Launched in 2019, Tellor is renowned as a multi-chain oracle network that provides decentralized and reliable data feeds for smart contracts. Being an innovative blockchain-based project, Tellor is powered by its native token, known as TRB.

With the increasing popularity and adoption of the Tellor blockchain, this token has continued to earn the attention of savvy investors. In this guide, we will show you some of the best places to buy TRB this year.

Aside from that, we will also provide a step-by-step guide on how you can buy this highly promising token.

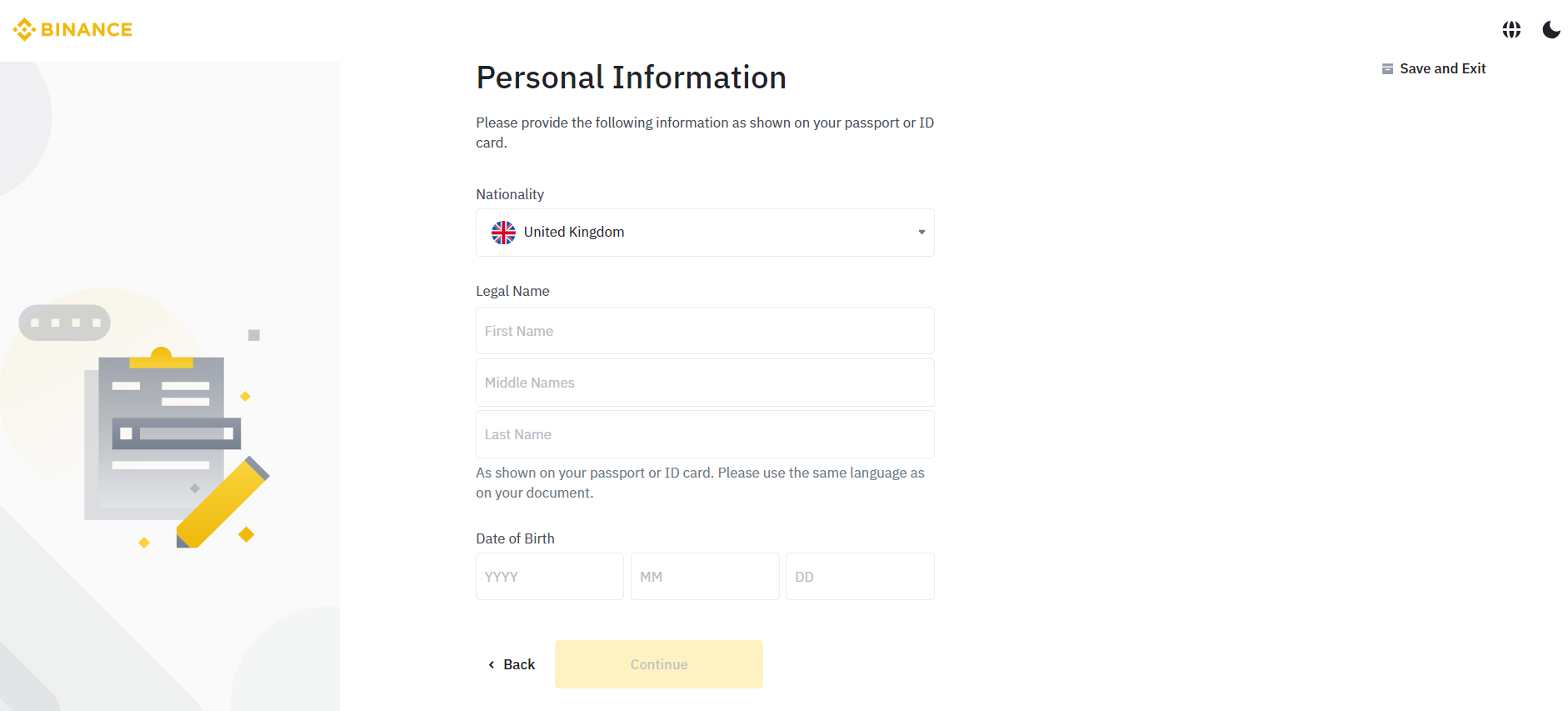

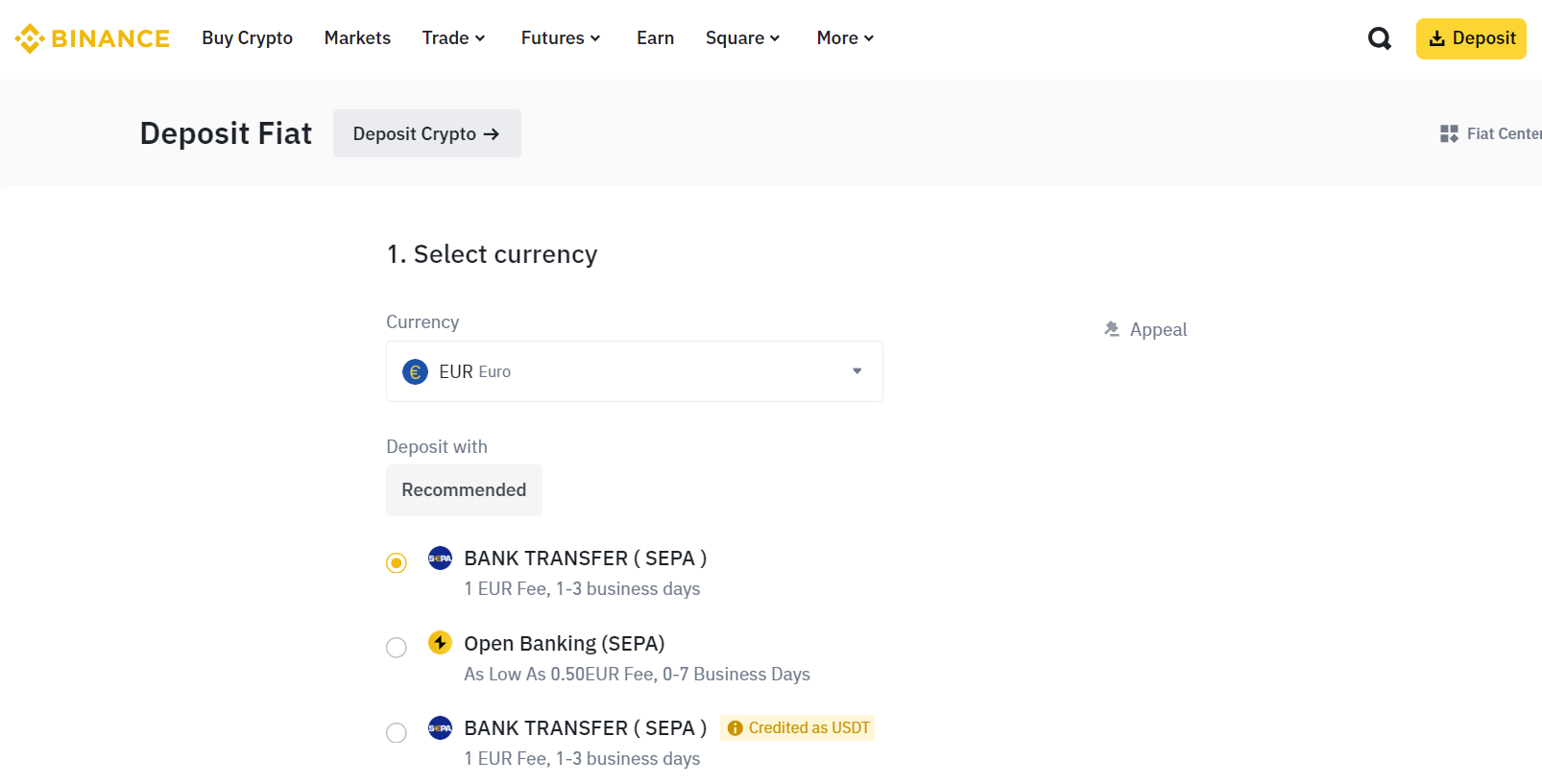

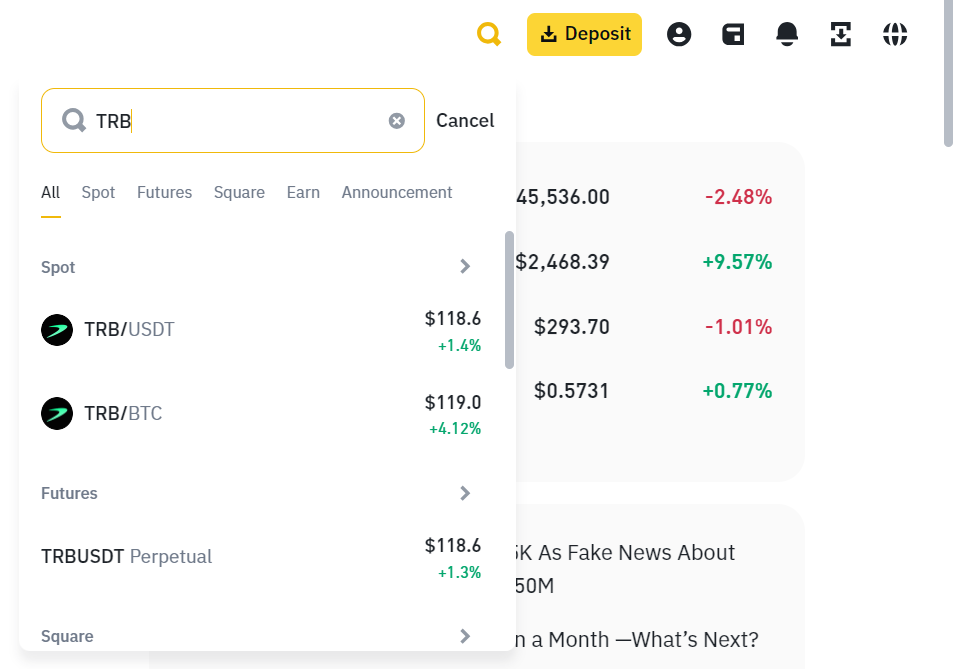

For those who don’t want to go into details about the token, here is a quick guide explaining how to buy Tellor token. The step-by-step process is explained through Binance exchange which we consider the best platform to buy TRB tokens. To buy Tellor tokens, first of all, you need to find a crypto broker that lists the TRB token. Tellor token is supported by prominent cryptocurrency exchanges, but it can be a tricky task to find out which one is the best. We explored several exchanges and picked up the top platforms to buy Tellor tokens in 2024. In this section, you will find detailed reviews about these exchanges and get familiar with their functions. When selecting a crypto exchange, traders mostly pay attention to trading and non-trading fees charged by the platform. With Binance, users can enjoy low fees as it offers quite a competitive pricing structure. As for the trading fees, the platform charges maker and taker fees, which differ depending on the cryptocurrency you want to buy or sell. The fees also depend on the trading volume. Traders buying in large amounts will get fee discounts. The non-trading fees charged by Binance include deposit and withdrawal fees. Binance supports multiple payment options to fund your account or to withdraw funds from it and fees differ depending on the payment method. Transaction speed also varies for different payment options. For example, wire and ACH transfers may involve lower fees, but the transactions can take a few days. Bank cards, on the contrary, charge a 2% fee, but transfers take up to a few hours. For more information about this, read our detailed Binance review. When it comes to functionality, Binance is among the best competitors. It supports a wide selection of tokens and NFTs, which makes it an excellent platform for creating a diversified portfolio. Binance is also a preferable platform among advanced traders as it offers multiple trading options, such as options trading, futures trading, etc. It provides an extensive selection of in-built tools for market analyses and supports several order types. Check out our guide to discover some of the top Binance alternatives to consider this year. Security is a priority too for the platform and it uses advanced tools to protect its traders’ accounts. The security features include 2 FA, SMS service, Google authenticator, device restriction ability, etc. The exchange is available through its website, while those who like to trade on the move can download the Binance app. One of Coinbase’s key features is its emphasis on security. The platform employs advanced security measures, including two-factor authentication, encryption, and cold storage for the majority of user funds, to protect against hacks and unauthorized access. As for the trading fees, Coinbase charges taker and maker fees like Binance; however, Coinbase fees are relatively higher compared to those of Binance. The maker fees differ, ranging