Compound is a decentralized, blockchain-based protocol running on the Ethereum network. It works as a decentralized application that directly enables DeFi features on the Ethereum blockchain. It has its native ERC-20 token, COMP. The Compound protocol users can either request loans or earn interest by lending the cryptocurrencies they own.

The Compound Protocol promotes active usage of the protocol and ensures a healthy market by increasing incentives for participation on both sides. It utilizes its token COMP to reward its users whenever they interact with the protocol. In addition, users can get rewarded with extra COMP tokens for borrowing, withdrawing, and repaying loans.

This update will provide more information about the COMP token and how to buy it. If you’re interested in investing in COMP, keep reading to learn everything you need to know.

On this Page:

How to Buy Compound

- Choose an exchange offering COMP token; eToro is highly recommended as FCA, ASIC, and CySEC regulate it.

- Open and verify your trading account at eToro.

- Add funds into your account.

- Search for ‘COMP’ to open charts and trades.

- Enter the amount to trade COMP and push “Trade Now.”

Best Exchange to Buy Compound in September 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Compare Crypto Exchanges & Brokers

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

How to Sign Up at eToro

The following is an overview of the investment process with FCA-regulated broker eToro for first-time buyers of the COMP token.

Step 1: Open an Account

Please follow the steps outlined below to open a new trading account.

- On the eToro website, click the “Join Now” or “Trade Now” button.

- On this page, you’ll find an electronic form for entering all of the personal information required to open a new trading account.

- Please complete this form with all the required information.

- eToro users can sign in via Facebook or Gmail.

- Please read eToro’s Terms & Conditions and privacy statement before submitting your information for consideration.

- Please indicate your agreement with all terms by checking the appropriate box after reviewing them.

- Submit your information by clicking the “sign-up” button.

eToro website homepage

If you want to use the mobile app for iOS and Android, check out the guide to the eToro app. It has screenshots of how the app looks and works.

Your capital is at risk.

Step 2: Upload ID

eToro will require supporting documentation to verify your identity, such as a copy of your passport or driver’s license. Besides, a copy of the most recent utility bill or bank statement will also be required to validate the stated address. The verification process will begin automatically once the documents are uploaded.

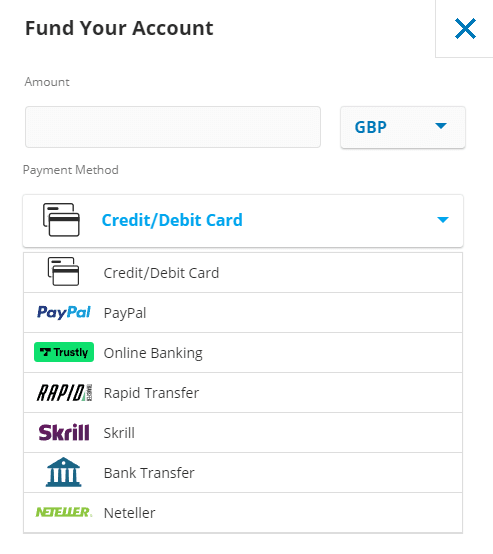

Step 3: Make a Deposit

After submitting supporting documents, the next step is to add deposit funds into your eToro account by connecting a payment method. eToro accepts bank transfers, debit or credit cards, e-wallets, and PayPal as payment methods.

Deposit methods on eToro

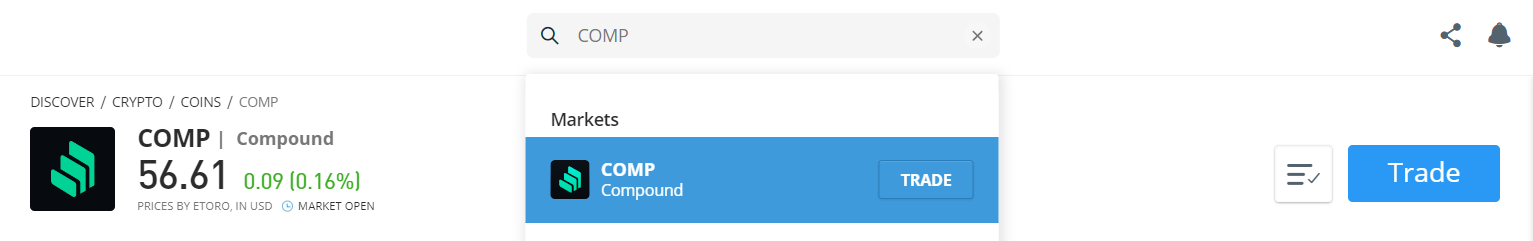

Step 4: Buy Compound

In this step, type COMP in the search bar of your eToro account, and it will show the specified coin. Once you see COMP in a search bar, click on the Trade button to enter the number of COMP coins you would like to buy.

