Litecoin has often been referred to as Bitcoin’s younger brother, the silver to Bitcoin’s gold, and rightfully so. If you are looking for an alternative Bitcoin asset, you might want to buy Litecoin.

There are many platforms where you can buy Litecoin. This guide explores some of the best brokers that allow you to buy the asset.

On this Page:

How to Buy Litecoin – Quick Guide to the Best Brokers for Buying Litecoin in September 2024

If you want to buy Litecoin right now, this quickfire guide should be handy. Follow these quick steps to invest in Litecoin.

- Open an account: You’ll first need to open an account with a trusted cryptocurrency broker. We recommend Capital.com, as the platform.

- Upload ID: Investors must verify their identity by uploading a passport copy and proof of address.

- Deposit: Before you can purchase Litecoin and other cryptos, you must deposit funds on Capital.com using one of the available payment methods.

- Buy Litecoin: Search for ‘LTC’ on the navigation bar. Enter the amount of tokens you wish to purchase, and confirm the trade.

What is Litecoin?

If you are new to crypto, you may wonder what Litecoin is and what it aims to achieve. This section will give you a full breakdown of the crypto asset and its role in the blockchain.

So what is Litecoin?

- The simplest way of defining it is that Litecoin is a digital currency that enables you to transfer and receive value digitally.

- As a digital currency, Litecoin is in a virtual form and cannot be physically held like fiat currency.

- Like Bitcoin, Litecoin uses distributed ledger technology (DLT) or ‘blockchain’ that enables transactions to be carried out in a decentralized manner.

- This makes it hard for a single authority to have a majority stake in the network.

- Litecoin uses a more improved proof-of-work (PoW) algorithm called Scrypt that gives it higher block time finality than Bitcoin.

When transactions occur on the Litecoin network, funds are transferred from one wallet to another. This takes about two and a half minutes to validate the transaction – not minding where both transacting parties are. Litecoin’s history is closely tied to that of Bitcoin. When the pseudonymous Satoshi Nakamoto introduced the premier digital asset in a whitepaper, digital currencies were still a fantasy.

However, when the Bitcoin network launched in 2009, it picked several cryptographic and blockchain experts’ interest who felt that the benchmark crypto-asset would rewrite finance history. Twelve years later, it has changed how people spend and earn money.

One such blockchain enthusiast was Google engineer Charlie Lee, who felt the first digital currency’s underlying weaknesses could be improved. This led to the birth of Litecoin in 2011. Although based on a similar PoW consensus mechanism, Litecoin uses a more novel and lighter algorithm named Scrypt.

Lee said that the idea behind the project is that Litecoin is the “silver” to Bitcoin’s “gold.” Meaning Litecoin is a lighter version of the Bitcoin network. This new algorithm enables the Litecoin network to process transactions faster. Bitcoin has a block finality countdown of 10 minutes. Litecoin can validate and add users’ transactions to the blockchain in 2.5 minutes, shaving off more than ¾ of the time it takes Bitcoin to confirm one transaction on its network.

Another uniqueness of Litecoin is its hard-cap limit. The Bitcoin network will only ever mine 21 million coins, and this event is expected to occur in 2140. Litecoin, on the other hand, has four times that figure, and only 84 million LTCs will ever be mined. This has seen Litecoin enthusiasts point to the network’s perceived advantage over the more established digital currency brand.

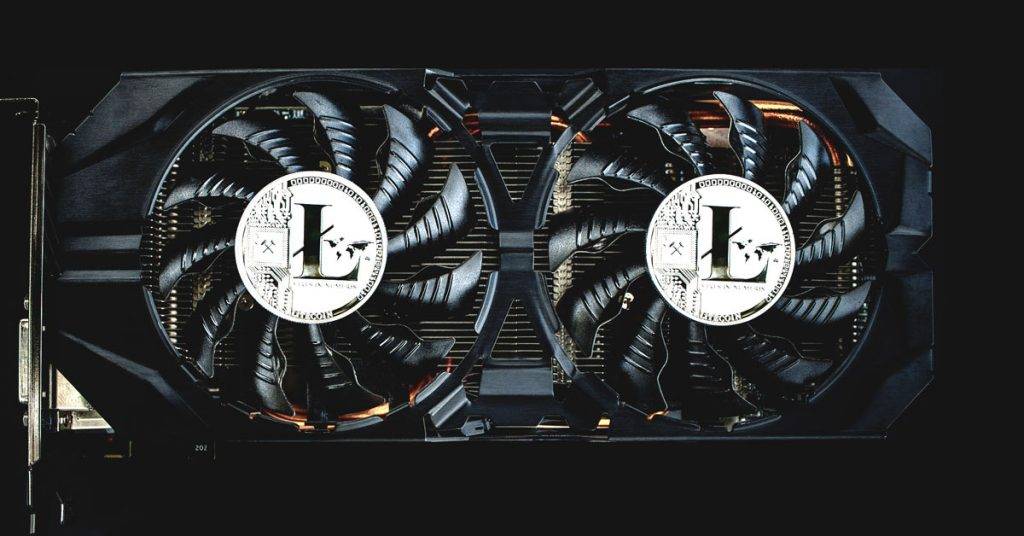

Litecoin is also more retail-driven in its mining approach. Digital currencies are created by users who allocate a particular amount of their computing resources to solve complex mathematical puzzles to be the first to validate these transactions. Miners (as they are called) are given block rewards in the network’s currency for validating transactions. So a Litecoin miner gets LTC as block rewards.

