XRP is the cryptocurrency of the Ripple network and a company of the same name. XRP has become the 5th largest crypto by marketcap, and Ripple is one of the most widely used blockchain-based payment systems after Bitcoin.

This guide shows you how to buy Ripple (i.e., how to buy XRP), explains where best to buy XRP, and covers whether XRP is still a good investment now in 2024.

How to Buy Ripple – Quick Guide

- Choose a cryptocurrency exchange – we recommend Kraken

- Create and verify an account

- Deposit funds into your account

- Search ‘Ripple’ in the drop-down menu

- Click ‘Trade,’ select an amount of XRP to buy, and finalize the purchase

Best Exchanges to Buy Ripple in September 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

How to Buy XRP – Kraken Tutorial

Want more details about how to buy XRP? We’ll walk you through the process using Kraken, which offers low fees and excellent trading tools.

1. Open an account with Kraken – To get started with Kraken, head to its website and create a free account. You’ll need to enter a new username and password, then fill in personal details about yourself.

2. Identity verification – The KYC process on Kraken requires that users upload ID photos and some other vital personal information like country of residence, date of birth, address, and the last four digits of your social security number.

3. Deposit – Kraken requires you to fund your new account with a minimum deposit of at least $10. You can use various payment methods, including a debit and credit card.

4. Buy XRP – From the Kraken dashboard, click the Buy panel to search and select XRP. Enter the amount of Ripple you want to buy and finalize the purchase.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

What is XRP?

First, Ripple is entirely pre-mined. That means generating new XRP tokens doesn’t require enormous mining operations like Bitcoin. Transactions on the Ripple blockchain are validated by consensus among users, and new XRP is released to users monthly based on how many transactions are taking place using Ripple.

Another important difference between XRP and other top cryptocurrencies is that the Ripple blockchain is fast. When you want to send XRP to someone, the transaction is instantly processed on the Ripple blockchain. In contrast, sending money with Bitcoin or Ethereum can take seconds to minutes and is generally quite expensive.

Ripple Labs

Unlike other cryptocurrencies, which are entirely decentralized, XRP is partially controlled by the company that created it: Ripple Labs. Ripple Labs doesn’t have control over XRP transactions, but it does work to maintain the blockchain and push for the mainstream adoption of Ripple.

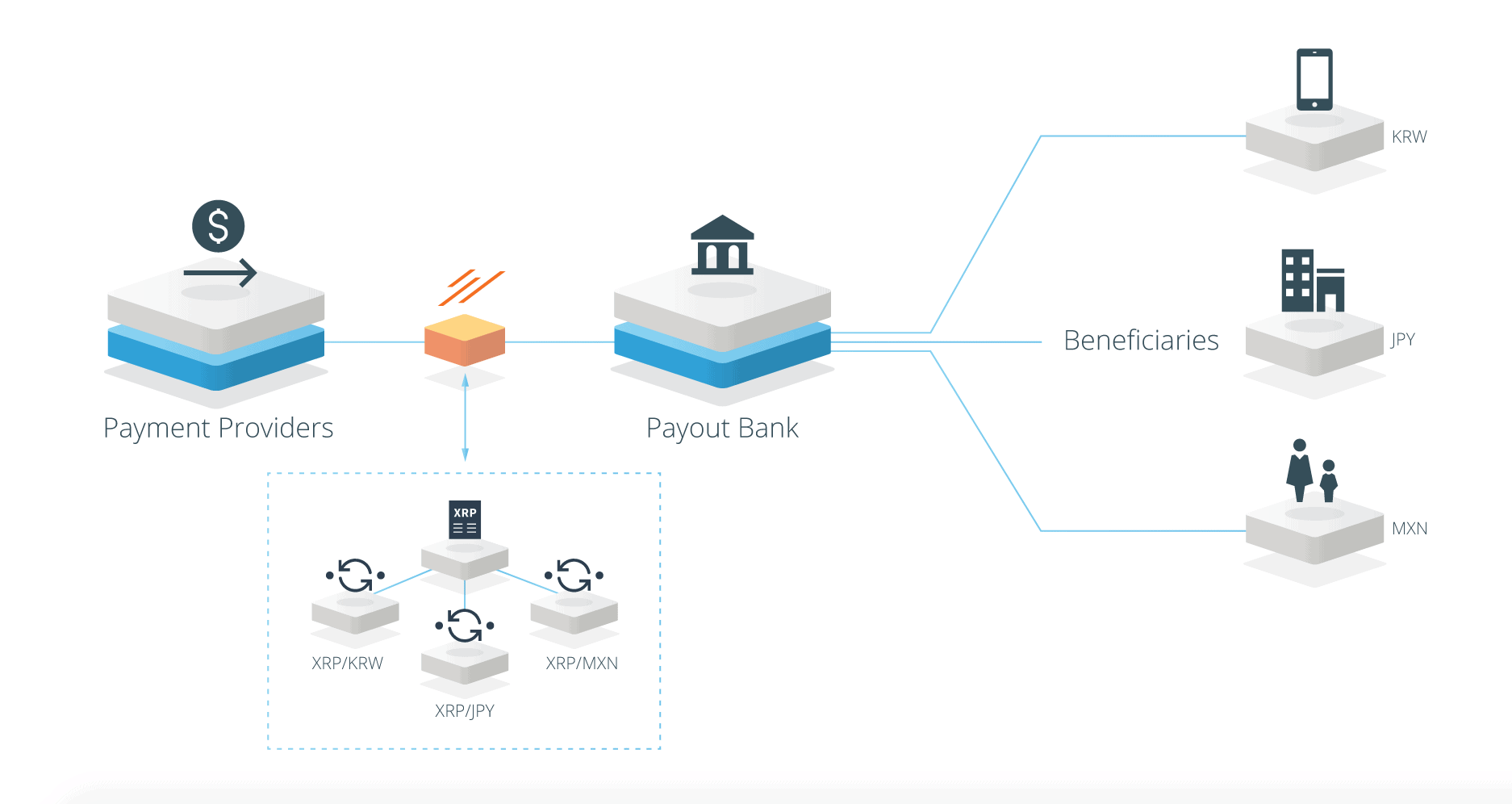

To that end, Ripple Labs has created a network of more than 200 financial institutions – including Santander, MoneyGram, Westpac, and American Express – that use Ripple to facilitate borderless payments.

