Brendan Eich, the co-founder of Mozilla and Firefox, created the Basic Attention Token (BAT) to increase the safety, fairness, and efficiency of digital advertising through blockchain technology. The Brave web browser’s native token is built on Ethereum (ETH). BAT’s white paper was published on January 7, 2018, and the project was completed by the beginning of 2021.

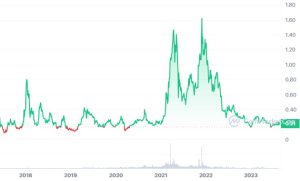

9Basic attention token went through a bull run in late 2021 and reached $1.9- an all-time high. But the token entered the retracement zones in 2022. The arrival of crypto winter pushed the value of this token down below the $1 mark, and it accumulated around $0.1 till the end of 2022.

BAT opened in 2023 at $0.17 but has since experienced close to a 100% increase thanks to more interest pouring into the crypto markets. But will the momentum hold up for this year and beyond? The answer to that and more is answered in this guide that teaches how to buy Basic Attention Token.

On this Page:

How to Buy Basic Attention Token

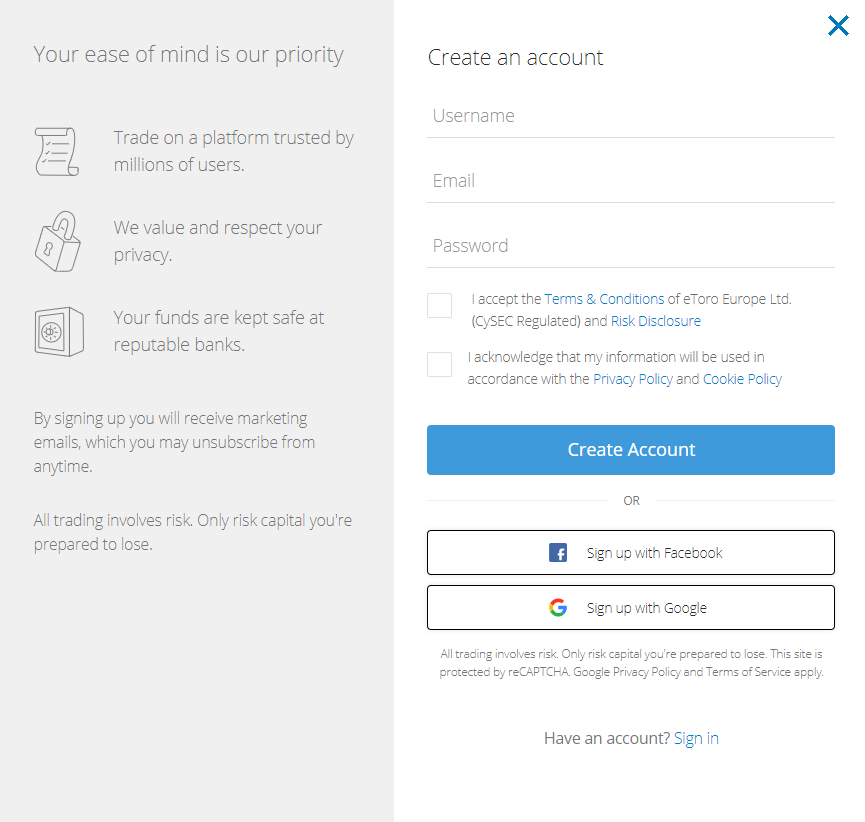

- Create an eToro account by going to eToro and clicking ‘Join Now’ to access the signup page. Fill out your full name, email address, password, username, and cell phone number. You can also sign up with your Facebook or Google account.

- Upload ID: Because eToro is regulated, the site requires users to go through a paperwork verification process. Simply upload a copy of your driver’s license or government-issued ID card to accomplish this. You must also submit a new copy of your utility bill or bank statement.

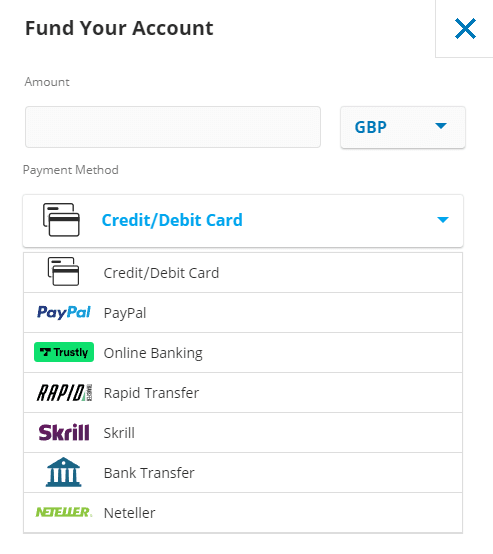

- To make a deposit, select the ‘Deposit Funds’ option. The minimum deposit structure on eToro differs depending on the user’s location. Check it out and pay with bank wire transfers, credit/debit cards, PayPal, Skrill, and other methods.

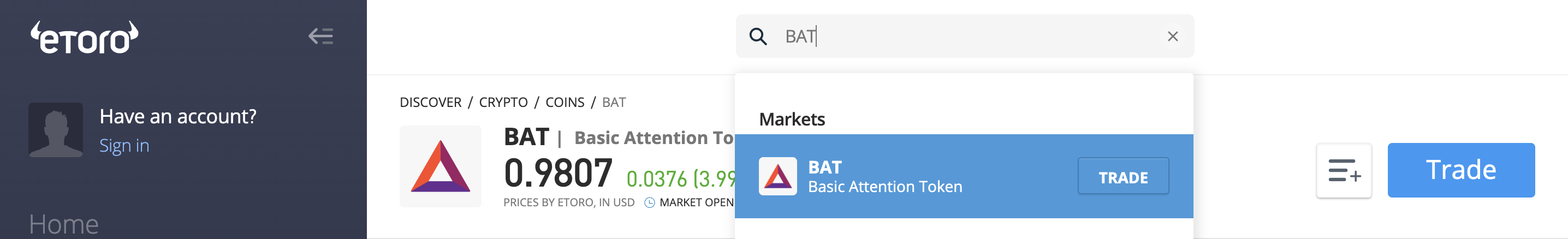

- Buy BAT: Type ‘BAT’ into the search field and click on the first result, ‘Trade.’ To complete the transaction, enter the amount you wish to purchase and click ‘Open Trade.’

