The derivative market is consistently the world’s largest, surpassing the traditional stock market. Every project attempted to adapt blockchain technology to that market, although some could not do so due to technological limitations. However, dYdX started in 2017, shows that it could be a good platform for making derivatives, evidenced by its substantial token airdrops.

dYdX is an Ethereum-based layer-2 decentralized trading platform that enables various financial products, including perpetual, margin, leveraged, and spot trading. It lets people trade in both directions by combining off-chain order books with a settlement layer that is on the blockchain.

According to the company’s official website, the dYdX exchange has already made a name in the crypto industry, with 64,000 unique traders, $11 billion in total volume across perpetual and margins, and $250 billion in flash transactions via dYdX liquidity pools.

In addition, the platform partnered with StarkWare, which used StarkEx, a Layer 2 scalability engine, to improve non-custodial trading on dYdX. In simple terms, the effect will be similar to that of the planned Eth 2.0 upgrade in that gas expenses will be eliminated, minimum trade sizes will be reduced, and trading fees will be cut.

Do you have any additional questions about where to buy dYdX or how it works? Continue reading for a more in-depth explanation of dYdX.

On this Page:

How to Buy dYdX (DYDX)

- Choose an exchange that offers dYdX – we recommend eToro as investing with eToro online is risk-free from a regulatory standpoint. eToro is one of the more popular brokers, with a user base of over 20 million traders.

- You can create a free eToro account simply by completing an online form.

- To protect the security of your account, provide a phone number.

- To evaluate your trading experience, answer the eToro questions.

- Verify your eToro account by providing identification, proof of identity, and proof of address.

- Search for “dYdX” in the drop-down menu to see the chart and open trades.

- Click “Trade” and select the amount of dYdX to buy.

Best Exchange to Buy dYdX in September 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Compare Crypto Exchanges & Brokers

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

How to Sign Up at eToro

Opening a free eToro account is simple because it is user-friendly, especially for beginners.

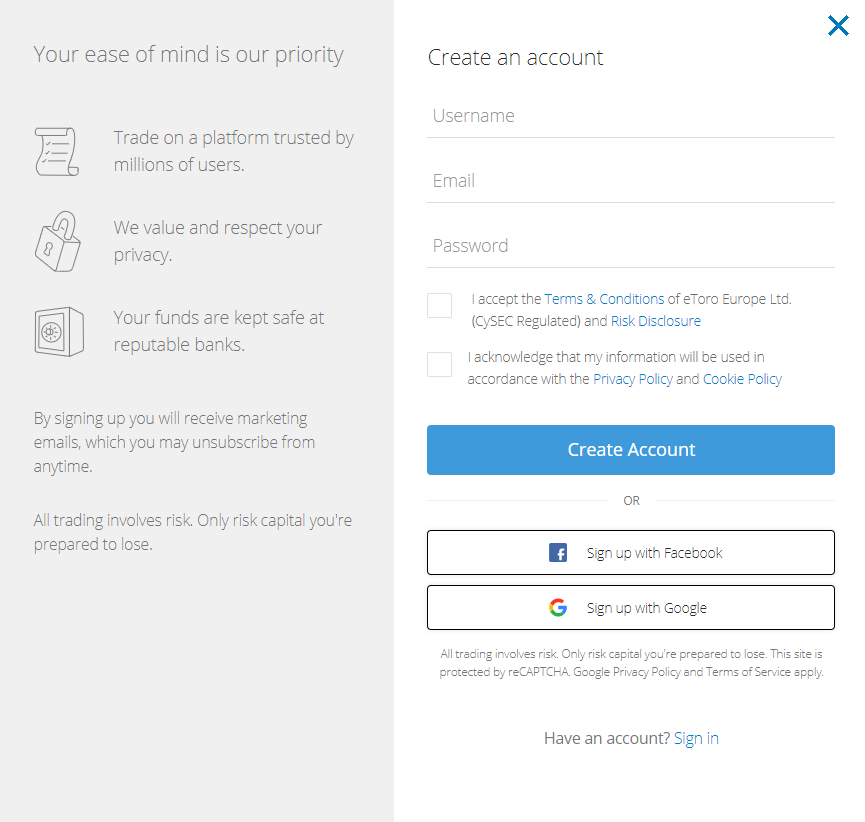

Step 1: Open an Account

Please follow the steps outlined below to open a new trading account.

- On the eToro website, click the “Join Now” or “Trade Now” button.

- On this page, you’ll find an electronic form where you can enter all your personal information needed to open a new trading account.

- Please fill out this form with all of the required information.

- eToro offers the option of logging in through Facebook or Gmail.

- Please read eToro’s Terms & Conditions and privacy policy before submitting your information for consideration.

- Please indicate your agreement with the terms by checking the appropriate box after reviewing them.

- To submit your information, click the “sign-up” button.

eToro website homepage

If you want to use the mobile app for iOS and Android, check out the guide to the eToro app. It has screenshots of how the app looks and works.

Your capital is at risk.

Step 2: Upload ID

To comply with regulatory standards, eToro will request a copy of your driver’s license or passport and your presented identity. A copy of the most recent utility bill or bank statement will be required to validate the address. The verification process will begin automatically once the documents are uploaded.

Step 3: Make a Deposit

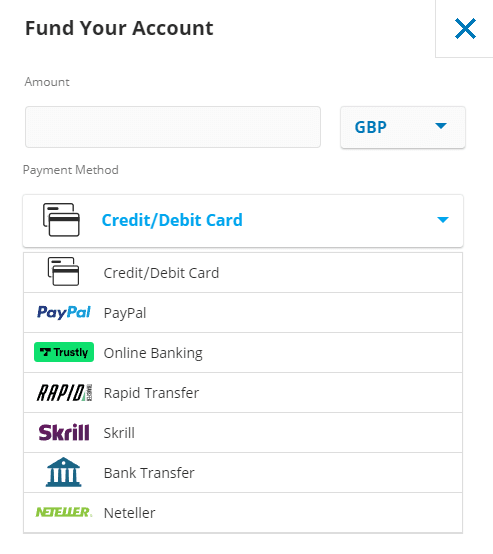

When you’re ready to deposit funds, go to the ‘Deposit Funds’ section and enter the amount you want to deposit. A minimum deposit of $50 is required to open an account with eToro, which can be made in various ways. Payment methods accepted include debit cards, credit cards, bank transfers, Skrill, PayPal, and Neteller.