from %0-%0.04, while taker fees range from %0.05 and can reach up to %0.6. The fees can change depending on the trading volume and your tier. The exchange supports instant deposits and withdrawals through such payment methods as debit cards, PayPal, Apple Pay, and Google Pay. ACH transfers and wire transfers are also among the supported payment methods; however, transfers take 1-3 business days. The next key feature of Coinbase is that it hosts a huge array of coins. Users can trade a variety of cryptocurrencies on the platform, including well-known ones like Bitcoin, Ethereum, Litecoin, and others. In fact, it is considered one of the best spots to buy Ethereum. For advanced traders, the platform offers Coinbase Pro with more advanced tools, lower fees, and more order types. Check out our Coinbase review for more information. Another significant feature is its mobile app that allows users to manage their cryptocurrency portfolios, track market prices, and execute trades on the go. Those interested in crypto earning can also make use of its “Learn” program. Participants can earn passive income in over 100 different assets by learning about crypto trading and how it works. If you are looking to diversify your portfolio, you can easily find some of the most promising crypto coins on KuCoin. It supports over 700 different cryptocurrencies along with TRB. It’s often one of the first exchanges to list new cryptocurrencies. KuCoin offers spot, futures, and margin trading, and trading fees differ for each of them. Like in the case of Binance and Coinbase, KuCoin reduces trading fees when users buy and sell in larger volumes. The deposits and withdrawals can be conducted in multiple ways as KuCoin supports many popular payment options, including bank cards, PayPal, Google Play, SEPA, etc. The minimum deposit differs depending on the cryptocurrency. KuCoin places a strong emphasis on security. The exchange implements industry-standard security practices, including two-factor authentication, withdrawal whitelist controls, and other measures. Another important feature is that KuCoin offers staking and earning opportunities. Through the KuCoin Earn feature, users can stake different assets and earn rewards. The APYs vary depending on the staked coins and the staking period. Explore our comprehensive KuCoin review. As for the user experience, KuCoin boasts of offering an intuitive user interface that provides an excellent trading experience for both, advanced traders and beginners. Its website is easy to navigate, and beginners can easily find the tools they want. The exchange also supports mobile trading, and its app is available for Android and iOS devices. KuCoin offers services in 200 countries and is licensed in the Seychelles. KYC procedure is mandatory for users of the KuCoin platform. While exploring the platform, traders will find some of the most trending crypto coins in the market right now. MEXC supports over 1700 tokens and more than 2000 crypto pairs. The list is constantly refreshed with new listings. For more information, we recommend that you read our MEXC review. The trading options include spot trading, futures trading, perpetual futures, and copy trading. The demo trading option is also available for those who want to practice their skills before using real money. What is most important is that MEXC charges low fees providing a better experience, especially for high-volume traders. While it offers 0.1% maker and taker fees for spot trading, this can go as low as 0%, depending on your trading volume. Other important features of MEXC include staking possibilities, which