Best Exchange to Buy Basic Attention Token in September 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Compare Crypto Exchanges

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

How to Sign Up at eToro

Signing up for an eToro account is easy because the platform is user-friendly, especially for newcomers.

Step 1: Open an Account with eToro

To open a new trading account, please follow the steps outlined below.

- Click the “Sign up” button on the eToro website.

- It will extend an electronic form on the following web page to enter your personal information.

- Fill out this electronic form with the required information to register an account.

- The good news is that you can also use Facebook or Gmail to log in.

- Before filling in your details, you should read and accept eToro’s Terms & Conditions and privacy policy.

- After carefully reading the terms, please confirm your acceptance by checking the appropriate box.

- Finally, enter your information by selecting “signup.”

eToro website homepage

If you’d instead use the eToro mobile app for iOS or Android, check out our screenshot-heavy guide to the eToro app.

Your capital is at risk.

Step 2: Upload ID

After you submit the information, eToro will ask you to submit a copy of your driver’s license or passport to ensure you are who you say you are.

It will be necessary to show a copy of the most recent utility bill or bank statement to prove the correct address.

You can also send a copy of your driver’s license, passport, or national ID card to show that you have a picture ID. After the documents are submitted, the verification process will start right away.

Step 3: Make a Deposit

Once the account is ready, enter the “Deposit Funds” section and the amount you want to deposit. The minimum amount you need to start an account with eToro is $50. You can deposit with debit cards, credit cards, bank transfers, Skrill, PayPal, and Neteller. EToro does not charge deposit fees.

eToro is cheaper than competitors like Coinbase, which charges 3.99% when you use a debit card to buy Bitcoin. Once you choose a payment method, click the “Deposit” button to finish the transaction.

Deposit methods on eToro

In June 2021, eToro listed the Basic Attention Token (BAT) coin. It implies that all major altcoins, including BAT, can be traded on eToro.

Step 4: Buy Basic Attention Token on eToro

The final step is to purchase a BAT coin, which takes less than 15 seconds. The simplest method is to type ‘BAT’ into the search field and then click ‘Trade’ on the first result that appears.

Searching Basic Attention Token eToro

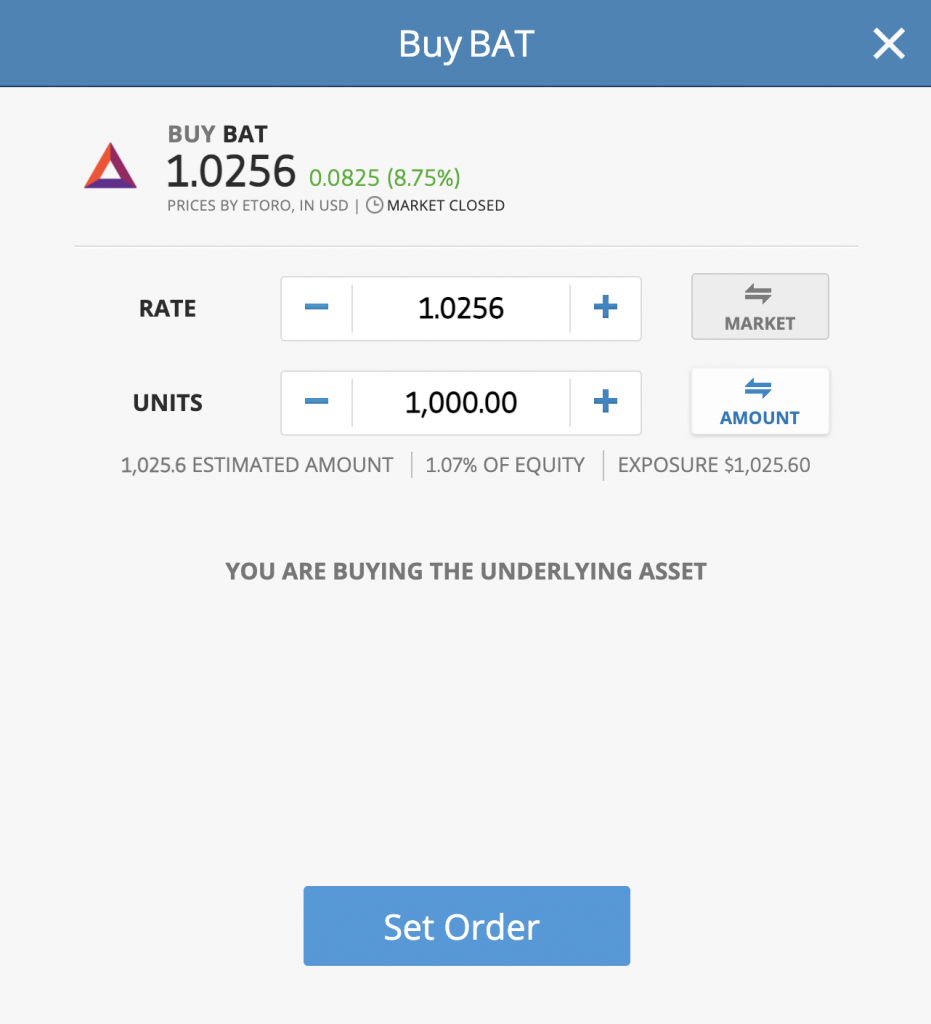

Step 5: Review Basic Attention Token Price

In this step, you will be taken to an order page where you can enter how many Basic Attention Token eToro coins you want to buy. You should do a lot of research and choose your coin carefully. Finally, spread your money around instead of putting all your eggs in one basket. Then, to add the BAT to your portfolio, click on “Open Trade” to do so.

Basic Attention Token Price Chart on eToro

Since there’s no maker/taker fee, only spread (the difference between the buy and sell prices) is charged.

Step 6: Buy BAT

You should have done your research by now and be ready to open a buy order. If that’s the case, you can click the “Trade” button to open a trade.

Buy Basic Attention Token on eToro

Please enter the amount or unit of BAT you want to buy on this screen. eToro lets you choose from two ways to make trades. One is called “Order,” and the other is called “Trade.”