There are no deposit fees at eToro. Once you’ve chosen a payment option, click the ‘Deposit’ button to finish the transaction.

Deposit methods on eToro

Step 4: Buy dYdX

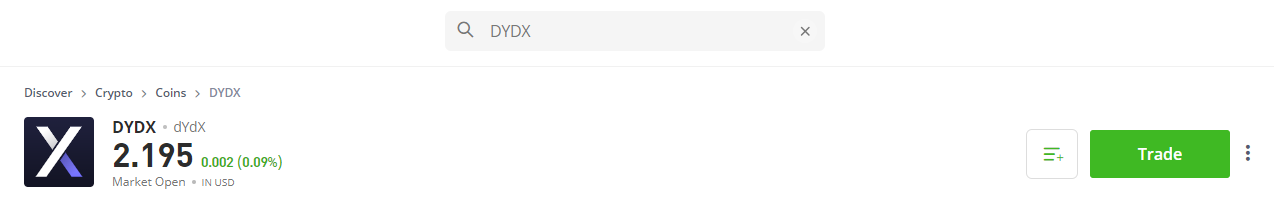

To purchase dYdX, enter dYdX in the search box and click on the first result. Then clicking on the trade button will lead to the next page showing a series of options related to the dYdX coin.

Searching DYDX on eToro

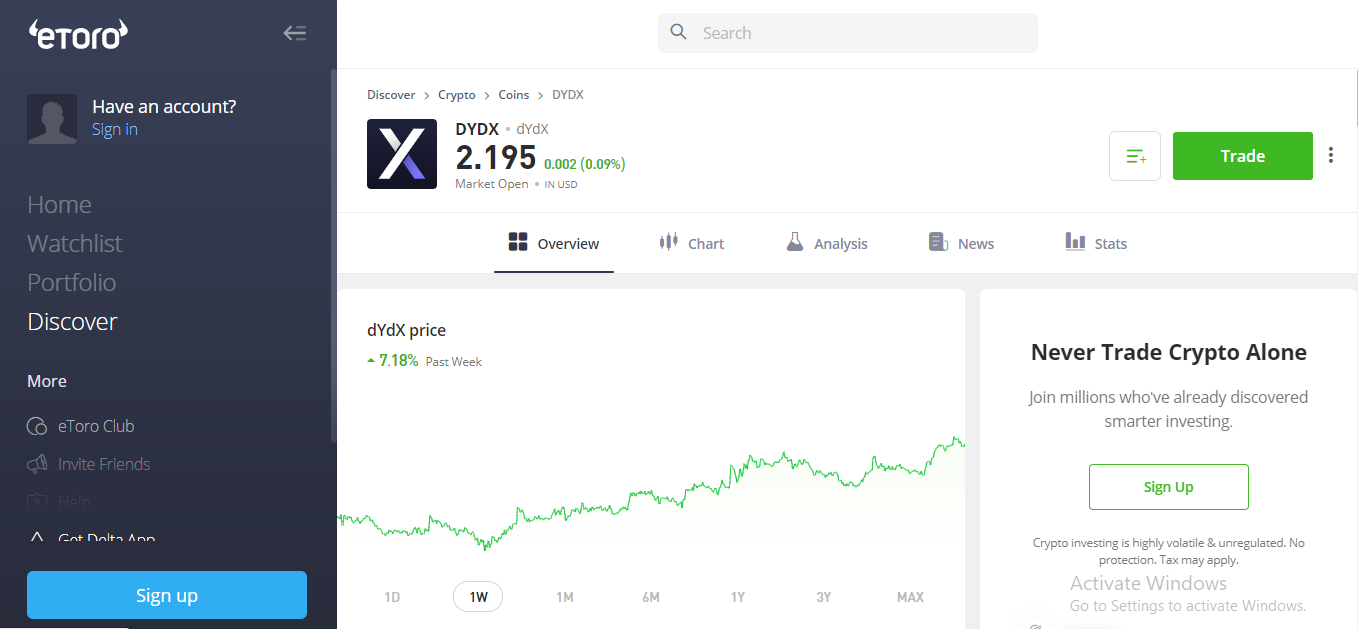

Step 5: Review dYdX Price

This will take you to an order page where you can enter the number of dYdX coins you want. Then, to include the dYdX in your portfolio, click ‘Open Trade.’

We support storing your digital assets in a third-party wallet in addition to the trading platform. One viable option is the eToro Crypto Wallet, which now supports over 120 cryptocurrencies and dYdX.

DYDX Price Chart on eToro

The good news is that eToro does not charge a maker/taker fee; instead, they charge a buy/sell spread.