Note – ‘Ripple’ refers to XRP, the digital currency that trades over the Ripple blockchain, and Ripple Labs.

Where to Buy XRP

Choosing where to buy XRP is one of the most important decisions you’ll need to make. Ideally, the best place to buy XRP will offer low fees, top-tier trading tools, and a built-in XRP wallet. You’ll also want to look for a Ripple broker that accepts multiple payment methods.

With that in mind, let’s look at the best places to buy Ripple today.

1. Kraken – Highly Preferred Choice for Buying XRP

Kraken is a very popular crypto exchange, even among the early adopters of Bitcoin and other popular altcoins like XRP. It was created in 2011 and launched officially in 2013. It is headed by the platform’s founder Jesse Powell and is owned by Payward Inc.

At the time of writing, it is the sixth largest cryptocurrency exchange in terms of volume traded and has one of the most dedicated user bases. The platform is headquartered in San Francisco and has offices worldwide.

Kraken caters to over 8 million users globally and has over 120 top cryptocurrencies on the exchange. It is one of the few exchanges to support around 7 fiat currencies and 3 major stablecoins like USDT, DAI, and USDC. The company offers numerous products and services like spot trading, futures, indices, margin trading, stakings, OTC, and an NFT marketplace.

Kraken has two major products. One is the normal exchange, while the other is an advanced version of the same exchange called Kraken Pro. In this, users can benefit from lower fees and advanced trading products.

Pros

- Reputed platform

- Over 120 cryptocurrencies

- Seven fiat currencies supported

Cons

- Requires Kraken Pro for advanced trading

- Has had some legal troubles in the past

2. MEXC – Trusted By 10 Million Users Worldwide

Ranked 11th in terms of trading volume on CoinmarketCap, MEXC has captured the imaginations of crypto traders with its combination of different innovative trading tools and an interactive interface. While its headquarter is currently in Seychelles, MEXC is present in more than 170 countries and regions worldwide, catering to over 10 million users.

As one of the biggest crypto exchanges around, MEXC boasts over 3.6 million weekly visits. One key attraction for MEXC is its distinctive levy structure that charges 0% fees for both maker and taker spot trades. Apart from XRP, MEXC supports a vast range of cryptocurrencies and trading pairs.

When it comes to trading features, MEXC allows both spot and futures trading. More so, the crypto exchange has a trading engine that can process more than 1.4 million transactions per second. After buying XRP on MEXC, users can also stake their tokens to further compound their gains.

Overall, MEXC is licensed by top regulators across countries, including the United Kingdom, Switzerland, and Canada.

Pros

- Highly competitive fee structure

- Supports a wide range of cryptocurrencies, including XRP

- Staking mechanism

- Regulated by key regulatory entities

Cons

- Limited fiat options

3. eToro – Reliable Place to Buy XRP

eToro is one of the most popular financial service platforms in the world. The service is very popular for its ability to provide exposure to different asset classes. You can buy heavyweight crypto-assets like Bitcoin, Ethereum, Ripple (XRP), and Defi coins like Aave.

Users enjoy many benefits, including commission-free trading, a quick account opening process, and a Copy Trading feature that lets you copy the trades of some of the top traders available. That said, eToro only provides one base currency and charges a $10 inactivity fee if you don’t use the app for a year.

In terms of fees, eToro is quite competitive. The platform is a zero-commission platform that uses a spread. Regarding, few Bitcoin brokers can compete with eToro. eToro makes it easy to buy XRP tokens without paying a penny in commission. However, the broker charges a small fee of 0.5% forex fee when you make a deposit. eToro USA LLC does not offer CFDs, only real Crypto assets are available.

Depositing and withdrawing funds on eToro is also relatively straightforward. The platform provides access to funding options like PayPal, Neteller, and debit cards.

Pros

- Accepts debit/credit cards and bank transfers

- Minimum deposit of just $10

- UK and US traders accepted

- Over 2,400 global stocks and shares and 250 ETFs – buy Ripple stock

- Social network with copy trading

- Regulated by the FCA, ASIC, and CySEC

- Approved by the SEC

Cons

- A withdrawal fee of $5

- The platform is denominated in US dollars

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

4. OKX – Buy XRP At a Low Fee

OKX is the sixth biggest cryptocurrency exchange in the world by market capitalization. Launched in 2017, OKX is a Seychelles-based exchange that allows users to buy XRP using crypto and over 112 different fiat methods.

The trading fee to buy XRP on OKX varies depending on two factors. The first one is the number of OKB tokens held by the user. And the second is the loyalty tier, which is determined by an investor’s trading volume.

Along with standard trading, OKX supports derivatives & margin, leverage, and spot trading. The platform also offers staking opportunities to help users earn passive income by holding XRP or other assets in their trading accounts. And in addition to trading utilities, OKX also features an NFT marketplace and dApp building tools. Institutional investors also have access to nuanced facilities like the Liquid marketplace on OKX.

To protect users’ assets, OKX has implemented OKX Risk Shield. The OKX Risk Shield is an asset-risk reserve that holds a certain portion of a user’s assets inside cold storage. That makes it possible for investors to recover from losses that may happen due to hacking attempts.

Pros

- Accepts multiple modes of payment

- Low minimum deposit requirements

- OKX Risk Shield enabled to protect users’ assets

- Offers Copy Trading facilities

Cons

- Not available in the US

- Holding OKB tokens is required to lower the trading fee

5. Binance – Top-Rated Crypto Exchange to Buy XRP

Binance is the world’s largest cryptocurrency exchange. The company handles tens of billions in daily trades and has hundreds of cryptocurrencies available for customers. Of course, unlike eToro, Binance doesn’t offer exposure to other asset classes.

What Binance lacks in asset diversity, it more than makes up for in its singular focus. The company offers crypto transactions and trading at incredibly competitive commissions and fees, and you’ll find that working on Binance is pretty impressive.