Bitcoin has seen large mining corporations seize the mining business from individuals. This has been due to using sophistical mining hardware called Application-Specific Integrated Circuits (ASICs). Miners use these sophisticated mining rigs due to the Bitcoin difficulty level, which is updated often.

Litecoin, conversely, is more individualistic, as miners can still utilize their system’s CPU or GPU to validate transactions on the network. Not barring this, some miners also use special mining rigs to increase efficiency.

Litecoin is not as big of a brand as Bitcoin. Still, the silver digital currency is among the top twenty most valuable cryptocurrencies, with a market cap of over $11 billion. And like Bitcoin, Litecoin is highly liquid, and you can trade against significant pairs like US dollars and stablecoins like USDT on various crypto exchanges globally.

Best Places to Buy Litecoin in September 2024

Here’s a quick summary of the best platforms to buy Litecoin this year. We recommend the following brokers:

These platforms have been carefully selected and reviewed as the best brokers to buy Litecoin. They were selected based on several factors. These factors include a healthy mix of fees, user-friendliness, payment methods, etc. Our list of the best platforms to buy Litecoin offers traders cutting-edge trading tools and a wide selection of tokens.

Where to Buy Litecoin

To buy Litecoin, you’ll need a reliable cryptocurrency exchange. The right Litecoin exchange is not only trustworthy, but they’re also easy to use in terms of onboarding, payment, and trading. In this section, we will be examining the best platforms to buy Litecoin.

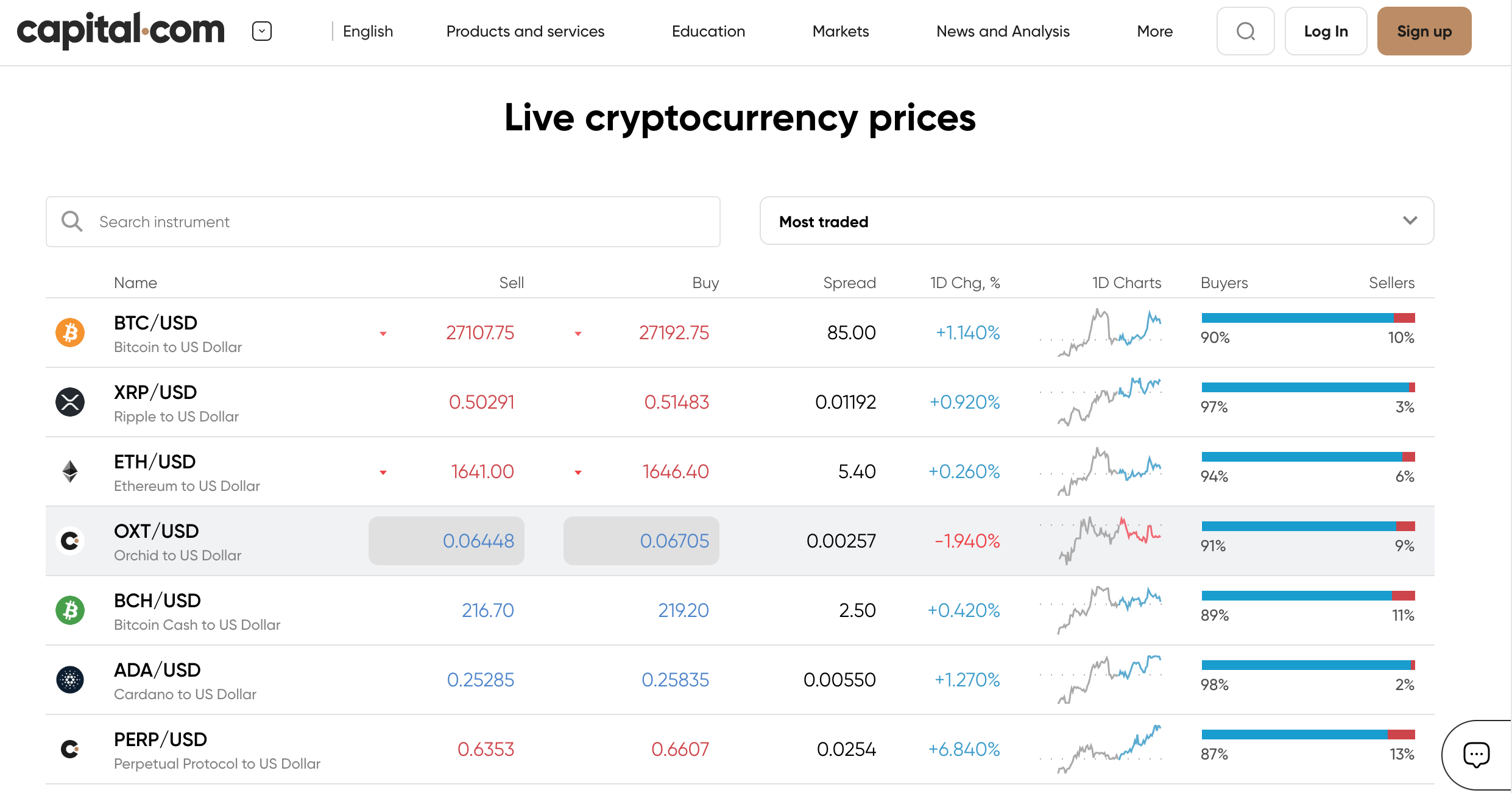

1. Capital.com – Trade Litecoin CFDs Commission-Free

Capital.com is a credible platform from where you can buy Litecoin. The broker offers several assets, from cryptocurrencies to currency pairs, stock indices, and ETFs.