Order: You can set up a pending order (buy limit order) to buy BAT when it reaches your price.

Trade: When you click “Open Trade,” you can immediately start a trade at the current market price. Afterward, you can sell BAT on eToro and make money (or loss).

Read more about how to buy cryptocurrency in 2024 here.

Your capital is at risk.

Where to Buy Basic Attention Token – Best Platforms

The Ethereum blockchain and a specialized web browser recognized as Brave are used by the Basic Attention Token (BAT). The BAT token is used as currency on the Brave platform and can be purchased for various advertising services. It is intended to be shared among users, advertisers, and publishers and is based on an unusual concept critical to advertising firms operating in the digital age: user attention.

The creators of BAT want to improve how advertising is done in the digital age. Current trends, they believe, are disadvantageous to users, publishers, and advertisers alike. Users are bombarded with ads and trackers and targeted by malware, becoming more aggressive and powerful.

After much research, we found the best places to buy BAT. The list of places to buy BAT in 2024 is based on their characteristics, fees, and why each is unique. eToro is safe, has reasonable prices, and is easy to use. Because of this, it has become the best place to buy BAT coins.

Best Brokers to Buy Basic Attention Token

1 – eToro

eToro is a multi-asset Israeli trading platform that lets you trade more than 2000 different types of assets. On eToro, you can buy and sell stocks, commodities, forex, CFDs, social trading, indices, cryptocurrency, index-based funds, and exchange-traded funds, among other things (ETF).

eToro serves UK customers through a unit regulated by the Financial Conduct Authority (FCA) and Australian customers through an entity regulated by the Australian Securities and Investment Commission (ASIC). It’s a subsidiary in Cyprus that’s run by the Cyprus Securities and Exchange Commission and does all the other things (CySEC). eToro is considered safe because top financial regulators have approved the UK and Australian businesses, which are well-known in fintech.

Today, eToro has grown into an international community of more than 20 million people who share their investment plans, and anyone can copy the best ideas. Users can easily buy, hold, and sell assets on the platform because it is easy to use. They can also see their portfolios in real time and make transactions whenever they want.

Many types of financial instruments exist, like stocks, commodities, forex, CFDs, social trading, indices, cryptocurrency, index-based funds, and exchange-traded funds (ETFs).

Copy Trading makes it easy for novice traders to profit from the experience of more experienced users. It does this by automatically copying the trading activities of more successful investors.

The copying trader’s limit orders are rebalanced and changed based on the stop loss (SL) and take profit (TP) levels the investor sets in the spotlight.

In this way, novice traders can make money while limiting their losses by only trading with strategies that have worked in the past. CopyPortfolio, eToro’s in-house portfolio management tool, is also on the market.

Furthermore, eToro offers stake rewards upon buying Ethereum and holding it in your wallet, or Cardano or Tron.

Read more about how to stake crypto.

Cryptocurrency trading: EToro’s prices for trading actual cryptocurrencies align with what other companies charge, like 0.75 percent for buying or selling Bitcoin. At eToro, converting from crypto to crypto costs only 0.1 percent, on top of the spreads already there. eToro is a leading broker for crypto trading in 2022, with an extensive preference for crypto-assets and CFDs and the underlying.

eToro is overseen by some of the best regulatory bodies in the world, like the United Kingdom’s Financial Conduct Authority (FCA). Australia’s Securities and Investment Commission, Cyprus’s Securities and Exchange Commission, and the Financial Industry Regulatory Authority (FINRA) are also in charge (FINRA). User funds are kept separate from the platform’s operating capital by CySEC rules for all CySEC-registered brokers. This is how the platform works.

Deposit Fee: eToro has a good deal for its users regarding fees. EToro does not charge deposit fees. Deposits can be made with a bank wire transfer, a credit or debit card, or PayPal, Skrill, Sofort, Netteller, and many other ways.

Minimum Deposit: The minimum deposit varies based on the user’s location. For example, those in the United Kingdom and most of Europe need to deposit at least $200 before starting to trade. There is a $50 deposit for users in the US.

eToro supports the leading cryptocurrency, Bitcoin, and major altcoins, including Ethereum, Aave, XRP, Graph, and other prominent cryptocurrencies.

eToro Minimum Deposit

EToro can be traded online and on handheld devices through their mobile app. The opening process of an eToro account is straightforward and takes about a few minutes.

Pros & Cons of the eToro platform:

- Copy-trading – Ability to copy the trade of successful traders.

- Trusted by 20 million registered users

- Most payment options supported

- Regulated by ASIC, FCA, and CySEC

- User-friendly interface

- Staking of ETH, ADA or TRX

- Less technical analysis (TA) tools and indicators than Binance

- The large spread on altcoins

- A withdrawal fee of $5

Your capital is at risk.

2 – Binance

Binance, which was launched in late 2017, is a third-party exchange platform that lets people buy and sell cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BNB), and many more, allowing people to buy and sell cryptocurrencies like these. Even though the company’s headquarters are on the European island of Malta, the project was started by Changpeng Zhao, a native of China who now lives in the United States (CZ).

As one of the biggest cryptocurrency exchanges in the market, Binance has grown a lot quicker in less than two years. The platform can handle more than $2 billion worth of daily trading. Binance used to be primarily a crypto-to-crypto exchange. It didn’t deal with fiat transfers or withdrawals at all. Later, we’ll see that today’s platform can only accept a limited number of bank accounts and credit card deposits. Besides its tools and features, Binance has a learning platform, an NFT platform, and other services. In addition, Binance has a lot of different trading tools, like real-time charts with moving averages and exponential moving averages.

The Binance app, the Binance website, or even the Binance desktop client can also be used to make trades.

To get to their portfolios and transaction history, traders can also use the Binance interface. They can also review their order book and price charts on the Binance interface. Stop orders, limit orders, stop-limit orders, stop market orders, and trailing stop orders are some of the order types used on the exchange. They include trailing stop orders. If you want to trade, you can also choose from various views. These include traditional and margin and OTC.