Beyond that, Binance offers leveraged trading to professional traders looking to take bigger bets. You get dedicated customer service, and Binance even offers a staking service for you to lock your coins and get rewards. That said, Binance’s trading platform is still too complicated. So, beginners might not find it so easy to navigate.

Pros

- Impressive customer service

- Sophisticated trading available

- Competitive trading and non-trading fees

Cons

- Complex user interface

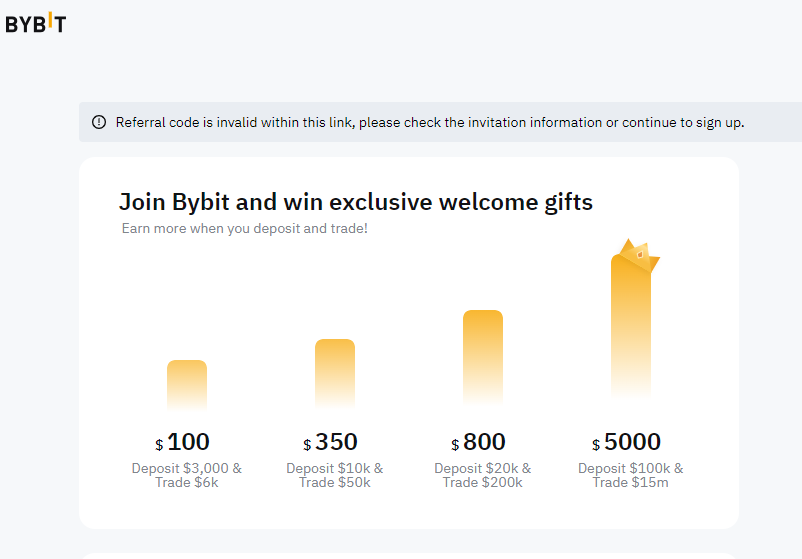

6. Bybit – Beginner-Friendly Place to Buy XRP

Launched in 2018, Bybit is a cryptocurrency exchange that has earned a good reputation in the crypto space thanks to its willingness to add innovative cryptocurrencies to its trading list. That said, it is a suitable place to buy XRP due to the beginner-friendliness of its platform.

Every aspect of UI has been simplified. Beginners can use simple trading tools such as “One-Click Buy” and P2P Trading. Also, Bybit offers spot and margin trading with up to 10x leverage for veteran traders. XRP is one of the leveraged tokens on the platform, and users can short XRP with up to 3x leverage at press time.

Bybit also has a host of educational tools. Many articles are available – all using simple language to explain crypto trading and blockchain technologies. Those factors have made Bybit the fifth biggest cryptocurrency exchange by market capitalization. And on CoinGecko, Bybit ranks as 3rd biggest cryptocurrency exchange.

Bybit features an audited proof of reserve, which validates that it holds and secures users’ assets inside their trading accounts. Using this facility, users can verify their assets’ balance, the wallet address ownership that Bybit has chosen to reveal, and the reserve ratio.

Pros

- Accepts multiple modes of payment

- The minimum deposit varies depending on the cryptocurrencies

- Supports 100+ cryptocurrencies

- It has listed 300+ crypto trading pairs

- Copy trading and trading bots are available

Cons

- Not available in the US

- Not a regulated cryptocurrency exchange

7. PrimeXBT – Leading Crypto Derivatives Platform

Founded in 2018, PrimeXBT is a multi-asset broker that allows users to trade XRP and a host of other cryptocurrencies in the market. By offering a variety of investment opportunities, this reputable trading platform has earned the confidence of seasoned traders and beginners across the globe.

Among the lineup of interesting features on PrimeXBT is crypto derivatives, offering up to 200x leverage on Bitcoin and Ethereum CDs. In recognition of the importance of educating those still finding their feet in the industry, PrimeXBT has an academy that’s managed by market experts and leaders. Over the years, the platform has created quality educational materials and videos to enlighten users about the revolutionary capabilities of crypto.

It is possible to earn on PrimeXBT without even trading. It has an affiliate and referral program that allows users to claim commission for inviting friends and families to trade on its website. For every first deposit that’s worth $500, users will receive an additional $100 bonus.

Pros

- Custodial wallet

- Excellent mobile and web versions

- Rewarding welcome bonus

- Regulated and secure

Cons

- No demo account

8. Margex – Highly Secure Crypto Trading Platform

Following its establishment in 2019, Margex has swiftly established itself as a force to reckon with in the crypto derivatives landscape. The exchange is focused on ensuring the widespread adoption of cryptocurrencies by leveraging cutting-edge trading systems to provide numerous trading opportunities for users.

Among these offerings are leverage trading, copy trading, and staking options which allow users to maximize their capital. Margex also provides real-time market charts so that users can make informed decisions. More so, when it comes to security, Margex is second to none.

Over the years, the exchange has adopted multiple security elements like cold storage, email notification, 2FA, and more ensure the safety of users and their funds. More so, to ensure that users can test their trading skills without risking any funds, Margex supports demo accounts. Finally, getting started with the platform is relatively easy, even for newbies.

Pros

- Supports staking

- Sleek interface

- No KYC verification required

- Supports a considerable number of cryptocurrencies

Cons

- Limited trading pairs

9. KuCoin – Multiple Award-Winning Crypto Exchange

Describing itself as the “people’s exchange, KuCoin is one of the most reliable places to buy XRP this year. Since making its debut in 2018, the crypto exchange has been thrilling users with its diverse trading tools like margin trading, P2P fiat trading, futures trading, automated trading bot, lending, and many more.

KuCoin Lend program is a peer-to-peer service that allows users to lend their assets to margin traders and earn passive returns. Users can also put their idle crypto coins into best use by taking advantage of KuCoin’s Earn initiative. Those willing to purchase XRP on the exchange can do that with debit and credit cards, bank transfers, PayPal, and Google Pay.

In addition to XRP, the exchange is offering more than 840 cryptocurrencies for users across 200 countries and regions worldwide. For those interested in NFTs, KuCoin is the right place to be as it allows the buying of top collections without stress.