Searching COMP on eToro

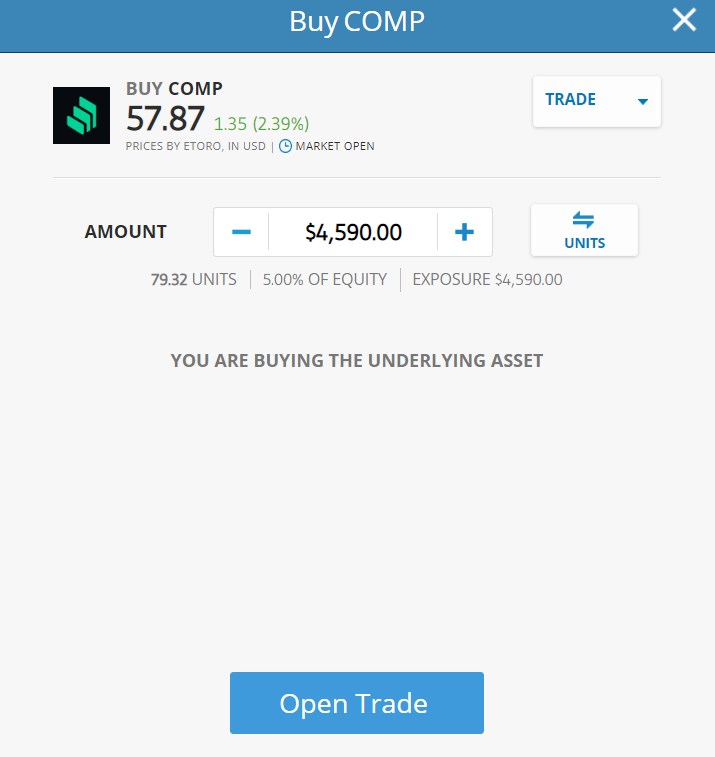

Step 5: Review Compound Price

This step will take you to an order page to enter the number of COMP coins you wish to purchase. Following that, click Open Trade‘ to add the COMP to your portfolio.

Apart from the trading platform, we support storing your digital assets in a third-party wallet. One viable option is to utilize the eToro Crypto Wallet, which now supports more than 120 cryptocurrencies in addition to COMP.

COMP Price Chart on eToro

On May 26, 2021, eToro listed the COMP token. There is no need to search for the desired coin on other exchanges because it is available on eToro. The good news is that there is no maker/taker fee on eToro because they only charge the buy/sell spread.

Step 6: Buy Compound

Once you click on the “Trade Now” button, the order box will appear where you can add the amount you want to allocate to the compound token. Once the order is confirmed, eToro will proceed to execute the purchase, and then you can find the COMP token in your portfolio.

Buy COMP on eToro

Two Types of Buy Orders

Pending Order: You will be able to place a pending order (buy limit) that will execute your trade once the COMP token’s price reaches a specified level.

Instant Buy: To purchase Compound immediately, click on ‘Open Trade’ at the current buy price. The underlying asset, COMP, will be added to your eToro account. Then, you can sell COMP whenever you want to realize your profits.

Read more about how to buy cryptocurrency in 2024 here.

Your capital is at risk.

Where to Buy Compound- Best Platforms

Compound (COMP) is an Ethereum token that allows the Compound protocol to be managed by the community. The protocol consists of a series of decentralized interest rate marketplaces that enable users to provide and borrow Ethereum tokens at changeable interest rates. COMP token holders and their delegates can also discuss, propose, and vote on protocol improvements.

We’ve narrowed down the best sites for purchasing COMP after extensive study. Our list of places to buy COMP in 2024 includes their features, fees, and the reasons for their exclusivity. eToro has positioned itself as the leading platform for purchasing Compound cryptocurrencies. The platform is safe, has reasonable prices, and is simple to use.

Best Brokers to Buy Compound

1 – eToro

eToro sprang to prominence thanks to its social investing platform, a cutting-edge technology that allows users to duplicate the transactions of other investors. Founded in 2007, eToro now boasts over 20 million members in 140 countries, including the United States. While eToro provides multi-asset brokerage services in other countries (including equities, commodities, and currency trading), the platform now only permits US customers to trade cryptocurrencies. The company plans to increase its offerings in the United States throughout the future.

eToro is currently available in 44 US states as well as Washington, DC. While all US residents can open a free eToro account to engage in virtual trading. eToro, on the other hand, is now unavailable for cryptocurrency trading for residents of the following states: Delaware, Hawaii, Minnesota, Nevada, New York, and Tennessee.

Additionally, it now allows you to stake prizes for purchasing and saving Ethereum, Cardano, and Tron in your wallet.

Read more about how to stake crypto.

Trading and transaction Fee – eToro’s trading fees are the same as those charged by other companies, such as 0.75 percent when buying or selling bitcoin. On eToro, converting between cryptocurrencies costs only 0.1 percent on top of the existing margins. As a result, in 2022, eToro will be the market leader in cryptocurrency trading, with a strong preference for crypto-assets and CFDs.

Customer service options – eToro’s customer service options are limited to email and a support ticket. “Club Members” can reach customer service via live chat for a charge.

Regulation –eToro is supervised by some of the world’s most recognized regulatory authorities, including the United Kingdom’s Financial Conduct Authority (FCA). The Australian Securities and Investment Commission, the Cyprus Securities and Exchange Commission, and the Financial Industry Regulatory Authority (FINRA) are also in charge (FINRA). In accordance with CySEC laws, user funds are kept separate from the platform’s operating capital for all CySEC-registered brokers. This is how the platform works.

Deposit Fee: eToro charges a reasonable fee structure to its customers. Making a deposit at eToro is free of charge. Deposit methods include bank wire transfer, credit or debit card, PayPal, Skrill, Sofort, and Netteller, among others.

The minimum deposit amount varies depending on the user area. Before trading, individuals in the United Kingdom and the rest of Europe, for example, must make a minimum deposit of $200. Users in the United States must provide a $10 deposit.

eToro accepts Bitcoin, the leading cryptocurrency, as well as major altcoins such as Ethereum, Aave, XRP, Graph, and other popular cryptocurrencies.

eToro Minimum Deposit

Buying and selling on eToro can be done online as well as on handheld devices through their mobile app. The opening process of an eToro account is straightforward and takes about a couple of minutes.