enable users to earn passive income through a few cryptocurrencies. There are two staking options – flexible and locked, and the APY can reach up to 6.8%. MEXC also offers excellent customer support service with such options as multi-lingual support through a 24/7 live chat, email support, FAQ section, and social media support. As for safety, MEXC is a regulated platform and is compliant with FCA and CySEC. The exchange also emphasizes its security features and integrates 2FA, cold storage, KYC, and powerful encryption mechanisms to protect users’ accounts from fraud. This makes sure you can securely invest in Tellor tokens through payment methods like SEPA, credit and debit cards, quick buy and sell, and P2P trading options. The Tellor token is the native token of a decentralized oracle called the Tellor protocol. Oracles are systems that provide smart contracts with real-world information, such as prices, weather data, or other external data that smart contracts cannot access on their own. The main aim of the Tellor protocol is to provide a transparent and permissionless Oracle protocol for smart contracts so they can easily get the data they need. According to Tellor’s website, the protocol stands out with its ability to collect data from the decentralized network of reporters. Tellor incentivizes providing accurate and open data and ensures that everyone can become a reporter to provide data and that the data can be checked by everyone. The project was founded in 2019 by a committed and experienced team who also had experience in creating another Ethereum protocol, Daxia. As the native token of Tellor protocol, the TRB token plays a pivotal role in its ecosystem. It has three main use cases in the data reporting and governance process of the protocol. First, it assists in data reporting. Users who want to become data reporters stake their TRB tokens in the pool and participate in the process. They need to provide accurate data to the smart contracts, and in return, they get rewards in the form of TRB tokens. The next use case of the TRB token is acting as collateral which ensures that the providers provide accurate data. In case there is a disagreement about the accuracy of the data, the TRB tokens are locked from the providers as collateral. When the reporter loses the case because of the data inaccuracy, they also lose the TRB tokens they staked, and the tokens go to the party who disputed the accuracy of the data. Eventually, TRB is a governance protocol and TRB holders have the right to participate in the governance process of the protocol. Users who have TRB can actively take part in the decision-making process about the project’s updates, changes, dispute resolutions, and other improvements related to the ecosystem of the Tellor protocol. You may still have doubts about investing in TRB tokens and may need some more information to make up your mind. If so, in this section, you will find some factors why the TRB token is a good investment that can help you make a better decision for yourself. One of the reasons to consider the TRB token a good investment this year is its strict connection to the Tellor project. Tellor is an important project for DeFi as it tries to tackle some of the major problems that smart contracts face regarding the external data they need to work properly. The project is run by a team of professionals with experience in the blockchain sector. The protocol’s success can mean success for the coin, too, as it will attract a lot of attention to the token. All of the above clearly makes Tellor one of the best Defi tokens in the market right now. The