Pros

- Cheap platform charges

- Trusted by millions of users across 200 countries worldwide

- Rewarding initiatives – KuCoin Earn and Lend

- Automated trading

- Advanced trading tools

Cons

- Users must fulfill identity verification requirements to increase withdrawal limits

10. Huobi – Secure Crypto Exchange to Buy XRP

Like eToro, Huobi was launched during the early days of cryptocurrencies. A well-established household name in crypto, it was founded in 2013, just after Ripple.

Since then, Huobi – aka Huobi Global – hasn’t been hacked or had any other security issues. As of 2023, Huobi is, in fact, offering assistance and advice to Bitmart, a small crypto exchange that experienced hacking, to help them improve their safety procedures.

Huobi offers both spot and margin trading – meaning, as well as buying XRP; you can also take a long or short XRP on the platform using leverage if you think it’s due for a pullback. It offers up to 200x leverage on some assets, more than most XRP trading platforms.

One unique feature of Huobi is its free in-house crypto trading robot with a ‘grid trading’ system. Currently, it has a backtested 7-day annual yield of 44% – that ROI performance data is updated weekly. It also offers high-yield crypto staking of up to 50% APY on several assets, crypto loans, and a welcome bonus.

Pros

- Operating since 2013 without being hacked

- Crypto staking

- Grid trading bot

- Both spot & futures trading

Cons

- No smart portfolios / copy-trading, unlike eToro

- 0.2% maker/taker fee is higher than Binance & Coinbase Pro

11. Crypto.com – Crypto Debit Card & App

Crypto.com is a crypto exchange and mobile app with a crypto debit card so that you can make retail purchases with XRP. Founded in 2016 and featuring celebrity endorsements, e.g., by Matt Damon in its TV advertising, Crypto.com also signed a sponsorship deal with F1 racing (Formula One), the UFC, and several sports teams.

United States residents can use the app and the VISA debit card, but not the exchange, although that may change. The Crypto.com exchange offers spot, margin, and futures trading (derivatives).

Crypto.com’s metal prepaid card rewards you with up to 8% crypto cashback on purchases, and you can earn interest on crypto on the platform, although not XRP yet. Its highest crypto interest rates are 14.5% per annum on stablecoins like USD coin (USDC). The Bitcoin interest rate is 8.5% if you hold that alongside XRP to stabilize your portfolio.

Crypto.com supports 250+ cryptocurrencies and has over 10 million users. It also has its own NFT marketplace where you can create, showcase, sell, and buy NFT tokens.

Pros

- Up to 14.5% per annum interest on crypto

- In-house NFT marketplace

- DeFi staking

- Crypto prepaid VISA card and wallet

Cons

- American investors partially restricted

- High spreads

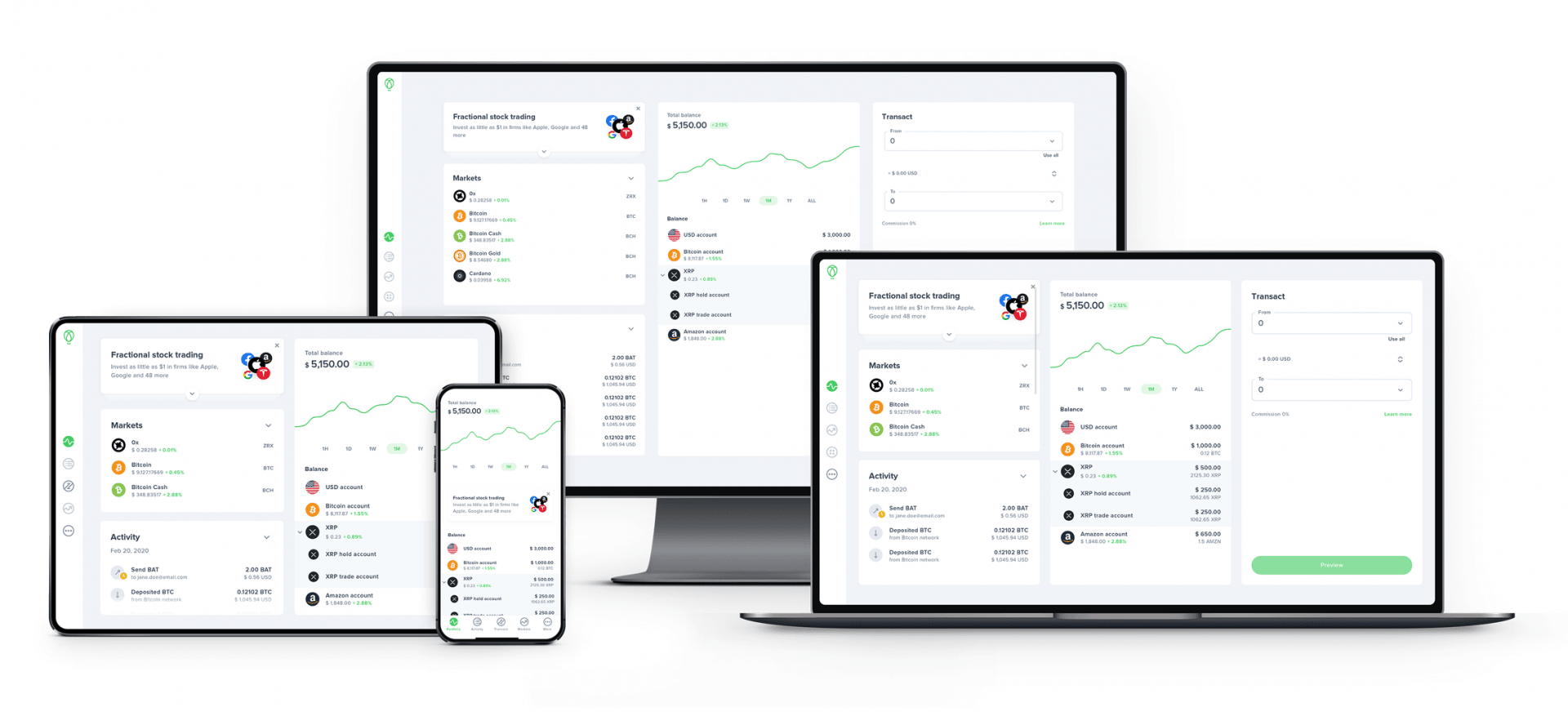

12. Uphold – Easy Web & App Trading

Trusted by 7 million users across 184 countries, the Uphold exchange platform, app, and debit card are a fast and convenient way to buy Bitcoin. Alongside their website, they also have an app on Google Play and the App Store for Android and iOS users.