Binance trading tools

Binance has a lot of different trading tools, like real-time charts with moving averages and exponential moving averages. Users can use the Binance app, the Binance website, or the Binance desktop client to make trades on the platform. To get to their portfolios and transaction history, traders can also use the Binance interface. They can also review their order book and price charts on the Binance interface.

Two-factor authentication (2FA)

Binance uses two-factor authentication (2FA) and FDIC-insured deposits in US dollars (USD). Users in the United States can keep their devices under control through address whitelisting and cold storage, which Binance Exchange does to keep them safe. Even though the prices aren’t very high, some customers may not get customer service.

Just ensure you don’t confuse this US-based exchange with its parent company, Binance, which isn’t in the US. Overall, Binance, which we’ll discuss here as a US operation, is an excellent way to start with cryptocurrencies.

Binance listed the Basic Attention Token (BAT) token in November 2017 and offers trading several pairs like BAT/BNB, BAT/BTC, and BAT/ETH.

Fees: 0.015 percent to 0.10 percent for purchase and trading fees, 3.5 percent or $10 for debit card purchases, whichever is greater, or $15 per US wire transfer.

Pros & Cons of the Binance platform:

- Margin trading – Leverage on long and short trades

- A wide range of transaction types are available.

- Over 500 coins are available for trading.

- A broader selection of cryptocurrencies.

- Professional traders have access to all the chart indicators they need

- More staking options – Binance Earn feature

- US customers can’t use the Binance platform, and the Binance.US exchange is very limited

- Lack of copy-trading feature

- High fees for credit card deposits

3 – Coinbase

If you’ve heard of any cryptocurrency exchange, Coinbase is likely the name of it. Coinbase has been a popular place for people to buy and sell bitcoins since 2012. In 2021, Coinbase became the first crypto exchange to go public on the Nasdaq, which made the platform more popular with everyone else.

Today, there are more than 56 million people who use Coinbase to trade more than $300 billion worth of cryptocurrency each quarter. It is the third-largest exchange in terms of trade volume, according to the crypto data firm CoinMarketCap. Coinbase, which CEO Brian Armstrong runs, is a popular choice for new investors because the platform accepts debit/credit cards, bank transfers, and even PayPal.

On the other hand, Coinbase’s leading brokerage service lets people buy and sell cryptocurrencies right from the site. However, because the company also has Coinbase Pro, a more traditional exchange platform, it acts as both a broker and an exchange simultaneously.

In addition to its leading consumer-based service, Coinbase, the company is gaining a strong foothold in the institutional market. This is especially true of the platform’s “custodianship” services, which protect cryptocurrency assets with the same level of protection that big businesses use.

Coinbase fee – Coinbase’s fees can be very high, even though the company is top-rated. This could eat up a lot of any gains you make. Coinbase, for example, recently said it is getting a lot of money from institutions weekly. They say it ranges from $200 million to $400 million. Even though cryptocurrency is still very new, this number will only get bigger.

Regulation – Coinbase is registered with FinCEN as a money service business and follows all rules against money laundering and terrorism financing. People who use Coinbase must be able to provide their real identity. Coinbase has been approved by the Financial Conduct Authority to be a money service business in the UK outside of its US operations. This means Coinbase can do business in the United Kingdom (FCA). Using Coinbase, you can buy and sell cryptocurrencies like Bitcoin and over 50 other types. You can also use this if you want to change one cryptocurrency for another. You can also send and receive cryptocurrency.

Coinbase Pro – Coinbase Pro lets you set your limits or market orders for BAT coins so that you can buy and sell them at your own pace. Sometimes, the maker/taker fee can be as low as 0.5% until you trade over $10k in volume in 30 days. Then it goes down to 0.35 percent.

There are no maker fees for free trading in crypto if your 30-day trading volume is more than $300 million. It’s good to know that Coinbase started selling many different coins in November 2018. BAT trading on Coinbase Pro is now fully live. The BAT/USDC is in full trading mode. Limit, market, and stop orders are all now available.

Pros & Cons of the Coinbase platform:

- Offers access to nearly 100 cryptocurrencies.

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Well-known and trusted by US regulators

- Cryptocurrency is insured in the event the website is hacked.

- Instant deposits and withdrawals to/from the bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker/taker fee (unless the trading volume is very high)

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

4 – Bitfinex

Bitfinex, founded in 2012, is one of the aged cryptocurrency exchanges. Since its beginning, the exchange has stayed a market leader in cryptocurrency trading, ranking 8th among the world’s largest cryptocurrency exchanges by volume. It’s also closely linked to the Tether stablecoin, which has landed the exchange in hot water with regulators. The low fees of Bittfinex are a plus, but its spotty history may be a concern for potential users.

Founders: Bitfinex began in December 2012 as a peer-to-peer Bitcoin exchange, offering digital asset trading services to consumers worldwide. Giancarlo Devasini has served as Bitfinex’s CFO since 2013 and has been instrumental in the company’s growth. Giancarlo Devasini started his career as a physician, graduating from Milan University with a Doctor of Medicine degree in 1990.

Is Bitfinex a regulated exchange?

Bitfinex Securities Ltd., a provider of blockchain-based investment products, has opened its regulated investment exchange (Bitfinex Securities) in the AIFC to improve members’ access to a diverse range of financial products. As a result, Bitfinex is not regulated in any way. Instead, the company is headquartered in Hong Kong and registered in the British Virgin Islands.

Fees and deposit limits: For bank transfer deposits, Bitfinex charges a 0.1 percent fee. If you deposit $10,000, for example, you will be charged a fee of $10. If you make a cryptocurrency deposit, you will be charged a small fee based on the coin you use to fund your account.

Withdrawal fees: Bitfinex charges a 0.1 percent fee for bank transfer withdrawals. You can pay a 1% expedited fee if you need funds within 24 hours. Alternatively, bitcoin withdrawal fees vary depending on the coin.

Bitfinex listed Basic Attention Token on Jan 14, 2022, and enabled trading against USD and USDt, with margin and funding markets set to be enabled as sufficient liquidity develops.

Pros & Cons of the Bitfinex platform:

- Low transaction costs

- Margin trading, derivatives, and advanced order types are all available.

- Paper trading and a mobile app are appropriate for inexperienced cryptocurrency traders.

