The globe is obsessed with cryptocurrencies, blockchain technology, and decentralized finance (DeFi), with the market seeing significant growth in the first half of this year. This enthusiasm has resulted in emerging new and emerging cryptocurrencies, including gaming.

AXS aims to bring blockchain technology to the masses in a fun way. It’s play-to-earn crypto and built on the Ethereum (ETH) network. While playing, participants can earn the Axie Infinity Shard token (AXS) and the other in-game token, Smooth Love Potion (SLP).

Players breed, raise, and battle in the Pokemon-inspired Axie Infinity game world to earn tokens. Axies are cute digital pets, and each one is unique. Axie is a non-fungible token (NFT) that can be bought and sold. You need at least three to start playing the game. Thankfully, the bear market has reduced their price massively.

On this Page:

How to Buy Axie Infinity Shards

- Choose an Axie Infinity exchange – we recommend Coinbase.

- Create an account

- Deposit funds into your account

- Search ‘AXS’ in the top menu

- Click ‘Open Trade’ and select an amount of AXS to buy

Best Place to Buy AXS in September 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Compare Crypto Brokers & Exchanges

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

How to Buy Axie Infinity (AXS) – Full Step-by-Step Guide

Do you want to know how to acquire Axie Infinity (AXS) right now? To acquire Axie Infinity (AXS) right now, simply follow these simple instructions.

- Open an account: To begin, you’ll need to register with a reputable Bitcoin exchange – Coinbase is recommended.

- Upload ID: Coinbase requires users to upload a copy of their government-issued identification and verify.

- Deposit: You can now use a debit/credit card, Paypal, Neteller, Skrill, or a bank transfer to make a deposit.

- Buy Axie Infinity (AXS): Search for Axie Infinity (AXS)’ and click the ‘Trade’ button. Enter the amount of Bitcoin you wish to buy ($25 minimum) and confirm the order.

How to Buy AXS

After collecting detailed information about Axie Infinity (AXS), the next step is to open an account with a broker company. As Axie Infinity (AXS) is listed on the Blockchain network, finding a broker with access to the blockchain is crucial. Some of the most prominent cryptocurrency brokers in the United Kingdom have been discussed above.

Looking for a more in-depth explanation of how to buy Axie Infinity (AXS) online? If that’s the case, the article below will lead you through the processes required to purchase AXS most safely and cost-effectively.

Step 1: Open an Account

The first step is to visit either visit the Coinbase website or download the mobile app and set up an account using an email and phone number.

Step 2: Upload ID

To comply with regulatory rules, Coinbase will request users to provide a copy of their driver’s license or passport to verify their identity, as well as verify and confirm their email address and phone number. Proof of address is also required by some users.

Step 3: Make a Deposit

The minimum amount required to start an account with Coinbase is $10, which can be deposited in a variety of ways, including:

- Debit cards

- Credit cards

- Bank transfers

- Skrill

- PayPal

- Neteller

Step 4: Search for Axie Infinity (AXS)

You should now have a Coinbase account funded at this stage of our step-by-step guide. Now it’s time to buy Axie Infinity (AXS) – it cannot be traded directly for fiat currency so users must first purchase a stablecoin such as Tether (USDT) to convert.

Then, find the correct trading pair – AXS/USDT – and follow the steps to complete the transaction.

1 – Coinbase

Coinbase is among the most well-known cryptocurrency exchanges in the United States and one of the world’s largest. Nevertheless, keep in mind the hazards of trading these speculative currencies. Coinbase, the largest cryptocurrency trading platform in the United States, was founded in 2012 in San Francisco.

CoinMarketCap.com, a market research website, is also among the top crypto exchanges globally in terms of traffic, liquidity, and trading volumes. Coinbase is a cryptocurrency brokerage that provides custodial services for institutional cryptocurrency storage and a cryptocurrency payments network for businesses. Furthermore, USD Coin (USDC) is a stable cryptocurrency pegged to the US dollar.

Coinbase became the first crypto trading company in the United States to be listed on a US exchange in April, with an IPO valued at roughly $86 billion. While bitcoin brokerages are not covered by the Securities Investor Protection Corporation or SIPC, Coinbase covers its site for any losses incurred due to theft or hacking.