Uphold charges a spread of 0.85% when buying Bitcoin and 1% when selling. Some other popular assets you can invest in with Uphold include Apple stock, Amazon, AT&T, Tesla, Gold, Silver, Platinum, Palladium, and more. Their motto is ‘anything to anything’ trading.

They also open investing to anyone through fractional stock trading – you can invest as little as $1 in companies like Google. Unlike some online stockbrokers, you must accumulate much capital to get started.

Pros

- No deposit or withdrawal fees

- Debit card pays 2% cashback for using crypto

- Also, buy and trade stocks, metals, fiat currencies

Cons

- Paypal not yet supported

- Fewer crypto assets are supported than larger exchanges

13. Libertex – CySEC Regulated Broker

Libertex is another service that provides exposure to FDs for any investors who would like to access them. However, unlike Capital.com, Libertex allows you to invest in more than just CFDs.

Its benefits include quick withdrawals, competitive commissions on trading, and the availability of up to 1:600 leverage for professional traders. Libertex has a $100 minimum deposit on the flip side and a complex fee structure that you might not understand so easily.

Pros

- Leverage trading available

- Regulated broker service

- Withdrawals are processed in about 24 hours

Cons

- Inadequate research tools

14. Coinbase – Largest Crypto Exchange in the United States

Coinbase is the largest cryptocurrency exchange in North America and the most valuable publicly listed crypto company. The exchange is based in San Francisco and comprehensively controls the American crypto market.

With Coinbase, you get just about the same benefits as Binance. The exchange operates on the same scale as the latter, providing additional services beyond buying and selling. You can trade and stake; big companies can even enjoy Coinbase’s custody service.

Coinbase also does better than Binance by providing a much better user interface, making it easier for beginners to use the service. The exchange’s fees vary from 0.5% to 4.5% depending on factors like the asset, channel, and transaction size.

Pros

- Friendly user interface

- A low minimum balance of $2

- Fund insurance in the event of a hack

Cons

- Complex fee structure

Why Buy XRP? XRP Analysis

Why should you buy XRP stock when so many cryptocurrencies are seeking attention? This cryptocurrency was the third-largest behind Bitcoin and Ethereum for most of last year. While it fell to the 5th largest cryptocurrency by market cap in 2023, there are still several reasons to be bullish about XRP.

Better Global Payments

One of the most celebrated aspects of Bitcoin is that it enables truly borderless payments – making it easier for anyone to send money anywhere in the world. However, it doesn’t always do this seamlessly. Bitcoin payments can take several minutes to process, and there are often high transaction fees.

Ripple offers borderless payments but without the high transaction fees or waiting times of Bitcoin. Thanks to its consensus-based verification system, the Ripple blockchain can handle more transactions and push them through instantly. To put Ripple’s success in perspective, this cryptocurrency can process 1,500 transactions per second – compared to just 7 transactions per second for Bitcoin and 15 transactions per second for Ethereum.

Integration with the Financial System

Another advantage Ripple has over Bitcoin, Ethereum, and other cryptocurrencies is that major financial institutions use it. Ripple has created a global network of over 200 banks, credit card companies, and e-payment providers. That makes it easier for them to send money worldwide while lowering transaction costs.

While many cryptocurrency enthusiasts look down on Ripple, for this reason, banks and credit card companies are likely to play a role in deciding which digital currencies see widespread use. So, Ripple might not be as decentralized as other blockchain-based cryptocurrencies, but it could be more widely used. Ultimately, that should be the most essential thing for XRP investors.

SEC Troubles

You’ll want to note before you buy XRP that the coin has been in trouble with the US Securities and Exchange Commission (SEC) recently. The SEC sued Ripple and two executives in 2020, claiming they had broken securities laws when they sold XRP to raise more than $1.3 billion.

The SEC alleged that Ripple should be listed as security since it is released regularly instead of mined. The SEC thinks that XRP is a stock, not a currency.

As a result, XRP was delisted from several cryptocurrency exchanges, including Coinbase, the largest crypto exchange in the US. More importantly, that’s prevented any new financial companies from signing on to use XRP for payments.

However, in a recent development following an extended legal battle, Ripple Labs achieved a significant triumph in the United States District Court within the Southern District of New York on July 13. Judge Analisa Torres delivered a partial ruling favoring the company.

#XRPCommunity #SECGov v. #Ripple #XRP BREAKING: Judge Torres has issued her Ruling on the Parties Motions for Summary Judgment. https://t.co/MA65CeuhZh

— James K. Filan 🇺🇸🇮🇪 (@FilanLaw) July 13, 2023

Based on the documents submitted on July 13, Judge Torres granted summary judgment in support of Ripple Labs, concluding that the XRP token does not qualify as a security, specifically concerning its sale on digital asset exchanges. In one of the favorable stances of this outcome, Coinbase announced the re-listing of XRP.

W.

W for @ripple.

W for the industry.

W for the builders.

W for a clear rulebook.

W for updating the system.Oh, and XRP is now open for trading.

— Coinbase 🛡️ (@coinbase) July 13, 2023

Following this ruling, on August 18th, the SEC filed a Motion to Certify Interlocutory Appeal in its lawsuit against Ripple Labs. Ripple’s Chief Technology Officer, David Schwartz, shed light on the ongoing legal proceedings and potential appeals in response to queries about the SEC’s appeal.

He explained that parties losing any claims or issues during a lawsuit are entitled to appeal adverse rulings once the lawsuit concludes. Schwartz further elucidated that the appeal request was made since the suit remains ongoing for all parties involved.