- Suitable for experienced traders

- Over 100 coins are supported

- Bank wire deposits and withdrawals are accepted

- There is no regulation.

- US citizens are not accepted.

- Expensive trading fees

- Hacked on more than one occasion

- The support team only available via email

5 – KuCoin

KuCoin, founded in 2017, is a global cryptocurrency exchange allowing its eight million members to trade a wide range of currencies. These things, like spot, margin, futures, and peer-to-peer trading, as well as lending and staking, are examples of what you can do.

KuCoin says it has the best level of security and about 400 different types of cryptocurrency. It is very easy to use despite its many different features. For another thing, a Kucoin exchange has some of the lowest fees in all cryptocurrency businesses.

The founders – In the cryptocurrency world, KuCoin is one of the most popular exchanges, and Johnny Lyu is the Co-Founder and CEO of KuCoin. It has grown into one of the most renowned cryptocurrency exchanges, with over 8 million active users from 207 countries and territories. There was round-A funding for KuCoin in November 2018, with IDG Capital and Matrix Partners giving the company $20 million. Forbes Advisor named it one of the Best Crypto Exchanges of 2021 in 2021.

Deposit & Withdrawal – The only way to deposit and withdraw money from Kucoin is through the KuCoin Deposit. You will need to put money into your cryptocurrency account because the network doesn’t accept a deposit in the form of cash. Only cryptocurrency deposits and withdrawals can be made and used. You can’t use your debit or credit card, bank account, or e-wallet to pay.

Trading Fees: Kucoin has a simple fee structure for trading. The platform charges 0.1 percent to people who make and take, making it one of the cheapest cryptocurrency exchanges on the internet. If you own the platform’s Kucoin Shares tokens, you can cut down on your fees even more.

KuCoin listed Basic Attention Token (BAT) on Feb 07, 2022, and supported trading pairs, including BAT/USDT.

Pros & Cons of the KuCoin platform:

- User-friendly exchange

- Leverage up to 100x on cryptocurrency

- Advanced tools backed up by cutting-edge technology

- Vast selection of altcoins

- Ability to buy crypto with fiat

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Not available in the U.S.

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

6 – Bybit

It has embarked on a journey to create the next-generation financial ecosystem powered by innovative and advanced blockchain technology. Having over 1.6 million Bybit users globally, whether retail or professional clients, Bybit remains customer-focused and strives to offer the best user experience possible.

Founders – In March 2018, Ben Zhou founded the company.

Before becoming the exchange’s CEO, he was the general manager of XM, a forex brokerage firm. Ben Zhou assembled an A-team of investment banking and fintech experts who had previously worked for Alibaba, Tencent, Morgan Stanley, and other well-known firms.

While the exchanges have many similarities, Bybit has included some distinguishing features that may make them appealing.

- Bybit exchange provides three contract options for trade derivatives products, including Bitcoin and other cryptocurrencies:

- Inverse Perpetual

- USDT Perpetual

- Inverse Futures

- It provides access to various trading features, including cross and isolated-margin trading.

- Bybit provides 100X leverage trading, which is not adjustable when used with the cross-margin option.

- Limit orders, conditional or conditional limit orders, stop-loss orders, and advanced orders such as Good till Cancelled, Immediate or Cancel (IOC order), and Fill or Kill are all supported by Bybit. Advanced Order Forms are simple to use and convenient to access.

- It offers a variety of data analysis tools for accessing data, including price moving averages, moving average indicators, and monthly price ranges. It also contains funding information, specific index prices, a rolling volatility chart, BTC daily realized volatility, market analysis, and recent news.

- It offers the crypto community a great trading experience with an easy-to-use user interface.

Pros & Cons of the Bybit platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Crypto derivatives are extremely risky

- Not suited to spot trading

- May share your data with third parties for marketing

What is Basic Attention Token?

Basic Attention Token is an Ethereum (Erc20) token that supports Brave Software’s blockchain-based digital advertising platform. Internet users who use Brave’s free web browser (available at Brave.com) to browse the web can determine to replace the ads they see with Brave’s ad network. Advertisers then compensate users with BAT in exchange for their attention. Basic Attention Token is a cryptocurrency for the $330 billion digital advertising industry.

BAT intends to improve the user’s web browsing experience, enabling marketing companies to target ads more effectively. The project’s creators discovered that digital marketing is frequently inefficient – users are bombarded with irrelevant ads, businesses receive less return on their advertising spend, and marketing agencies ultimately end up playing a numbers game – and BAT seeks to change this.

The Brave browser

Brendan Eich created Basic Attention Token, and he has some impressive credentials for the project, having co-founded Mozilla and invented the JavaScript programming language. The token completed its initial coin offering (ICO) in 2017, raising $35 million in 30 seconds by selling 1 billion BAT. Brave Software had reserved 500 million BAT at the time; of that total, 200 million BAT tokens were set aside for the Brave team, with the remaining 300 million set aside to be sold later to promote the platform.

BAT is intended to work with the Brave browser, which by default, blocks ads. Users can display ads from trusted partners in exchange for BAT tokens. As a result, users see only ads they want to see, and advertisers aren’t wasting money. The Brave Micropayments Ledger keeps track of the BAT token, enabling the token to be exchanged between users, publishers, and advertisers, resulting in a streamlined ecosystem for digital advertisements.

The BAT token could be used to pay for services and content through the Brave browser or exchange for fiat currency on various exchanges.

Is there anything that makes Basic Attention Token different from the rest?

The Basic Attention Token is mainly used to pay for advertising campaigns through Brave Ads. This is the main use case for the token. As of November 2020, advertisers must spend at least $2,500 monthly on ads to start a campaign. A self-service platform that could have lower limits is in the works.

Basic Attention Tokens are the only way to pay for this ad budget now. Advertisers can get these tokens from third-party exchange platforms. People and publishers get the rest. Brave takes a small cut, and the rest goes to them and others who use the service.

One thing that makes the Basic Attention Token and the Brave Browser ecosystem unique is that it can reward people who aren’t already part of the network. This includes both websites and individual Twitter users. These users can then safely sign up for the platform to collect any tips they have.

Both Basic Attention Token and Brave Browser have had many people use them since they were released. A total of 20.5 million people use Brave Browser every month; the Basic Attention Token is now held by more than 368,000 unique wallets, which is a lot.

