Bybit is a Singapore-based trading platform for crypto derivatives. It has recently created quite a buzz as many users have shifted to this platform. With more than 3 million registered users as of today, it is known for its user-friendly interface and wide range of features.

So, what is this all-new craze for the platform all about? In this in-depth Bybit review, we will uncover every aspect of this crypto derivatives exchange in detail, and deconstruct its innovative online trading, mining, and staking experience for retail and institutional clients all over the world.

Update – the maker rebate for futures trading that we wrote about in this guide was cancelled in Q1 2022.

Bybit Platform Features

- Up to 100x leverage

- Cold Wallet Storage/ Manual Withdrawals

- No Limits on Withdrawals

- No KYC (unless the investor wants to withdraw over 2BTC every day).

- Active customer support with a live chat function

- Grey release feature for on-the-go platform maintenance

- Integration with TradingView with comprehensive API tools

- Compatible on IOS and Android mobile apps

- 1 Click Coin Swaps

- 100,000 TPS per contract

- Allows leveraged trading and perpetual contracts

- Low margin trading fees

What is Bybit?

Bybit calls itself a “professional, smart, intuitive” online platform offering trading, mining, and staking functions in a transparent and efficient exchange environment. With 24/7 multilingual customer support and time-bound all-round assistance to retail and institutional investors all over the world, Bybit is counted among the most reliable exchanges for the emerging digital asset class.

Bybit platform

Interestingly, Bybit offers flexible strategies for all trading levels, though it has exclusively come to be associated with more experienced traders. The platform boasts of a growing suite of products, the top ones being:

- Spot trading for seamless purchase and sale of cryptocurrencies at the best available rates with Bybit’s special competitive market liquidity

- Derivatives trading for hedging, speculating or increasing leverage across perpetual and futures contract types

- An exclusive ByFi center for yielding the best out of a personalized gateway to a multitude of DeFi and staking products

With the unprecedented number and types of developments the crypto sphere has witnessed over the past two years, an innovative and dynamic platform like Bybit which is built on the premise of transformation is certainly making headlines. Giving all crypto lovers a one-stop destination for making it big in the crypto race, Bybit has truly opened the doors to ‘Next Level Trading”, just like it promises.

Bybit Origins

Bybit was co-founded by Ben Zhou in March 2018 soon after he realized the bright potential of crypto trading in the near future. Prior to launching the now successful crypto exchange, Zhou used to work in a forex brokerage firm XM as its General Manager in China.

Narrowing his focus down to the establishment of a crypto derivatives trading platform, Zhou assembled an A-team of investment banking and fintech professionals with prior experience in leading global companies like Alibaba, Tencent, Morgan Stanley, and so on. No wonder, Bybit is today a pool of talent in blockchain, forex, and fintech from all over the world, and this reflects in its strong foothold in the crypto market.

The vision of the founding partners was crisp and simple – innovating within the vertical to come up with a one-of-a-kind solution that fuses the best of cryptocurrency and traditional finance. Soon, an enterprising team of industry-leading technology developers and pioneering professionals from myriad industries came together to breathe life into this vision, and Bybit was formed.

Current Market Overview

Bybit is currently viewed in the market as one of the most user-friendly crypto trading platforms around. It has been specifically designed with a bottom-up approach and utilizes the best in-class infrastructure for ensuring the safes, fastest, fairest, and most transparent trading experience ever.

The simplicity of the platform is the biggest reason for its massive influx, with more than 3 million registered traders. As mentioned earlier, Bybit witnessed more than $1.7 trillion worth of crypto asset transactions over the last quarter.

Top Features of Bybit You Should Know About

Bybit trading features

Smart Trading System

Bybit describes its goal as achieving constant improvement and industrial revolution, and this is reflected in its exclusive smart trading system. The platform enables investors to set up take profit and stop loss at entry, besides offering them the option to receive strategy alerts and adjust their orders with a few clicks alone. No other crypto trading platform offers this level of intuitive trading experience to investors across spectrums and geographies.

Significant Market Depth

Market depth is a significant criterion for investors because it helps determine where the prices of securities might be headed, factoring volume, liquidity, and trading position. Bybit offers the best-in-class market depth to its investors, thus bringing to the table the assurance of minimal price impact for every trade executed on the platform.

HD Cold Wallet

One of the biggest concerns for digital asset holders is the security of their investments, as these processes are entirely digital. Wallets, after all, are nothing but digital files storing all your crypto holdings, and there have been cases of crypto wallet hackings.

Thankfully, Bybit offers an ultra-secure HD (Hierarchical Deterministic) cold wallet storage solution for cryptocurrencies, which comes with hierarchical private and public key pairs generated from seed praise. These wallets provide unmatched record-keeping, privacy, and security without the need to backup all your keys.

100K TPS Matching Engine

Matching engines are truly the beating hearts of a crypto exchange, storing all orders placed by users. With its ultra-fast 100K TPS matching engine, Bybit ensures a speed of 10,000 transactions per second on its platform. This, along with the shortest maintenance pauses and engine availability 24 hours a day, seven days a week, gives you a leg up on your competitors in the crypto trading field.

State-of-the-Art Pricing System

One of the best parts about using Bybit is the promise of fair liquidations, thanks to their dual-price mechanism. This special feature prevents traders from falling victim to market manipulations, which often lead to significant deviations of market prices on a futures exchange from the spot price, resulting in a mass liquidation of traders’ positions.

Powerful API – Market Data Pushed Every 20ms

Bybit’s powerful API helps traders conduct high-frequency trading with lightning-fast market updates. The Bybit Application Programming Interface can place and cancel active orders, check market data, manage accounts, and more.

99.99% System Functionality

Thanks to the grey release features and hot patches released on-the-fly for the Bybit platform, there are no server downtimes. Unlike other crypto trading platforms, Bybit ensures that users will always get access to the best deals, whether at the top or bottom of the chart, with premium user experience.

24/7 Customer Support

Another feature of the Bybit crypto trading platform that stands out of the crowd is its provision of round-the-clock, multilingual customer support for answering all your queries anytime, anywhere. Besides, the extensive help and learning resources section of the platform covers everything about Bybit in exhaustive detail.

Pros and Cons

- High Security: Multiple levels of authentication and supports cold wallet storage.

- Leverage: Up to 100x with a few selected cryptos, up to 50x with other cryptos.

- Variety of Products: Spot and margin trading, long/ short trade via the derivatives platform.

- Quick verification: It takes a few minutes for the registration and process.

- 24/ 7 Customer Support: Enables live chat or ticket raising for support.

- Low Charges: No fees for crypto deposits, low charges for withdrawals.

- Multiple Order Types: Enables limit, market, or conditional orders.

- Cryptos: Supports among the most popular 20 cryptos.

- Demo account: Testnet demo platform enables users to rehearse skills before real trading.

- Wide user base: High liquidity platform with over 2 million users worldwide.

- Attractive Referrals: $20 for every referral, referred users receive $20.

- Globally inclusive: Extends support in 13 languages.

- Limited spot trading pairs.

- You cannot deposit or withdraw fiat currencies. Nonetheless, Cryptos can be purchased by credit/ debit cards.

Some Basic Concepts

What is Crypto Derivatives Trading?

If you have ever wondered what keeps the global financial market going with secure supplies at low prices and credit making out of thin air, derivatives trading is the answer you were looking for. More flexible and easily manageable, derivatives trading involves traders signing a contract to trade an underlying asset at a specific date and price.

Understand a derivative as a contract between a seller and a buyer to trade an underlying asset at a specific price. Derivatives trading delivers value from a single primary underlying asset, and therefore often makes use of leverage to attain the best prices or profits. While futures contracts continue to be the most popular types of derivatives, forwards, perpetual swaps, and options are also widely used.

Bybit Crypto Derivative Trading

When it comes to the use of derivatives in crypto trading, however, the applications are wide and varied. From risk management or hedging to price speculation of assets without actual purchase, there are several perks of trading crypto derivatives.

It is a cost-efficient method of volatility protection against cryptos, besides a high liquidity granting mechanism for unprecedented diversification. Crypto trading has its own limitations as well, though, as it involves huge risks, regulatory concerns, and a lack of due diligence.

Margin Trading Explained

Margin trading can be understood as the concept of a trader borrowing funds from an exchange and using these funds to trade a financial asset. The flexibility and opportunity to score big through such investments, despite using low amounts of capital, make margin trading an enticing option for a large number of investors today.

Margin trading offers investors the ability to buy long and sell short, besides granting them the widespread use of leverage. No wonder, this type of trading attracts speculators, market makers, and arbitrageurs alike because their catering needs are instantly met with in this form of trading.

Bybit, for instance, offers a leverage ratio from 1x (regular) to 100x, which traders can adjust as per their preferences. Without having to put in huge capital, traders can actually make huge profits, though there is always a chance of significant losses too. Bybit adopts two margin systems to facilitate this type of trading – isolated margin and cross margin – which have been discussed in detail below.

Traders can easily switch between the two modes whenever they have an active position to their rescue. The only exception occurs when they are holding hedged positions of a USDT contract. Margin trading has its own benefits in the form of making significant gains while having traded only a small amount in reality. Besides, traders have the option of diversifying their portfolio of investments through a range of different positions now open.