James if Judge Torres denies this does the SEC have the option to appeal it after the fact to the appellate courts?

— Clayton Williams (@ohclaytonn) August 18, 2023

Nonetheless, the case’s outcome is poised to have far-reaching implications for the classification and regulation of digital assets moving forward. Still, it’s worth considering when deciding whether to buy Ripple.

Choosing the Right Broker When Investing in XRP

Today, hundreds of options are available for people who want to buy XRP online. However, you need to consider which of those is right for you. These factors will help you out:

1. Fees

There’s always a financial incentive when crypto is involved. Ensure your broker has acceptable deposits, withdrawals, transfers, and trading fees. Payment gateways: A good crypto broker will support different payment gateways, allowing you to deposit and withdraw your money however you please.

2. Customer support

If any issues arise, a customer support agent should be accessible and can offer assistance.

Trading facilities: To trade XRP, you want a broker with proper trading facilities like leverage and margin trading.

3. Safety

The safety of your funds is the most essential thing regarding crypto. Don’t compromise on this.

Responsible Investing: An Important Note For XRP Investors

All cryptocurrencies carry risk. The crypto market is more volatile than most others, and you must be careful navigating it. To wit, keep the following tips in mind:

- Always research: The market changes at will, and you must be ready. Before investing, research to know when to enter and exit the market. This will give you the confidence you need to proceed.

- Choose a strategy: Some people buy a HODL, and some people are day traders. Whatever works for you, stick to it and be patient.

- Seek expert opinions: Always ask for opinions before investing. You can check on review sites and more to get this. They have experts who monitor the market and give their takes to corroborate their work with your personal research.

- Set a target for your investment: Be disciplined to know when you’ve hit a short or long-term investment goal. Don’t get greedy.

XRP Mining: Is It Possible to Mine XRP?

Mining is a system where validators verify transactions to release more cryptocurrencies and keep a specific blockchain functional. It serves a dual role, facilitating transactions and providing a framework for introducing a new currency into circulation.

However, XRP operates quite differently. The asset is pre-mined, with the XRP Ledger initially creating 100 billion tokens. Every now and then, some of these tokens are released into circulation.

While it is impossible to mine XRP, you could exchange other assets like Bitcoin or Ethereum for XRP. However, the process is usually capital intensive as you must pay for specialized mining equipment (GPUs and ASICs) and deal with a high electricity cost.

Minimizing Risk in XRP Investment

With so much talk about its volatility, staying safe when investing in XRP is important. These tips should help you out:

- Keep researching: Remember that investment is a continuous journey. You have to keep researching to know how to react to market trends. Also, check out review sites and their expert predictions.

- Use a stop loss: In case of a market downturn, a stop loss will help to minimize your losses. This is very important.

- Watch the market: The crypto market turns on a dime. You want to keep checking the news to see what is happening with XRP, so you can make moves when sentiment turns sour.

- Diversify Investments: You should diversify instead of focusing on just one investment. As the saying goes, do not put all your eggs in one basket. A diversified crypto portfolio refers to investing in different digital assets to reduce risk in case one or more fails to perform.

- Avoid FOMO: FOMO means the Fear of Missing Out. This term is popular in crypto and refers to people’s craze to invest in an asset. When people jump into investment only for fun or because it is trending, that is FOMO. You do not have to do this. You should research to determine if the asset is safe to invest in before going ahead.

Ways of Buying XRP

There are several different ways how to buy XRP. Let’s look at some of the most popular XRP payment methods.

Buy XRP with PayPal

You can buy Ripple with PayPal using an eToro exchange that accepts payments. Alternatively, you can use PayPal and any cryptocurrency exchange to buy Ripple with Bitcoin.

Buy XRP with Credit Card

You can also buy XRP with a credit card. eToro, Capital.com, and Binance all allow you to fund your trading account with a Visa or Mastercard credit card.

Buy XRP with Debit Card

If you want to buy XRP with a debit card or bank transfer, you can do that, too. All the brokers we highlighted accept Visa or Mastercard debit cards and electronic bank transfers.