next factor to believe in the success of the TRB token is the value that it brings to the Tellor protocol project. TRB isn’t simply a coin to speculate on price changes: it has a crucial role within the Tellor protocol. Its various use cases for the Tellor ecosystem prove that TRB can become a well-established cryptocurrency along with the success of the Tellor project. If Tellor becomes a popular project, the demand for the coin will grow too. Check out our list of the best crypto coins to buy now. Eventually, taking a look at the TRB price performance, we can see TRB token as one of crypto projects with the most potential. Tellor has mostly followed the trends of the general crypto market and had its share of bullish and bearish markets. The price of the token increased with the bullish trend in 2021, and after going through the “crypto winter,” it could recover once Bitcoin and major altcoins increased in value. Even during the last steep rise and fall of its price, the token didn’t go back to the lows of $10 as it was in 2023. Despite losing most of its value after hitting $590, the coin is still traded at $110 and above. Tellor token was launched in the same year as the Tellor protocol. It started its journey in late 2019 with a price of $1.7. By the year 2020, Tellor was already traded at above $4. Tellor kept increasing in value during the first months of 2020, and soon, it experienced its first significant price increase. In September 2020, Tellor hit its first all-time high, reaching $67. The correction took its price down below the $20 mark, and TRB eventually closed the year with a price of $17. The first half of 2021 was successful for the whole crypto market as long as the market experienced a bullish cycle, with most of the major cryptocurrencies hitting new all-time highs. In May, when the prices of Bitcoin and other popular cryptocurrencies soared, Tellor managed to cross the $100 mark and set another all-time high, this time reaching $123. The quick raise was followed by another correction, and Tellor had a resistance level of $32 at that time. The second half of the year was not successful for Tellor, despite the fact that the general crypto market was again on the price surge. This time, Bitcoin and other major coins hit their historic all-time highs, with BTC reaching over $68.000. However, Tellor did not take this advantage, and its highest price was only $72 at that time. The bullish cycle was followed by a bearish one, and the whole market entered a phase that has become known as “crypto winter.” Tellor closed 2021 with a price of $32 but continued to experience a decrease during the first months of 2022 due to the crypto winter. Tellor kept its price above $10 for most of the year, but for a short time, it went below the $10 mark and was traded at $9.7. In 2023, almost no significant fluctuation happened to Tellor. Only in the middle of the year, following the general trend, it managed to increase its value to $45, but the prices dropped again shortly. Tellor Token All-time Price Performance Source coinmarketcap.com After that, Tellor was mostly fluctuating between $10-$15 until the recent price pump. After dropping to $9, Tellor has started a crazy surge in price since September 2023. First, it hit $47 in October; then, its value crossed the $100 mark for the first time since 2021. Reaching $140 eventually, Tellor dropped to $73. In a few days, it set its record-breaking all-time high of $590, which equals a YTD return rate of 4200%. This was followed by a quick decrease in price, and $68 million worth of assets were said to be liquidated, making