One cannot deny the associated risks of margin trading, however. When the market goes awry, trades can be liquidated quickly, especially if you have a huge leverage at stake. This can happen unpredictably in the case of the already notorious crypto trading. Thankfully, Bybit comes with a stop-loss order feature for traders dealing with exactly this volatile side of cryptocurrencies.

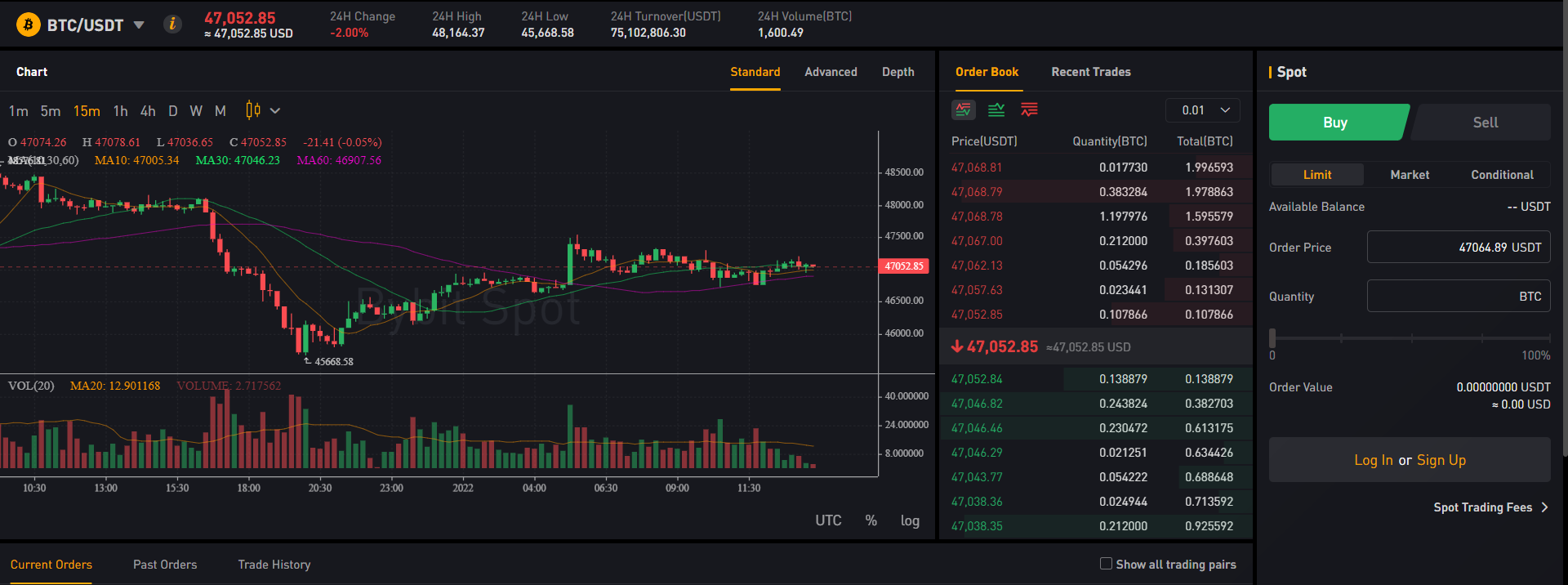

Spot Trading Explained

Crypto spot trading refers to the transaction between buyers and sellers of trading one cryptocurrency for another at the current market price. Bybit, for instance, provides spot trading between BTC and USDT, with the price of the trading pair representing how many USDT units are required to buy 1 BTC. Bybit charges a 0.1% trading fee from both Takers and Makers.

Bybit Spot Trading

In spot trading, traders must actually purchase the underlying assets until the value increases. In contrast, the crypto derivatives market does not require investors to actually own the crypto. Rather, the trading happens based on speculation of crypto market prices.

How does Bybit work?

Several trading products on Bybit

Features overview

Bybit effectively has no KYC process. You can open an account on Bybit with a phone number or an email address. You will have to use a third party app to buy crypto with fiat currency. Bybit offers margin and futures trading and facilitates up to 100x leverage.

You can leverage 100x on Bitcoin and 50x leverage on other currencies. It has a cold wallet storage for enhanced security. The withdrawals take place thrice a day. You can virtually make unlimited trades and withdrawals. Its grey release feature enables on-the-go platform maintenance.

This effectively reduces downtime, maintaining live trading round the clock. It has an outstanding customer support service that runs 24/ 7 with a live chat function. It offers seamless integration with TradingView, offering comprehensive API tools. Bybit carries out 100,000 TPS per contract, being 10 times faster than the industry average. This means that there is a very minimum scope of overload.

Its one-click coin swap feature allows users to swap between supported cryptocurrencies from their accounts without any hassle. The platform app is available on IOS and Android mobiles. Users can go for short-term insurance against losses. The wide range offered by Bybit ensures convenient trading experiences. As a derivatives trading platform, Bybit does not facilitate the physical transfer of Bitcoin between buyers and sellers.

Services offered

It facilitates three types of trading, namely, Spot Trading, Derivatives Trading and Decentralized Finance (DeFi).

- Spot trading: Spot trading facilitates trading of one crypto in exchange for another crypto at the existing price. ByBit’s spot trading provides three types of orders.

- Limit order

- Market order

- Conditional order

- Derivatives trading: Trading of derivative contracts whose values are determined on the basis of underlying assets. Traders speculate the prices of the assets and buy or sell the contracts as per their speculation.

- Margin/Leverage Trading: Allowing traders to borrow funds from the exchange up to a certain percentage to make the trade without depositing huge funds in their platform/wallet.

Ease of Use and Interface

(Score 9/ 10)

Bybit user-interface

Bybit’s interface is extremely user-friendly as compared to other crypto exchanges. Many feel that Bybit’s interface is inspired by Binance. Since Binance’s interface is known to be highly user-friendly, this is indeed good news. Users can swiftly choose between the dark mode and normal mode interface while using Bybit.

Bybit allows users to easily shuffle between wallets. It eases the process of account management, BTC, and ETH futures market, etc. While on the left side of the platform, you have the trading charts, the right side has the contract details, and the order book is located at the center of the platform. With a customizable and modular interface, Bybit makes use of Tradingview’s charting technology. Thus, managing positions as per ADL Ranking is hassle-free.

With 1,00,000 transactions per contract, Bybit has a robust order-matching engine. It thus minimizes fast order execution risks. Users feel connected to the Bybit platform unlike a lot of other exchanges in the market. It has a generous rewards program, offers 24/7 customer support, making trading experiences flexible and fair. Bybit is known to prioritize security and customer satisfaction and it has generated a huge base of content users.

Bybit also has a mobile app to help users trade while on the go. Available both on the iOS and Android systems, the app comes with uninterrupted trading functionalities. The experience of using the mobile app is similar to using it on a desktop.

Security

(Score 9/ 10)

Bybit has clearly focused on cybersecurity more than most other popular crypto exchanges. With many layers of security involved, it is considered the most safe and secured platform for traders. These security measures definitely prevent hackers from distorting the platform and thus ensure optimal protection to users and their funds. Following are the security features of Bybit-

-

Cold Wallet Storage

ByBit has a hardware wallet system that stores all of the users’ funds in cold storage. This ensures the safety of the storage from all kinds of cyber threats. Unlike many other exchanges that use online accessible crypto wallets (hot wallets), Bybit’s traders are given cold deposit addresses. Asset consolidation and withdrawals take place with offline signatures on Bybit.

-

Two-Factor Authentication

Bybit has two-factor authentication for added security and safety. There is a single authentication level for registrations, log-ins, and using the platform to buy cryptos. However, it is mandatory to set a combination of email/ SMS authentication and Google Authentication for withdrawing money, changing security settings, or resetting your password.

API management verification also makes Google Authentication compulsory. Bybit manually reviews withdrawal requests thrice a day. This provides added security from hackers. You can withdraw funds from your account once every eight hours.

-

Zero-Trust Architecture

This platform has a zero-trust architecture. As it uses an internal system for software lifecycle management, it has experienced cybersecurity consultants onboard for pen-testing. A reliable third-party security auditor scrutinizes duties and works allocation. All Bybit employees undergo strict background checks, required security training, and assessments to prevent any kind of internal threat.

-

White Hat Hackers’ partnership

Partnering with white hat hackers help Bybit to proactively identify potential cybersecurity loopholes. It also has bounty programs to reward loophole discoverers.

-

Additional Authentication Layers

If you use the Bybit mobile application, you can use another additional security feature. It allows you to activate pattern lock and fingerprint recognition. This helps in keeping the app secured and preventing unwanted access.

Taking all of these into consideration, it is safe to say that Bybit has gone out of the way to make sure that the platform is highly secured for traders. By carefully analyzing both external and internal risks, it has deployed the right mechanisms for enhanced safety. Hence, it ranks amongst the top when it comes to maintaining the highest security norms as per the industry standards.

Customer Support

(Score 9/10)

24*7 support:

Bybit has become very popular among its competitors because of its active 24/7 customer support service. It clearly stands out on this front as it is difficult to receive instant customer support on many other platforms.

-

Fast response

Customer service executives on Bybit respond quickly and they go out of the way to assist customers. Thousands of reviews on social media and other channels like YouTube have vouched for the fact that Bybit might be at the top when it comes to customer service.