Pros & Cons of the eToro platform:

- Copy-trading – Ability to copy the trade of successful traders.

- Regulated by ASIC, FCA, and CySEC

- User-friendly interface

- Trusted by 20 million registered users

- Most payment methods supported

- Staking of ETH, ADA or TRX

- Less technical analysis (TA) tools and indicators than Binance

- Service is only available in 44 US states.

- Buy / sell spread large on altcoins

Your capital is at risk.

2 – Bitstamp

Bitstamp is a Luxembourg-based cryptocurrency exchange launched in 2011 by Nejc Kodri and Damijan Merlak. This seasoned cryptocurrency exchange offers a low-fee cryptocurrency marketplace primarily intended by professional investors and large financial organizations. Bitstamp was formed two years after bitcoin’s foundation, making it one of the first bitcoin exchanges in the crypto market.

Bitsamp is best suited for experienced investors seeking a high-quality cryptocurrency trading platform. It is, nevertheless, a good platform for consumers who want to buy digital assets once and deposit them on Bitsamp’s web cold storage wallet.

Payment Fee: Bitstamp’s payment fees are minimal in comparison to most digital asset exchanges. When it comes to deposits, the United Kingdom offers two possibilities. The first alternative is to use an international wire transfer, which includes a 0.05 percent fee (very low compared to other crypto platforms). The free Faster Payments option is the second choice.

The withdrawal fee is also cheaper than the industry norm – 0.1 percent for international wire transfers and 2 GBP for Faster Payment. The one drawback to Bitstamp is the exorbitant cost they charge on credit card cryptocurrency purchases — 5% on any amount.

Minimum Deposit: Bitstamp, unlike most other online trading platforms, does not demand a minimum deposit to start an account. However, it, like Bittrex, has a minimum order amount of $50 USD/EUR/GBP, whereas other exchanges may have a significantly greater minimum order amount.

Bitstamp trading fees: Bitstamp is often recognized as a low-fee exchange, particularly for high-volume traders. The biggest trading cost you can pay for a daily volume of less than $10,000 is 0.5 percent (above the average in the industry, which is around o.25 percent ). However, when the investor’s overall amount of transactions increases, the costs reduce considerably. As a result, if your revenue surpasses $20,000,000, your fees may be as low as 0%. Individual investors could anticipate paying a charge of roughly 0.1 percent when using Bitstamp.

Security: Bitstamp claims to keep 98 percent of its digital assets offline in cold storage, with all assets insured, and two-factor verification is now needed for all investors executing crucial account tasks. However, it placed near the bottom of our study of crypto exchanges in terms of security, according to crypto exchange security evaluator CER, indicating that it may yet have an opportunity to improve to become a leader in this category.

Customer Support: The customer service at Bitstamp is available 24 hours a day, seven days a week. Moreover, clients can use phone support for urgent inquiries.

Bitstamp listed Compound (COMP) on June 16, 2021, whereas COMP/USD, COMP/EUR, and COMP/BTC are the trading pairs available on the exchange.

Pros & Cons of the Bitstamp platform:

- Allows for the purchase of cryptocurrency with fiat currency using a bank account, debit card, or credit card.

- Around-the-clock phone support.

- Available in over 100 countries.

- No margin trading.

3 – Huobi

Huobi Global, headquartered in Singapore, was founded in 2013. Originally based in China, the company relocated to Singapore following China’s cryptocurrency ban. The exchange calls itself a digital asset exchange rather than a cryptocurrency exchange. It supports ICO tokens and allows trading in over 350 cryptocurrencies.

According to the company, the future development of the blockchain economy will result in the creation of new categories of digital assets. Houbi Global has three platforms: one for the entire world, one for Houbi Japan, and one for Houbi Korea. This exchange’s services are not available to US traders. It provides a sophisticated trading experience, including margin and futures trading, interactive charts, and limit and stop orders.

The platform provides up to 5% leverage for margin trading. Houbi Global’s fee structure is very reasonable and comparatively low.

Deposit – The minimum deposit fee is $100 USD, and other fees, such as deposit fees, transaction fees, and withdrawal fees, vary by currency.

Fee – Those who want to buy cryptocurrency with a credit or debit card must pay a higher fee to Houbi. Maker and taker fees are charged at a flat rate of 0.2 percent. Depending on the scale volumes, it can also fall to as low as 0.1 percent.

Houbi Global provides email, phone, online chat, a ticket system, and social media platforms for customer support. It offers a variety of security features such as 2-factor authentication, cold storage, account freezes, and bitcoin reserves.

On August 19, 2020, Houbi listed COMP. COMP/USDT, COMP/BTC, and COMP/ETH are the trading pairs that have been made available.

Pros & Cons of the Huobi platform:

- 24/7 customer support.

- Excellent trading platform

- More than 350 cryptocurrencies.

- High-quality cyber security

- Strong customer support

- Low trading fees

- Professional trading tools.

- Mobile app

- Not available in the US.

- No fiat deposits or withdrawals

- Complex account registration process

4 – Crypto.com

Crypto.com, a global cryptocurrency exchange, was founded in 2016. It is based in Hong Kong and currently serves over 10 million traders in over 90 countries. It allows you to buy and sell over 250 cryptocurrencies with relatively low trading fees. The Crypto.com platform’s unique selling point is that it allows users to stake their cryptocurrency. Users can earn up to 14.5 percent p.a. interest by staking or holding them in a crypto.com wallet.