Tellor the most liquidated token in 24 hours. Many analysts consider that the price fall was related to the fact that a significant amount of TRB tokens worth $2.4 million were transferred to the Coinbase platform. According to the rumors, the transfer was made by the Tellor team and this raised some concerns that Tellor’s price is a speculation and that the team might have played a role in its market performance. Despite this, Tellor is still relatively higher compared to its price at the beginning of the year. Its current value is $117, with a YTD return rate of 754%. The price predictions for the Tellor token made by the AI-based platforms, taking into account its market performance, are quite optimistic. Quite bullish predictions are given by the Digital Coin Price and the Price Prediction platform, which both suggest that the token will keep growing over the coming years and set new all-time highs. Starting with the Digital Coin Price, we can notice that Tellor will keep an average price of $242 during 2024 with the possibility of hitting $275 as its maximum price for the year and dropping to $112 as its minimum price for the year. The platform suggests that the average price of the token will remain above $250 during 2025, too, and it will be $456 in 2026. In 2027, the coin may cross the $500 mark, and in 2031, it may even reach $1000 and above. The Price Prediction platform gives almost similar data indicating that the coin will have an average price of $174 in 2024 with a maximum price of $210. During the next year, Tellor’s average price can reach $256, but it will still remain under $300. In the long-term perspective, Price Prediction gives more bullish figures, suggesting that TRB can hit $500 in 2027 and have an average price above $1000 in 2029. CoinCodex shows the opposite and gives comparably bearish predictions about the coin. The platform considers the TRB token a good buy in the short-term perspective, with the current sentiment being Neutral and the Fear & Greed index showing 76. However, in the long-term perspective, TRB will keep its yearly highs and yearly lows slightly above $110 in the next 3 years. In 2029, TRB’s yearly low can even drop below $100 and reach $59, while its yearly high can soar to $257. Check out our Tellor Price Prediction guide for more insights into the future potential of the token. There are different ways to purchase TRB tokens, including fiat and non-fiat options. Below you will find some of the most popular payment methods that can be used to buy TRB tokens and the names of the exchanges that support the mentioned payment method. Check out our Bitcoin Price Prediction guide. Although transaction fees may be a bit higher compared to other payment options, the transaction speed is also high. You don’t need to wait for days as long as your account will be funded in up to 2-3 hours, and transactions can be completed as fast as a few minutes. If you are a beginner, we recommend that you explore our guide on how to buy cryptocurrency safely this year. Once you have done your research on the TRB token and decided to buy some coins for yourself, you may need some help with the buying process. To guide you through all the steps, we have made a detailed tutorial on how to buy Tellor tokens. Follow these few simple steps with Binance to make the purchase. To start with, visit the Binance website and click on the Register button to create a personal account. Here, you will need to fill in your email and click on the “Next” button to continue. Once you verify your account with the email you provided, you can create a password and follow the