-

Live chatbox

In many platforms, customers have to go through a ticket system while many others offer customer support only 5 days a week. Bybit has a 24/ 7 chatbox and users can initiate a conversation instantly by clicking on the chat box available on the right-hand bottom corner of the platform.

Leverage and Trading

(Score 9/10)

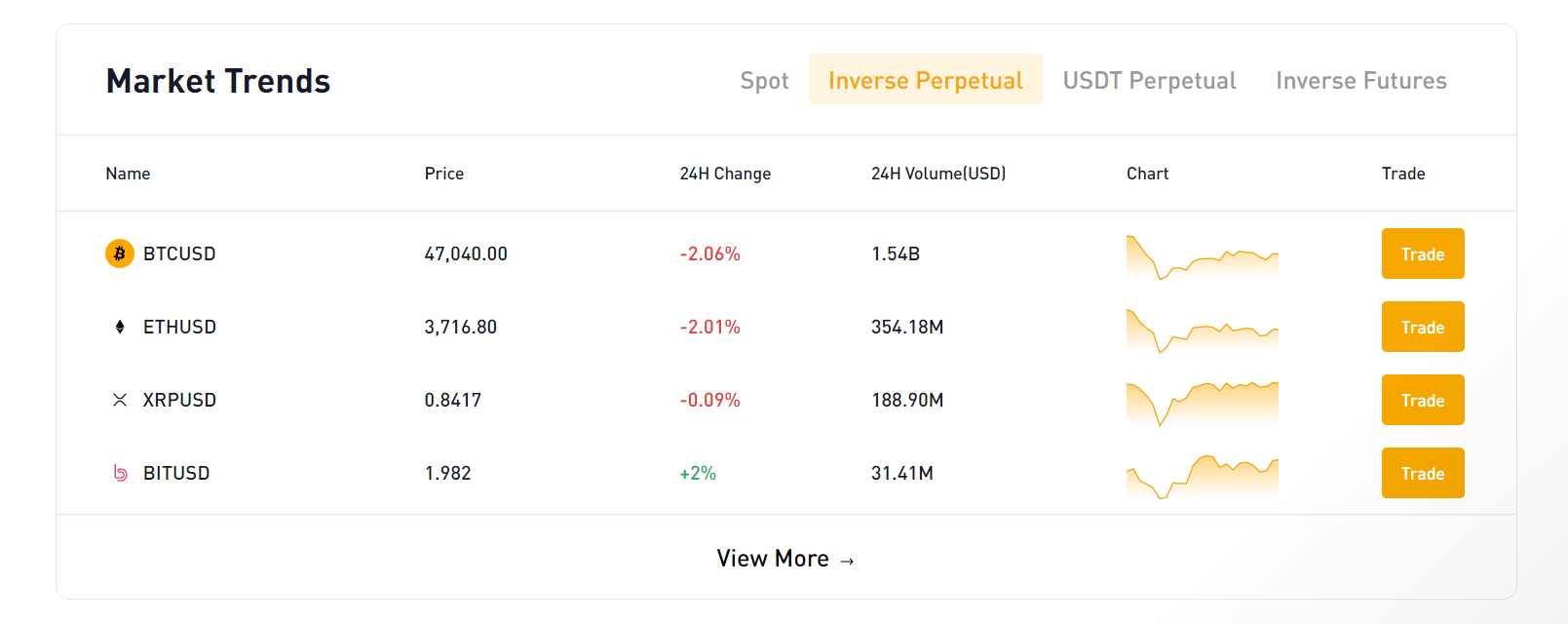

Bybit offers a range of different contracts that can be purchased on the platform, including Inverse Perpetual Contracts (BTC, ETH, EOS, or XRP-margined), USDT Perpetual Contracts (USDT (tether-margined), and Inverse Futures Contracts (BTC-margined).

-

Inverse Contracts

These contracts use the US dollar to confirm traded quantities and use cryptocurrencies like BTC, ETH, EOS, or XRP to determine values of margins, profits, and losses. Long position profits and losses can be calculated as Contract Value multiplied by the difference between 1/Entry Price and 1/Exit Price.

Depending on the type of contract you wish to trade, the choice of the base currency must be made accordingly. For instance, traders wanting to trade BTCUSD contracts must use BTC as base currencies, while those trading on ETHUSD contracts must hold ETH, and so on.

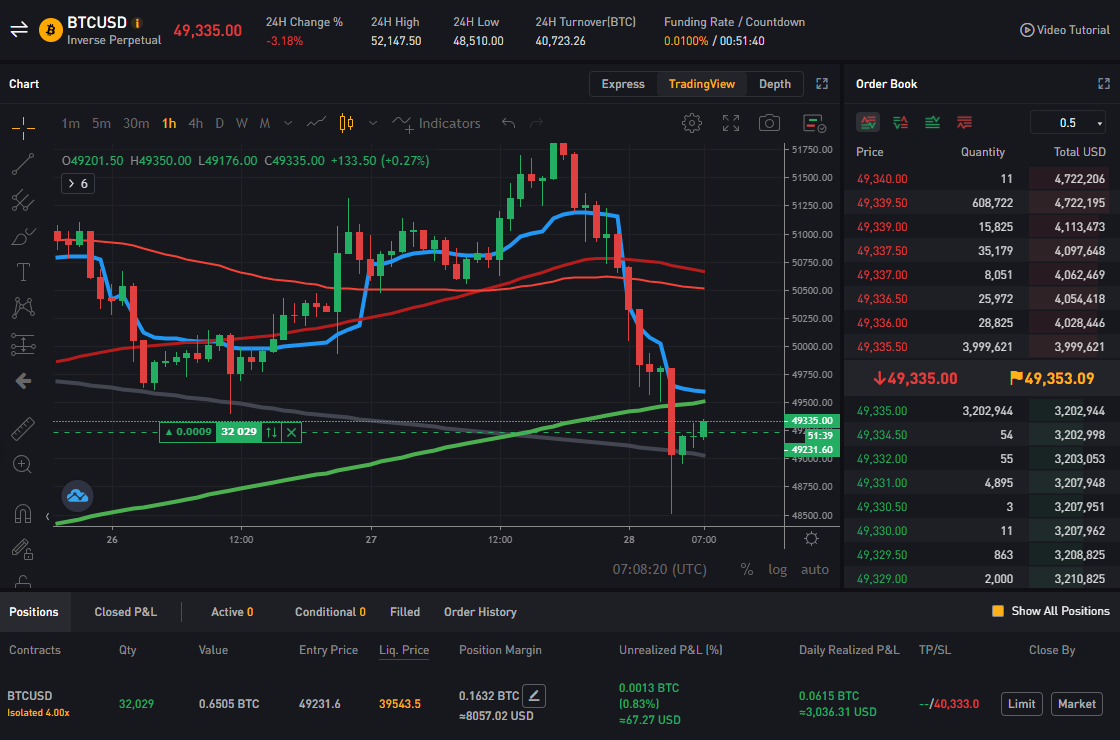

Bybit inverse contract

Interestingly, Bybit also comes with an Asset Exchange Function that allows traders to conveniently change their BTC assets into ETH instantly. Thus, even if you have BTC and not ETH on Bybit, you can simply use the Exchange function to facilitate trading on ETHUSD, and vice versa. This is applicable for all coins currently present on the Bybit platform.

While quoting of inverse perpetual contracts takes place in USD, all the profits and losses will be settled in the base currency. Each contract is valued at 1 USD, meaning that trades as low as 1 USD can be easily keyed on the platform. This makes it convenient for traders to monitor their exchanges and has been specifically designed for this purpose. Traders are given the option to set these quantities with 1 USD minimum units, and there is no need to manually enter Satoshis, the smallest unit of Bitcoins.