Coinbase.com listed Axie Infinity (AXS), Request (REQ), TrueFi (TRU), Quickswap (QUICK), and Wrapped Luna (WLUNA) on August 13, 2021, and on the Coinbase Android and iOS apps. Customers of Coinbase can now trade, transmit, receive, or store AXS, REQ, TRU, QUICK, and WLUNA in most Coinbase-supported regions, with certain restrictions noted on each asset page here. Coinbase Pro also supports trading in these assets.

Axie Infinity Shards (AXS), the main token, can be purchased and sold on platforms like Coinbase. To play the game, you must have some AXS, but you may also exchange AXS like Bitcoin, Dogecoin, or any other significant cryptocurrency. AXS will also function as a governance token, giving holders a say in the game’s development.

How do you get started with Axie Infinity?

To participate, you’ll need an Ethereum-compatible crypto wallet and some ETH. You can purchase ETH via an exchange such as Coinbase and transfer it to Coinbase Wallet (which is distinct from the main Coinbase app and can be downloaded from the Apple App Store or Google Play) or Metamask.

First, purchase at least three Axes from the game’s marketplace. Sky Mavis keeps 4.25 percent of all Axies, virtual real estate, and other things that users sell to one another. “Rare” axes with desirable features are more expensive.

Players can also “breed” new Axies for some of the game’s two native cryptocurrencies, Axie Infinity Shards (AXS) and Small Love Potion (SLP). You can gain SLP by defeating other players and completing tasks.

Pros & Cons of the Coinbase platform:

- It offers access to more than 50 cryptocurrencies.

- Low minimum to fund an account.

- Cryptocurrency is insured in the event a website is hacked.

- Higher fees than other cryptocurrency exchanges.

2 – Binance

Binance is the world’s largest cryptocurrency exchange by daily transaction volume, with over $20 billion in deals per day. It gives you access to hundreds of assets and a smooth trading service that makes it simple to make money.

The advantages of Binance are pretty astounding. The trading commission is a flat 0.1 percent, which is extremely low. Expert traders can use sophisticated tools, including futures and margin trading, and the exchange offers a variety of deposit and withdrawal methods. Combining this with Binance’s high liquidity makes it easy to see why it’s so popular.

Binance, on the other hand, is a crypto-only exchange. The exchange also charges high credit card transaction fees, and the primary portal isn’t particularly user-friendly. Furthermore, the Binance interface is not particularly user-friendly for newcomers. As per the recent updates, Binance has finalized the Ronin network integration of Axie Infinity (AXS) and Smooth Love Potion (SLP) and has opened deposits for Ronin AXS & SLP tokens.

Binance will continue to enable deposits and withdrawals of ERC20 and BEP20 AXS and SLP tokens in addition to Ronin AXS and SLP tokens.

Pros & Cons of the Binance platform:

- Excellent liquidity

- Exceptional security features

- Professional traders have access to sophisticated products.

- Not suitable for newbies.

3 – Bitfinex

Bitfinex is a renowned cryptocurrency exchange that provides advanced trading choices at reasonable prices. Giancarlo Devansini and Raphael Nicolle, the exchange’s founders, created the exchange in the British Virgin Islands in 2012. It is now headquartered in Hong Kong and is led by CEO JL Van Der Velde. In 2020, the company’s net worth was evaluated at more than $800 million, and in 2021 witnessed even more growth; the broker saw a 300 percent increase in new customers in the first three months.

The cryptocurrency exchange has grown to become one of the largest in the world, with offices in the United Kingdom (GBP), Europe (EUR), Japan (JPY), and other countries. Its services are most appropriate for experienced or professional traders. In addition to traditional cryptocurrency purchases, the site provides margin trading, staking, and lending.

Fee-taker costs range between 0.2 and 0.055 percent, whereas Maker fees range between 0.1 and 0.0 percent. There is no trading cost for big orders placed through the OTC desk. Bank wire transfers incur a 0.1 percent deposit and withdrawal fee. For foreign withdrawals, this can be increased to 1%.