Aside from trading, the exchange offers a variety of other services such as staking rewards, Visa card benefits, NFT trading, DeFi products, and more.

Through its university portal, the exchange also provides access to a variety of educational guides. This platform is appropriate for users who want to do more with their cryptocurrencies than simply hold them.

Security – Crypto.com employs a number of security measures, including MFA, which stands for multi-factor authentication. It also employs whitelisting to protect customer accounts. To prevent hacks and losses, the platform employs compliance monitoring and stores customer deposits offline in cold storage.

On dollar balances, Crypto.com exchange provides $250,000 in FDIC insurance. Crypto.com provides customer service via email, live chat, and a help page.

Cashback – In addition to the Obsidian Card, Midnight Blue Card, Ruby Steel Card, and others, Crypto.com offers five prepaid Visa cards. These cards are accepted anywhere Visa is accepted and guarantee a certain percentage of cash back on purchases. Under certain conditions, the Obsidian card offers the highest cashback rate of 8%. The Midnight Blue card provides 1% cashback, while the Ruby Steel card provides 2% cashback. There is no annual fee for using the card, and depending on the card, ATM withdrawals are also free.

Deposit – The minimum account balance on this platform is set at $1. The Maker/Taker fees range between 0.04 and 0.40 percent. Credit/debit card purchases are charged at 0% or no fee during the first 30 days of account opening. In addition, users can earn up to $2000 for each friend they refer.

Cryptot.com listed COMP on 16th July 2020.

Pros & Cons of the Crypto.com platform:

- More than 20 fiat currencies are supported.

- A separate NFT platform

- There are no fees for sending cryptocurrency to other users via the mobile app.

- It offers up to 8% cashback on its own Visa card.

- Price alerts

- Up to 14.5% p.a. interest earnings

- Competitive fee

- Pay more for lower balances.

- Residents of New York are not eligible.

- Services for the US platform are limited.

- No customer service via phone.

5 – Bybit

Bybit is a new peer-to-peer (P2P) cryptocurrency derivatives exchange seeking to establish itself in the emerging cryptocurrency margin/leverage trading sector. Despite its March 2018 launch, Bybit quickly garnered traction in the bitcoin trading community and began registering customers.

The exchange allows traders worldwide to engage in leveraged margin trading on a select set of cryptocurrency assets, with BTC, ETH, EOS, and XRP trading at up to 100x leverage.

Bybit, based in Singapore, is a cryptocurrency-to-cryptocurrency exchange that does not need consumers to go through onerous KYC verification and currently has a daily trading volume of up to $1 billion.

Founders – Ben Zhou launched the company in March 2018. Before becoming the exchange’s CEO, he was the general manager of XM, a forex brokerage firm.

Leveraged trading: The principal product offering of Bybit exchange is perpetual futures with a leverage ratio of 100:1. This suggests that they intend to compete with established exchanges like Binance and Phemex, which provide comparable non-expiry futures contracts.

Fee – 0.075 percent is charged to market takers, whereas -0.025 percent is charged to market makers. As a result, market makers will be rewarded when they initiate a deal. This low fee encourages market makers to be active and fill the order book.

Pros & Cons of the Bybit platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Not suited to spot trading

6 – Binance

Binance is one of the most active cryptocurrency exchanges in daily transaction volume, with more than $20 billion transacted each day. It provides access to hundreds of assets and a welcoming trading atmosphere that makes profiting simple.

Minimal fees, a comprehensive charting interface, and compatibility for hundreds of coins are Binance’s most distinguishing qualities. Binance, in contrast to eToro, is a cryptocurrency-focused exchange that does not provide copy trading, FX, commodities, or other financial services.

Binance uses two-factor authentication (2FA) and deposits in US dollars (USD) that are FDIC-insured. Binance also uses device management in the United States, address whitelisting, and cold storage to protect its customers.

Fees: Fees range from 0.015 to 0.10 percent for buying and trading, 3.5 percent or $10 for debit card purchases, whichever is greater, and $15 for US wire transfers.

Back in 2020/06/25, Binance added Compound (COMP) to its platform and opened trading for several crypto pairs, including COMP/BTC, COMP/BNB, COMP/BUSD, and COMP/USDT.

Pros & Cons of the Binance platform:

- Over 500 cryptocurrencies for trade

- Wider range of altcoins

- More staking options – Binance Earn feature

- Professional traders have access to all the chart indicators they need

- Margin trading – long or short on leverage

- Massive selection of transaction types

- US customers can’t use the Binance platform, and the Binance.US exchange is very limited

- High fees for credit card deposits

- No copytrading

7 – Coinbase

Coinbase was founded in San Francisco and is primarily considered one of the most prominent bitcoin trading platforms in terms of the user base. Coinbase was the first large cryptocurrency exchange in the United States to go public, debuting on the Nasdaq in April at $381, valuing the exchange at $99.6 billion fully diluted.

Coinbase allows you to buy and sell cryptocurrencies such as Bitcoin, Ethereum, Litecoin, and over 50 more. It can also be used to convert between cryptocurrencies and to transfer and receive cryptocurrency. Coinbase displays the current bitcoin price and trend, as well as your portfolio and industry news, similar to stock trading apps. Use the Coinbase Pro exchange to trade, which charges less than the Coinbase main site. Coinbase Pro is more akin to a broker.