-

Perpetual and Futures Trading

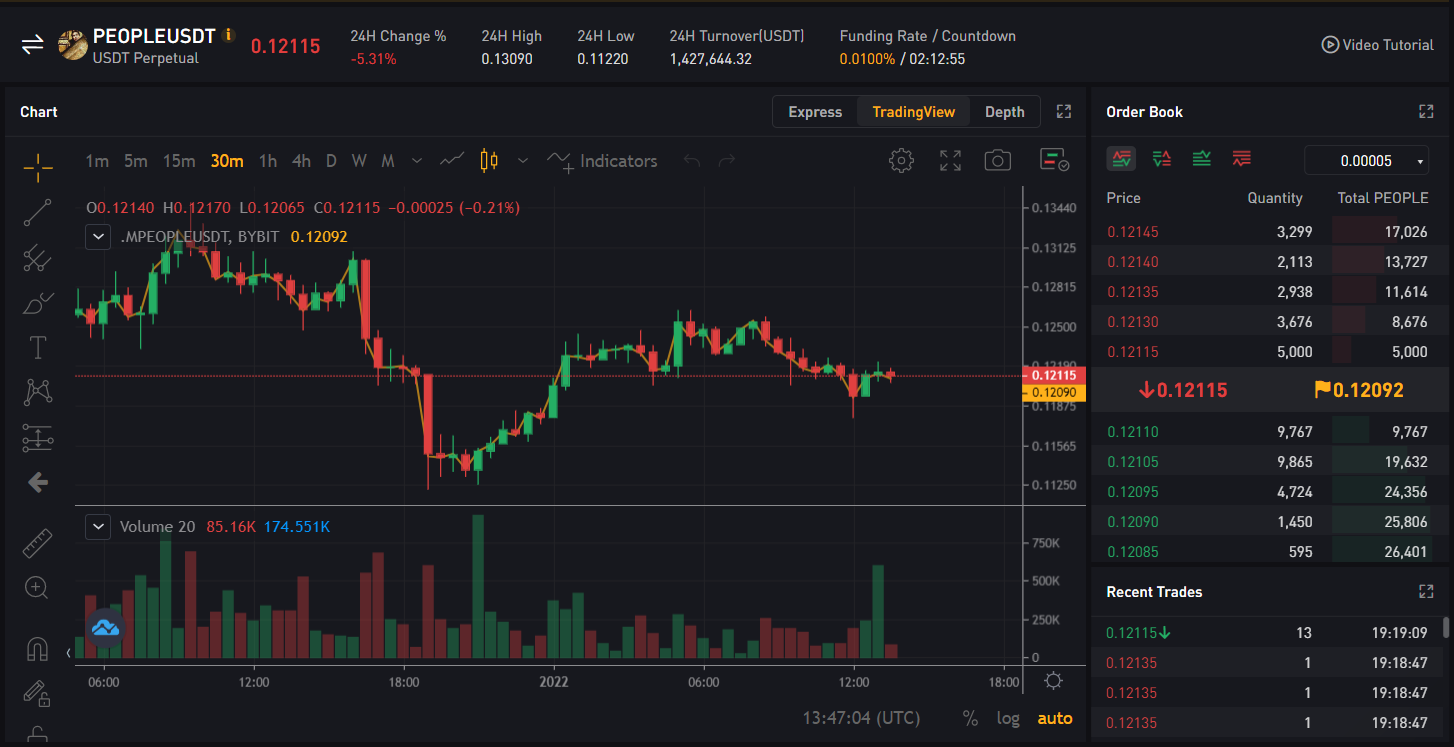

To understand perpetual and futures trading on Bybit, we first need to acquaint ourselves with their working concepts. Perpetual trading refers to trading when you enter a position without exchanging the underlying asset on the spot. This means that you can hold your position for as long as you want, seemingly perpetually, as long you have sufficient margins.

On the other hand, futures trading happens when you agree to buy or sell a contract’s underlying asset at a mutually agreed-upon price, but at a later date specified in the agreement. Therefore, perpetual trading and futures trading differ significantly in terms of settlement time and expiration date.

Perpetual trading has no expiration, to be precise. This brings for traders greater flexibility in terms of settlement price predictions or contract closing. Futures trading, on the contrary, locks you in a future price. The expiration will bring settling on the spot price whenever a future trading has taken place.

The USDT perpetual contracts, quoted and settled in USDT, come with the advantage of being a USD-pegged stable coin, providing a solid basis to its value. These coins are not subject to as much speculation as other crypto assets for the same reason. Though the USDT is also laced in controversies, it continues to attract investors due to its proven immunity to wide price fluctuations.

USDT perpetual contracts can be used for trading Bitcoin (BTC), Ethereum (ETH), Bitcoin Hash (BCH), Chainlink (LINK), Litecoin (LTC), Tezos (XTZ), Cardano (ADA), Polkadot (DOT), and Uniswap (UNI).

-

Leverage

The Bybit platform makes it possible to use leverage during trades, enabling you to use borrowed capital to trade more than the actual value of the assets you are currently holding in your crypto wallets. This leverage trading can be used to boost gains in case crypto prices go towards your predictions.

Similarly, you can also compound your losses if the price moves away from your analysis. Therefore, while blending together strategy and luck, Bybit offers you the option to make every trade potentially lucrative. Imagine buying 100 contracts to long BTC with a 3x leverage, which could simply triple your profits with soaring prices.

The leverage of your choice can also dictate your initial margins, thus maintaining transparency and honesty among investors. The maximum leverage on Bybit will go down in accordance with the escalation of contract value held. This means that the initial margin requirement changes come in a fixed increment at every specific contract value increase or decrease.

Bybit offers 100x leverage to traders, provided they put up a margin of 1% as the initial notional amount. The leverage can be adjusted after opening a position – a feature not available on most other crypto exchange platforms. The maintenance margin, however, is fixed at 0.5% for contracts irrespective of their size.

-

Margin

The maintenance margin, as stated above, is fixed for Bybit irrespective of contract size. This margin represents the minimum amount of collateral needed to have to continue holding a position. The maintenance margin rate usually follows the movement of the initial margin base rate.

Bybit offers more than one way to control profits and losses on the platform, besides risk exposure management. Tools like take profit and stop loss or hedging, besides being limited to USDT perpetual contracts alone, are not the only effective solutions at your disposal. You can also use isolated margin and cross margin to achieve the same objectives.

The isolated margin mode, for instance, allows you to place margins for an open position without lining your collateral to the rest of your account balance. This means there is just a single risk of liquidation involved. The leverage can be set up to 100x in this mode.

On the other hand, the cross-margin mode allows you to place 100% of the corresponding trade pair coin’s equity at stake. This helps reduce liquidation chances, but one needs to be careful to not take the available balance below the maintenance margin, or else you might end up losing it all.

Leverage can be adjusted manually in the cross-margin system, while Bybit itself gives you an effective value looking at the position and maximum amount you could lose. Combined with the dual price mechanism and promise of fair liquidation, these features make for one of the most secure and smooth trading experiences across all crypto exchanges.

- Types of Orders

There are three types of orders available on ByBit:

- Limit Order: This order type enables the investor to preset the price at which the order will be fulfilled. For a buy limit order, the order will take place only at the specified price or a lower price. Whereas for a sell order, the order will take place at the selected price or higher price. Hence, the investor gets a guaranteed price but not a guaranteed execution of the order. If the order is not fulfilled, the investor misses out on the trading opportunity.

Limit order can be submitted with three different time enforce options. Time enforce options enable the user to decide how long the order will remain active before it gets executed or expired.

- GTC- (Good-till-Cancelled) order remains fully effective until executed or cancelled by the user.

- IOC- (Immediate or Cancel)- These orders or a portion of them must be executed immediately at the limit price or better. Otherwise, the unfilled portion will be cancelled on its own.

- FOK (Fill-Or-Kill)- These orders must be filled entirely and immediately at the limit price or better. Otherwise, the whole order gets cancelled.

Let us understand this with the help of a simple example. The above screen highlights the maker rebate of 0.025% on the left hand side. When the investor uses limit orders, the fee is displayed as negative as in the case above, meaning the exchange pays the trader and not the reverse.

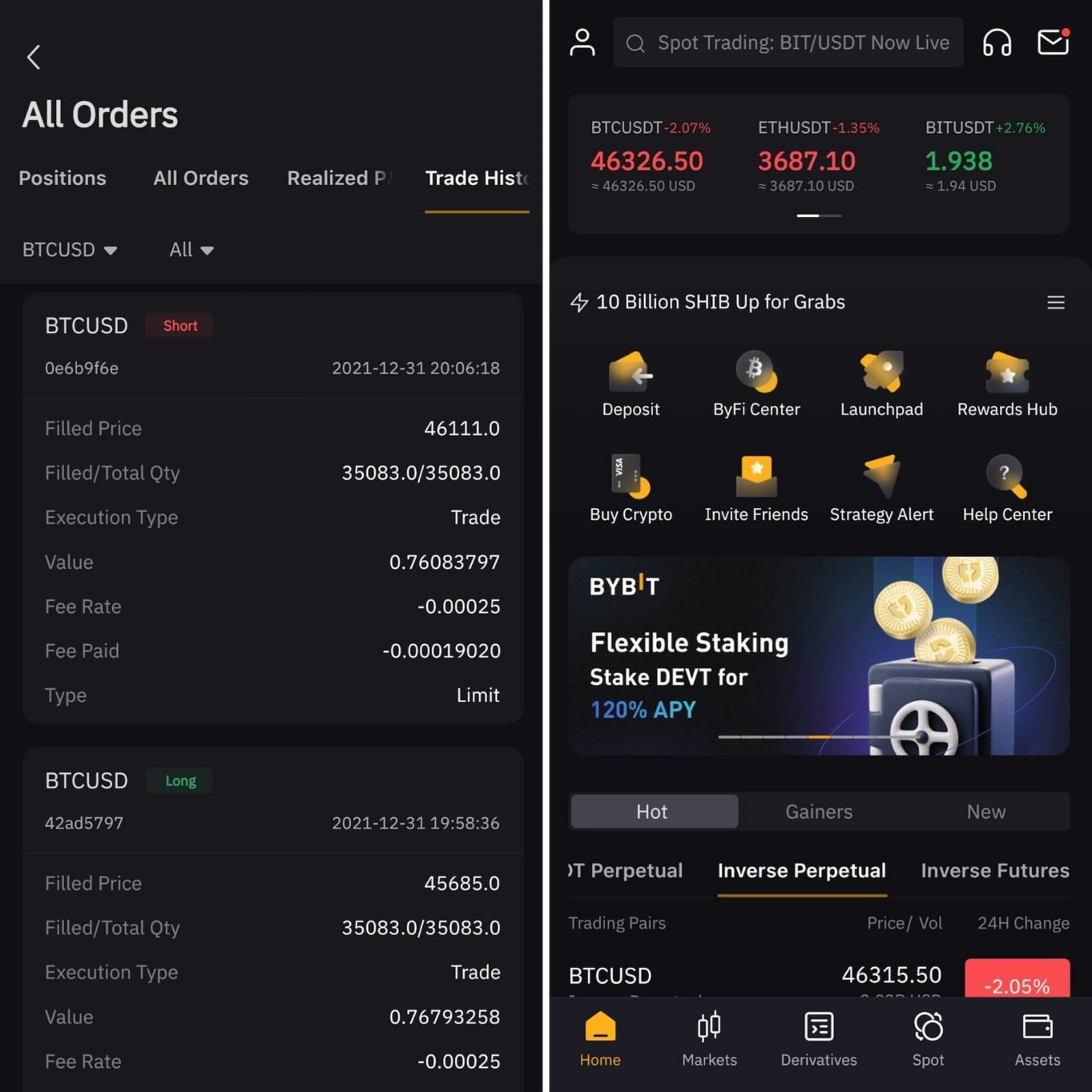

The preset Limit Order can result in adding up to hundreds of dollars over time, such as in this case, where the value has reached to about $20 for opening and closing the position on top of the actual profit. 35083 contracts, thus around 35,000 worth of virtual BTC, have been opened and closed with Limit Orders in this case.