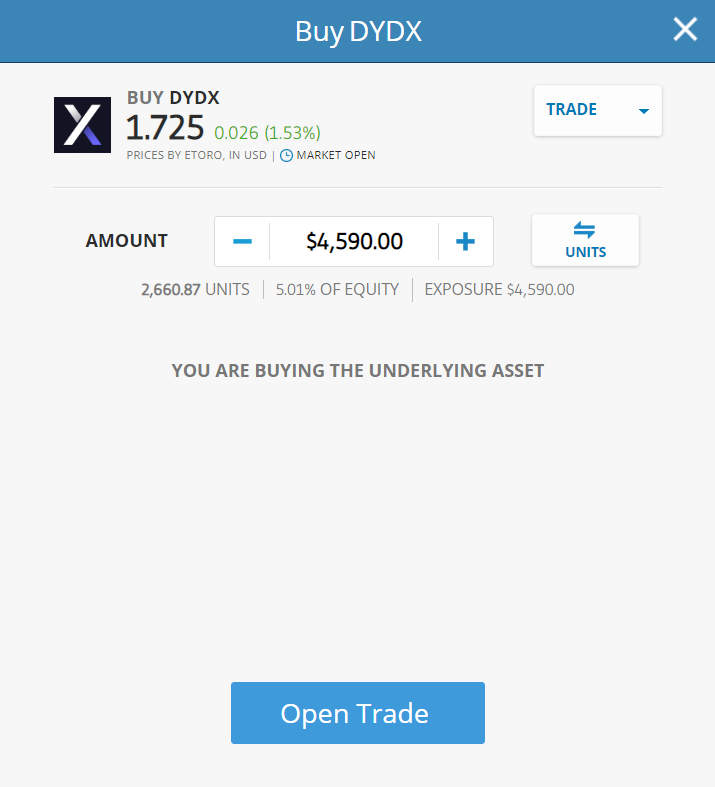

Step 6: Buy DYDX

After clicking the ‘Trade Now’ button, an order box will appear for you to enter the amount you wish to invest in the DYDX token. Once the order is confirmed, eToro will initiate the purchase, and the DYDX token will appear in your portfolio.

Instance trading is a type in which trades are executed at market prices, and coins are credited to your portfolio.

You can, on the other hand, place a pending order. You can place a pending order (buy limit) to execute your trade when the DYDX token’s price reaches a certain level.

Buy DYDX on eToro.

Read more about how to buy cryptocurrency in 2024 here.

Your capital is at risk.

Where to Buy DYDX – Best Platforms

dYdX (DYDX) is a decentralized exchange platform for cryptocurrency margin trading with assets such as BTC, ETH, SOL, and DOT. Most dYdX crypto margin trading products are built on the Ethereum blockchain. However, the exchange recently launched Layer 2 for instantly settled, low-cost trades.

This section will discuss the top exchanges and platforms to trade DYDX. After extensive research, we’ve identified the best platforms for purchasing DYDX. Our comparison of 2024 DYDX buying sites includes their characteristics, fees, and the reasons for their uniqueness. eToro has positioned itself as the leading platform for purchasing DYDX cryptocurrency. The platform is secure, reasonably priced, and easy to use.

Best Brokers to Buy DYDX

1 – eToro

eToro rose to prominence due to its social investing platform, an innovative technology that enables users to replicate other investors’ transactions. Since its inception in 2007, eToro has grown to over 20 million members in 140 countries, including the United States. While eToro provides multi-asset brokerage services in other countries (including equities, commodities, and currency trading), the platform only allows US consumers to trade cryptocurrencies. In the future, the company intends to expand its offerings in the United States.

eToro is currently available in 44 US states and the District of Columbia. While all residents of the United States are eligible to open a free eToro account for virtual trading. Whereas eToro is currently unavailable to residents of the following states: Delaware, Hawaii, Minnesota, Nevada, New York, and Tennessee for actual cryptocurrency trading.

Additionally, it allows you to stake prizes for purchasing and storing Ethereum, Cardano, and Tron in your wallet.

Continue reading to learn more about how to stake cryptocurrency.

Trading and transaction fees: eToro charges the same trading and transaction fees as other companies, such as 0.75 percent, for purchasing or selling bitcoin. On eToro, the cost of converting between cryptocurrencies is only 0.1 percent in addition to the existing margins. As a result, eToro has positioned itself as the market leader in cryptocurrency trading in 2022, with a strong preference for crypto-assets and CFDs.

Customer support options: eToro’s customer support options are limited, with email and a support ticket being the only options. “Club Members” can access customer service via live chat for an additional fee.

Regulation: eToro is regulated by some of the world’s most reputable regulatory authorities, including the United Kingdom’s Financial Conduct Authority (FCA). Additionally, the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the Financial Industry Regulatory Authority (FINRA) are responsible (FINRA). User funds are segregated from the platform’s operating capital by CySEC regulations, which apply to all CySEC-registered brokers. This is how the platform functions.

Deposit Fee: eToro maintains a reasonable fee structure for its customers. eToro does not charge a fee for depositing funds. Deposits can be via bank wire transfer, credit or debit card, PayPal, Skrill, Sofort, or Netteller.

The required minimum deposit varies by user region. For example, individuals in the United Kingdom and the rest of Europe must make a $200 minimum deposit before trading. Users in the United States are required to make a $10 deposit.

eToro Minimum Deposit

Buying and selling on eToro can be done online and on handheld devices through their mobile app. The opening process of an eToro account is straightforward and takes a few minutes.

Pros & Cons of the eToro platform:

- Copy-trading – Ability to copy the trade of successful traders.

- Regulated by ASIC, FCA, and CySEC

- User-friendly interface

- Trusted by 20 million registered users

- Most payment methods supported

- Staking of ETH, ADA or TRX

- Less technical analysis (TA) tools and indicators than Binance

- Service is only available in 44 US states.

- Buy/sell spread large on altcoins

Your capital is at risk.

2 – Bitstamp

Bitstamp is a cryptocurrency exchange that is based in Luxembourg. Although the platform began with a focus on clients in the European Union, it now provides services on a global scale. You can buy and sell various cryptocurrencies on the Bitstamp exchange and deposit and withdraw funds using standard payment methods such as a debit/credit card or bank account.

The platform has operated since 2011 and is one of the oldest in the Bitcoin trading scene. At the time of writing, Bitstamp had a daily trading volume of around $40 million. This is significantly lower than the fees charged by other exchanges such as Coinbase, Bitoasis, or Kucoin.

Bitstamp fees: Bitstamp makes money on two fronts in terms of fees. The platform charges fees for trading and deposits. Regarding trading fees, you’ll pay between 0.0 percent and 0.5 percent for each trade you make, depending on the transaction’s value.If you’re a professional trader and manager, you can reduce this to 0.0 percent if you trade more than $20 million monthly.

Deposit fees

- Debit cards: Fixed fee of $10. For deposits of more than $10,000, you pay 2%.