Capital.com offers a zero-commission structure as well. This means you do not have to pay additional fees when placing a trade.

The broker offers mainly CFD trading options that allow you to speculate on the price of an asset without having to own it. This could be beneficial because you don’t need to worry about storage, wallets, or private keys. Capital.com offers leverage of up to 1:20 when trading stock CFDs. However, it is important to trade carefully, as even though leverage can significantly increase your potential profits, it can also increase potential losses.

This broker is also heavily regulated by the UK Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC), ensuring users trade safely and securely.

Capital.com also ensures they cater to beginner traders by offering a wide array of educational materials on their website. They also provide articles, glossaries, and courses that help get you up to speed in the markets. They also offer a demo account you can use before trading for real, which provides a risk-free way of gaining exposure to the trading platform.

Pros

- Commission-free trading

- Superb charting and analysis interface

- Tight spreads

- Regulated by the FCA and CySEC

- Access to the best charting and analysis tools

Cons

- Can’t build custom investment strategies

71.2% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

2. Binance – Top-Rated Crypto Exchange to Buy Litecoin

Binance is the world’s largest crypto exchange by daily trading volume. It is a top-tier platform offering trading on over 500 digital currencies.

Binance provides access to several cryptocurrencies. It also gives users multiple ways to trade assets. You can instantly buy or sell digital currency by paying using a debit card, credit card, or bank account transfer. The exchange also offers leveraged trading and access to crypto futures, thereby allowing traders to buy cryptos bigger than their wallet balances.

Additionally, Binance has a highly detailed web and mobile trading platform where you can analyze price movements and changes in momentum. Regarding commissions, Binance charges start from 0.1% per transaction, among the industry’s lowest fees.

Pros

- Largest cryptocurrency exchange in the world

- Low trading fees

- Supports debit/credit cards and bank transfers

- Low deposit fees for UK traders

- Ideal for advanced traders that seek sophisticated tools and features

Cons

- Not great for newbie investors

Your Capital is at risk.

3. Coinbase – Largest Crypto Exchange in the United States

Coinbase is one of the leading mainstream cryptocurrency exchanges in the world. The exchange has many cryptocurrencies for users to invest and trade in. It was launched in San Francisco in 2012.

Coinbase has a unique interface that is geared toward beginners or newbies. Therefore, making trading on the exchange very easy. Experienced traders can also use Coinbase’s professional platform, Coinbase Pro.

Coinbase Pro has advanced charting functions, allowing users to make crypto-to-crypto transactions and place market, limit, and stop orders.

Pros

- The simple interface accommodates newbies and expert traders

- Coinbase is one of the most liquid exchanges, so your transactions move quickly

- Coinbase offers a lot of altcoin choices

- Low minimum balance

Cons

- Complex fee structure

- Trading is more expensive than on other platforms

Your Capital is at risk.

4. Libertex – Industry-Leader Broker for Stocks and CFDs

Libertex is the trading subsidiary of Libertex Group. The platform’s uniqueness comes from its zero spreads price structure.

Libertex charges commissions on trades and not spreads. The broker offers two web trading platforms for traders. This includes the MT4 and the Libertex Web Trader.

Libertex is a fully regulated online broker with over 20 years in the industry. It covers about 213 markets and gives users access to stocks, ETFs, forex, and cryptocurrencies. On Libertex, traders have access to over 50 cryptocurrencies. It also offers traders access to margin trading with leverage as high as 1:30 for retailers and up to 1:600 for professional clients.

Libertex has an easy-to-use mobile app and desktop trading interface that provides users with flexibility and a seamless trading experience.

Libertex supports several deposit channels, such as Skrill, Neteller, credit and debit cards, bank transfers, Multibanco, Sofort, Trustly, etc. Like many other brokers, Libertex also offers a demo account you can use before real trading. This provides a risk-free way of gaining exposure to the trading platform.

Pros

- Demo account available

- Flexible payment and withdrawal methods

- Easy technical analysis for research and testing

Cons

- Poor education segment

- Charges for some of the withdrawal channels

Your Capital is at risk.

5. Plus500 – Regulated Platform Offering Different Asset Classes

Plus500 is a CFD broker offering over 2,000 financial instruments, including forex, commodity, cryptocurrency, and index trading.

The trading service was founded in 2008 in Israel and is under the Plus500UK Ltd brand. It is an easy and simple-to-use platform that offers a seamless trading experience.

Plus500 interface is integrated with WebTrader 4, a user-friendly layout built especially for advanced traders. Plus500 is very secure; it offers a two-step login authentication for security purposes. The platform is based in London and regulated by several international financial authorities, including UK’s Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC).

Pros

- Simple trading interface

- Competitive trading fees across all trading pairs

- Access to different asset classes

- Negative balance protection to mitigate losses

Cons

- Customer service is limited to chat and email alone

Does not accept customers in the United States

6. AvaTrade – Legacy Crypto Trading Platform for Investors

AvaTrade is one of the oldest online brokerage platforms. It was founded in 2006 and is part of the AVA Group of Companies.