next steps to finalize your account. The registration process is followed by filling in some personal information, such as your nationality, name and surname, date of birth, etc. Once you finish the registration, you will also need to go through the KYC procedure and verify your identity. This requires providing an identity document, such as your government-issued ID, passport or driver’s license, and a selfie. If you provide all the documents correctly, your account will be verified in a short time, and you can start investing in coins or trading. Now that you have a verified account, your next step is to fund it with some money. You can do this through traditional payment methods, including bank cards and wire transfers, or you can connect your crypto wallet, deposit other coins, and exchange them with TRB tokens. Make sure that you check the speed and fees related to the deposit options, as Binance charges different fees for different payment methods, and the transaction speed varies too. To fund your account, click on the “Deposit” button, and a window will pop up with multiple payment options. Click on your favorite method to start the process. Then follow the steps and provide the necessary details about the payment option to make the deposit. Consider that the minimum trade on Binance is $10, so you need to deposit at least that much, excluding the fees. Once your deposit is completed, you will be ready to purchase TRB tokens. To do it, type the token name in the search area. You will notice that TRB is available to buy with BTC or with BUSDT. Select which pair you want to trade and click on it. When you click on the pair to trade, you will be navigated to a separate page where you can find a lot of advanced tools and technical indicators to track the price performance of the pair. If you want to buy the coin immediately, scroll to find the buy window, where you need to fill in the number of TRB tokens you want to purchase. Finally, confirm the transaction to make the purchase. If the transaction is successful, the coins will be transferred to your Binance wallet shortly. To conclude, in this guide, we explored the Tellor token and its price performance. Tellor is the native token of the Tellor oracle protocol, which addresses one of the major problems with blockchain oracles – data accuracy. The token plays a crucial role in the blockchain project and has multiple use cases, including serving as a staking and reward mechanism, acting as collateral, and being a governance token. In late 2023 and early 2024, the Tellor token price showed an incredible soar in price reaching $590 in a few hours and setting a new all-time high. However, the price has dropped to about $110 in the last few days. Currently, the price of the token is $117, with a market cap of above $320 million. While many still consider Tellor a good investment, others are afraid of its sudden price rise and drop. In any case, it is always better not to put all your money in one coin and to diversify your portfolio with another coin, thus reducing the risks of using your money. We consider Bitcoin Minetrix the best alternative to Tellor token. Unlike Tellor, Bitcoin Minetrix is a low-cap coin and has a lot of room for growth. BTCMTX is a valuable project, too – while Tellor tries to bring new solutions for the DeFi sector, BTCMTX brings new solutions to the cloud mining sector, allowing people to get mining rewards without being involved in the mining process. Bitcoin is still available on presale and you can visit its official platform right now to participate. New Crypto Mining Platform - Bitcoin Minetrix