- Credit cards: 5% of the deposit amount (plus any fees that your credit card provider charges)

- SEPA (European Bank Transfer): Free

- Bank wire: 0.05% transaction charge (minimum/maximum €7.50/€300)

- Cryptocurrency: Free

- ACH: Free

- Faster Payments (UK): Free

Withdrawal fees

- Debit card withdrawals: n/a

- Credit card withdrawals: n/a

- SEPA (European Bank Withdrawals): €3

- Bank wire: 0.1% transaction fee (minimum €25)

- ACH: Free

- Faster Payments (UK): 2 GBP

Pros & Cons of the Bitstamp platform:

- Allows purchasing cryptocurrency with fiat currency using a bank account, debit card, or credit card.

- Provides dedicated phone customer service 24/7.

- Available in over 100 countries.

- No margin trading.

3 – Huobi

Huobi Global was founded in 2013 in Singapore and is headquartered there. Initially headquartered in China, the company relocated to Singapore following China’s cryptocurrency ban.

The exchange bills itself as a digital asset exchange, not a cryptocurrency exchange. It supports over 350 cryptocurrencies and ICO tokens. The company believes that as the blockchain economy evolves, new categories of digital assets will emerge. Huobi Global operates three platforms: one for the entire world, one for Huobi Japan, and one for Huobi Korea. This exchange’s services are unavailable to traders in the United States.

It provides a sophisticated trading environment through margin and futures trading, interactive charts, and limit and stop orders.

The platform provides leverage of up to 5% for margin trading. Huobi Global’s fee structure is highly reasonable and competitive.

Deposit: The minimum deposit fee is $100 USD, and additional fees, such as deposit fees, transaction fees, and withdrawal fees, vary by currency.

Fee: Huobi charges a higher fee for purchases made with a credit or debit card. Maker and taker fees are charged at a flat rate of 0.2%. It can also be as low as 0.1 percent, depending on the volume of the scale.

Huobi Global provides customer support via email, phone, online chat, ticket system, and social media. It protects users with multiple layers of security, including two-factor authentication, cold storage, account freezing, and Bitcoin reserves.

Huobi listed DYDX on September 08, 2021. The trading pair available for trading include DYDX/USDT.

Pros & Cons of the Huobi platform:

- 24/7 customer support.

- Excellent trading platform

- More than 350 cryptocurrencies.

- High-quality cyber security

- Strong customer support

- Low trading fees

- Professional trading tools.

- Mobile app

- Not available in the US.

- No fiat deposits or withdrawals

- The complex account registration process

4 – Crypto.com

Crypto.com launched as a global cryptocurrency exchange in 2016. It is based in Hong Kong and serves over ten million traders in approximately 90 countries. It facilitates purchasing and selling over 250 cryptocurrencies with relatively low trading fees. The platform’s unique selling point is that it enables users to stake their crypto. Users can earn up to 14.5 percent p.a. interest by staking or holding them in a crypto.com wallet.

Along with trading, the exchange offers various other services, such as staking rewards, Visa card benefits, NFT trading, and DeFi products.

Additionally, the exchange provides access to various educational resources via its university portal. This platform is ideal for users who wish to do more with their cryptocurrency than simply hold it.

Security: Crypto.com employs various security measures, including MFA or multi-factor authentication. Additionally, it utilizes whitelisting to safeguard customer accounts. The platform uses compliance monitoring to prevent hacks and losses and stores customer deposits offline in cold storage.

The Crypto.com exchange provides FDIC insurance of up to $250,000 on dollar balances. Crypto.com offers customer support via email, live chat, and a help page.

Cashback: Besides the Obsidian Card, Crypto.com offers five prepaid Visa cards, including the Midnight Blue Card, Ruby Steel Card, and more. These cards are accepted everywhere. Visa guarantees a certain percentage of cash back on purchases. The Obsidian card offers the highest cashback rate of 8% when certain conditions are met. The Midnight Blue card earns you 1% cashback, while the Ruby Steel card earns 2%. There is no annual fee for card use, and ATM withdrawals are also free, depending on the card.

Deposit: This platform’s minimum account balance is set to $1. Maker/Taker fees range between 0.04 and 0.40 percent. During the first 30 days after account opening, credit/debit card purchases are charged at 0% or no fee. Additionally, users can earn up to $2000 for each referral.

On 13 September 2021, dYdX (DYDX) was added to the Crypto.com App, joining a growing list of over 100 supported cryptocurrencies and stablecoins, including Bitcoin (BTC), Ether (ETH), Polkadot (DOT), Chainlink (LINK), VeChain (VET), USD Coin (USDC), and Crypto.org Coin (CRO).

Pros & Cons of the Crypto.com platform:

- More than 20 fiat currencies are supported.

- A separate NFT platform

- There are no fees for sending cryptocurrency to other users via the mobile app.

- It offers up to 8% cashback on its own Visa card.

- Price alerts

- Up to 14.5% p.a. interest earnings

- Competitive fee

- Pay more for lower balances.

- Residents of New York are not eligible.

- Services for the US platform are limited.

- No customer service via phone.

5 – Bybit

Bybit is a new peer-to-peer (P2P) cryptocurrency derivatives exchange that aims to enter the rapidly expanding cryptocurrency margin/leverage trading market. Despite being only founded in March 2018, Bybit is quickly becoming a popular Bitcoin trading platform.

On the Bybit exchange, digital assets such as BTC, ETH, EOS, and XRP can be traded with up to 100x leverage, allowing traders worldwide to engage in leveraged margin trading in a selected range of crypto products.

Founders: Bybit, headquartered in Singapore, is a crypto-to-crypto exchange. Ben Zhou founded Bybit in March 2018 after serving as XM’s China District General Manager for seven years. XM is a major broker, and the core team at Bybit has experience in investment banking and the forex market and being early blockchain adopters.

To combat the threat hackers pose, Bybit employs secure cold storage technology. This means they keep most of their cryptocurrency reserves and their client’s assets in secure “air-gapped” offline wallets.