Is it Worth Buying Basic Attention Token in 2024?

The Basic Attention Token (BAT) is catching the attention of crypto enthusiasts in 2023 as its strong fundamentals fuel speculation of a potential price surge. In the wake of recent market fluctuations attributed to the LUNA-FTX crash-induced crypto winter, investors are closely monitoring the broader cryptocurrency landscape.

BAT, which has shown signs of stabilization around the $0.30 mark, is now poised to make a potential climb to the previous high. Traders are eyeing this crucial level as a potential threshold that, if breached, could trigger bullish momentum and make BAT an enticing investment opportunity this year.

As of the latest data, the price of Basic Attention Token stands at $0.207552, accompanied by a 24-hour trading volume of $40.09 million. The token commands a market capitalization of $309.22 million, contributing to a market dominance of 0.03%. Over the past 24 hours, BAT has demonstrated a slight uptick of 0.06%.

The historical trajectory of BAT showcases its peak price of $1.910480, attained on November 28, 2021, during its all-time high. In contrast, the token’s lowest valuation was registered on March 13, 2020, when it hit an all-time low of $0.086163.

Following its peak, BAT’s lowest price since the previous all-time high settled at $0.154312, marking a cycle low. Conversely, the highest price recorded after the cycle low was $0.223620, signaling a cycle high.

The sentiment surrounding Basic Attention Token’s price prediction is neutral, while the Fear & Greed Index hovers at 50, indicating a neutral market sentiment. With a current circulating supply of 1.49 billion BAT out of a maximum supply of 1.50 billion, the token’s yearly supply inflation rate is -0.42%. It translates to creating approximately -6.31 million BAT in the past year.

Regarding market capitalization rankings, Basic Attention Token holds the 15th position within the DeFi Coins sector and secures the 36th spot within the Ethereum (ERC20) Tokens sector. Observing BAT’s movements as it navigates the dynamic crypto landscape in 2023. The token’s performance and its potential to capitalize on prevailing market conditions have positioned it as a noteworthy contender for investment consideration.

Will the Price of Buying Basic Attention Go Up in 2024?

Current trends suggest that Basic Attention Token (BAT) has increased value, from $0.17 at its 2023 opening to $0.40, nearly tripling. This surge, however, is attributed to Bitcoin’s increased support, making it uncertain whether BAT will maintain this growth pace throughout the year.

Despite this, BAT’s ecosystem, tied to the Brave browser, has significantly progressed. In 2022, BAT and Brave accomplished foundational developments, such as the multichain Brave Wallet and integrating over 80 DApps into the Brave Wallet Partner Program. These achievements set the stage for future 2023 goals, which include introducing enhancements to the BAT-powered Rewards ecosystem and integrating Web3.

During 2022’s crypto industry turbulence, Brave and BAT continued expanding utility for users and creators. 2023 promises transformative updates for BAT, enhancing its on-chain utility for users, creators, and advertisers.

The 2023 outlook for BAT includes plans for NFT creator collaborations, Brave Search Ads support, and improvements to Brave Rewards and Creators’ features. Partnerships with gaming and esports platforms are also in the pipeline, exploring more uses for BAT. The year will see additional cross-chain BAT NFT collaborations, educational initiatives, and community engagement.

2022 was a foundational year for Brave, BAT and Community.

In this post, we take a look back at key accomplishments from last year and lay out our goals for $BAT for 2023, including product improvements, creator collaborations, and business partnerships: https://t.co/dVJyKZd3dh

— Basic Attention Token (BAT) (@AttentionToken) March 3, 2023

The Basic Attention Token is valued at $0.207824, with a 24-hour trading volume of $23,821,029. Looking back, BAT has seen 19 out of 30 (63%) green days, displaying a 3.22% price volatility over the past 30 days. Based on the Basic Attention Token forecast, the current period is favorable for buying BAT.

When you’re considering an investment, follow these things:

You must choose a cryptocurrency broker with care. What are your plans for accomplishing this? To begin with, look for the following characteristics in a Bitcoin broker:

1. Financial stability: When trading, you don’t want to engage with a broker whose asset base is comparable. A solid financial foundation is required of a qualified crypto broker, which means they must have a considerable cash base. This ensures your Bitcoin is safe and the broker does not go bankrupt.

2 – Excellent trading platform: Cryptocurrency trading, like forex trading, necessitates a trading platform that is both easy to use and packed with extensive features. Crypto traders should easily manage their accounts, perform technical analysis, execute market trades, and remain current on the latest crypto news using the trading platform. The trading platform must react rapidly because cryptocurrency is more volatile than any other market.

3 – Credibility, reliability, and experience: Although the crypto market is fresh compared to other markets, this does not mean every broker you encounter is inexperienced. You can work with reliable and competent crypto brokers. They have the essential credentials, including licenses from well-known and reputable regulatory bodies and professionals on their team. You can browse customer reviews and learn more about the broker’s services to discover whether they fit you.

4: Customer care provided by crypto brokers: Crypto trading is available 24 hours a day, seven days a week, so you can have a problem or question anytime. For this reason, finding a broker available 24 hours a day, seven days a week is critical. Furthermore, regardless of time zone, they should have a qualified support team that can answer questions and problems promptly and professionally.

5: Commissions and fees: Last but not least, you should investigate cryptocurrency brokers’ commissions and other fees. Make sure the broker thoroughly discloses the fees and any other risks so you can make an informed decision.

Buying BAT as a CFD Product

CFD stands for Contract for Difference, an agreement between two parties to trade the difference in the price of a market from when the contract is opened to when it is closed. Therefore, they let you trade over 12,000 global markets without possessing any actual assets.

CFD trading allows you to bet on the price movement of various financial markets, including indices, stocks, currencies, commodities, and bonds, regardless of whether they are rising or dropping in value. You will not pay UK Stamp Duty on earnings because you are betting on price movement instead of owning the underlying instrument.

How does CFD work?

Contracts that replicate live financial markets are used in CFD trading. These contracts are bought and sold in the same way the underlying market is. So instead of deciding how much of a specific asset to invest in – such as 1 BTC – you choose how many contracts to purchase.