The right hand side of the screen displays BIT/USDT values, which is the native token of Bybit, just like BNB for Binance. The staking coin DEVT also deserves a mention here, which is running at 120% APY.

- Market Order: Market orders are executed instantly. They take place at the best price available for buy or sell in the order book. The execution of these orders are guaranteed as opposed to limit orders. However, the price level may vary from your expected value.

- Conditional Order: These are advanced orders including one or more criteria for execution. Orders are submitted automatically once the specific criteria are met. These types of orders are commonly used in these scenarios:

- Stop Loss: Stop Loss instruction is used to close the existing positions and limit the losses to the minimum.

- Take Profit: This instruction is used to take the profit once the price reaches your expected target. Once the price reaches that level, the order gets executed and profit is earned. In this scenario, the investor misses out on the additional profit in case the price level goes beyond that price level.

- Stop Entry: This instruction is used to enter a long position when the price is on an uptrend. A conditional order can be submitted to enter the long position at the level where the price breaks its previous all-time high.

Deposits and Withdrawals

(Score 9/ 10)

Buying Crypto on Bybit

-

Deposits

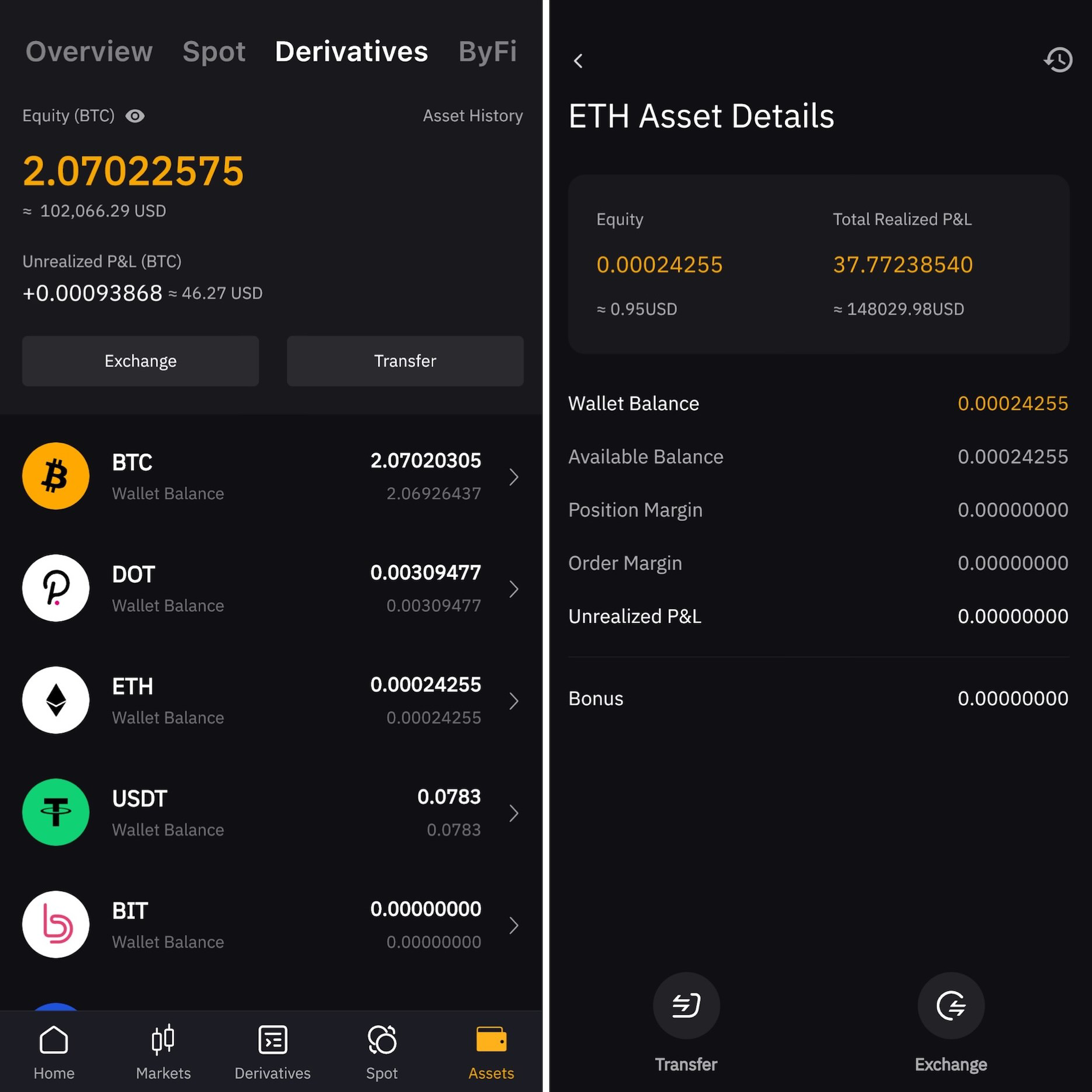

Bybit does not have any limit or fees while you deposit Bybit supported crypto. Users who have Bybit supported cryptos/coins can make a wallet-to-wallet transfer to Bybit and get their trading started.

- Go to the “Assets” page using the account dropdown menu.

- Click the “Deposit” icon.

- Select the preferred crypto/coin to deposit.

- Complete the deposit by scanning the QR Code or copying the existing external crypto wallet’s address

- Many users suggest that scanning the QR code is a better option as it ceases any potential error. It makes the transfer from private wallet to Bybit wallet safe and easy.

- For first-time deposits, in the case of deposits greater than or equal to 0.1 BTC within 48 hours, Bybit offers a $50 coupon. It offers a $10 coupon after 48 hours.

-

Withdrawals

Bybit enables users to withdraw cryptos by transferring from Bybit wallet to a compatible external wallet. The platform allows withdrawing funds up to 3 times per day with the timings being specific. This facility is different from many other platforms, which allow withdrawals once a day only.

Bybit facilitates withdrawals at 0800, 1600, 2400 UTC. The withdrawal request is successfully placed after Bybit confirms your request. The maximum time taken for this confirmation is 8 hours. To make withdrawals at the specific times mentioned, the request has to be placed before 30 minutes of the said timings otherwise the confirmation takes place at the next time cap. For instance, a withdrawal request after 1530 hours will be confirmed at 2400 instead of 1600.

To withdraw crypto on Bybit, simply-

- Go to the “Assets” page.

- Click on the crypto wallet “Withdraw” icon for the preferred withdrawal.

- Setting up 2FA is mandatory to make withdrawals.

- Select the address if the destination wallet address is added already.

- If the destination address is not added, click on “Add” for external wallet addresses.

- Click on the “Add” icon on your wallet address management page.

- Select the crypto, copy and paste your wallet address. Assign an address name and click on “confirm”.

- After adding wallet addresses, click on the “Withdraw” icon on the “Assets” page.

- Select the preferred address to transfer your crypto.

- Enter the withdrawal amount in crypto and click “Submit”.

To increase withdrawal limits, click on the “Increase Limit” just below the “Submit” icon. The completion of Basic Verification (Level 1) increases your withdrawal limit from 2 BTC to 50 BTC. You can increase the withdrawal limit to 100 BTC by completing the Residency Verification (Level 2).

Fees and Charges

(Score: 7/10)

Article detailing Bybit fee

There are several different types of fees you could encounter while using Bybit, and not all of them are the most affordable for beginners; they have been listed below.

-

Funding Fee

The exclusive funding mechanism of Bybit allows users to keep perpetual contract trading prices as close as possible to the spot prices. This means whatever the interplay between the two prices results in, the payment of the funding fee will come to depend on the same.

Let’s understand this better with a simple example. In case the trading price exceeds the spot price, long position holders are held responsible for paying funding fees to short position holders, which could end up attracting more traders to open short positions. The result? Trading prices get driven down.

Eventually, the excess of spot prices over trading prices would mean that short position holders pay the fee instead. This balanced cycle is characterized by funding fee payment every eight hours on the platform. The settlement times are 00:00 (UTC), 08:00 (UTC), and 16:00 (UTC). Funding rates for upcoming settlement schedules are determined by the spread between intervals.