To meet the withdrawal needs of traders, only a small portion of their coins are retained in their “hot wallets.” Furthermore, if they ever need to move cash from cold storage, they must implement a multi-signature address system.

Fees: Bybit employs a “maker-taker” pricing structure, meaning that traders will be charged a fee if they withdraw liquidity from their books, and they will be reimbursed if they contribute liquidity to the exchange. 0.075 percent is charged to market takers, whereas -0.025 percent is charged to market makers.

Withdrawal / Deposit: ByBit is a cryptocurrency exchange that accepts only cryptocurrencies. This means you won’t be able to fund your account with fiat currency. While this may be inconvenient for some, sites like Binance allow you to quickly convert your fiat dollars into Bitcoin.

To deposit cryptocurrency, create a wallet address and conduct a transaction. Navigate to the “Assets” section of your header to do this. This will display your wallet balances, and you can select “deposit” to see the BTC / ETH address.

Once you have the address, you can begin the transaction. The transaction will not be instantaneous because it must be transmitted over the network and confirmed by the Miners.

You will press the withdrawal button on the relevant asset for withdrawals. It will ask for your wallet address and a 2FA transaction confirmation. You will also be informed of the miner fee applied to the transaction.

Leveraged trading: The primary product offering of Bybit exchange is perpetual futures with a leverage ratio of 100:1. This suggests that they intend to compete with existing exchanges like Binance and Phemex, which offer comparable non-expiry futures contracts.

Key Features

Other critical characteristics are as follows:

- Users can switch between supported cryptocurrencies within their accounts with a single click.

- 100,000 TPS per contract – ten times the industry standard – ensuring no overloads occur.

- Leverage up to 100x – With Bybit’s generous leverage scheme, you can maximize your profits.

- Cold Wallet Storage/Manual Withdrawals – Bybit increases security by utilizing cold storage and three manual withdrawals daily.

- Unrestricted Trades and Withdrawals – Platform users have nearly limitless trading and withdrawal options.

- Accounts can be created and managed with just an email address and a login, eliminating the need for a Know Your Customer (KYC) process.

Pros & Cons of the Bybit platform:

- Up to 100x leverage on crypto

- Advanced tools supported by great technology

- Risk-free test environment to learn and experiment

- Educational resources

- Not available in the US

- Not suited to spot trading

6 – Binance

Binance is a popular cryptocurrency exchange that caters to skilled cryptocurrency traders. It provides minimal trading costs and a large selection of cryptocurrencies available worldwide, albeit its trading options in the US are fairly limited.

Key Takeaways:

- Binance provides a safe and affordable way to invest in and trade cryptocurrencies.

- Binance is a free cryptocurrency exchange with cheaper costs than many other exchanges.

- Internationally, Binance has over 365 cryptocurrencies available for trade, but only 60 are available in the United States.

Binance is the world’s largest cryptocurrency trading platform as it offers many trading options and capabilities, although it is not very user-friendly. People of all skill levels will have to learn a lot about Binance. Binance’s desktop and mobile dashboards provide a broad range of trading choices, including a great assortment of market charts and hundreds of cryptocurrencies. Users can also choose from a wide range of trading options, such as futures and options, as well as other order forms.

Binance is a Chinese decentralized cryptocurrency exchange launched by software developer Changpeng Zhao in 2017. Binance is also battling regulatory concerns in some countries despite being the world’s largest cryptocurrency exchange by trading volume. Authorities in the United States are investigating it for money laundering and tax evasion. Furthermore, the site has been blocked in some countries.

Fees: Binance’s fees are among the lowest in the industry. Users in the United States will pay a bit more on Binance.us, but the fees are still lower than on other big platforms. Binance charges fees for both makers and takers. The fees change depending on how many trades and how much BNB you have.

0.015 to 0.10 percent for buying and trading, 3.5 percent or $10 for debit card purchases, whichever is bigger, or $15 for US wire transfers.

Security: Two-factor authentication (2FA) via the Google Authenticator app or short messaging service (SMS), address whitelisting, device management, and the option to restrict device access are among Binance’s security features. US dollar amounts are also protected by FDIC protection when maintained in custodial bank accounts on the Binance.us platform.

These protections can help users keep their accounts safe. In addition, the site doesn’t have as many safety measures as some of the most popular cryptocurrency exchanges.

Binance listed the DYDX token on September 9, 2021, and it offers to trade on DYDX/USDT.

Pros & Cons of the Binance platform:

- Over 500 cryptocurrencies for trade

- A wider range of altcoins

- More staking options – Binance Earn feature

- Professional traders have access to all the chart indicators they need

- Margin trading – long or short on leverage

- Massive selection of transaction types

- US customers can’t use the Binance platform, and the Binance.US exchange is limited.

- High fees for credit card deposits

- No copy trading

7 – Coinbase

Coinbase is a popular cryptocurrency exchange that simplifies buying, selling, and exchanging cryptocurrencies. Coinbase is a cryptocurrency trading and investment website allowing users to purchase, trade, and exchange over 100 tradable cryptocurrencies, including Bitcoin, Ethereum, and Dogecoin. Coinbase is a major firm with over 73 million users and $255 billion in assets.

Coinbase Pro

For simple buy and sell orders, beginners may prefer the original Coinbase site. Coinbase Pro, available to all Coinbase users, gives experienced users access to extra tools and order types.

Cryptocurrencies are a new asset class that can be risky, making them inaccessible to some investors. On the other hand, Coinbase is a wonderful alternative for newcomers and veterans alike if you’re interested in cryptocurrency.

Coinbase was founded in 2011 as a Bitcoin sending and receiving platform. The company now employs over 2,700 people worldwide and accepts a variety of cryptocurrencies. Coinbase is a decentralized organization with no centralized headquarters.

Coinbase has over 100 million users in over 100 countries, and consumers trade $327 billion each quarter. Coinbase manages a thriving Bitcoin ecosystem with over 9,000 financial institutions.