Pros & Cons of the Bitfinex platform:

- Established since 2012

- Suited for advanced traders

- Over 100 supported coins

- Accepts bank wire deposits and withdrawals

- U.S. citizens not accepted

- Not regulated

- High trading fees

- Hacked on more than one occasion

4 – KuCoin

KuCoin, which debuted in 2017, is a cryptocurrency exchange that provides third-party brokerage services. Despite having only three years of trading history, the platform has grown to become one of the largest cryptocurrency exchanges in the world. One of the key reasons is that the exchange hosts over 200 coins and over 450 cryptocurrency pairs. This includes big pairs like BTC/USDT and ETH/USDT and many crypto-cross pairs. If you want to trade a less liquid ERC-20 token, you’ll almost certainly find it at KuCoin.

KuCoin charges only 0.10 percent for bitcoin trading fees. This puts it on par with companies like Binance. Similarly, KuCoin has its digital token, KuCoin Shares (KCS). By owning and storing KCS tokens, you will receive lower trading costs and a percentage of the trading commissions collected by KuCoin.

Crypto-to-Crypto Exchanges – Every trading coin pair at KuCoin is crypto-to-crypto, not least because it does not provide any fiat-denominated securities. Instead, if you want to trade in the crypto-to-USD market, you must first trade your selected cryptocurrency against the USDT.

KuCoin listed Axie Infinity (AXS) on July 16, 2021, and supported trading pairs, including AXS/USDT.

Pros & Cons of the KuCoin platform:

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- User-friendly exchange

- Low trading and withdrawal fees

- KuCoin Shares allow users to invest in the success of KuCoin

- Users can trade using Arwen without transferring funds into a third-party wallet

- Due to KuCoin’s commitment to rapidly launching new, innovative crypto assets, customers can access various trading pairs

- Users can choose from a vast number of trade pairs

- No bank deposits

- Since it’s a crypto-only exchange, it can be tough for newbies to utilize

- Lacks the trading volumes found on some of the more established platforms

- No fiat trading pairs

5 – Bybit

Bybit is a newer trading platform that debuted in March 2018. It provides an industry-leading leverage trading exchange focusing on cryptocurrency derivatives, trading key coins such as Bitcoin, Ethereum, and EOS against

Takers are charged a fee of 0.075 percent for each order, which is a fairly average rate in the market. On the other hand, Makers pay a 0.025 percent fee — so if you are the maker in a $1000 trade, you would only pay $997.50, which we thought reasonable. The fees are the same regardless of the currency used in the transaction. There is also a tiny cost of 0.0005 Bitcoin for BTC transfers, which is lower than the global industry standard.

- USDT everlasting BTC, ETH, EOS, and LTC pairs

- Trading costs range from 0.025 to 0.075 percent for leverage up to 100 times.

- Order books with high liquidity and low spreads

- Bybit is a mobile trading app.

- 4.9 out of 5 stars based on over 50,000 reviews

- Affiliate and referral program (30% commission)

Pros & Cons of the Bybit platform:

- Trustworthy and reputable trading platform

- 4th largest derivatives exchange in the world by volume

- Variety of markets, including spot, perpetual, and Futures

- Advanced and feature-rich trading platform

- Intuitive and responsive mobile app

- Difficult for beginners to navigate

- A limited number of spot trading pairs against BTC

What is Axie Infinity (AXS)?

Sky Mavis is the team that founded AXS in 2018. C0-founded by Trung Nguyen and Aleksander Larsen, the main goal of the coins was for players to enjoy earning them by competing in games, but they also wanted to provide an excellent return to customers. In 2021 Axie Infinity rocketed to the moon, and many investors profited several hundred percent.

On September 29, Axie Infinity broke the bottom reversal pattern and has doubled in value since then. There will be a retracement, but there is a chance that AXS will record a new all-time high before the upswing ends. Axie Infinity is a new type of crypto-based game platform. AXS price is typically correlated to the game’s popularity; it tends to drop if players migrate to a competitor or lose interest. Typically, people participate in this game to make money.

Its appeal is the possibility for profit, particularly in poor countries. Axie’s impressive revenue streams are driven by high involvement. Axie generated more revenue in June than big decentralized exchanges such as Uniswap and Aave.