Your position will profit if the market moves in your favor. It will suffer a loss if it moves against you. When you finish selling the contracts you acquired initially, you realize your gain or loss.

We recommend trading altcoins with leverage on Binance or CryptoRocket. Binance supports more altcoins, including BAT. Whereas, CryptoRocket supports fewer altcoins, currently about 40. BAT isn’t available on Cryporocket, but they are consistently adding new coins.

Furthermore, we also recommend trading altcoins on derivatives broker Libertex. They offer margin/leveraged trading and are consistently adding fresh altcoins.

Taxation on BAT Earnings

Crypto traders may face significant tax implications as the value of various cryptocurrencies, such as Bitcoin and Ethereum, has risen dramatically. However, with the Internal Revenue Service (IRS) ramping up enforcement efforts, even those who possess cash — let alone trade it — must exercise caution to avoid violating the law. However, given the IRS’s attitude toward cryptocurrency, this may be simpler than you believe.

“At the moment, the Internal Revenue Service (IRS) has a rather sizable enforcement area,” says Brian R. Harris, a tax attorney with Fogarty Mueller Harris, PLLC in Tampa. “They’re attracting much attention because they’re targeting individuals who own, trade, or utilize cryptocurrency.” Those individuals may be audited or scrutinized for compliance.

While Bitcoin’s anonymity (or at least semi-anonymity) has been one of its selling points, authorities have been attempting to catch up in recent years with some success. “The IRS and FBI are improving their ability to track and trace Bitcoin as part of criminal investigations,” Harris contends. Additionally, they can freeze assets if required, he adds.

As a result, individuals who engage in cryptocurrency transactions should be aware of applicable laws and any taxes that may be charged due to their actions. The good news is that the IRS recognizes cryptocurrencies in the same way it treats traditional capital assets like equities and bonds. The bad news is that this treatment also makes purchasing products and services using cryptocurrencies more difficult.

What are cryptocurrencies?

Crypto assets are digital assets created via encryption to serve as a medium of exchange for financial transactions. The term “crypto assets” refers to digital currencies, utility coins, and security tokens. Cryptocurrency is a term that refers to a virtual or digital currency. Cryptography is used to secure financial transactions, manufacture new units, and confirm asset transfers.

Crypto assets have recently gained prominence as they signify a seismic shift in financial systems. Technical advancements in crypto assets have come a long way and can potentially disrupt the financial system as we know it. Central banks and other financial institutions can influence the direction of this landscape. However, this global phenomenon is creating uncertainty on various levels, including how particular crypto assets differ and the success of the ecosystem’s primary members. Additionally, a new financial landscape has arisen with the buzz around Bitcoin, altcoins, cryptocurrencies, and tokens.

As more institutions in the capital markets grapple with the implications of crypto assets, traders continue to be concerned about fees and regulatory ambiguity, even as crypto asset marketplaces diversify the fiat currencies they support. Additionally, this whitepaper discusses the taxonomy of crypto assets, market participants, and the current capital market situation.

The Internal Revenue Service (IRS) issued IRS Notice 2014-21, and IRB 2014-16, guiding individuals and businesses about virtual currency transactions’ tax treatment. The IRS classifies virtual currencies as bitcoin property, which means they are subject to the same taxation as stocks or real estate. If you purchase BTC for $10,000 and sell it for $50,000, you will owe capital gains taxes of $40,000.

Traders who own Bitcoin as a capital asset but are not in the business or trade of selling cryptocurrencies may find answers in the IRS’s Frequently Asked Questions on Virtual Currency Transactions.

Bare Attention Token trades are taxed like any other crypto-to-crypto trade in the United States. All crypto-to-crypto and crypto-to-FIAT trades are taxed in the United States. The BAT enables you to exchange one cryptocurrency for another, a transaction the IRS considers a taxable event. Calculate your capital gain or loss on the crypto-to-crypto trade by determining your cost basis when you purchased the initial currency. The difference between the sales revenues and the cost basis calculates the capital gain or loss.

While BAT and other decentralized exchanges give users anonymity, the taxable events associated with their use remain the same. As a result, the requirement for crypto tax reporting is the same if you utilize other well-known DEXs, such as Uniswap. Yes, while trading crypto on decentralized exchanges, you must pay taxes.

Apart from cryptocurrency trading, Decentralized Finance (DeFi) comprises a broad range of cryptocurrency-related activities. Other possibilities are accessible, including staking rewards, earning interest, obtaining crypto loans, and joining a liquidity pool. Any crypto trades you make on a DeFi protocol will result in taxable capital gains. Other activities, such as increasing interest in cryptocurrencies or accumulating cryptocurrency staking rewards, will boost your annual taxable income.

Automated Trading With Robots

An Expert Advisor, more commonly referred to as a trading robot, is a piece of computer-based trading software that executes transactions on your behalf in your account. While selling robots and expert advisors online has grown to be lucrative, numerous factors must be considered before diving in. While automating a plan has several advantages, it also has several downsides. The crucial point to remember is that making much money is rarely straightforward. The promise of rapid money is the oldest and most well-known trade deception in history.

Trading robots and acquiring the ability to automate strategies might assist you in making money.

Nevertheless, learning how to trade effectively may take longer than learning how to trade manually, as a person must first understand how to trade manually before learning how to automate the procedures using a computer language. And purchasing a program entails several risks, which will be discussed shortly. Finally, we’ll discuss all of this and more in greater detail below, as well as the advantages and disadvantages of robotic trading and EAs.

What Is Expert Advisor (EA) or Automated Software?

Automated trading software is called expert advisors (EAs), robotic trading, automated trading, and black box trading. Automated software is a computer program that runs in the background and executes tasks without the person who runs it. Because it is a program, it will accept trades only if the parameters match those provided in the program. Developing a trading program requires high trade knowledge and programming ability.

Because EAs are based on trading strategies, they must be simple enough to be reduced to a set of programable rules. Complex strategies are more challenging to program effectively. Individuals who acquire trading software completely depend on the trader’s and programmer’s abilities. This is a grave scenario.