Fee: Coinbase is secretive about its pricing and fees, and its comprehensive price schedule was suddenly removed from the Coinbase online support area. Conversely, costs are displayed on the trade screen before you enter a deal, so you know exactly how much you’ll be paying.

These are the fees you can expect on the Coinbase platform:

Trade Size => Coinbase Fee

$10 or less => $0.99

$10 to $25 => $1.49

$25 to $50 => $1.99

$50 to $200 => $2.99

Additional fees may apply to some account funding and withdrawal methods, as well as other less common services:

Payment Type => Coinbase Fees

Bank account => 1.49%

USD Wallet => 1.49%

Debit/credit cards => 3.99%

Wire transfer => $10 incoming, $25 outgoing

ACH transfer => Free

Security: Coinbase uses industry-leading security standards to safeguard customer deposits and assets. However, there are always risks when using cryptocurrencies, so following online best practices is critical to keep your account information safe.

Almost all of a customer’s assets are kept cold in a global network of safe deposit boxes, including digital and paper backups. Its website has bank-level encryption and security. Two-factor authentication is required for all accounts, preventing anyone from accessing your account unless they have your phone.

Key Takeaways:

- Coinbase provides a safe and secure platform for investing in and trading cryptocurrencies.

- Several currencies, including Bitcoin and Ethereum, are supported by Coinbase.

- One of the most appealing features of the Coinbase platform is its user-friendly UI.

- Coinbase Pro gives any Coinbase user access to lower costs and more services.

Pros & Cons of the Coinbase platform:

- Trade against the US Dollar, GBP, or EUR rather than USDT

- Well-known and trusted by US regulators

- Instant deposits and withdrawals to/from a bank account

- Remember to use Coinbase Pro for lower fees

- Higher maker/taker fee than Binance unless your trading volume is very high

- The Coinbase Pro website is slow and lacks chart indicators

- Less customer support

8 – KuCoin

KuCoin is a cryptocurrency exchange with more than 200 locations throughout the world. While some of the exchange’s features may appeal to seasoned traders, KuCoin is not licensed in the United States and has received negative customer feedback. KuCoin is a significant cryptocurrency exchange where users may purchase, sell, and trade digital assets.

In addition to traditional trading options, the platform supports margin, futures, and peer-to-peer (P2P) trading. By staking or lending their cryptocurrency, users can receive rewards. Compared to some of its competitors, KuCoin has low trading costs, which makes it a good choice.

KuCoin is a cryptocurrency exchange launched in 2017 by eight co-founders in Seychelles. For over a decade, it has grown to be one of the world’s biggest exchanges by trading volume. It has more than 10 million users in more than 200 countries. Users in the United States can sign up for a KuCoin account, but access to functionality is limited due to KuCoin’s absence of a US license.

Fee: KuCoin’s maker/taker fee structure is tiered, with trading costs ranging from 0.0125 percent to 0.01%, depending on your tier level. Its fees are relatively low compared to competitors, which may charge up to 0.50 percent for each trade. Users can also save money on trading fees using their KuCoin Token (KCS) balance.

KuCoin charges withdrawal and trading fees, which vary by asset and are subject to change based on market performance. Deposits are free on this exchange, but it’s important to note that KuCoin now only accepts a limited number of cash deposits.

Security: KuCoin provides users with a distinct password for trading and security measures such as multi-factor authentication and encryption. This password is required in addition to the user’s standard log-in information when making trades or withdrawing funds. It adds an extra layer of security and is a relatively uncommon security feature among cryptocurrency exchanges.

Deposit and Withdrawal: KuCoin does allow for the purchase of Bitcoin with fiat currency, but only through a third-party application. Payments can be made with a credit or debit card, Apple Pay, or Google Pay, but not by bank transfer; however, the fees could be exorbitant.

Key Takeaways:

- KuCoin has a large number of cryptocurrencies to choose from.

- It is one of the top three most active exchanges in terms of trade volume.

- There are advanced trading options available, such as margin and futures trading.

- KuCoin has a comprehensive support center that answers frequently asked concerns regarding the platform’s tools and capabilities.

KuCoin listed DYDX on September 08, 2021, supporting just the DYDX/USDT trading pair.

Pros & Cons of the KuCoin platform:

- User-friendly exchange

- Low trading and withdrawal fees

- Vast selection of altcoins

- Ability to buy crypto with fiat

- 24/7 customer support

- No forced Know Your Customer (KYC) checks

- Ability to stake and earn crypto yields

- Complicated interface for newbies

- No bank deposits

- No fiat trading pairs

9 – Bitfinex

Bitfinex is a large cryptocurrency exchange offering various cryptocurrency goods and trading choices, including spot trading, margin accounts, derivatives, and paper trading. Bitfinex will indeed have everything you need to manage your cryptocurrencies in one place, with a mix of tools that novice and advanced users can use.

Founded: Bitfinex is one of the oldest cryptocurrency exchanges, founded in 2012. According to CoinMarketCap, the exchange has been a big player in the cryptocurrency market since it started. It is eighth in the world’s biggest cryptocurrency exchanges by volume.

Giancarlo Devasini has been Bitfinex’s Chief Financial Officer since 2013 and has played a critical role in the company’s success. Giancarlo Devasini began his career as a physician in 1990, earning a Doctor of Medicine degree from Milan University.

Security: Bitfinex employs several industry-standard security procedures to protect user accounts and funds. For example, two-factor authentication, robust APIs for connecting third-party services, withdrawal protection methods, and cold storage of customer assets are just a few of the features that can be used by people who sign up.

Is Bitfinex a regulated cryptocurrency exchange?

Bitfinex Securities Ltd., a provider of blockchain-based investment products, has established a regulated investment exchange (Bitfinex Securities) in the AIFC to facilitate members’ access to a broad range of financial products. Bitfinex, as a result, is entirely unregulated. While the corporation’s headquarters are in Hong Kong, it is registered in the British Virgin Islands.