Is it Worth Buying AXS in 2024?

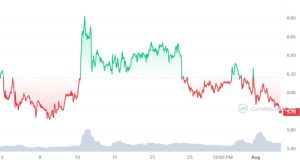

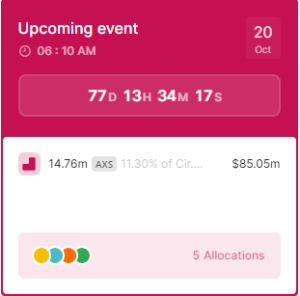

Axie Infinity (AXS), the blockchain-based gaming platform’s native token, has been a rollercoaster of price performance marked by short-lived surges and subsequent dips. As the cryptocurrency navigates the challenges within the current bearish zone, it has achieved some recovery. Over the past 30 trading days, AXS’s price has soared by an impressive 7%. However, this apparent bullish sentiment is met with cautious optimism due to the token unlock event that presents potential bearish indicators.

The recent weeks have witnessed a renewed surge in market demand for Axie Infinity. Notably, the platform experienced a price correction leading up to the previous unlock event in April; the latest one happened on July 22. Contrary to historical patterns, the current scenario showcases a 33% price rally this month, attributing this surge to AXS investors who have been staking and holding onto their tokens to reap forthcoming rewards.

A key metric, the Axie Infinity Mean Coin Age, has been steadily rising since the onset of July. The metric has surged by 40%, ascending from 28.9 to 44.2 between July 1 and July 19. Calculated by dividing the total coin age by the circulating supply, the Mean Coin Age offers insights into shifts in the average duration of token holdings.

This sustained increase suggests a widespread bullish sentiment, indicative of a wave of accumulation. It implies that AXS holders are positioning themselves to stake their tokens and leverage higher rewards during the impending token unlock event. However, the market dynamics might shift dramatically once this event concludes.

There’s a lot going on that’s keeping Axie supported:

- It is one of the most valuable gaming cryptocurrencies in market capitalization.

- Its senior management team has prior experience in both blockchain and gaming.

- It has a whitepaper with a well-defined roadmap and objectives.

However, the significant price increase makes it appear to be a fad rather than a long-term investment. Here are some of the most severe Axie-specific risks:

- Axie may encounter further server issues or other technical difficulties.

- If the value of Axie declines, playing the game will become less profitable, and the community may disband.

- Given the rate of technological advancement, there’s always the possibility that a newer game will dethrone it.

Will the Price of Axie Infinity (AXS) Go Up in 2024?

The long-term estimate for Axie Infinity is not as bullish this year as last. The bear market and arrival of better and more inclusive games have hurt Axie Infinity’s bottom line. As a result, the estimates for Axie Infinity paint a bearish picture. 2022 saw Axie Infinity falling loser to its all-time lows at $6, a range at which it accumulated till the end of this year.

However, the AXS price has seen a massive comeback since entering 2023. The token has seen a massive uptick by almost 50% thanks to Bitcoin gaining more support from the broader cryptocurrency market.

An intriguing development on the horizon is the rise of traders queuing orders in anticipation of a potential token unlock sell-off scheduled for October 20. On-chain data points to a surprising trend. Despite the ongoing price surge over the last month, some AXS traders are ramping up-sell pressure, as indicated by 29.70 million tokens being listed for sale.

Considering intricate on-chain indicators, the outlook for AXS appears multifaceted. It’s plausible that AXS could muster a final push to reclaim the $6.0 mark, but the token unlock might subsequently trigger a retracement toward the $4.50 level.

However, the critical support level at $5 must first be overcome to initiate this bearish shift. On the brighter side, the bullish faction stands a solid chance of maintaining dominance if the AXS price escalates above the $8 mark ahead of the Token Unlock. Investors’ potential preference to take profits could act as a hindrance to the rally. Yet, if these investors flip the $7 resistance level, AXS could potentially rally toward the $8 milestone.