It, like any other piece of software, will require periodic updates. Market conditions change, and trading software must keep pace. If a knowledgeable individual does not maintain the software, it will most likely have a limited profitability shelf life (if it was profitable to begin with). EAs developed and maintained by skilled traders and programmers offer the most substantial long-term profitability potential.

Risk Reduction When Investing in BAT

The Basic Attention Token, or BAT, is the token that enables a new blockchain-based digital advertising platform that aims to fairly reward users for their attention while also supplying advertising revenue with a better return on their ad spend.

If you’re considering purchasing it, watch equivalent tokens in the DeFi market and stay informed about regulatory changes. You will get the most out of the token if you have a basic understanding of decentralized finance. Cryptocurrency wallets (digital wallets) and exchange companies are major threats to your digital money.

While a cryptocurrency wallet does not contain your digital currency, it does include a private key that enables you to swap Bitcoin over the Internet. This private key is your digital identity on the cryptocurrency market, and anyone who obtains it can conduct fraudulent transactions or steal your money.

Cybercriminals utilize sophisticated techniques to compromise digital wallets and steal or move crypto assets without the user’s knowledge. Securing your wallet is crucial for protecting your digital wealth from hackers.

1- Make use of a cold wallet

Compared to hot wallets, cold wallets are not connected to the Internet and are not susceptible to cyberattacks. Keeping your private keys locked in a cold wallet, also known as a hardware wallet, is the safest option.

2 – Connect to the Internet over a secure connection

When trading or doing crypto transactions, use only a secure internet connection and avoid public Wi-Fi networks. For increased security, use a VPN when connecting to your home network. Your IP address and location are changed when you connect to a VPN, protecting your internet activity from harmful intruders.

3 – Multiple Wallets

Because there are no restrictions on wallet creation, you can diversify your Bitcoin investments by using many wallets. Rather than that, utilize one wallet for daily transactions and another for all other transactions. This will safeguard your Bitcoin assets and decrease the danger of a security breach.

4- Safeguard Your Device

To safeguard against newly discovered vulnerabilities, keep your device updated with the newest antivirus software. By utilizing a strong antivirus and firewall, hackers are prevented from exploiting the issue by developing applications targeting the vulnerability, increasing your device’s security.

5 – Ensure that you change your password regularly.

The importance of a strong password cannot be emphasized when it comes to security. According to a study, over three-quarters of millennials in the United States use the same password across multiple devices, applications, and social media accounts. According to the survey, most also used the same password across over 50 different websites. Remember to use a complex, difficult-to-guess password that you update frequently.

For instance, if you have multiple wallets, create unique passwords for each. Use two-factor (2FA) or multi-factor (MFA) for enhanced security. 6: Continue researching: Market research will assist you in identifying market trends and preparing for them. Utilize survey sites and expert tips to acquire the necessary information.

Basic Attention Token: Where Does BAT Go From Here?

Basic Attention Token developed a bullish momentum at the beginning of 2023, thanks to Bitcoin crossing the $20k resistance. The token has also remained bullish even after Bitcoin stabilized a little bit. After witnessing a monthly increase of 100% at the beginning of 2023, the crypto crowd wonders if BAT will be able to keep up the momentum and move up to test higher levels.

Basic Attention Token Price Prediction 2023

Experts and people agree that the BAT price will only cross $0.42 by the end of 2023. The token is yet to come with better utilities beyond the Brave ecosystem. If these are introduced, BAT may move up, but till then, $0.42 is our conservative estimate for the end of 2023.

Basic Attention Token Price Prediction 2024

If more people use Brave, more value may be put into BAT. Experts say that by the end of 2024, BAT will likely increase to $0.6. But a realistic estimate says the BAT price will increase to $0.55.

Basic Attention Token Price Prediction 2025-2026

2025 will see the normalization of crypto, which will move the market away from its volatile tendencies. BAT will benefit from that, allowing it to close in on its all-time high. Our experts say that the BAT price may increase to $0.92.

Summary

The Basic Attention Token (BAT) is a cryptocurrency that powers a blockchain-based digital advertising platform. The platform was created to give users fair rewards in exchange for their attention while providing advertisers with higher ad profits. Brendan Eich, the founding member of the Mozilla browser and the JavaScript programming language, launched the project in 2015. Eich’s main goal is to change the present predicament in the online advertising market. On May 31, 2017, an ICO was held, wherein the company raised $35 million in less than half an hour. The asset’s price has changed dramatically since then.

There are several ways to invest in Basic Attention Token if you think BAT will increase in price again in 2022 in another bull run. We recommend opening an account on a regulated exchange, such as eToro, Binance, or Coinbase, as the most convenient option to buy BAT.

eToro is the most beginner-friendly platform with the most deposit options and a social trading platform that allows you to network with other investors to hear their market opinions and price targets for Basic Attention Token, Bitcoin, and all other coins.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

Any risks in buying Basic Attention Token now?

If you are considering investing in BAT, you should be prepared for volatility and risk. All cryptocurrencies are risky investments, but small coins like BAT are especially so. They are extremely volatile, which means you could make a lot of money or lose a lot of money. Considering the current price of BAT, it's testing a double bottom pattern that may push BAT/USD higher in 2023.

Should I buy Basic Attention Token?

Basic Attention Token hasn't generated that much interest in the latter half of 2022. But it has grown immensely in the early days of 2023. However, the current sentiment around this asset remains neutral. So, it may be a good idea to have some BAT holdings for diversifying your investment.

Where can I spend my BAT?

The Basic Attention Token isn’t a very popular coin yet and can't be used to make a direct purchase via e-commerce or retail. However, you can always convert BAT into BTC, ETH and other altcoins to make a direct payment online.

Is it safe to buy Basic Attention Token?

BAT's developers have built several security measures into the digital token system in response to concerns about fraud and privacy. According to the developers, they plan to mitigate potential ad fraud through the use of cryptography, improved client-side integrity, and transparency achieved through open source.

Will Basic Attention Token ever hit $10?

Basic Attention Token has an optimistic outlook, but it will be challenging for BAT to reach $10 anytime soon. The crypto world will grow and progress like anything else over the next 4 to 5 years. In terms of the currency's future, the currency could be a profitable investment, with market predictions predicting that the price of the Basic Attention token will reach $7 by the end of 2025.

Bitcoin

Bitcoin