Tellor coin is a cryptocurrency that can be used for trading or investment purposes to generate income on its price fluctuations. But it also plays an integral role within the Tellor blockchain. One of the main use cases is staking through which users can take part in the data reporting process and earn rewards based on the accurate data they provide to the blockchain. Another use case is governance, as it is also a governance token and enables holders to take part in the decision-making processes related to the Tellor protocol. It is also used as collateral from the side of data providers to make sure that the data they provide is accurate.

The Tellor token and the homonymous blockchain project were co-founded by Brenda Loya and Michael Zemrose in 2019. At first, they had a project called Daxia, and they designed Tellor in an attempt to solve the problems users were facing with the existing oracles. Brenda is the CEO of the project and has experience in blockchain, while Zemrose, the CSO of the project, has experience as a business consultant.

According to Coinmarketcap, Tellor hit a record-breaking all-time high of $590 on January 1st, 2024. This price was recorded at 2 a.m.; however, it lasted only for a short period. By the end of the day, the Tellor token lost most of its value again and traded below the $200 mark.

According to market analyses, it is highly unlikely that the TRB token can reach $500 this year. However, the crypto market is quite volatile, and though predictions are based on their historical price performance, any unexpected event in the crypto space can change the direction of the events.

The maximum supply of the TRB coin is not clear. Currently, it has a total supply of 2,588,303 TRB tokens, and 2,544,563 TRB are in circulation. Its current value is $121, which makes a market cap of $299,872,262. TRB token is rated as the 151st largest cryptocurrency by its market capitalization.

There are multiple reasons to consider Tellor coin a good investment. One of these reasons is that it backs an innovative blockchain protocol that addresses a very crucial issue related to oracles. Tellor acts as the fuel for the Tellor blockchain project and has several vital use cases within that project. However, analyses by some experts indicate that the recent price pump of the token raises some concerns and that it can be a result of speculation. Hence, you need to do your own research and always consider that there are risks of losing your investment. Alternatively, you can back up your investment by diversifying your portfolio. We consider Bitcoin Minetrix one of the best alternatives to the TRB token. How to Buy Tellor Token – Step-by-Step Guide

Where to Buy Tellor Token?