How to Choose the Right Crypto Broker

Given the abundance of brokers from which to purchase AXS, you must make the best decision possible. As you look for the best broker for you, consider the following factors:

1. Fees

When trading cryptocurrencies like AXS, finding a low-cost broker is crucial; what’s the significance? Because fees can quickly accumulate. Get a breakdown of the broker’s fee structure before deciding on a trading platform. Fees for withdrawals, deposits, transactions, and trading should be included.

2 – Safety

The correct broker should have appropriate safety and security standards to avoid illegal access to your assets.

3. Support

A reputable broker will also have a strong customer service department to assist you with your every requirement.

4. Deposit Options

You want to be able to make as many deposits as feasible. There are always a lot of choices, from bank transfers to credit cards to payment processors. Just keep in mind that each one comes with its own set of expenses.

When you’re considering an investment, follow these things:

Each cryptocurrency carries inherent risks, and this is particularly true for AXS. Thus, anytime you invest, it is critical to avoid succumbing to FOMO. Apart from following others, you must investigate before investing in any digital asset.

1 – Continued research: Before investing your money, conducting thorough research on the product is critical to prevent its associated hazards.

Here are the different methods we looked into:

- Reviewing social media channels.

- Take note of the transaction volume.

- Review the principles.

- Explore popular subjects.

- Make use of the potential of specialist forums.

- Analyzing future events

- Escort crypto meetups.

2 – Monitor the market:

Market monitoring is the second stage in learning more about your chosen product or digital asset. The market may move contrary to your expectations, and maintaining your calm when the market does so is equally critical. The most effective method of market monitoring is to peruse review sites and their associated recommendations.

Buying Axie Infinity (AXS) as a CFD Product

Contracts for differences (CFDs) are derivatives that allow you to speculate on multiple financial markets without owning the underlying asset. It is widely used in established markets such as foreign exchange currency pairings, stocks, bonds, indices, and commodities.

Trading CFDs entails more than simply buying and selling; it also entails agreeing to swap the difference in an asset’s price when the contract is opened and expires.

CFD trading has entered the cryptocurrency industry, and AXS is now available as a CFD product. If you’re having trouble understanding bitcoin trading and where to keep your crypto funds, you may use CFDs to profit from AXS. We recommend trading AXS CFDs on Binance, a well-established, reputable exchange with margin trading on leverage.

Taxation on Axie Infinity (AXS) Earnings:

As the cryptocurrency market is new and finding its ground, regulatory agencies, including the SEC, want to regulate it. Furthermore, the Internal Revenue Service has been trying to set up a cryptocurrency tax regime. Cryptocurrencies and digital assets are treated as properties and fall under the capital gain tax bracket. However, in certain situations, some earnings from cryptocurrencies are also considered income and fall under the income tax bracket. The following are the taxable events that qualify for capital gains and income taxes when trading digital assets.

The Internal Revenue Service (IRS) issued IRS Notice 2014-21 and IRB 2014-16, providing guidance for individuals and corporations on the tax treatment of virtual currency transactions. Individuals with bitcoin as a capital asset but not in the trade or business of selling cryptocurrency might find answers in the IRS’s Frequently Asked Questions on Virtual Currency Transactions.

Profit is referred to as gain in the tax world. It’s the difference between your tax basis (typically what you bought for the shares plus transaction charges) and the amount you get when you sell or exchange them.

Axie Infinity Taxable Events

With genuine revenues earned on Axie Infinity, doubts about Axie Infinity taxes have emerged: Is it necessary to record income on income taxes? If so, then how?

The short answer is that most Axie Infinity transactions are undoubtedly taxable, even if your AXS, SLP, and NFTs never leave Axie World. The IRS regards any crypto-to-crypto transaction as a taxable event. Because most assets in Axie Infinity are tokenized, even seemingly non-transactional behaviors, such as using potions or spawning new animals, may be taxed.

Underneath, we describe how some Axie Infinity activities would be taxed in the United States:

Getting an Axie

A player must first acquire an Axie with ETH to play the game. If the ETH you used at the trade is worth more than when you got it, you have realized a capital gain. This difference in value must be recorded on Form 8949.

Buying and selling an Axie

If you sell an Axie for a profit on Axie Marketplace, you have realized a capital gain. You must disclose any difference between Axie’s cost basis and its selling price on your crypto taxes.