-

Trading Fee

Along with the exclusive maker-taker model of Bybit, the platform issues maker rebates. Therefore, market makers are in charge of providing liquidity and enhancing market depth with their order, ending in rewards by Bybit in the form of rebates. On the other hand, market takers take some liquidity off the books, and will be responsible for bearing Bybit’s trading fees in return.

The trading fee value and market rebates are the same across currencies like BTC, ETH, USD, EOS USD, and XRP USD inverse perpetual contracts and BTCUSDT USDT perpetual contracts – 0.075% taker fees and -0.25% maker rebates. While they affect your account balance immediately, the initial margin remains unaffected by both rebates and taker fees.

-

Asset Exchange Fee

Bybit charges a constant asset exchange fee at a flat rate of 0.1%, no matter what the amount of crypto coin being dealt in.

-

Asset Recovery Handling Fee

As a helpful and unique measure facilitating traders, Bybit allows you to retrieve wrongly deposited unsupported cryptocurrencies easily. For this purpose, the platform may even return your coin to its originating crypto wallet, even convert it to USDT and credit your account with it. No matter what, you end up incurring a one-time handling fee of 20 USDT whenever the asset recovery is successful, and this is called the asset recovery handling fee.

This fee is also fixed across use cases, just like other Bybit fees. The company allows you to retrieve coins, however, only if they are worth the handling fee charged, that is 20 USDT.

-

Withdrawal Fee

Bybit pays a standard miner fee, therefore it is only obvious that it comes with a fixed withdrawal fee. This fee is charged irrespective of the amount of funds you extract from your crypto wallet. To be honest, the Bybit transfer fee is much higher compared to other crypto exchanges, and this becomes a cause for concern for beginners who have just stepped into the field.

Insurance Fund

(Score 8/10)

The Bybit Insurance fund aims at reducing the possibility of Auto-Deleveraging. By creating the insurance fund, Bybit uses the balance to cover up the gap in case a liquidated order is closed at a price worse than the bankrupt price. This essentially means that only an insufficiency in the Insurance Fund will trigger the Auto-Deleveraging.

An increase or decrease in the Insurance Fund depends on the difference in price between the final Liquidation Price and the Bankruptcy Price of each liquidated position. In such a scenario, either the market price is higher or lower than the bankruptcy price. Thereby-

- There is an increase in the Insurance Fund when the market price is better than the Bankruptcy Price at the time of the liquidation. In this case, the remains price adds to the Insurance Fund.

- The Insurance Fund covers the contract loss in case the final execution price is worse than the Bankruptcy Price.

Auto-Deleveraging System takes over the liquidation only when the Insurance Fund is insufficient to cover the gap between the final execution price and Bankruptcy Price. Daily Insurance Fund Balance helps Bybit users to track the current balance of the Insurance Fund.

Bybit Mutual Insurance

ByBit Mutual insurance is offered to users to take care of potential loss. It is an optional crypto risk management tool. If you hold perpetual contracts on Bybit, you can acquire the mutual insurance to protect any potential loss. Traders’ premium fee is credited Mutual Insurance Fund.

When users perpetual contract positions are insured and if they experience loss, with the Mutual Insurance Fund, they can receive compensation for their loss. Since the crypto market is highly volatile, insuring your perpetual contracts is recommended by experienced traders.

As the price of an asset is determined by a variety of factors, it is always a better idea to have alternative mechanisms that help you at junctures when your trades incur losses.

Referral/ Affiliate Program

Score (10/10)

Bybit review offers a few rewards for first-time deposits of the supported assets.

- “A Big Deal” coupon comes with a reward of $50. On first time deposits more than or equal to 0.1 BTC, 3 ETH, 11800 XRP, 1390 EOS, or 5000 USDT within 48 hours of singing up with the platform, users receive $50.

- If users deposit after the 48-hours window, they get a $10 Bybit welcome bonus upon meeting the minimum deposit requirement. The bonus is credit in the corresponding deposit coin.

- Users who follow the company on social media can also claim a $5 Bybit bonus with additional $5 if they deposit BTC.

Bybit offers giveaways, flash deals, and raffles for existing users. You can simply go to the Rewards Hub and the Latest Promotions page to know about these.

The Bybit’s referral program gives $20 to users for every new user they refer. The qualified referees get a $20 welcome bonus. A successful referral is when the referred user creates an account on Bybit with the referral code/ link, makes a deposit, and executes at least one BTCUSD inverse perpetual/ futures contract trade.

You can send QR code invitations to your prospective referees and ask them to can simply register on Bybit by using your referral code/ link. The bonuses can be used as a margin, to cover trading losses/ offset fees. Withdrawal bonuses is not possible, however, you derive profits by using them for your trades.

Bybit’s Referral Program

Bybit’s Affiliate Program lets you enjoy lifetime commissions on every new active user sign-up. Its two tire commission model helps you to earn substantially. It gives users 30% of the platform’s profits from the referral’s trades and 10% of the profits of the sub-affiliates (which is a referral turned into a Bybit Affiliate).

Bybit’s network is widespread with more than 11,000 content creators. The platform claim to have a much higher rate than industry standards and to have paid BTC 5,600 in commissions already. The process of being a Bybit affiliate is simple. When the platform confirms your affiliation, it gives you a unique referral link. You can share this with prospective referees.

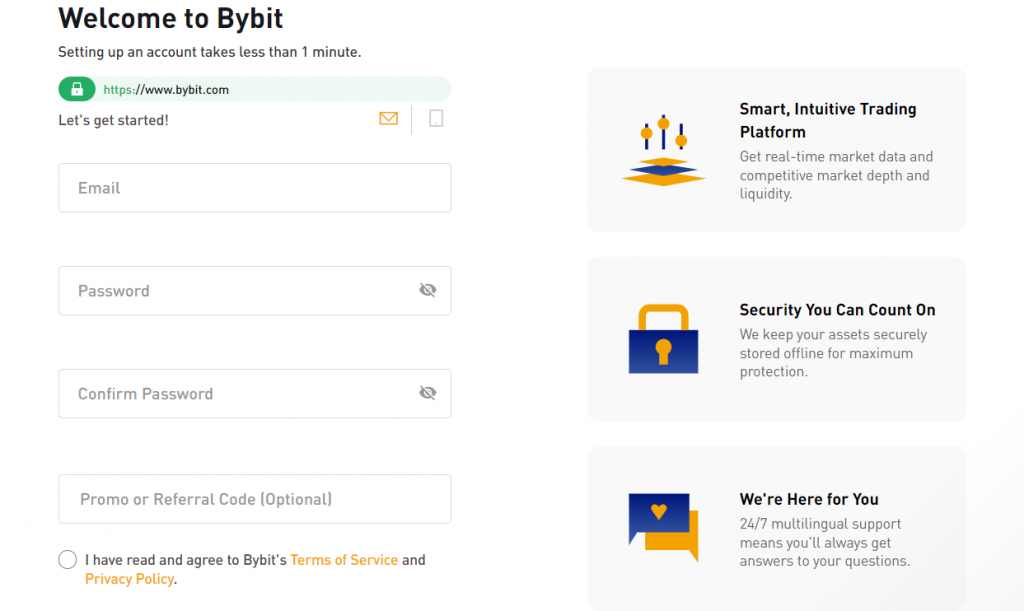

How to Open an Account on Bybit

For web users, head over to the Bybit homepage on the web. The registration box will be visible on the right side of the page. If you are on the Fiat Gateway page or any other page, then click “Sign Up” to enter the registration page.

In the Bybit’s app, to enter the registration page:

- Click on the icon in the lower right corner of the homepage, or

- Click on the icon in the upper left corner and select “Sign Up”

You can then choose to register by your email address or mobile number.

Sign Up by Email

To sign up by email, enter:

- Your Email address

- A strong password

- Referral code (optional)

- Carefully read and agree to the terms and privacy policy.

- Check that the information provided by you is correct, and click “Sign Up”.

- Complete the verification requirements in the verification page that appears.

- Enter the verification code sent to your email inbox.

- Click on “Complete Registration”.

Sign Up by Mobile

To sign up by mobile, select or enter:

- Country code

- Mobile number

- A strong password

- Referral code (optional)

- Carefully read and agree to the terms and privacy policy.

- Check that the information provided by you is correct, and click “Sign Up”.

- Complete the verification requirements in the verification page that appears.

- Enter the verification code sent to your mobile number.

- Click on “Complete Registration”.

Payment Methods on Bybit

There are two major Payment methods for trading in ByBit

- Transfer of Crypto/coins from other platforms

Coins can be transferred from other platforms to ByBit wallet provided the same are compatible in ByBit.

- Fiat currency:

You can also use the Fiat Gateway. It supports BTC, ETH, and USDT and 45 fiat currencies. These include the US dollar, the Euro, the Australian dollar, and the British pound.

You can make use of multiple payment options, which are facilitated by different third-party service providers. The options depend on the fiat currency you choose. You can scan through the fees and select the vendor accordingly.

Payment methods available are Electronic fund transfers, Visa/Mastercard credit, debit cards and cash deposits (limited to certain areas).

- Asset Exchange

You also have the option of Assets Exchange (which was earlier known as Coin Swap). It is a fantastic a tool to covert Bybit-supported crypto coin into others. Bybit does not have any minimum deposit. The purchase limit per order is $20– $15,000. Bybit charges a withdrawal fee and the two-factor authentication is mandatory for withdrawals.