Binance – Overall Best Crypto Exchange to Buy Tellor Token

We consider Binance the best exchange to buy Tellor tokens for being a reputable, secure, and functional exchange. Binance is widely known as one of the best crypto exchanges worldwide. It accepts users from over 100 different countries and has a quite friendly user interface, even for beginners. One of the things that makes Binance so popular is that it’s the largest crypto exchange in terms of trading volume.

Coinbase – Best Exchange to Buy Tellor Tokens for US Users

KuCoin – Diverse Trading Features

MEXC – Top Crypto Exchange to Buy Tellor Token with Low Fees

What is Tellor Token?

Is Tellor Token a Good Investment Right Now?

Tellor Project Brings Value to the DeFI Sector

The Tellor Token has Multiple Use Cases

The Price Performance of Tellor

Tellor (TRB) Token Price

Tellor Token Price Prediction

Ways of Buying Tellor Token

Buy Tellor Token with Bitcoin

Buy Tellor Token with PayPal

Buy Tellor Token with a Credit or Debit Card

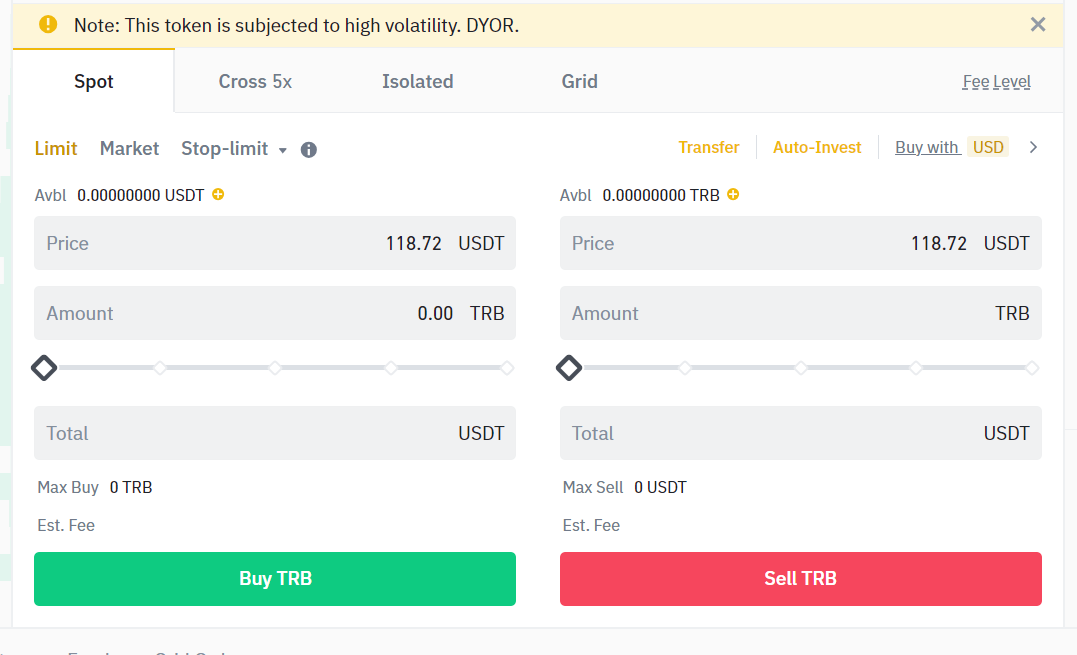

How to Buy Tellor Token – Step-by-Step Tutorial

Step 1 – Create an Account with Binance

Step 2 – Deposit Funds on Your Account

Step 3 – Search TRB Token

Step 4 – Buy TRB Token

Conclusion

FAQs

What is Tellor coin used for?

Who is the founder of Tellor token?

What’s the all-time high for Tellor Token?

Can Tellor reach $500?

What is the limit supply of Tellor tokens?

Is Tellor coin a good investment?