Obtaining SLP

SLP made through battling axes is considered normal income. Based on the advice of your tax advisor, you should declare this income as the market value of the SLP on the day you earned or claimed it.

In exchange, you can sell AXS or SLP.

Making a profit by selling or otherwise disposing of AXS or SLP when its value is higher than when you obtained it is a capital gain. Form 8949 should be used to report these earnings.

Getting an Axie or another item as a gift

According to the IRS’s guidance on airdrops, you will owe regular income tax on the received gift if another player sends you an Axie or another in-game item. The amount of income you must disclose is Axie’s fair market value (FMV) on the date you got it.

Winnings Distributions and Manager Payouts

Because all winnings are paid to the management, the manager is liable for all earnings gained through their scholar’s triumph in battle. When the management delivers a percentage of the wins to the scholar, they may remove some or all of that sum, depending on whether they consider Axie Infinity a business or a pastime.

When the management transfers the agreed-upon portion of the gains to the scholar, the scholar likewise experiences a taxable event and must pay income tax on their share of the payout.

Axie Breeding

A player must spend AXS and SLP to breed Axis. This is a taxable expenditure; you must pay capital gains taxes on any increase in the AXS and SLP’s value between the time you earned and spent it.

These breeding costs could be regarded as transaction fees. If you and your tax advisor interpret them correctly, you may be entitled to deduct part or all of these expenses.

An Axie’s worth is determined by its unique “genetic” characteristics. However, some of its value relies on its breeding potential; each Axie may only be bred seven times, and the breeding price increases with each breed.

Receiving a new Axie in your wallet will very certainly be taxed as a typical crypto-to-crypto transaction and recorded on your Schedule D. However, it is unclear how to calculate the cost basis of a newly produced Axie; the IRS has not published any guidelines on Axie breeding.

Calculating Your Capital Gains Tax

The crypto market has seen exponential growth in the past year, and government agencies are trying to take knowledge of it. Given the recent spike in the non-fungible token (NFT) sub-sector, the IRS is also looking to get a piece of the crypto pie. Two things essentially decide the number of capital gains tax rates for cryptocurrencies: your income tax bracket and how long you have held on to your crypto asset. This will help you calculate your:

a.) Capital Gains on Short-Term Investments

The short-term capital gains tax largely depends on how long you have been trading or holding cryptocurrencies. You will be taxed under your normal tax bracket if you have made gains or losses from trading or holding crypto for less than a year. Losses you incur for that trading year can prove helpful. Leveraging a tax-loss harvesting strategy, you can write off up to $3,000 of your taxes. You also enjoy the privilege of post-dating your taxes to the following year.

b.) Capital Gains on Long-Term Investments

Long-term capital gains apply if you have been trading cryptocurrencies for over a year. You will pay taxes between 0 to 20% depending on your income. We have itemized the income tax brackets on this link.

Automated Trading With Robots

A trading robot is a computer program that, on a computerized basis, executes all of the activities of a professional trader on an exchange. The computer software is a fully automated version of tried-and-true trading techniques. Regardless of the direction in which asset values move, robots outperform humans during periods of substantial market volatility. This is because they rely on trading strategies to generate profits even when the market is down.

In addition, the most successful Bitcoin bots worldwide are known for their lightning-fast research and execution. As a result, they can complete many transactions daily and take advantage of any trading opportunities.

Trading Axie Infinity (AXS) can be a challenging profession for anyone, and there is no assurance that your market analysis will result in a profit. There are other sure ways to grow your capital with little to no effort to get around this problem. Ideally, the bots make a profit bigger in risk-adjusted terms than if you had just bought and held the same coins throughout.

Axie Infinity (AXS) Mining: Can You Mine AXS?

Axies are fascinating creatures that players control in Axie Infinity. Each Axie is a non-fungible token (NFT), which means it is a one-of-a-kind digital collectible in and of itself. Axies can be bred and battled, but they can’t be mined.

Playing to earn is a newer gaming style, but it’s gaining popularity. Players earn cryptocurrency tokens within the game, which they can trade for hard cash on decentralized exchanges.