Limit and market orders for Compound can be placed on the Coinbase Pro exchange. The maker/taker fee is 0.5 percent for the first $10,000 in volume exchanged in 30 days, after which it drops to 0.35 percent. You can trade cryptocurrency for free without paying a maker fee if your 30-day volume exceeds $300 million.

On June 22, 2020, Coinbase listed COMP, with open trade for trading pairs such as COMP/USD and COMP/BTC.

Pros & Cons of the Coinbase platform:

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Well-known and trusted by US regulators

- Instant deposits and withdrawals to / from bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker / taker fee than Binance unless your trading volume is very high

- Coinbase Pro website is slow and lacks chart indicators

- Less customer support

8 – KuCoin

KuCoin, founded in 2017, is a global cryptocurrency exchange that provides a variety of trading options to its eight million customers. Spot, futures, margin, peer-to-peer (P2P), and staking and lending are all examples of derivatives.

KuCoin, the cryptocurrency platform, claims to provide the best level of security as well as a selection of about 400 different cryptocurrencies. Despite its extensive feature set, it is an easy-to-use exchange with a plain user interface. Furthermore, KuCoin has one of the lowest fees in the cryptocurrency industry.

Chief Executive Officer and Co-Founder

Johnny Lyu is the Co-Founder and CEO of KuCoin, one of the world’s most well-known cryptocurrency exchanges. KuCoin has grown to become one of the most well-known cryptocurrency exchanges. It has more than 8 million registered users from 207 nations and territories throughout the world.

IDG Capital and Matrix Partners provided $20 million in round A funding to KuCoin in November 2018. In 2021, Forbes Advisor named it one of the Best Crypto Exchanges of 2021.

Deposit and Withdrawal

KuCoin does allow for the purchase of bitcoin with fiat currency, but only through a third-party application. Payments can be made with a credit or debit card, Apple Pay, or Google Pay, but not via bank transfer. However, the fees could be exorbitant.

You will also be obliged to purchase a certain amount of one currency right away. You may, for example, spend $200 on Tether (USDT), a stablecoin tied to the US dollar. Tether can then be used to purchase further currencies. You couldn’t just deposit $200 and wait for the right time to invest it. Other exchanges permit you to deposit funds and then choose how and when to spend them.

KuCoin Transaction Fees

Kucoin’s trading fee structure is straightforward. The platform charges both makers and takers 0.1 percent, making it one of the most affordable bitcoin exchanges online. You can further reduce your fees if you hold the platform’s native Kucoin tokens.

Kucoin listed COMP on its exchange on June 26, 2020, with the trading pair COMP/USDT.

Pros & Cons of the KuCoin platform:

- User-friendly exchange

- Low trading and withdrawal fees

- Vast selection of altcoins

- Ability to buy crypto with fiat

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

9 – Bitfinex

Bitfinex is a well-known cryptocurrency exchange that allows users to buy, sell, and trade a wide range of digital coins. In 2012, the Hong Kong-based portal was established.

Because Bitfinex’s trading area has a strong set of chart analysis tools, intermediate and professional traders are more likely to use it.

Aside from cryptocurrencies, the only way to deposit and withdraw funds is via wire transfer. Bitfinex, like Coinbase, is one of the few platforms that allows you to short cryptocurrencies and utilize leveraged trading strategies.

Founders – Bitfinex was founded in December 2012 as a peer-to-peer Bitcoin exchange, offering digital asset trading services to customers all around the world.

Giancarlo Devasini has served as Bitfinex’s Chief Financial Officer since 2013 and has been instrumental in the company’s growth. Giancarlo Devasini began his medical career in 1990, after graduating from Milan University with a Doctor of Medicine degree.

Is Bitfinex a licensed exchange?

Bitfinex Securities Ltd., a blockchain-based investment product provider, has established a regulated investment exchange (Bitfinex Securities) in the AIFC to improve members’ access to a comprehensive range of financial products. Bitfinex, as a result, is fully unregulated. While the corporation’s headquarters are in Hong Kong, it is registered in the British Virgin Islands.

Fees and deposit limits – Bitfinex charge a 0.1 percent fee for bank transfer deposits. If you deposit $10,000, for example, you will be charged a fee of $10. If you use cryptocurrencies to fund your account, you will be charged a small fee based on the coin you choose.

Withdrawal fees – Bitfinex charges a 0.1 percent fee for bank transfer withdrawals. You can pay a 1% expedited fee if you need funds within 24 hours. Alternatively, the costs for bitcoin withdrawals vary depending on the coin.

Bitfinex listed Compound (COMP) on August 26th, 2020 and opened trading for COMP/USD and COMP/USDT.

Pros & Cons of the Bitfinex platform:

- Established since 2012.

-

Suitable for experienced traders.

-

Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

-

There is no regulation.

-

US citizens are not accepted.

-

Expensive trading fees

- Hacked on more than one occasion

- Support team only available via email

What is Compound (COMP)?

The organization behind the COMP token is Compound Labs Inc., founded in 2017 by Robert Leshner and Geoff Hayes. The company was formed to design a protocol that would allow financial exchange markets to have interest rates based on their assets.

The idea behind this organization gained attention from many investors, including Coinbase, Polychain Capital, and others, and it managed to raise more than $8 million dollars to start its project. This is what happened in September 2018: The Compound Protocol was created. This became one of the most popular DeFi protocols in the crypto world.