Fees and deposit limits – Bitfinex charges a 0.1 percent fee for bank transfer deposits. For instance, if you deposit $10,000, a fee of $10 will be assessed. If you fund your account with cryptocurrency, a small fee will be applied depending on your chosen coin.

Fees for withdrawals – Bitfinex charges a 0.1 percent fee for bank transfer withdrawals. If you require funds within 24 hours, a 1% expedited fee is applicable. Alternatively, Bitcoin withdrawal fees vary by coin.

User’s Trading Experience: Bitfinex provides a user-friendly trading environment, with advanced traders appreciating the capabilities and possibilities provided. For instance, you can start with a free paper trading account, which gives you access to the Bitfinex platform with play money, akin to a stock market game, to test your strategy before investing real money.

Key Takeaways:

- Bitfinex is a well-known cryptocurrency exchange that supports 150 different coins.

- It’s good for low fees and high liquidity when actively trading and investing.

- The exchange has many features that both new and experienced traders can use.

Pros & Cons of the Bitfinex platform:

- Established in 2012.

-

Suitable for experienced traders.

-

Over 100 coins are supported.

-

Bank wire deposits and withdrawals are accepted.

-

There is no regulation.

-

US citizens are not accepted.

-

Expensive trading fees

- Hacked on more than one occasion

- The support team only available via email

What is dYdX (DYDX)?

DYDX (dYdX) is the governance token for the non-custodial decentralized cryptocurrency exchange’s layer two protocol. It lets traders, liquidity providers, and other community members help decide the protocol’s future.

People who own tokens can suggest how the dYdX’s layer two could be better. They can also save money on token staking and trading fees. Layer 2 is used for trading cross-margined perpetual on the platform and is based on Starkwire’s StarkEx scalability engine. The scaling method allows dYdX to speed up transactions, reduce gas costs, reduce trading fees, and lower the minimum trade size.

dYdX is an open-source platform featuring smart contract capability for lending, borrowing, and trading crypto assets. Although dYdX allows spot trading, it primarily focuses on derivatives and leverage trading. The exchange was launched in 2019 after being formed in 2017 with over $10 million in seed venture capital funding. On September 9, 2021, the DXDY token had its initial coin offering (ICO).

Who are the dYdX founders?

The founder and CEO of DYDX is Antonio Juliano, an experienced programmer with expertise in blockchain technology. He initially became involved in cryptocurrency in 2015 when he accepted a position as a software developer at Coinbase, a cryptocurrency exchange platform. His business began in early 2017 when he started dYDX; Antonio Juliano, who studied computer science at Princeton, started his business when he was 18.

dYdX’s chief of operations is Zhuoxun Yin. Previously, I worked for Nimble, a social sales and marketing CRM, and Bain & Company, a consulting firm. Zhuoxun Yin earned a bachelor’s degree in commerce from Queensland.

How Does dYdX (DYDX) Function?

According to the company’s official website, the dYdX exchange has already made a name in the crypto industry, with 64,000 unique traders, $11 billion in total volume across perpetual and margins, and $250 billion in flash transactions via dYdX liquidity pools. In addition, the platform partnered with StarkWare, which used StarkEx, a Layer 2 scalability engine, to improve non-custodial trading on dYdX.

In simple terms, the effect will be similar to that of the planned Eth 2.0 upgrade in that gas expenses will be eliminated, minimum trade sizes will be reduced, and trading fees will be cut. dYdX aims to provide safe trading services with low gas and charge costs. With the help of StarkWare, the platform is now moving to Layer 2 to improve its ability to settle trades.

According to the dYdX platform’s official website, this modification is being made because: “Ethereum’s transaction rate is just 15 TPS, insufficient to support the hypergrowth of DeFi, NFTs, and other technologies.” Although Ethereum 2.0 is predicted to boost network speeds to 100,000 TPS, base layer scaling is still far off.

Meanwhile, Layer 2 scaling solutions like Rollups free up Ethereum’s base layer by offloading execution, resulting in lower gas costs and more throughput without placing the network under additional strain. Finally, StarkWare’s dYdX integration combines STARK proofs for data integrity with on-chain data availability to provide a fully non-custodial protocol.

Is it Worth Buying dYdX (DYDX) in 2024?

In the realm of cryptocurrency, one platform that stands out in the DeFi movement is dYdX. It provides digital asset enthusiasts a platform to explore opportunities within the crypto market. With a team of experienced developers and institutional investors, dYdX has built a strong reputation despite occasional turbulence in the cryptocurrency landscape.

In 2023, a significant announcement was made by dYdX Exchange through a blog post, signaling a change in its operational dynamics. New users were notified that the platform’s onboarding process would be temporarily paused. Existing users were given a brief seven-day window to conduct trades before transitioning all accounts into “close-only mode.”

This operational adjustment effectively limits users to only withdraw funds from their accounts, imposing restrictions on any further trading activities. dYdX expressed regret for the inconvenience these new measures could cause to its user base.

The decision to limit services in Canada stemmed from the Canadian Securities Administrators (CSA) issuing a new set of regulations for service providers. These regulations prioritize asset segregation and place a stronger emphasis on transparency.

In the first quarter of 2023, the cryptocurrency exchange landscape within Canada has experienced significant changes due to tightening regulatory pressures. With these shifts, several digital currency exchanges have indicated their potential withdrawal from the Canadian market.

While there are rumors of platform suspensions for Blockchain.com and Deribit, Crypto.com and Coinbase have publicly confirmed their commitment to continuing operations in Canada. They view this as a strategic move within their global expansion plans.

Financial experts and market analysts are optimistic about dYDX, anticipating significant growth and a consistent rise in value. However, caution is necessary due to the inherent volatility of the cryptocurrency market. Potential risks persist, urging investors to conduct thorough research and exercise prudence before making vital investment decisions.