Within the game, there is an entire economy (a world called Lunacia). In Lunacia, players can use their in-game tokens, Smooth Love Potion (SLP) and Axie Infinity Shard (AXS), to acquire land, farm, or breed Axies. Furthermore, gamers can use the tokens to pay for rent or food because the tokens have monetary worth.

Decreasing Risk in AXS Investment:

Every investor needs to find ways to protect themselves from any significant loss. If you want to cap your risks, then follow these rules:

Hedge your risks: You should always have a well-balanced portfolio of investments. Use financial instruments strategically to mitigate the risk of adverse price movements. On the other hand, the investors hedge one investment by making a trade-in another.

Use a stop loss: A stop-loss order restricts an investor’s loss on an adverse move in a security position. You don’t have to monitor your holdings daily if you use a stop-loss order. An investor’s ally is a stop loss. Be a note of it, and make sure you stick to it. When things don’t go as planned when investing, you’ll want to know when to take your money out.

Set a target: Short-term traders who want to manage risk should employ take-profit orders. This is because they can exit a transaction as soon as their predetermined profit target is met, avoiding the risk of a market decline. Traders who follow a long-term strategy dislike such orders since they reduce profits.

Use multiple exchanges: To reduce risk in crypto trading, I use a variety of exchanges, employ hardware wallets, and invest in various narratives (Oracles, Defi, or insurance). To reduce risk when trading, trade only when truly strong patterns form or when a coin has reached its bottom.

Fundamental & Technical Analysis: I prefer to focus on coins with strong fundamentals. I only invest on rare occasions in response to news or other events. If I decide to invest, I will also do technical analysis. I consider things like where the currency is in its life cycle.

Are there any trading patterns? The coin has support and resistance, recent price history, news, and forthcoming events. If I invest in fundamentally sound coins, I can stay calm even if the price changes a lot because I know the price will eventually rise.

AXS vs. Other Cryptocurrencies

Axie Infinity (AXS) vs. Ethereum (ETH)

Axie Infinity (AXS) is a crypto-based Pokémon game where participants nurture, battle, and trade Axies, cute NFT pets. It has two native cryptocurrencies: Axie Infinity Shards (AXS), which can be purchased and sold on exchanges, and Small Love Potion (SLP), granted to players for playing the game. This enthusiasm has resulted in the emergence of new and emerging cryptocurrencies. On September 29, Axie Infinity broke the bottom reversal pattern and has doubled in value since then.

The Ethereum network’s programs and services all require computational power to function (and that computing power is not free). Besides, Ether is a payment method network users use to pay for the services they want from the network.

Axie Infinity (AXS) vs. Bitcoin (BTC)

Axie Infinity is a new type of crypto-based game platform, and its price is typically correlated to the game’s popularity. The price drops if players migrate to a competitor or lose interest. Typically, people participate in this game to make money.

Conversely, Bitcoin uses peer-to-peer technology to manage transactions and issue new bitcoins without a central authority or banks. The network as a whole is in charge of these tasks. Anyone can participate in Bitcoin because it’s open-source, and nobody owns or controls it. Several of Bitcoin’s unique qualities enable it to be used in ways no other payment system has been able to.

Axie Infinity Price Predictions: Where Does Axie Infinity Go From Here?

Axie Infinity’s position in various sectors is as follows: It holds the 26th rank in the Ethereum (ERC20) Tokens sector, the 8th rank in the NFT Tokens sector, the 4th rank in the Gaming sector, and the 4th rank in the Metaverse sector.

Axie Infinity is currently priced at $5.80, with a 24-hour trading volume of $104.19 million. Its market capitalization stands at $481.34 million and holds a market dominance of 0.04%. Over the past 24 hours, the price of AXS has decreased by -1.98%. Notably, on November 6, 2021, Axie Infinity achieved its all-time high price of $163.89, whereas its all-time low of $0.124080 was reached on November 6, 2020.

The price of Axie Infinity recently reached a cycle low of $4.61, following an all-time high. On the other hand, the most recent cycle high stood at $6.88. There is a prevailing bearish sentiment around Axie Infinity’s price prediction, while the Fear & Greed Index indicates a neutral reading of 52.