Compound is a decentralized finance protocol that allows its users to deposit and borrow cryptocurrencies and, at the same time, earn interest while doing so. Though the idea was not new in the industry, it still attracted much attention due to its unique service, which distinguished it from other alternatives.

It was the ability to create liquid money markets for cryptocurrencies by establishing interest rates and using algorithms that adjusted these values in real-time and decentralized ways. In this way, the Compound generates pools with vast liquidity, which offer high interest rates to their liquidity providers.

In simple words, the Compound protocol allows its users to deposit cryptocurrency into lending pools designed for other users to borrow from. In return, lenders earn interest. Once a lender lends a COPM token, Compound rewards them with a new cToken like cETH, cDAI, and cBAT. The users can have several DeFi-related tokens to work with, including DAI, ETH, USDC, WBTC, BAT, REP, ZRX, SAI, etc.

Users can transfer and trade their cTokens, but they can only be redeemed for the cryptocurrency locked in the protocol for which they represent. The whole thing is run by “autonomous smart contracts,” which allow users to get their money back at any time.

How does Compound (COMP) work?

Compound, like traditional banks, allows users to deposit various cryptocurrencies and earn annual interest on their deposits. The main difference between a bank and a compound is that the latter does not have custody of its users’ deposits. Instead, users send their cryptos to and interact with a smart contract rather than another company or user. This feature makes sure that no person or authority can control or take control of funds.

The exciting thing about Compound is that it is a decentralized platform, and it does not need to follow the Federal Funds Rate. Since there is no central authority, the Compound can do something different and not be shut down.

COMP fundamentals

- What it does: it allows its users to borrow and lend tokens, and it works as a cryptocurrency exchange and a liquidity market, and it uses smart contracts to eliminate the need for a third party on the Ethereum blockchain. It is one of the few protocols that offers a way to monetize through cryptocurrency lending.

- Management team: The CEO, Robert Leshner, and CTO, Geoff Hayes, founded Compound Labs Inc.

- Date launched: The Compound mainnet was launched in September 2018.

Is it Worth Buying Compound (COMP) in 2023?

COMP has grown its community strength in a short time and has already positioned itself as one of the best Defi tokens in the space at the moment. Various bearish events like the LUNA selloff, FTX crash etc. had affected the price of COMP greatly, and had brought down its value considerably. The token, which was trading in the $800 range during the bullrun back in 2021 had dropped to the $39 level towards the end of 2022.