The independent nonprofit organization known as the dYdX Foundation recently achieved a significant milestone in their pursuit of decentralized finance (DeFi). They launched a public testnet for their latest version, v4, putting them ahead of schedule for the forthcoming mainnet release. This development is being hailed by the foundation as a crucial step towards accomplishing complete decentralization for the dYdX platform.

dYdX’s value can be influenced by market conditions and is prone to fluctuations. Predicting its precise price movements, therefore, becomes challenging. Nevertheless, the optimistic outlook on dYdX’s projected value and anticipated growth suggest it could be a relatively secure investment option. As with any investment, potential stakeholders should assess their risk tolerance and gather comprehensive insights before committing funds.

Will the Price of dYdX (DYDX) Go Up in 2024?

The trajectory of dYdX’s Price in 2023 is receiving significant attention, as indications suggest a potential upward surge. The ticker for perpetual contracts decentralized exchange, DYDX, has been showing a bullish trend for an extended period, even amidst market dormancy and the absence of clear signals from Bitcoin (BTC). Since June 10, DYDX has maintained an ascending trajectory along an upward-trending line.

On July 31, a significant price surge occurred as the DYDX token experienced an impressive 10% increase within 24 hours. This surge was driven by a remarkable rise of 110% in trading volume, highlighting heightened interest and involvement from investors.

The impending token unlocks program, scheduled for August 1 around 6:00 PM GMT, adds momentum to the current bullish sentiment. This significant event will introduce approximately 13.95 million DYDX tokens into the circulating supply, accounting for roughly 3.81% of the total supply.

Such events historically trigger price rallies. Investors anticipate and seize opportunities under the “buy the rumor, sell the news” adage. Additionally, an increase in supply could potentially lead to a decrease in value. This trend is often exploited by long-term investors to enhance their portfolios.

As a result, this scenario might fuel an upward trend in DYDX token prices. According to the developments, dYdX’s price outlook for 2023 seems optimistic. Several factors contribute to the potential for an upward trajectory in this regard.

dYdX Price Predictions: Where Does DYDX Go From Here?

The prominent cryptocurrency, dYdX (DYDX), is currently valued at $2.19. In the last 24 hours, there have been a minor decline of -0.38% in its price. The trading volume for dYdX within this period stands impressively at $131.15 million, indicating significant market activity.

With a market capitalization of $342.03 million, dYdX establishes its position in the cryptocurrency landscape. However, its market dominance remains modest at 0.03%. This performance places dYdX at number 13 within the Exchange Tokens sector and number 6 in the Layer 2 sector in terms of market capitalization rankings.

The total circulating supply of dYdX is currently 156.26 million DYDX tokens out of a maximum supply of 1.00 billion DYDX tokens. It’s worth noting that the annual supply inflation rate for dYdX stands at 138.31%, resulting in approximately 90.69 million DYDX tokens created in the past year.

It is essential to remember that dYdX has undergone price fluctuations over time. On September 30, 2021, this cryptocurrency achieved its all-time high, soaring to an impressive price of $27.61.

Conversely, its all-time low was recorded on June 18, 2022, when it dipped to $1.008300. Since then, the lowest Price experienced after its all-time high is $1.008300, whereas the highest price since the last cycle low reached $3.65.

Regarding market sentiment, the current outlook for dYdX is assessed as bullish. Additionally, the Fear & Greed Index, an indicator of market sentiment, is currently at 54, signifying a neutral stance in the market.

dYdX Price Prediction 2023

According to the in-depth technical analysis of the market and dYdX’s historical pricing data, it is predicted that dYdX may have a growth of at least 11.89% at the beginning of March 2023. In the middle of the month, its price is expected to grow more than 96%.

Though the coin’s price has depreciated in specific periods, it can take off. Its market value is well above its price in December 2022, which is a good sign. The market seems bullish in 2023. Its price may reach an average estimate of 57% from the current price by the end of the fourth quarter of 2023. It could get a max level of $9.12 and a low of $5.67 by the end of 2023.

dYdX Price Prediction 2024

For 2024, our crypto experts believe that the estimated price of dYdX should be $3.29 to $11.449. In the best-case scenario, we are looking at an average of $9.015, around dYdX’s max level of 2023. This means we are still looking at a bullish market for the token next year.

dYdX Price Prediction 2025-2026

The price forecast continues to look optimistic for dYdX even in the year 2025. Based on the predictions by our technical team, the price of dYdX is estimated to be in the range of $5.21 to $25.879. This indicates that the price is expected to rise tremendously by more than 800% in the best-case scenario.

If market fundamentals still favor dYdX in 2026, the price may be quite steady and in the same range as in 2025. We are looking at an average of $15.37, with an upper range of $25.92 and a low range of $5 in 2026.

Summary

Regarding the token, DYDX is a governance token that allows the dYdX community to investigate the dYdX Layer 2 etiquette. dYdX enables traders, liquidity providers, and dYdX associates to collaborate on an advanced protocol by allowing shared protocol control. dYdX provides for a robust ecosystem through governance, awards, and staking – all intended to push dYdX’s expected growth and decentralization, resulting in a better user experience.

As we discussed above, the coin has the potential to grow exponentially. Therefore, if you want to buy it, our suggested regulated broker, eToro, can help you get started. The platform is, of course, licensed and regulated by the FCA and has one of the best reputations in the industry. Furthermore, eToro provides a wealth of educational resources to help those new to the market learn the ropes.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

Any risks in buying DYDX now?

,

Is it safe to buy DYDX?

Because dYdX is decentralized, users' funds are locked into smart contracts rather than being held by an exchange. The Ethereum blockchain protects it. The only danger of using dYdX is making a bad trade.

Where can I spend my DYDX?

DYDX coins are not commonly accepted as a form of payment. To make online payments, DYDX tokens can be converted into other crypto or fiat currencies.

Will DYDX ever hit $100?

Saying that DYDX will reach $100 is highly speculative. On the other hand, analysts predict that the DYDX token will reach new highs by 2025, citing the price's impressive long-term growth. DYDX is expected to have an average price of $20 in 2025, with prices potentially rising to $30 in the near future.

Bitcoin

Bitcoin