The online broker supports various currencies, such as cryptocurrencies, indices, CFDs, options, bonds, etc.

One of the unique qualities of Ava Trade is the availability of different trading platforms. It offers MetaTrader 4 and 5 as well as the proprietary AvaTradeAct platform. With the MT4 or MT5 account on AvaTrade, you can buy and sell currency pairs without paying a commission.

The broker will only charge you a variable spread instead. AvaTrade also offers users access to various forex trading tools such as advanced order types, technical indicators, and chart drawing tools. It also has a demo account option where no deposit is required to start trading. The broker supports both credit and debit cards.

AvaTrade is regulated by the Financial Services Regulatory Authority Abu Dhabi.

Pros

- A social app for replicating other investors’ trades.

Research and education tools available

Customer support is available in different languages

Cons

- A $100 minimum deposit appears expensive

- Withdrawal requests take up to 5 days to process

Your Capital is at risk.

7. Revolut – Personal Finance Service With Crypto Support

Revolut is a FinTech firm based in London that offers banking services to customers. The service provides a quick and easy interface for users to receive, send, and exchange currencies wherever they are.

Although Revolut focuses on simple transactions, the platform also provides cryptocurrency services. Users can convert crypto to fiat currency in only a matter of seconds.

Revolut does not allow you to trade crypto directly on the platform; you can only buy, transfer or withdraw crypto here. There are other benefits of Revolut. The platform provides access to loans and phone and travel insurance.

Pros

- Expansive support for crypto

- Quick transactions and asset conversions

- Additional features like loans, virtual cards, and insurance

Cons

- No trading available

- Inadequate customer service

Your Capital is at risk.

8. CryptoRocket – Newbie Crypto Trading and Exchange Platform

Launched in 2018, CryptoRocket is an online broker that offers trading services for various assets. This includes cryptocurrencies, indices, stocks, and so on. However, the broker is more focused on cryptocurrencies.

CryptoRocket charges low deposits with a minimum deposit of only $10. However, deposit methods on CryptoRocket are limited, unlike other services. You can only deposit with wire transfers, Bitcoin, and cards.

One feature that makes CryptoRocket unique is the same-day withdrawal service for credit card transactions. The broker enables traders to access advanced charting and analysis tools and the latest news to help with their strategies and trades. For advanced traders, leverage of up to 1:500 is available.

Pros

- Same-day withdrawals for credit card transactions

- Low minimum deposit threshold

- Up to 1:500 leverage

- No withdrawal or deposit fees

Cons

- Not registered by any financial authority

- Limited deposit channels

- Doesn’t accept U.S. clients

Your Capital is at risk.

9. Changelly – Simple Exchange for Instant Litecoin Purchases

Changelly is a cryptocurrency exchange that was established in 2016. It has a very fast and easy interface for buying and selling cryptocurrencies. It differs from other exchanges because it converts cryptos quickly to fiat currency.

It is known for its privacy features. Changelly does not require your personal information or any form of proof of address before you can buy crypto on the platform.

At Changelly, you get a flat rate for crypto-to-crypto trades on Changelly, which stands at 0.25 percent. The platform has no specific deposit fees, but you must factor in transaction fees when exchanging. Changelly is a safe and legitimate service that you can use. It also provides trading through its Changelly Pro arm, where you can put your money to work. Changelly is registered in Hong Kong.

Pros

- Support for over 1500 cryptocurrencies.

- A flat rate exchange fee means you know what you’re getting

- 24/7 live customer support for all users

Cons

- High fees for crypto-to-fiat conversion

- Exchange platforms can be slow

Your Capital is at risk.

Compare Litecoin Exchanges

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

Why Buy Litecoin? Litecoin Analysis

People buy Litecoin for various reasons. Some are for speculation on the open market, and others are more attracted to its faster validation process. If you are still in doubt about whether to buy Litecoin or not, we list a few reasons why we think you should buy Litecoin today.

Litecoin’s Solid Economics

Borrowing from Bitcoin’s hard-cap limit of 21 million coins supply, Litecoin also has a hard-cap limit. The development team behind the project says that only 84 million LTCs will ever be mined, and so far, 79% are in circulation. This makes it a scarce commodity, like Bitcoin. Digital assets with a hard-capped limit are known to retain their value over time. Before Bitcoin and digital currencies advent, investors bought gold bars, stocks, and exchange-traded funds (ETFs) to preserve their wealth and hedge against inflation.

Fractional Investment

Many investors are put off by the high value of Litecoin, believing they need to buy up to 1 LTC before they can trade the digital asset. However, this is not so. Litecoin can be broken down into smaller units, and you can buy any amount of Litecoin that you want.

Meanwhile, you must invest through a cryptocurrency broker supporting fractional investment ownership.

24/7 Marketplace

Unlike the traditional stock market, which has closing and opening periods, the crypto market does not operate this way. This means you can trade Litecoin anytime you want due to the high liquidity the digital currency boasts of.

At the moment, over $1.7 billion of Litecoin has been sold. This is great for traders who want to liquidate their position when making a profit. This means you can buy and sell Litecoin every day, always.

Is it Worth Buying Litecoin in 2023?

Designed to be a faster and cheaper alternative to Bitcoin, Litecoin launched in 2013 at a price of slightly over $4. It went through a short positive uptrend reaching a price of $33 but shortly dropped below its launching price and did not experience any significant fluctuations until April 2017. Litecoin’s value skyrocketed in 2017 until, eventually, it hit an all-time high of $301, increasing by over 7400% compared to its initial price.