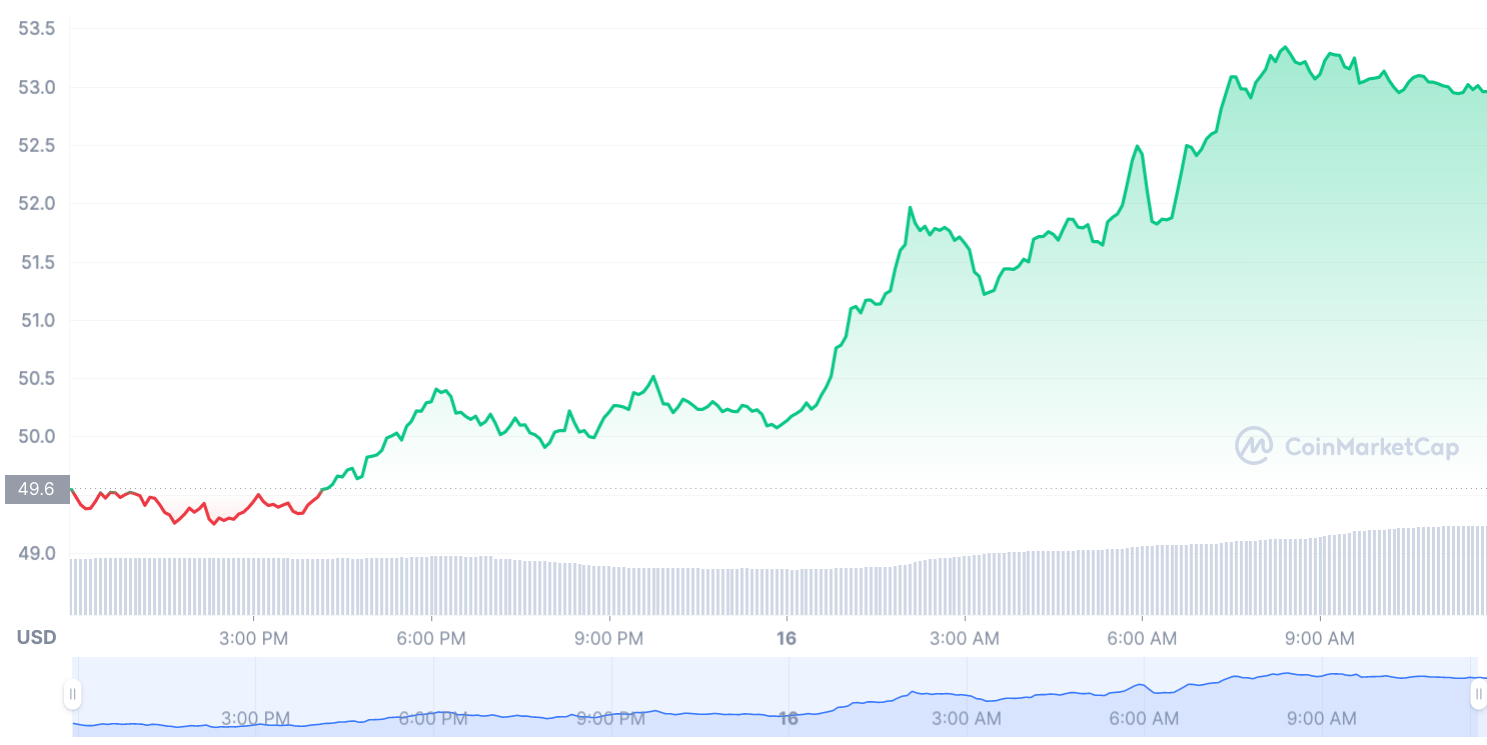

While it is safe to say that 2022 was a rather unpleasant year for COMP, there is much hope for it in 2023. Infact, the project has already started bringing major updates and has been keeping its community updated about the same through many of its social media handles. Currently, the price of COMP is seeing an uptrend and has risen from the aforementioned $39 level to its current $53 range again.

Since the latest price momentum suggests that COMP has turned its movement from bearish to bullish, we can say it has a higher chance of shooting up in price in the foreseeable future.

Will the Price of Compound (COMP) Go Up in 2023?

Compound coin is a governance token, which is prone to be affected by overall sentiment in the DeFi markets. The scope of growth for COMP is evident, since the concept of Defi is revolutionary, and one that has the potential to be used in multiple finance enterprises in the future. While the trend for investing in Defi tokens for huge profits may have subsided since the last bull run, a strong project like COMP can surely see major upward movement as the market condition gets better.

Moreover, the occasional price drop in COMP has never altered the long-term projection for the token. Investing in digital assets is always risky, but since COMP offers revolutionary financial services to crypto users, the technology is expected to produce record gains in the future. If you have a lot of tokens, Compound is a great way to lend some of them and get more tokens in the form of interest over time.

Currently, Compound hosts more than 20 pools of different cryptocurrencies like Ethereum, Uniswap, and stablecoins like DAI and TUSD. However, there is potential for more coins to be added to this pool, which will only benefit the COMP token in terms of prices. Each of these pools has different lending and borrowing interest rates, which are the same for everyone regardless of how many tokens they supply or borrow.

Compound (COMP) Line Chart – CoinMarketCap

Another aspect that could contribute to the growth of the compound token could be the use of COMP in governance. This is directly correlated to the success of COMP as a project. Essentially, the more people participate in the Compound ecosystem, the more people will be required to hold COMP tokens. This is because COMP features a DAO system, where investors can vote for making major decisions using their tokens.

Meanwhile, the increasing popularity of liquidity mining could also play an essential role in pushing COMP prices higher this year. The incentives to provide liquidity to DeFi protocols have also made the sector more attractive these days. The use case of the compound protocol in this scenario holds great potential for future price growth of the COMP token.

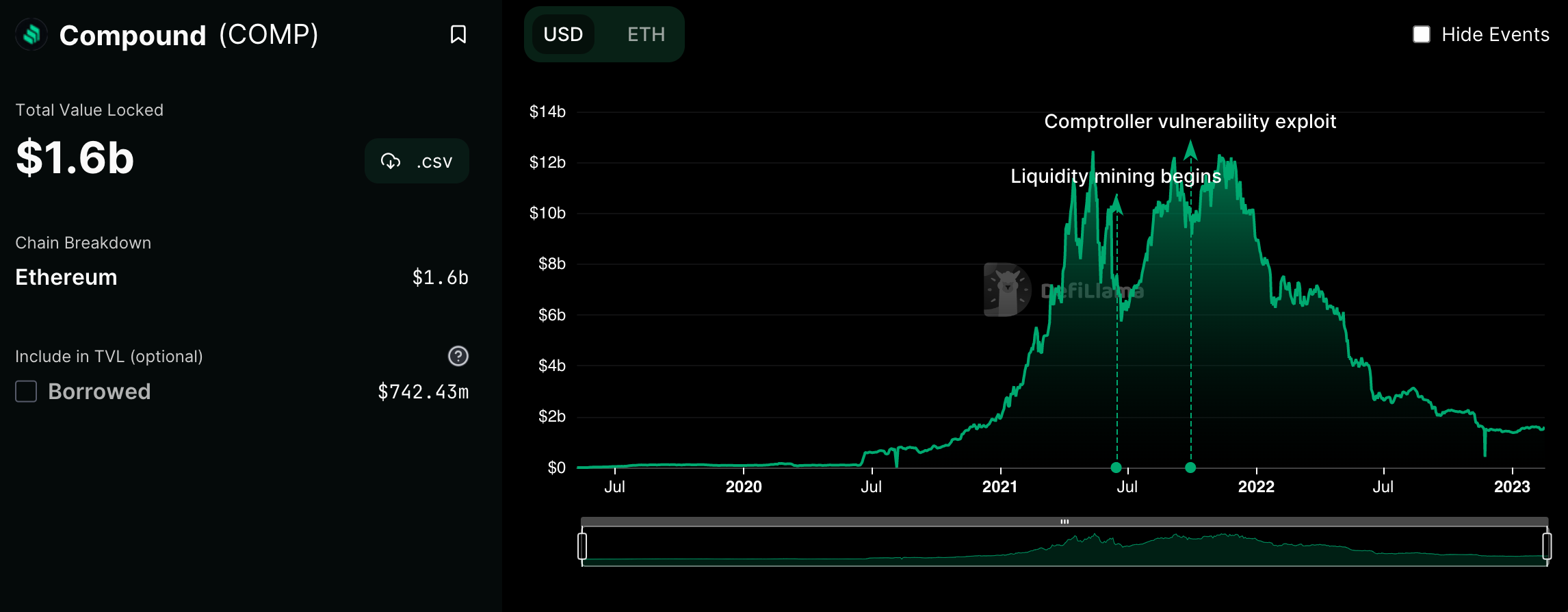

The Compound protocol’s falling total value locked (TVL) has added downward pressure on the project despite its increasing adoption, and investor confidence. While this may generally mean a lower price for COMP, the bullish nature being seen within the market currently could potentially encourage more tokens to be locked within the Compound protocol.