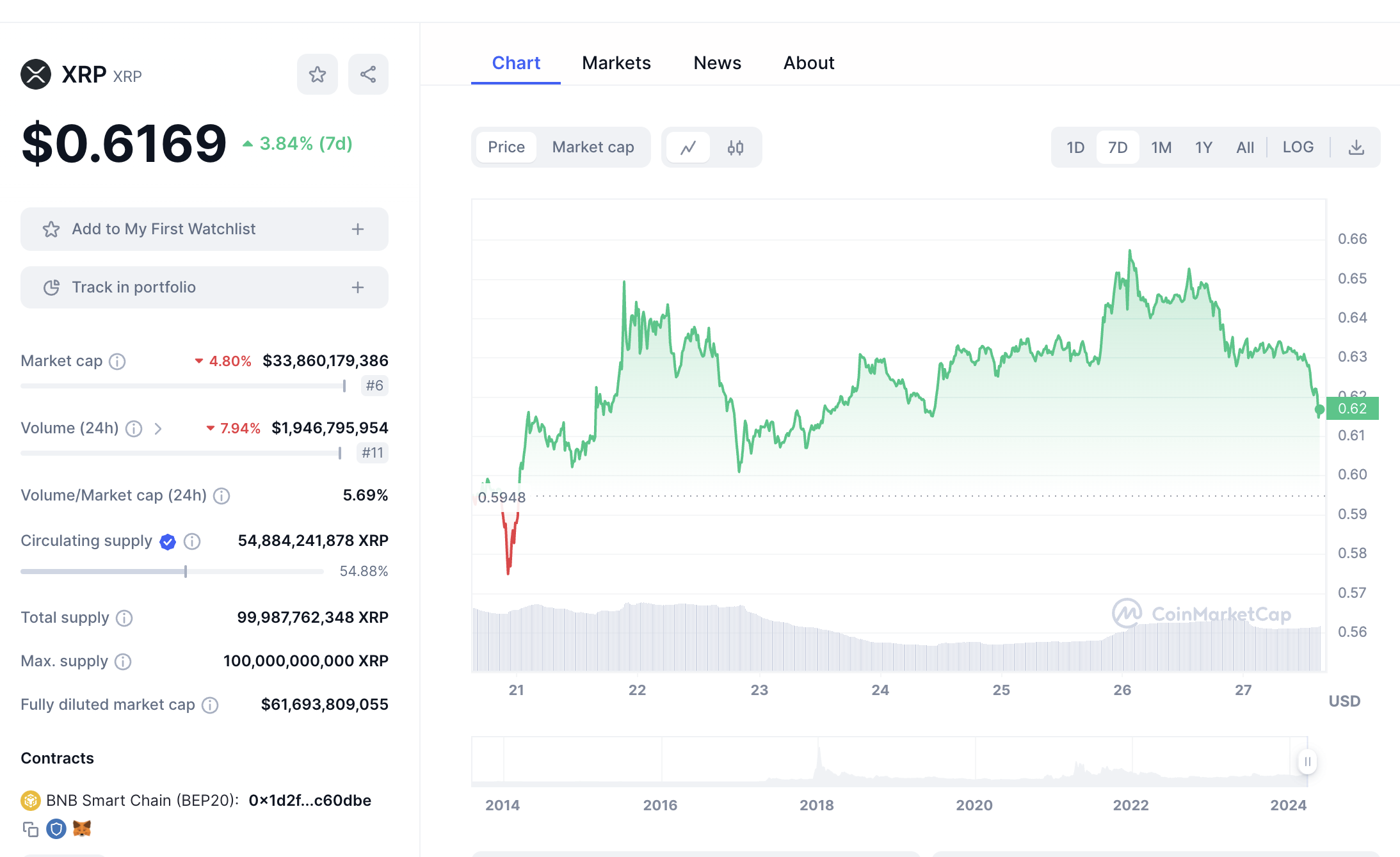

XRP Price

XRP has been following a volatile trajectory since it became available on cryptocurrency exchanges. Its most extensive bull run happened in 2018 when it crossed the $3 mark. But the retrace that happened after proved to be equally effective, which caused XRP to accumulate below the $1 mark till 2020. The reason for such a downfall was that the SEC filed a lawsuit against XRP for selling unregistered security.

Though the XRP price dropped to $0.1 after the SEC lawsuit, the cryptocurrency did not experience a severe crash and was still traded 20 times higher compared to its initial price. XRP experienced its next bullish momentum in 2021 with Bitcoin’s bull run. The price of the cryptocurrency got closer to the $2 mark.

Though most of the other popular cryptos hit new all-time highs during that bull cycle, XRP was still affected by the SEC court case and could not set a new record. The bull market was followed by the “crypto winter” of 2022, which pushed this token’s value back to below $1, and the token hasn’t gotten closer to getting to this level ever since.

XRP opened 2023 with a price of $0.34. While the general market had a short bull run in mid-January 2023, this had only a little impact on XRP and got it close to barely touching $0.54. The token struggled between the $0.40 to $0.50 range before mid-July, when new details about the SEC against XRP lawsuit were revealed.

On July 17, Judge Torres granted summary judgment in support of Ripple Labs. According to the initial decision, cryptocurrencies are not considered a security when sold on public exchanges. This was not only good news for XRP but the whole crypto market and had a positive impact on the general market.

XRP reached its 2023 highest level and rallied almost 70% to the key resistance level at $0.82. However, XRP dropped back to $0.5 due to Bitcoin crashing around that time.

BTC slowly started to gain ground by the beginning of the third quarter of 2023 but that didn’t have much of an impact on the XRP price. And when Bitcoin reached its all-time high in March 2024, people’s reception towards Ripple was lukewarm.

The token has only sustained its value above the $0.62 mark since the beginning of 2024. At press time, XRP stands as the sixth biggest cryptocurrency by market capitalization.

XRP Price Prediction

It’s difficult to say with certainty where the price of XRP is headed next. Although the recent jump in Ripple’s price is encouraging, investors had seen this same price action before in December 2017. At that time, the XRP price was on a bull ride, and the enthusiasm was followed by three years of bearish activity. While history could repeat itself, it won’t necessarily.

Ripple’s legal battle regarding the sale of XRP took a turn as the court determined that the institutional sales violated federal securities law. Thus, the token’s trading volume has surged by 1500% recently.

The SEC classification of XRP as a security had previously impacted the cryptocurrency, diminishing its demand in the US and restricting Ripple’s cross-border liquidity business that relies on XRP. XRP has reached its highest value in over a year, surpassing key resistance. This breakthrough suggests a potential rapid rise toward the next major resistance level above $0.90.

XRP holders could benefit from short-term gains in this range, supported by technical buying after XRP broke above a long-term ascending triangle pattern. The token market’s early stages of a new bull market, driven by institutional adoption and favorable macro conditions, indicate the possibility of XRP revisiting its all-time highs.

In early 2018, XRP reached a peak of $3.31. Considering the developing nature of the crypto asset class and technology, the growth potential of Ripple’s cross-border payments business and broader XRP adoption remains uncertain. Achieving a price of $100 for XRP may take decades rather than years or months if it ever occurs.

It should also be noted that SEC’s lawsuit against XRP is not completely closed yet, and the court only published its initial decision. If XRP gets the final victory, this could change a lot in the general market. Analysts also predict that XRP can repeat its all-time high of $3.31 and get even higher hitting the $10 mark. Still, XRP volatility should be taken into account, as anything can happen in the market that can change the course of the actions.

Investing in XRP vs. Trading XRP

Ripple is suitable for both trading and investing, although both carry a significant amount of risk. A clear bull case for long-term investors looking to buy Ripple will be made for the coin. Financial institutions are adopting it over Bitcoin and Ethereum, which can pave the way for widespread adoption. Even if XRP becomes a coin primarily used by financial institutions for international payments, that would be an enormous win for Ripple investors.

On the other hand, the SEC’s regulatory action against Ripple poses an existential threat to the coin’s adoption. If you believe XRP can prevail over the SEC, now could be a good time to invest. However, if you think the SEC could force changes to how the Ripple blockchain is structured, it may be best to wait.