Litecoin saw a stiff decline in 2018. It experienced a number of ups and downs which eventually led to a price of $30 at the end of the year. The prices fluctuated extensively from 2019-2020. In 2019 Litecoin’s halving event took place, which reduced the block reward from 25 LTC to 12.5 LTC. However, Litecoin’s price continued dropping following the halving event in 2019.

2020 was not a successful year for the cryptocurrency compared to BTC, whose price increased a few months after its halving event. While Litecoin hit the $100 mark in 2019, it was traded below the $50 mark for most of 2022. However, 2021 was a promising year for Litecoin. It started the year with a price of $130 and, following the bullish trends in the broader market, hit its highest all-time high of $386.45.

While most of the major cryptocurrencies set new all-time highs in November 2021, Litecoin could not do the same. Peaking at $250, LTC entered the bearish market and closed the year with a price of $146. Litecoin was never traded below $100 until May 2022.

After that, the cryptocurrency suffered extensively from the crypto market crash and lost its value following Bitcoin and many other cryptocurrencies. LTC’s price continued to decrease over the second half of 2022, and for a time, it was even traded below $50.

However, Litecoin experienced a successful recovery in 2023 and marked its previous price high of $100. The coin witnessed an impressive surge on July 4th, soaring to a 14-month high of $114. In just one week, Litecoin outperformed the broader cryptocurrency market by surging nearly 30%.

Traders and investors showed unwavering optimism towards Litecoin, fueled by the anticipation surrounding its upcoming block reward halving event scheduled for August. Litecoin’s halving event takes place every four years, and it reduces the supply of the coin by 50%. This is why many investors anticipate that the halving event will positively affect Litecoin’s price, as it will create scarcity for the coin.

The halving took place on August 2, which reduced the reward per block from 12.5 coins to 6.25 coins per block. Two weeks before its halving event, LTC prices dropped to $64, and during this time, there was significant interest among whales in Litecoin. On the day of halving, Litecoin increased to $68; however, this was followed by a decline leading the LTC price to $59.

The popular belief among crypto analysts is that Litecoin’s halving was a “buy the rumors, sell the news” event. It is already the second time Litecoin’s halving is followed by a negative supply shock which leads to a price decrease. So, is it still worth investing in this cryptocurrency?

One of the major things to take into account is the institutional interest in Litecoin. The cryptocurrency seems to be receiving quite significant institutional interest from such top institutions as Charles Schwaab, Fidelity Investments, and Citadel Securities, who launched the EDX marketplace, and Litecoin was among the four cryptocurrencies traded on it.

🔍 Search trends for #Litecoin hit a new yearly peak! Media topics suggest the upcoming halving event (ETA 20 days) is a key driver for the heightened interest.#LTC pic.twitter.com/Ato8P7proy

— IntoTheBlock (@intotheblock) July 12, 2023

Ways of Buying Litecoin

If you want to add Litecoin to your investment portfolio, we can show you several ways. Some of the best payment methods available for you are:

Buy Litecoin with PayPal

PayPal’s global reach is a major plus for anyone who wants to buy Litecoin. Currently, PayPal does not offer direct purchases of digital currencies through its platform, although you can make payments with your digital assets on PayPal. However, you can buy cryptocurrency with PayPal if you have funds in your account. Digital assets like Litecoin can easily be purchased using PayPal as a payment method.

Buy Litecoin with a Credit Card

An alternative to PayPal is to use your credit card to purchase Litecoin. This is a huge advantage, as not all crypto brokers support credit card payments. Also, some credit card issuers may classify Litecoin as a “cash advance,” which could require you to pay a cash advance fee before you complete the transaction. This fee could be 3 to 5% of your total transaction. Speaking with your credit card issuer before trying out this option is advisable.

Buy Litecoin with Debit Cards

Another option is to use your debit card. Given the easy and fee-saving feature, many traders prefer using their debit cards for trading. You must consider a broker’s processing fee to buy Bitcoin with a debit card. Various crypto exchanges have different fee structures depending on their payment method. Some may require paying 4 to 5% on debit card transactions, while others may be substantially cheaper.

What to Keep in Mind Before Buying Litecoin?

Are you thinking of buying Litecoin? There are a few things you should keep in mind as you trade in the crypto market:

Volatility

You must have come across this statement before and think it may be a way to deter interests from the crypto space. However, this is not a smokescreen. Cryptocurrencies are volatile, and most depend on Bitcoin’s price movement. This sees them rise and fall with the benchmark cryptocurrency.

The May crypto market crash was a case in point, which wiped off 50% of the crypto market valuation in one week. This was due to a regulatory clampdown by Chinese authorities on crypto mining in its Inner Mongolia regions. Bitcoin and Litecoin plummeted in value, slumping to $113.16 on July 19. Although Litecoin has recovered somewhat in the last few weeks, you must keep its volatile nature in mind.

Transparency

All digital currencies use blockchain technology, and the underlying framework of this solution rides on transparency, meaning all transactions are open to public scrutiny. So your Litecoin transactions will be shared and traceable by everyone worldwide. So if you are uncomfortable with this, you should reconsider buying Litecoin.