Traders do not have to pay a two-way transfer miner fee. However, an exchange fee is charged on each conversion request. The fee is charged based on the amount involved in the conversion.

Some Special Features of Bybit

Bybit Calculator

The Bybit Calculator is a special tool that allows traders to use available account and position information, such as position margin, leverage, average prices of entry and exit, and contract quantities. This information is then used to calculate profits, losses, target price, and liquidation price. Traders thus get the benefit of a clearer picture of their trading goals, besides the facility of better management of their position.

The Bybit calculator is available on the top right corner of the Order Zone. Formula for calculating Profit and Loss, while excluding fees, is Quality of Contracts (1/entry piece – 1/exit piece). You can even calculate these values as percentages, measure the Return on Investment (ROI) as the ratio of return on assets to the initial margin used in the position.

Bybit Trading Bot

With cryptocurrencies trading round the clock, 365 days a year, it is biologically impossible for traders to keep one eye always on the market. However, considering the volatility and unpredictability of cryptocurrencies, leaving the market unmonitored could lead to several lost opportunities.

This is where trading bots come in, which are automated software designed to monitor, analyze, and implement trading activities. These bots are factored with predetermined inputs which their algorithms utilize for buying and selling crypto based on specific strategies. The entire process is automated, with algorithms like market making, trend following and mean-reversion programs playing integral roles.

There are several types of crypto trading bots available today, and Bybit’s counterpart is perfect for carrying out both simple and complex tasks alike. 3Commas has integrated with Bybit for this particular bot that can carry out crypto purchase and sale programmatically for you. Investors can even copy trading strategies from the best portfolios by linking their Bybit account to the 3Commas trading platform using relevant API keys for the purpose.

The best part about using the trading bot is that you longer have to spend hours and hours managing your portfolio – the bot does that for you. While being cost-effective at finding effective trades, bots will monitor countless trade pairs before market conditions change, which is impossible otherwise. No emotional judgments, high efficiency, and disciplined trading – that’s what you get out of Bybit’s trading bots.

Bybit Testnet

If you are one of those who want to test the platform before signing up, the Bybit Testnet is for you. This feature allows you to easily create demo accounts and check how orders work from start to finish. You can easily get demo coins for the purpose from the exclusive Testnet faucet, though these are limited at a release rate of 0.01 BTC per hour.

Investors can view trade details on the wireframe based on time intervals, along with short and long position attributes, unrealized profits, daily realized profits, stop loss, liquidation prices, entry position, and so on.

Bybit Mobile Application

The Bybit mobile application can be downloaded for both iOS and Android, the latter already having seem more than 100,000 downloads so far. The application has soon become a favorite among traders, and there are several reasons for the same.

Firstly, the Bybit mobile application is consistent with the platform’s overall ease of use and offers every function that its browser-based counterpart does. For instance, there are separate screens for contracts, price graphs, order books, recent trades information, order zones, wallets, and more. The application also provides multiple strategy alert options to traders, which can be customized along with other notifications.

Bybit App

You can also set alerts for sudden spikes and plunges in trading pair values if they cross a certain percentage within five minutes, thus always keeping you on the tab about unexpected market fluctuations. You can do the same with open interest changes as well. It is incredibly easy to set reminders about predicted funding rates half an hour prior to the settlement for trading pairs of your choice.

Having said that, the mobile application still lags behind in terms of precision of trading charts or simultaneously monitoring multiple positions. While it comes across as a safe resort when away from the desktop, the latter is still the more preferred interface for Bybit among traders.

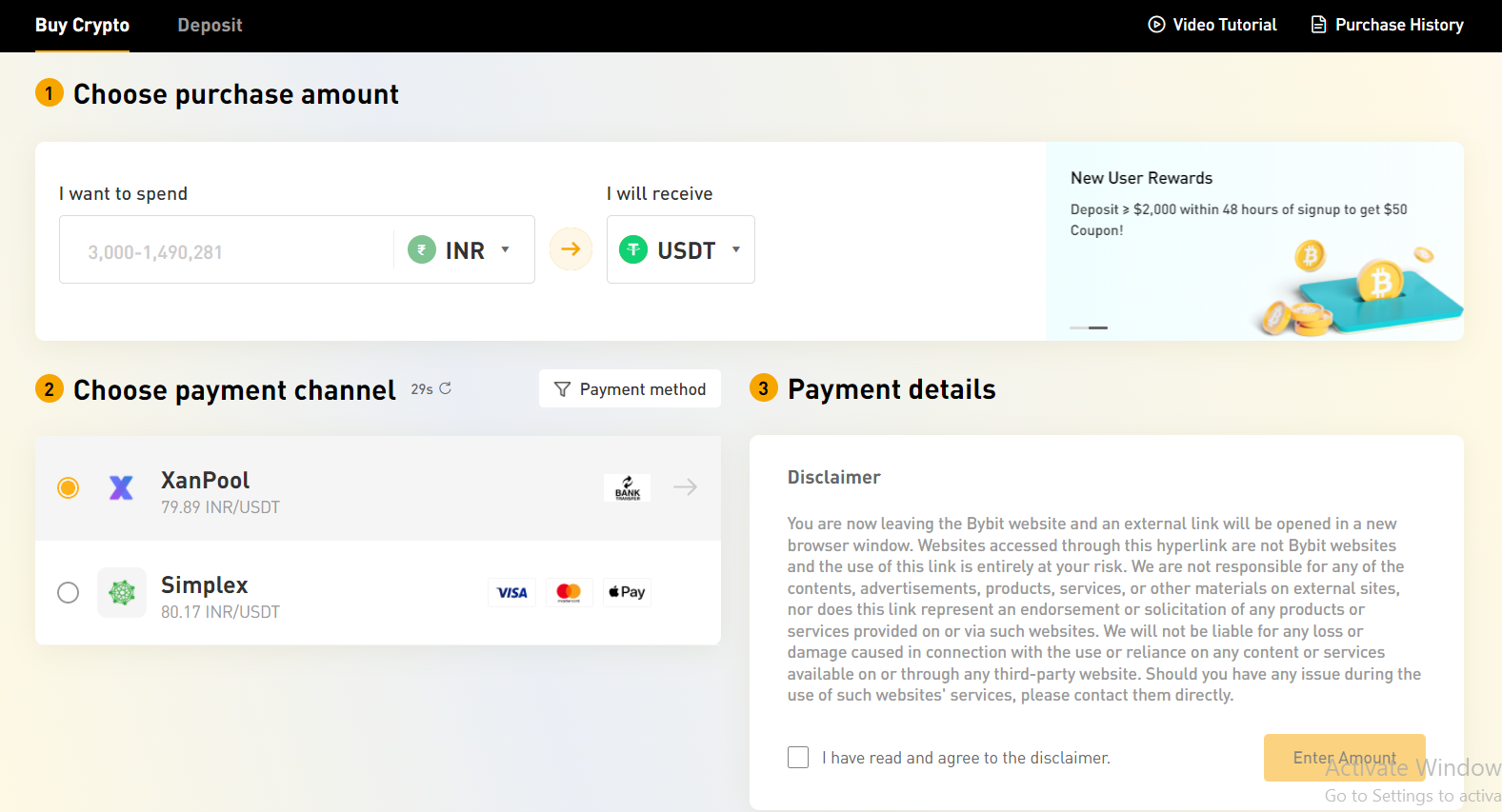

Fiat Gateway

The Bybit Fiat Gateway is your simplest solution to deposit fiat and convert it into BTC, USDT or ETH on the platform. All you have to do is enter the desired amount, followed by choosing the preferred service provider. Once the transaction is completed, you can proceed to checking your Balance on Bybit’s assets page.

To enter the Bybit Gateway deposit page, users must click on “Buy Crypto” on the left side of the navigation bar. Next, select the fiat currency you want to pay from the dropdown menu, check allowable purchase limits for each currency in the input box and select the cryptocurrency you would like to receive in your Bybit wallet address. Currently, the exchange supports only BTC, ETH, and USDT, so make your choice.

There are different providers for each of the corresponding cryptocurrencies you choose – for instance, buying BTC in USD comes with four providers – Mercuryo, Moonpay, Banxa, Simplex, Legend Trading and Paxful. The list appears in the form of a ranked list with the best exchange rate on top.

Once you have selected the service provider and taken a look at their exact exchange rate, click on the Continue button. Go through the information window pop-up in detail and then click on “Agree” to abide by their terms and conditions. Clicking on OK will take you to the official webpage of the provider you selected, and it is here that you have to complete the remaining steps for completing the conversion.

Why ByBit stands out of the crowd?

Rapid Trade Speed

A remarkable feature of Bybit that allows it to be ahead of various crypto exchanges is its phenomenal trade speed. Bybit facilitates 1,00,000 transactions per contract, which is 10 times quicker than the industry average. With a robust order-matching engine, it makes sure that there is a minimal chance of overload while trading. It can execute fast orders without potential risks.

Users thus enjoy a higher level of satisfaction as trading in the platform is quicker and convenient. Many other platforms do not offer such a solid mechanism. In this manner, trading with Bybit becomes less risky and flexible. The rapid trade speed is one feature that gives Bybit an edge over other competitors in the trading ecosystem.

Reliability

Bybit has a solid security mechanism and its features add to the safety of traders and funds on the platform. Its security framework involves multiple levels of authentication. This makes sure that your trading is secured and your funds are away from the access of potential hackers. It supports cold wallet storage, which makes it safer.