Compound (COMP) Total Value Locked

Currently, the TVL in COMP stands at $1.6 billion, down from an all-time high of around $12 billion back in 2021. Keeping in mind the abovementioned factors that add to the value of COMP and have the potential to weight its prices in the future further, we can say that there is a high probability that COMP prices will recover this year.

Compound Mining: Can You Mine COMP?

No, the compound native token COMP cannot be mined like the other cryptocurrencies like Bitcoin or Ethereum. However, the tokens and rewards can be multiplied on the Compound protocol by lending and borrowing cryptocurrencies through the platform. The rule is to earn interest and get as many COMP rewards as possible in the shortest possible time.

For example, people have found a way to multiply their earnings by folding their position 4x. It is done by first depositing USDC, borrowing USDT, and then converting the USDT to USDC. Then depositing the USDC onto the platform, leveraging it, withdrawing USDT and depositing it onto the compound platform several times over.

Compound Price Predictions: Where Does COMP Go from Here?

The following are the COMP price predictions made using different analytical websites’ algorithms.

WalletInvestor has been somewhat bearish while making a medium-term forecast for COMP and has estimated the average price of the token to reach $32.42 by the end of December 2023. For 2025, the website has suggested a surge in prices to the $675 range around May and then a steep drop down to about $16. Surprisingly, the five-year forecast suggests that prices could go as low as $4 by the end of January 2028.

According to LongForecast, COMP could reach $23 by the end of this year, and by 2024, the token price might dump to $10, which marks COMP as a bad investment according to the analysis website.

Let’s take a look at our technical outlook.

Compound Price Chart – Weekly Time Frame (RSI at 49.7)

Compound Price Prediction 2023

The first few weeks of 2023 have been in favour of COMP, but the price seems to have become stagnant at the $50 range. However, considering the bullish sentiment, the risk-off emotion seems to fade away and investors may look for bullish positions near $50. We predict that if everything goes smoothly, the maximum price COMP could reach this year will be $75.

Compound Price Prediction 2024

Due to the highly volatile nature of the industry, it is not easy to predict the future momentum of a cryptocurrency. According to the technical outlook, the COMP token might cross the $75 level if an excellent bullish run returns to the market. The average price in 2024 could be $100 to 110.

Compound Price Prediction 2025

While COMP may have seen a major uptrend up until the end of 2024, there is a likelihood that the token will face major consolidation to cool down in terms of value. We expect COMP to consolidate and loom around the $120 to $130 range in 2025.

Compound Price Prediction 2026

There are signs that the crypto market will enter a new age in the coming years. In the long term, the prediction for COMP as a governance token is very optimistic in the eyes of technical analysis. Thus, COMP might even recover to $350 by the end of 2026.

COMP Historical Price Movement (July 2020-Present)

Summary

Anyone looking to supplement their income by lending and borrowing cryptocurrencies may find COMP to be a good investment. Aside from the financial value, Compound Protocol users have another reason to keep their tokens. As a governance token, COMP gives its holders the ability to decide on the platform’s future direction by voting on future interest rates and other decisions.

Compound is a pioneer in the DeFi sector, and with time, Compound is securing an increasing number of partnerships. It currently supports a pool of 14 different cryptocurrencies, and it will undoubtedly add more to its pools in the future. However, the number of users on this platform is growing daily because the earnings ratio at this protocol is higher than that of many of its competitors.

The future growth potential of the COMP token appears to be very promising, and if you are interested in purchasing this token, we recommend using the eToro platform. It is a highly regulated brokerage platform that will keep your funds safe. It has a strong market reputation due to its FCA and other regulatory body licenses.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

Any risks in buying Compound now?

The cryptocurrency market is extremely volatile and risky. The market can move against you at any time. For the past four months, the compound price has been steadily declining, and this trend may continue for some time. However, prices have begun to show some bullish sentiment, and this could be an excellent time to enter the market.

Should I buy COMP?

Buying COMP can be profitable if the tokens are presented in your wallet and deposited on the protocol for ending others. It would help generate earnings in the form of extra tokens without losing the ownership of original tokens. Furthermore, the coins will also provide a right to vote in the future developments of the protocol.

Is it safe to buy COMP?

Being an ERC-20 token, the COMP token has the same security as the second-largest cryptocurrency.

Where can I spend my COMP?

COMP tokens can borrow or lend to earn interest, as they can be used to vote for future upgrades for the protocol. Further, we can convert COMP into leading altcoins to make it make e-commerce payments.

Will Compound ever hit $500?

There are indications that the cryptocurrency market will enter a new era in the coming years. The long-term prospects for COMP as a governance token are very promising. According to them, COMP may struggle to reach an all-time high of more than $900 by the end of 2025. However, the average price for this year is expected to be $350, with a minimum price of $300 predicted for 2025.

Bitcoin

Bitcoin