Addresses are Semi-Anonymous

Litecoin transactions are carried out on a wallet-to-wallet basis. These wallets combine several strings of numbers and letters, making identifying a user’s details difficult. No one can access your transaction history and wallet balance except you. However, new tools deployed by crypto forensic firms like Chainalysis now make it possible for law enforcement to uncover anonymity from the blockchain.

Choosing the Right Litecoin Broker

If you want to buy Litecoin online, you must look for the right broker that makes buying the asset in a safe and secure environment easy. To steer you in the right direction, we highlight some crucial details you should look out for when choosing a broker to buy Litecoin through:

Fees

The fee structure is the first thing you should look out for in a broker. You should check the deposit, withdrawal, hidden fees, and how much you must pay to convert your LItecoin to other digital assets. Every detail here matters. A crypto broker with expensive fees would affect your profits. Make sure you work with a broker with reasonable fees.

Safety

Safety comes next, and you should only buy Litecoin from an exchange with strong security protocols. A crypto exchange that does not take security seriously could lead to losing funds and leaking your details. This should be avoided at all costs. Also, you should move your funds from the platform to cold digital storage. This puts the safety of your funds solely in your care.

Support

If you hit a snag, you must contact the exchange to sort this out. You must work with an exchange with great customer support service.

Payment Methods

How do you make deposits and withdrawals? What payment methods does the platform support? Most platforms support bank transfers and credit/debit card payments. For additional options, you can also check out exchanges offering PayPal and other e-wallets.

Volume and Liquidity

The broker you decide to buy Litecoin through must have a high level of volume and liquidity of the said asset. This is important as it lets you access your funds anytime.

Litecoin Price

Litecoin – like all the other cryptocurrencies – is highly volatile. So, their price will constantly increase throughout a given day. This is basically because a single entity does not govern cryptocurrencies. As they are based on decentralized blockchain technology, their value is driven by demand and supply market forces.

- In essence, if the market sentiment for Litecoin is strong and more people invest – there will be a price increase.

- If the market sentiment for Litecoin is low and more people liquidate their positions, the price may crash.

Though market indicators predict that Litecoin’s price is expected to increase over the next few years, it is also important to do a fundamental analysis of Litecoin to understand the factors that can increase its demand.

Like Bitcoin, Litecoin is a payment system that enables fast and secure funds transfer between two parties. Though it is not as valuable as Bitcoin, Litecoin is among the most popular cryptocurrencies, and it means there is huge interest among investors in this coin.

Besides, Litecoin has a maximum supply of 84 million coins, and the number of coins that can be mined each year is halved, similar to Bitcoin. Though its supply is higher than that of Bitcoin, Litecoin still has a limited supply, so once the coin’s demand increases, its value will increase due to scarcity.

Currently, Litecoin is in the bearish market. Moving averages have two bullish and four bearish indicators, and technical indicators show neutral signals, but the Fear & Greed Index of 69% indicates greed among investors. Over the past 30 days, Litecoin has grown only by 0.3%. The coin increased by 3.03% in the last seven days and by 1.27% in the last 24 hours. Litecoin is currently the 15th largest cryptocurrency, with a market cap of $4.8 billion.

Litecoin Price Prediction 2023

You may have come across several opinions online on how much Litecoin will be valued in the future, and this is what is obtainable in the fast-paced crypto industry. Giving precise predictions about Litecoin is impossible as the price of the coin depends hugely on the direction of the broader crypto market.

One thing to pay attention to while investing in Litecoin is how much interest it gets from huge institutions. While Litecoin’s halving did not bring a positive scenario for the cryptocurrency, huge interest in this coin can be one of the factors changing the future price performance for Litecoin.

Looking at the technical analysis of Litecoin’s future price, we notice that the coin is expected to be traded below $100 throughout 2023 with an average price of $96. Litecoin’s maximum price for 2023 is predicted to be $105.

Litecoin Price Prediction 2024

According to the technical indicators, Litecoin’s average price for 2024 will be $139. While the minimum price of the coin is expected to be $136, it will eventually hit $150 and reach even $160 as its maximum price.

Litecoin Price Prediction 2025

The technical indicators predict that Litecoin can hit $200 in 2025 and be traded at $237 for its maximum price. The minimum price of Litecoin is expected to be $199, and the average trading price for 2025 is predicted at $205.

Investing in Litecoin vs. Trading Litecoin

You may have noticed the different strategies investors use in the crypto market. While some prefer to hold for the long term, others are much more comfortable trading LTC.

Which strategy is better?

We highlight the key differences between both.

Buying Litecoin For The Long Term

Investing in Litecoin may be the best strategy if you are just starting and know how the financial markets work. This way, you buy Litecoin and wait for the price to rise. You can sell or liquidate your position when you have made enough return on investment (ROI).

Long-term holding is highly profitable, which is the best strategy for several investors. For instance, if you bought $1,000 worth of Litecoin for 30 cents in 2011 and held it till May 2021, you would be smiling to the bank with more than a million dollars in your pocket.

Trading Litecoin For Quick Gains

Trading Litecoin may interest you if you are an experienced investor and understand how the financial market operates and how volatile the crypto market is. You can easily detect breakout movements beforehand and enter into positions to profit when the price moves.

Trading Litecoin may be a good choice if you have the time to spare or are a full-time trader. This way, you can make early entry points and turn out a profit if your forecast is right. For instance, if you bought LTC at $100 and the price surged to $168, you would have made a $68 profit. You can also utilize leverage to increase your possible returns. A 5x leverage could more than double your expected gains.