Although the platform is not regulated, it prioritizes security and takes the required safety measures. For withdrawals, two-factor authentication is a mandate. Thus, all of these make Bybit highly reliable.

Take Profit/ Stop Loss Orders Supported

Bybit supports Take Profit/ Stop Loss Orders, which helps the platform attract a lot of investors. The feature allows traders on Bybit to opt between the two trading preferences. According to the strategies they trade with, traders can pre-set a Take Profit/ Stop Loss when placing a Limit, Market or Conditional order.

They can change the Take Profit/ Stop Loss price before the execution of an order. This is another feature that helps Bybit stand out among other platforms, which do not offer the same.

Is Bybit Legitimate or Scam?

Like any other platform Bybit also has areas where it needs to improve. However, when it comes to the real concern of being a “legitimate platform,” it cannot be denied given the outstanding reviews provided by traders and investors on different online platforms.

Despite being an unregulated platform, it has put in place robust security mechanisms to provide highest level of security to traders and investors. As per ByBit Co-Founder’s recent interview, they have already obtained a license from Australia and are looking forward to obtaining licenses to operate in Portugal, France and Turkey. Bybit has attracted many investors with its interesting features and services offered.

Bybit recognition

The referral program is also better than many other platforms. With an incredible transaction speed of 100,000 TPS per contract, it reduces the risks of overload. Features such as up to 100x leverage and the multi-signature cold wallet storage make it a preferred platform as compared to its competitors. Not having a KYC process is a concern among regulators and it could include that to strengthen its reliability.

A solid regulation might help in enhancing its reputation and its legitimacy among traders. With the entire crypto market and exchanges undergoing tremendous transformations in terms of technology, it is good news that platforms like Bybit are looking forward to expanding their operations across countries and are seeking licenses from various jurisdictions.

Comparing Bybit with Top Exchanges

Etoro-ETH

Visit SiteDon’t invest in crypto assets unless you’re prepared to lose all the money you invest....

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

KuCoin

Visit SiteThe traded price of digital tokens can fluctuate greatly within a short period of time....

Bybit vs Binance

Binance is a more complex platform as compared to Bybit. Hence, it is generally popular among experienced traders. You can read our article on Top cryptocurrency exchanges too.

A brief distinction between Binance and ByBit based on certain important features:

- Basic features and services

Binance enables the buying, using, storing, and trading of crypto assets. You can buy crypto at spot prices and brokers margin trading with Binance. It enables leveraged tokens trading and futures contracts trading, buying/ selling assets to other users etc. Bybit allows spot and margin trading. It is relatively a newer platform. There are similarities between the two in terms of deposits and withdrawals. There are deposit limits on these platforms but they do have minimum order upon buying cryptos.

- Trading and withdrawal Fee

Binance and Bybit have the same withdrawal fee for BTC at 0.0005%. For ETH, Binance charges 0.005% whereas Bybit charges 0.01%.

Bybit trading fee is 0.075%. Binance has this rate only upon using BNB. For other trades, it has a fee of 0.1% per trade.

- Cryptos

Binance facilitates the purchase of 23 cryptocurrencies, including Binance Coin (its native crypto). Although Bybit provides wallets for five assets, use can use fiat money to buy only three among these.

- Regulation

Binance is regulated by FCA while ByBit is an unregulated platform.

- Ban on traders

The ban on traders across regions is higher in Binance than in Bybit. Hence, selecting the platform based on your region is essential. Both have good customer support and are extremely user-friendly platforms.

- Customer Support

ByBit’s customer support service is live 24*7 and can be simply approached through a live chat platform. For both minor and complex issues, the solutions are provided instantly to the traders.

Binance has a virtual chatbot that helps in resolving minor issues. However, in case of major issues, traders need to raise a ticket through their website.

- Security

ByBit has robust security features in place that include two-factor authentication process for signing in. Funds are stored in cold wallet to ensure additional security from cyber threats.

Binance also uses two-factor authentication process and has significantly improved their security measures since 2019 when they had a minor security issue. For storing funds, Binance makes use of a combination of hot and cold wallets.

Bybit vs eToro

A brief distinction between ByBit and eToro:

- Leverage trading

Bybit offers a crypto derivatives exchange up to 100x leverage on certain cryptos whereas eToro does not provide leverage trading.

- Regulation

eToro is regulated by Financial Conduct Authority (FCA), the ASIC (Australia), and CySEC (Cyprus). Regulation ensures safety and security to the traders and investors.

ByBit is not regulated. It has put in to place advanced security features to ensure the highest level of security.

- Trading analytics

Bybit comes with an in-built Tradingview that has outstanding indicators for traders. eToro comes with features like the social trading platform, Copy Trading, and CryptoPortfolio.

- Withdrawal and Deposit

Withdrawal fee at Bybit is 0.0005% for BTC, where in eToro it is $5. Bybit does not handle direct fiat deposits whereas on eToro, you can deposit through Paypal, Neteller, Skrill, and bank transfers.

- KYC requirement

Bybit effectively does not have a KYC process unless the trader wants to withdraw over 2BTC on a daily basis. eToro has a mandatory KYC process.

- Trading speed

The trade speed in Bybit is much higher than eToro.

- Trading Fee

ByBit charges 0.075% taker fees and offers -0.25% maker rebates.

EToro charges its trading fees through spreads. It charges one spread for both buying and selling crypto assets. The rate range from 0.75% for Bitcoin trades to 5% for trading Tezos. However, for most cryptocurrencies the rate ranges between 1.9% and 2.9%.

- Interface

Both have user-friendly interfaces that appeal to traders for seamless navigation and operations. They are available on desktop and on Android/ IOS mobile apps.

Conclusion

Our verdict after an in-depth Bybit review, looking at all the various aspects and features of the platform, has to be that it is certainly a game-changing and attractive crypto derivatives exchange. It becomes easy to surmise the unprecedented rise in Bybit’s popularity and its increasingly strong market position when one looks at its unmatched security, easy-to-use interactive interface, and all-round customer support in the first place.

With the variety of contracts and orders available on the platform and the provision of 100x leverage in margin trading, Bybit has become a sort of hub for any crypto veteran setting out to make big numbers. Added to this are the benefits of advanced security mechanisms, 24*7 active customer support, integration with TradingView platform with extensive analytic features, 1 click coin swaps, low margin trading fees, and compatibility across different operating systems and platforms.

The special features of Bybit such as its trading bots, fiat gateway and a user-friendly mobile app are exclusive to the crypto exchange, placing it clearly ahead of the league.

Having said that, Bybit also has some deficiencies, and the limited fiat-to-crypto conversion capability offered by the platform is one such example. However, there seems plenty of room to improve and grow as well. For instance, implementing a stricter KYC process could open up room for Bybit USA traders.

The platform provides unprecedented a transparent, trustworthy, and efficient trading experience backed by powerful technology. Our verdict: Bybit is all set to take over the crypto derivatives trading market soon enough, once some tweaks and corrections are in place. We also recommend eToro as its one of the most regulated crypto platforms.

FAQs

Is Bybit regulated?

No, Bybit is not regulated. It has recently received a license to operate in Australia and is seeking licenses from various other jurisdictions.

Does Bybit support fiat deposits?

No, Bybit does not process fiat deposits directly. These are processed by our Fiat Gateway partners, which include Banxa, XanPool, MoonPay, Mercuryo, E-check, Legend Trading and Simplex.

What are the supported fiat currency deposits?

Currently, the 59 fiat currencies supported include AUD, BGN, BRL, CAD, CHF, COP, CZK, DKK, DOP, EGP, EUR, GBP, HKD, HRK, IDR, ILS, INR, JOD, JPY, KES, KRW, KWD, LKR, MAD, MXN, MYR, NGN, NOK, NZD, OMR, PEN, PHP, PKR, PLN, RON, RUB, SEK, SGD, THB, TRY, TWD, UAH, USD, VND, ZAR, ARS, AZN, CLP, CRC, GEL, HUF, KZT, MDL, NAD, UYU, QAR, SAR, AED, and UZS.

Are there any transaction fees on purchasing crypto via Fiat Gateway?

It depends on the service providers you use. Most service providers charge a nominal transaction fees for crypto purchases. Get in touch with the concerned service provider to know more details.

Is KYC required on Bybit?

Bybit KYC verification is required if you want to withdraw more than 2 BTC per day.

Does Bybit charge any transaction fee?

No, Bybit does not charge any transaction fee.

Why is the final exchange rate different from the one reflected on the platform?

Bybit has indicative figures on the platform, which are based on the trader's last inquiry. For the final exchange rate, you may refer to our third-party providers’ website.

Does Bybit offer 100x leverage on BTC?

Yes, Bybit offers 100x leverage on BTC, enabling traders to trade more by using this feature.

Is the customer support on Bybit live?

Yes, Bybit has an active and live customer support service available 24/ 7 and can be accessed via live chat.

What is the trade speed on Bybit?

It has a rapid trade speed of 100,000 TPS per contract

How can I register on Bybit?

You can register on the platform by using it on the web or the mobile app by simply clicking on “Sign Up”. The registration process needs to be completed by using an email id or mobile number. The registration process is easy and takes just a few minutes.

What can we utlize bybit bonus?

Bybit bonuses can be used as margin, to cover trading losses and to offset trading fees prior to user's own capital.