The current volatility also presents a lot of opportunities for trading XRP. The coin’s wild price swings mean successful day trades can earn over 20% in a single position. However, be careful to protect your downside. The same volatility means losing a significant amount if a Ripple trade goes against you is possible.

Best XRP Wallet

One key aspect of how to buy XRP stock is setting up an XRP wallet. A Ripple wallet allows you to store XRP tokens safely – you can think of your wallet as a bank account for Ripple.

The best XRP wallet is the eToro cryptocurrency wallet, available for iOS and Android devices. This wallet holds not just XRP but more than 150 of the most popular cryptocurrencies. It’s highly secure and allows you to easily access your coins using your eToro login. You can instantly exchange between XRP and other top cryptocurrencies within your wallet using eToro’s exchange.

If you want more advanced wallet features, consider the Binance Trust wallet. This wallet supports over 500 cryptocurrencies and interfaces with BinanceDEX, a decentralized exchange, to make switching between tokens as simple as possible. The Binance Trust wallet also includes a decentralized finance (DeFi) marketplace. So, you’ll find apps to earn interest on your cryptocurrency or stake tokens on a blockchain.

Other popular XRP wallets include Exodus and Mycelium. These wallets are designed to be beginner-friendly, so they’re a good option if you’re just looking for somewhere secure to put your cryptocurrency. Another plus to these wallets is that they’re compatible with hardware wallets, which provide even more robust security for your coins.

XRP Reddit – Keep Up to Date with XRP News

One of the best ways to stay on top of the XRP market is to follow the XRP Reddit group. This online message board is a hub for Ripple investors and one of the first places where breaking XRP news is shared. If you’re interested in trading or investing in XRP, the XRP Reddit group is worth watching.

XRP vs. Other Cryptocurrencies

Here are some comparisons between Ripple XRP and other popular cryptocurrencies:

XRP vs XRP20

XRP-20 is a new cryptocurrency that resembles XRP and is launched in an attempt to give a chance to those who have missed the XRP bullish run. The coin’s main difference is that it is built on the Ethereum blockchain and uses the ERC-20 token standard. That means that XRP-20 can be used within Ethereum’s ecosystem: it can be staked, swapped on DEXs built on Ethereum, and have other functions. While including XRP-20 in your portfolio is a good idea, you should consider it is still a new token and is not as well-established as XRP.

XRP vs. Bitcoin

Bitcoin is the most popular cryptocurrency. The asset fills multiple roles, working as an investment option, a base for transactions, and a means of payment. It should be noted that XRP is quite more practical than Bitcoin regarding payments and transactions. But, Bitcoin’s greater popularity means that most businesses prefer it over XRP.

XRP vs. Ether

Ether is the second most valuable cryptocurrency. Like XRP, Ether’s value is primarily tied to something- the adoption of the Ethereum blockchain. Ether is in a strong place with sub-industries like decentralized finance (DeFi) and non-fungible tokens (NFTs) using the Ethereum blockchain.

XRP vs. Litecoin

Litecoin is also a payment-focused cryptocurrency. It was developed as the “lite” version of Bitcoin, focusing on payment efficiency and transaction speed. However, Litecoin is mostly a speculative investment like many other cryptocurrencies. XRP remains a superior tool for transfers.

Conclusion – Kraken – Best Crypto Broker to Buy XRP

XRP is one of the most popular cryptocurrencies in the world. In addition to being used by individual cryptocurrency investors, this digital currency is used by over 200 financial institutions to facilitate international payments.

Now that you know how to buy XRP and where to buy XRP, click the link below to create an Kraken account and start investing in XRP.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

FAQs on Buying XRP

Should I buy XRP?

XRP is a highly volatile cryptocurrency, so it should be considered a high-risk investment. That said, the coin has the potential to be one of the main cryptocurrencies used for international payments.

Where can I buy XRP?

You can buy XRP at a cryptocurrency exchange like eToro or Binance. You can also speculate on the price of XRP with CFDs using a trading platform like Capital.com.

What is XRP worth?

As of the beginning of 2024, a single XRP token is priced at just under $0.63. The entire Ripple project has a market cap of $33 billion.

What is XRP stock?

XRP is a cryptocurrency, much like Bitcoin. There is no XRP stock. The US Securities and Exchange Commission has alleged that XRP is a stock, not a currency. The case remains unresolved.

What is Ripple Labs?

Ripple Labs is a San Francisco-based company that developed Ripple in 2012. Today, Ripple Labs manages the Ripple blockchain and coordinates a network of financial institutions that use XRP for international payments.

Is Ripple a good investment?

While the financial market is unpredictable, Ripple is still a good investment opportunity. The continuous rate at which financial institutions adopt Ripple means it is headed for growth. Ripple also has a chance of prevailing in the US Securities and Exchange Commission lawsuit. Although we think XRP is a good investment overall, investors still need to weigh the pros and cons before going in.

Why is Ripple Cryptocurrency so cheap?

There have been some reasons why Ripple's price is lower compared to other major cryptocurrencies. One of them was Ripple's recently-concluded lawsuit with the US SEC. The case caused many exchanges to delist XRP, and this caused the price to drop. However, the token has started recovering its losses.

Is XRP a good investment in 2023?

Given its low price and increasingly mainstream adoption, XRP is a good investment. It has the potential for massive gains in the future.

Can you still buy XRP on Coinbase?

Coinbase has reinstated XRP trading after the project came out victorious in its legal battle with the SEC. Therefore, you can buy XRP directly from Coinbase. Alternatively, you can purchase XRP from regulated platforms like eToro.

What will XRP be worth in 2030?

Analysts and crypto enthusiasts have made several predictions of what XRP would be worth in years from now. Still, only a few forecasts include the year 2030. One of the few predictions that did not stop in 2025 is Trading Education. According to this website, XRP would trade at $22.90 by 2030.

Is XRP a good Cryptocurrency?

XRP is a highly volatile token and should be considered a high-risk investment. However, the coin has the potential to be one of the main cryptocurrencies used for international payments.

Bitcoin

Bitcoin

Comments are closed.