You can also sell or short your Litecoin position if you determine that the asset may drop in a few hours.

As cool as this may sound, trading Litecoin requires a good grasp of the market and analyzing an asset’s price action. This will help you determine whether to buy (long) or sell (short) a particular asset in a given trading session.

So, Which Should You Go For?

This solely depends on you and your aims for buying Litecoin. However, we have highlighted a few factors for you to consider before choosing your investment strategy.

Time

Time is of the essence in the crypto market. You need to ask yourself how long you want to hold your Litecoin. If you think of a few hours or days, you should choose the trading route to increase your potential returns. Investing holding is better if you do not have the time and want to hold for the long term.

Mindset

If you want to make a quick buck, you should consider trading. Keep an eye out for low entry points and a possible bullish streak early on, and you may be able to fulfill your financial dreams if you’re lucky.

Commitment

Several hot coins or cryptos are shilled by social media influencers and public figures and dumped when the price reaches a peak. If you bought at the top, you would likely see the value of your assets erode in real-time.

If you do not have the mental fortitude to bear such losses, ensure you do the needed research and get the right facts before investing.

Buying Litecoin as a CFD Product

A contract for difference (CFD) is a financial contract that pays the differences between the settlement price at the open and close of a trading session. CFDs are highly popular among FX investors and commodities traders, allowing investors to trade an asset’s direction within a short trading window.

CFDs have existed for a long time, and now this financial derivatives trading has recently found its way into the crypto market. You can trade Litecoin as a CFD product with several brokers who support digital assets. Buying Litecoin CFD will enable you to profit from the price movements of Litecoin without holding the underlying asset.

Would You Try Litecoin Mining?

Litecoin utilizes a proof-of-work (PoW) consensus mechanism – although a newer version – which means you can commit a certain amount of your computing resources to solve complex mathematical puzzles for block rewards.

However, unlike Bitcoin, mining Litecoin is far much easier. While large corporations have taken over the benchmark crypto asset using thousands of ASIC machines to validate transactions on the Bitcoin network, Litecoin can still be mined with your conventional CPU or GPU – if you have a dedicated graphics card. Also, you can use an ASIC machine to increase the efficiency of your block rewards.

This individual miner approach has seen Litecoin grow its validator network in the last ten years. The Bitcoin fork presently has 1,285, which is expected to grow with more adoption.

You should calculate your expected returns against your electricity bill to determine if this approach is worthwhile. Suppose you live in an area where electricity costs; you may profit by mining Litecoin rather than buying or trading it.

Keeping Crypto Risks To A Minimum

Through this guide, we have stressed two important points:

- Trading Litecoin is highly lucrative

- Volatility makes it a risky investment

If you buy Litecoin, you must take measures to reduce the likelihood of losing your capital. For this reason, we highlight some tips to have in mind when entering the vast universe of cryptocurrencies:

Work with Facts Only

Cryptocurrencies have been called a bubble waiting to explode, and that has been for a good reason. The 2017 crypto market crash and the recent May downturn show that the space is still in its infancy. So, before putting your hard-earned cash into crypto, conduct thorough research on the assets.

Make purchases based on facts, not emotions, or what your friends and coworkers say is the latest crypto in the block. Most are just hypes and will fade away. Turn your attention to dedicated crypto channels and expert review websites to understand the mission of a crypto project before even committing your funds to it.

Be Wary of Fraudsters

Crypto is the new Wild West of the crypto market, and you should have that at the back of your mind. Fraudsters are known to use public figures’ profiles and faces to swindle gullible investors into parting away with their digital assets. Tesla boss Elon Musk has been featured in several of these fraudulent schemes without his consent.

Do not give out your private details to anyone; only trade with regulated brokers.

Keep Your Investments Minimal

The big payouts are a draw for many people, and this causes them to invest large chunks of capital. We do not recommend taking this approach. Make sure you only put the money you can afford. Your mental health is as important as your financial well-being. Cryptocurrencies are risky, and we recommend starting with little capital and building from there. This helps you to familiarize yourself with the industry, especially if you are new.

Track Your Progress

You can use crypto wallets to keep track of your investment, especially if you are a trader. You also get full insight into the web platform and can enter or exit a position while on the move. Keep a close eye on the price movement of your asset and note what your returns are in a week, month, or year.

Keep Emotions in Check

You need to be level-headed to make any profit in the crypto space. Do not blindly enter a position without doing the necessary research or joining because of fear of missing out (FOMO). If you do this, you may enter at the peak and get stung.

Keep your emotions in check and let the crypto wave ride over your calm mind. If you do not make this bull run, there is always another opportunity to make gains.

Best Litecoin Wallet

Just like you need a place to store your crucial document and certifications, you need to find a secure place to store your Litecoin funds.

Several crypto wallets support storing Litecoin, as they give you access to your private keys.

Litecoin vs. Other Cryptocurrencies

Litecoin is one of the thousands of crypto assets in the crypto market. Let’s see how it compares to others:

Litecoin vs. Bitcoin

Litecoin may be faster and less energy-intensive, but it is still an infant compared to Bitcoin. Bitcoin commands more than 50% of the $2 trillion crypto market. It’s the first digital asset and most recognized of the bunch. Also, Bitcoin’s much smaller hard-cap limit sees it gain more value with time than Litecoin.