Axie Infinity (AXS) Price Prediction for 2023:

Experts suggest that the renewed faith in cryptocurrencies will likely push Axie Infinity’s price to $19 by the end of 2023. However, there would still be some volatility, and discounting the current level, AXS may hit an accumulation range above the $16 mark. The upcoming updates and developments in the GameFi Space are the catalysts for these bullish predictions.

Axie Infinity (AXS) Price Prediction for 2024:

Axie Infinity’s price in 2024 can reach higher if the GameFi space sees more developments and Axie Infinity takes some measures to be more inclusive. Currently, the project is a DeFi with games and a window dressing. Major developments are a must if people are to see this token climb higher.

On that note, experts say that Axie Infinity will reach closer to $24 in 2024, with the AXS price wicking bullishly at $29, closer to 2x of this year’s prediction.

Axie Infinity (AXS) Price Prediction for 2025:

Upgrades, developments, and the introduction of more legible projects in the GameFi space can push the AXS infinity price closer to $41 in 2025.

Axie Infinity (AXS) Price Prediction for 2026 and Beyond:

The following three years will see the cryptocurrency space going through a major shift. And old cryptos like Axie Infinity have to adapt to the changing space, equating to them taking measures to make the GameFi space more affordable. The cost of AXIS will likely reduce more than it already is for all gamers. That will create an influx of interest which will boost AXS’s price.

With that in mind, we can see Axie Infinity reaching $59 by 2026. Does that mean Axie Infinity won’t get closer to its all-time high in 2026? Yes. But there is a possibility that it might do so beyond that, but that would depend on the developments in the larger crypto markets.

Best Place to Buy Crypto

Axie Infinity (AXS) is a crypto-based Pokémon game where participants nurture, battle, and trade Axies, cute NFT pets. It has two native cryptocurrencies: Axie Infinity Shards (AXS), which can be purchased and sold on exchanges, and Small Love Potion (SLP), granted to players for playing the game. This enthusiasm has resulted in the emergence of new and emerging cryptocurrencies. On September 29, Axie Infinity broke the bottom reversal pattern and has doubled in value since then.

If you’re ready to take the plunge to get in on the action, you can complete your crypto journey using our recommended broker, Coinbase.

You should also remember the following:

- Investing in and trading AXS necessitates extensive research and effort.

- AXS is a high-risk investment.

- Invest just what you can afford to lose.

- Only use registered brokers and exchanges when trading or investing.

- You should consult review sites and online specialists for their thoughts on Bitcoin.

FAQs

Any risks in buying Axie Infinity (AXS) now?

When a coin grows by nearly 2000% in three months, you have to wonder how far it can go. There is a recurrent pattern in which people pile into a coin just because the price is rising. This not only raises the price higher, but it also raises the likelihood that those investors will buy at a high. That is why conducting your own study and considering the long term is critical. Considering its fundamental and technical outlook, the coin seems to be a safe investment.

Should I buy AXS?

The technical side of AXS is very optimistic; for instance, the coin is projected to reach a price target of around $19 by the end of 2023. Since the coin is near its all-time high, let's wait for a bearish correction until $100 before taking a buy.

Where can I spend my AXS?

AXS is still not as extensively accepted as Bitcoin, Ethereum, and Dogecoin. However, a growing number of stores are now taking it. Yet, you can always transform AXS into other cryptocurrencies like Bitcoin, Ethereum, or Tether to make payments online.

Is it safe to buy AXS?

Cryptocurrency market is unpredictable. AXS, like the other crypto assets, has gone through the tribulations of the bear market, which saw it dropping 90% in price. So, AXS might not be a safe token for short-term trades. For long-term holders, however, AXS may present major upsides.

Will AXS ever hit $1000?

It is doubtful for AXS to hit $1000 anytime soon. 2022's bear market brought it closer to its all-time lows, and in 2023, it started to climb. But whether AXS can keep the momentum depends on the community sentiments and AXS's developments. That being said, a lot has to happen for this token to reach $1000 at the moment - and we aren't seeing many significant signals of it doing the same right now.

Bitcoin

Bitcoin