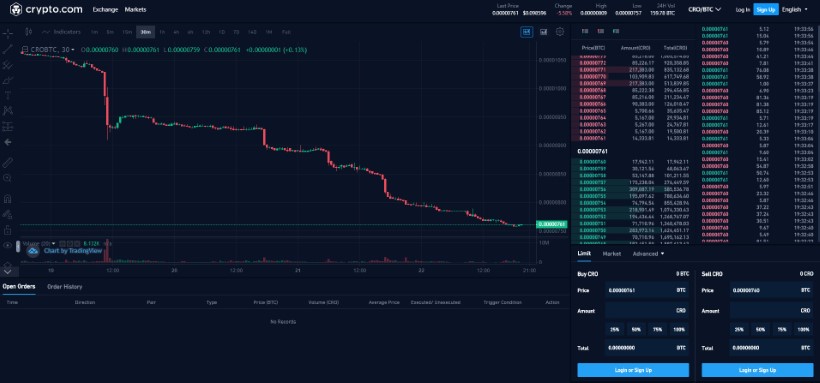

2. Crypto.com

As a well-known exchange, Crypto.com also offers a large range of cryptocurrencies and blockchain-related products. A broad range of currencies are accessible for buy, trade and trading at a low cost. Besides credit cards, the company also offers a decentralized trading platform and an NFT marketplace. Staking or storing cryptocurrency in a Crypto.com wallet for a certain period of time may earn users up to 14.5 percent interest.

Anyone interested in purchasing and storing cryptocurrencies such as Bitcoin and Ethereum may find Crypto.com to be a viable choice. If there is a lot of CRO trading or if you own a large amount, costs reduce to 0.40 percent. You can trade cryptocurrency futures and 250 different currencies on Crypto.com.

Crypto.com, situated in Hong Kong, was established in 2016. Customers throughout the world have access to more than 250 different cryptocurrencies. A comprehensive variety of cryptocurrency-related financial services are available via Crypto.com to consumers in over 90 countries.

Beginners and experts alike may benefit from Crypto.com’s wide currency choices, low costs, and other services. On the other hand, the sheer amount of choices may deter those just starting out.

We believe that Crypto.com is the best option for those who want to do more with their cryptocurrencies than just buy and hold them. Furthermore, anybody who intends to utilize cryptocurrencies as a means of trade rather than only as an investment vehicle would find this platform quite appealing.

Your capital is at risk.

How to invest in Proof of Stake coins

Perhaps you’d want to try your hand at cryptocurrency mining, but you can’t afford the high-tech mining equipment required to do so. Fortunately, you don’t have to worry about spending a bunch to make money.

Finding a trustworthy and well-maintained blockchain network that uses “proof of stake” transactions is the first step towards generating money using this method. In the previous section, we went through some of the most popular currencies that use the ‘proof-of-stake’ method.

The second phase is putting money into the network of your choosing by buying a certain amount of tokens. The more money you put in, the more money you make. In order to better understand the concept, assume that you deposit a particular amount of money into your bank account, and that amount grows over time as the bank earns interest on your money. ‘Proof-of-stake,’ as the name implies, is the same concept as this.

Why invest in Proof of Stake Coins

Blockchain technology and the ‘proof-of-work’ algorithm have been extensively criticized in recent years for the ever-increasing environmental impact they cause.

Cryptocurrency mining is a huge problem since it consumes a lot of energy, much like real-world money. It is estimated that the Bitcoin network uses the same amount of energy that it would take to run 6.6 million American residences for a whole day. A staggering 0.32 percent of the world’s power usage is used by Bitcoin, the world’s biggest blockchain platform, in July 2018.

A rise in trend numbers is expected in the next few years as the mining process grows more complicated. In order to maintain a reasonable profit margin, more demanding and complex mining rigs will be necessary to function.

In addition, every four years, the incentive, in the form of mining bitcoin, is half. The long-term goal of this system design is to keep the cryptocurrency’s value stable. As a result, many users may leave the blockchain network, making it an attractive target for cyberattacks.

‘Proof of Stake’ is a newer algorithm that aims for better network security and long-term viability due to the adverse forecasts made by the ‘proof-of-work’ consensus. Although this relatively new approach is used by the majority of emerging blockchain networks, it is extremely improbable that the largest cryptocurrencies would accept it anytime soon. Those who invested millions of dollars in sophisticated and very efficient mining equipment would have lost their money if this happens.

Risks of investing in Proof of Stake Coins

eCash’s creator, Amaury Sechet, says proof of stake has drawbacks.

For the last decade, billion-dollar blockchains have been protected by proof of work, which Sechet says is not as well tested as proof of stake.

For example, low-cost bribe attacks may be more difficult to prevent with proof of stake solutions than with proof of labor. The blockchain’s overall security is reduced when it is vulnerable to assaults.

Proof-of-stake systems may be swayed significantly by validators with huge holdings of a blockchain’s token or cryptocurrency.

The process of converting a cryptocurrency from proof of work to proof of stake is arduous and time-consuming. Changing consensus methods in any cryptocurrency will need a lengthy planning effort to preserve the blockchain’s long-term stability.

How much you should invest in Proof of Stake Coins

For all of the computing power and energy it uses, proof of work has a terrible image. In light of rising environmental concerns about blockchains that employ proof of labor, such as Bitcoin, proof of stake may provide better environmental consequences.

“Proof of work is most lucrative on a global scale when energy can be obtained at the lowest cost,” explains Marius Smith, who happens to be head of business development at a company called Finoa.

This reduces the cost of power for crypto mining by concentrating it in a few places. With its low power consumption and extensive distribution of infrastructure, Smith believes proof of stake may strengthen a blockchain system.

It is possible for more individuals to participate in blockchain systems by serving as validators thanks to proof of stake. In order to stake crypto, there is no need to invest in costly processing equipment or use a lot of energy. Coins are all you’ll need.

Staking is a tool offered by crypto exchanges like Coinbase, Binance, and Kraken. Everstake, for example, is a platform solely devoted to staking. In certain blockchains, cryptocurrency owners may earn 5% to 14% on their investments via staking.

Proof-of-stake blockchains also have the potential to be more scalable in the future than proof-of-work blockchains. Proof of stake blockchains may theoretically handle more concurrent transactions without sacrificing security or decentralization, according to Smith.

When it comes to using blockchains on a global scale in the future, “this is where a great lot of innovation is taking place now, and undoubtedly a difficulty that blockchains will have to solve,” he adds.

Read More

FAQs

Which cryptocurrency makes use of proof-of-stake?

Pepe Unchained, Shiba Shootout, Cardano etc are some of the most popular proof of stake cryptocurrencies. In order to go from proof of work to proof of stake, Ethereum, the second-largest cryptocurrency by market capitalization, is in the process of transitioning.

Is it advantageous to stake?

Staking has the main advantage of increasing your crypto holdings, and the interest rates on these holdings may be very generous. You may be able to make an annual profit of more than 10% or 20% in some circumstances. It has the potential to be an extremely lucrative investment strategy. The sole requirement is that the crypto be based on the proof-of-stake algorithm.

Is proof-of-stake a Better option than traditional staking?

How to invest in Proof of Stake Security using an image search. There is currently no better method for ensuring network security and consensus than proof-of-work. It's because proof-of-work involves an upfront investment in hardware and continual expenditures of resources, unlike proof-of-stake, which just requires a single upfront investment.