Litecoin vs. Dogecoin

Even though the meme token does not have a generic value proposition besides being a joke cryptocurrency, Dogecoin is still among the top ten most valuable crypto. The key difference between both has been the vibrant community that supports the parody coin. Besides that, Litecoin has a solid value proposition over Dogecoin.

Litecoin vs. Ethereum

Ethereum builds an entirely different blockchain ecosystem and is the alpha blockchain network in decentralized finance (DeFi). Given this, it occupies the second position on the crypto chart with an 18.5% share of the crypto market. Ethereum is still expected to grow larger as the years go by.

Litecoin vs. Cardano

Cardano is also in the same fold as Ethereum and is set to change the entire DeFi and blockchain ecosystem. Despite being in development, Cardano currently occupies the third position on the crypto chart. This shows that several investors are keen to buy into the Cardano dream. Compared to Litecoin, the network is on the frontier of a new blockchain ecosystem and may likely continue its upward climb.

Litecoin vs. BNB

Binance Coin is not a standalone crypto project like the others on this list, but the discount token has been a revelation these past months. Occupying the fourth position, BNB has seen phenomenal growth this year, only recently losing its third spot to Cardano. With the Binance ecosystem ever-expanding, BNB will continue to perform in the higher leagues of the crypto hierarchy.

What Next For Litecoin?

The cryptocurrency market has been experiencing a so-called “crypto winter” since November 2022. It all started with the bankruptcy of a popular crypto exchange FTX, followed by another crypto exchange – BlockFi. Litecoin has also suffered from the fallouts of the “crypto winter,” though not as much as many other cryptocurrencies.

While cryptocurrency has slightly recovered since 2023, a recent bearish trend in the broader crypto market led to the price drop below 100$. This was also influenced by the negative supply shock following its halving event. With Litecoin’s current price 5.5 times lower compared to its all-time high, now can be a good time to invest in crypto during the bear market.

But you need to do your own research and take experts’ opinions on how the bear market will end, what the expectations are regarding the prices of crypto, etc. It is also essential to do the fundamental analyses and pay attention to the events that can affect Litecoin’s price in the future.

You can do this by following the market news and exploring Litecoin’s roadmap to find out the upcoming changes or updates that can affect the coin’s value. One of the latest updates for Litecoin took place in May 2022 and was about its privacy-focused Mimblewimble Extension Blocks (MWEB) upgrade. Similar upgrades can attract public attention and increase the demand for the coin and institutional interest in it.

Conclusion

This guide has shown users how to purchase Litecoin in only a few minutes. Top crypto platforms such as Capital.com allow investors to create a new account in just 5 minutes, and give your trading access to Litecoin and several other cryptos.

Investors can access CFD trading options on Capital.com, to buy and sell cryptos without holding the underlying asset.

71.2% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider.

FAQs

How do you buy Litecoin?

The best way to buy Litecoin is through a regulated broker. This keeps your personal details and funds secure from bad actors. One of the most popular brokers is the Capital.com which offers top-notch security and low fees when you buy Litecoin.

Should I buy Litecoin?

Litecoin's historical data predicts further value growth. However, with every investment decision, make sure you only invest what you can afford to lose.

What is the best way to buy Litecoin?

The best way to buy Litecoin is to use brokers like Capital.com. The trading platform offers low fees, and is highly user-centric in design. With handy tools like CopyTrade and CopyPortfolio, you can easily make profits without having all the technical know-how of an asset.

How does Litecoin work?

Litecoin, like several other crypto protocols, is decentralized and built on blockchain technology. The asset permits the transfer of value digitally and is not controlled by any central authority. Given this, its price movement is largely dictated by market sentiment and not by any stock or government policy.

Is it safe to buy Litecoin?

All investments carry risk, but Litecoin is relatively safe. You should know that it is not one of the hundreds of shitcoins that now permeate the crypto market. Aside from general volatility, which threatens Futures traders, Litecoin is a safe investment for investors who want to buy and hold long term.

How do I make money with Litecoin?

The easiest way of making money with Litecoin is to buy low and sell high. You can also choose to mine it if you have the computing resources and electricity requirements.

What are the benefits of buying Litecoin?

Litecoin’s deflationary mechanism means it can be a good store of value for investors. It can be an alternative to protecting your wealth from inflation, much like Bitcoin does, given its silver narrative.

What are the best payment methods to buy Litecoin with?

We recommend using your debit card. However, some brokers offer support for e-wallet solutions like PayPal and Skrill. Those options are also suitable for buying Litecoin.

What are the best Litecoin brokers?

There are so many brokers that now offer Litecoin trades compared to a few years ago.

How can I buy Litecoin instantly?

To make an instant purchase, you will need to open an account with a regulated broker. Once you complete the registration process, you will buy Litecoin in seconds.

How can I buy Litecoin with USD?

The best means of buying Litecoin with US dollars is through an exchange or a broker.

What are the taxes for trading Litecoin?

There are several tax rates for trading Litecoin in different jurisdictions. The best way to know this is to confirm through a recognized government agency website.

How much is Litecoin worth?

Litecoin is highly volatile, which means its value can change in a few hours. As of Q4 2023, Litecoin's price is approximately $65.

How do you mine Litecoin?

You can mine Litecoin with your laptop, desktop's CPU or through a dedicated GPU unit. However, if you want to increase your efficiency, you should consider getting mining rigs like ASICs.