What is CFD trading?

Contracts for difference (CFD) is a form of derivative that lets traders speculate on the price movements, up and down, of different fast-moving global money and commodity markets such as indices, forex, treasuries, and shares.

CFD trading, therefore, refers to a trading agreement between a broker and trader where they agree to mimic the live market conditions and settle the trade differences arising between the time of opening and closing a trade. As the name suggests, CFD trading involves entering into a contract with your broker where you exchange the difference in prices arising between the time of opening and closing a trade.

On this Page:

How does CFD Trading work?

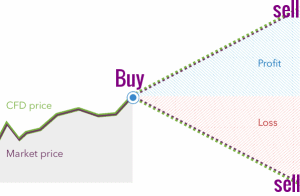

CFD trading involves taking up a position, often referred to as entering into a trade, by selecting the number of CFDs you are interested in trading and waiting for the market to go in your favor to enable you to realize profits. Your forecast and take profit position can involve the price going up or down.

And if your forecast and price action analyses show a higher probability of price going up, you click to buy, go long. The higher the price goes up in such a case, the larger your profits.

If on the other hand, you fail in your analyses or unexpected news and events change the course of the trade’s price action movement and it goes south, you will make a loss for every point it covers against your entry price.

The same principle applies to sell orders that you get into with the anticipation of a falling CFD price. If it performs as planned, you will gain for every point it falls below your entry price and vice-versa.

A CFD Trade Example:

For example, if you expect the price to buy Amazon stocks to go up, then you can enter into a trade by buying 5 CFDs at the price of $2030. If the shares really did go up and their market rose by 20 points to $2050, you would have made $100 (5*20=100). If on the other hand, the price of these shares fell by 20 points to $2010 by the time you liquidate the contract, you would have made a net loss of $100.

Similarities and difference between CFDs and traditional financial instruments exchange

Apart from the fact that you don’t get to own the financial instruments or that you can go long or short on any CFD asset, there are a host other differences between the two forms of trade. For instance, CFDs are subject to such factors as spreads, leverages, and margins.

One of the key similarities between the two forms of trade, however, is the fact that they both support hedging. They also don’t have time limits or expiry period for trades entered.

Factors affecting CFD trading

1. Spreads

A spread is the difference between the market Bid and Ask prices. When entering into a trade, you will have to pay the Ask price, and when closing your order get the bid price. Ideally, high-liquidity markets like forex are often associated with lower spreads while low liquidity markets have the highest spreads. Ideally, the higher the spreads the lower the profits.

2. Leverages

Leverage in CFD trading refers to the amount of loan capital that a broker is willing to advance you in order to facilitate your big trades. If you wished to buy $10,000 worth of Apple shares in the conventional securities market, you will be required to deposit $10,000 to the seller’s bank account.

When trading CFDs however you can make a similar purchase with just $100 in your trading account as your broker loans you the balance. Leverages are expressed in ratios such as 1:100 or 1:500, implying that for every dollar you deposit, your broker will multiply your deposit hundred or five hundred times.

3. Slippage and requotes

If you hope to enter into a trade at $10 but the markets moved up or down significantly by the time your broker receives your order, they may send a revised quotation, referred to as a requote, expressing their inability to enter into a trade at your desired price. Slippage, on the other hand, refers to the marginal difference between the price at which you wish to enter or exit a trade and the actual price at which the order hits the market. Slippage is more common than requotes and often in negligible amounts.

4. Hedging:

Hedging is the art of entering into two correlated trades with the hope that a profit in one offsets the losses in another. It is a risk management tool.

For instance, if you have 100 Facebook shares but fear that recent fines and privacy laws may affect their performance adversely, you can decide to short them with 100 CFDs Facebook shares. Should the Facebook shares perform dismally, you lose the value of actual shares but gain with your CFD trade.

What is the cost of trading CFDs?

Cost of trade refers to how much a trader has to pay to successfully execute a trade. It includes the actual cost of your desired financial instrument as well as the brokerage commissions and other non-trading fees and charges. They include:

What makes CFD trading popular with investors?

One of the factors influencing the establishment of the CFDs market was the need to eliminate such barriers to trading financial instruments as access to the market, legal bureaucracy, and minimum investment capital. Most of the brokers have therefore created trading accounts to suit these needs by eliminating minimum deposit amounts or maintaining them at affordable levels of $1, $5, or $10 for most standard and micro-accounts. While the CFD markets feature highly on the list of the largest global markets, there is no unified global regulatory body charged with overseeing their operations. This has not only encouraged the sprouting of scam CFD brokerage houses but also the continued operation of others of ill-repute. And given the significant role the broker plays in influencing the returns on your investment and the security of your deposits, it is imperative that you only trade with the best CFD brokers in the industry. How then do you identify reliable trader? 1. Ensure they are regulated Finance regulatory agencies scattered all around the world are charged with the responsibility of vetting the legitimacy and monitor the conduct of the different finance brokerage firms. These can enforce legitimate trading practices on CFD brokers operating within their jurisdiction. Do not register an account, provide personal details, or deposit funds with an unregistered and unregulated CFD broker. 2. Check their trading costs The last thing you need is a CFD broker that keeps shooting additional trading costs at your trades and profits. Note that while the spreads and commissions may seem friendly and competitive on the surface, some brokers are known to sneak in additional cost in the terms of conditions, taking advantage of the fact that most people never read through them. Go through these terms before signing up with a broker or committing your funds and identify possible hidden costs. 3. Vet their reputation CFD experts and traders who have interacted with different brokers are always voicing their opinions and concerns about a broker online. Go through the different independent and unbiased CFD brokerage review sites and use the reviews to gauge your preferred broker’s reputation. 5. Check the number of instruments listed A broker’s reliability should extend to their ability to provide their clients with a wide range of financial instruments to choose from. This ensures that you don’t end up settling for low liquidity and high spread markets due to the limited number of instruments and market access provided by the broker. 6. Open a demo account The surest way of gauging a CFD broker’s transparency and reliability is by opening a demo account with them. While you can’t use the demo to test their transparency in the computation of trading cost, it becomes handy in testing every other factor that makes a good broker. These include their order execution speeds, quality of customer service, gauge the average spreads for different markets, and practicability of such trading techniques as scalping.

Profits earned from CFD trades are considered an income and different countries treat these incomes differently.

The use of leverage funds isn’t mandatory in CFD trading. You don’t have to feel obliged to trade the leverage to its entirety for every trade.

Yes. It is possible to lose more than the deposited amounts with your account dipping into negative balances. This, however, will only occur when you either use a broker without stop-loss risk management features or negative balance protection.

Copy trading CFDs is a part of the larger social trading where beginner traders copy trade settings of profitable trades from more experienced traders and replicating them in their accounts, thereby scoring similar profits.

CFD trading presents you with some of the most flexible trading platforms free from regulatory bureaucracy and capital limitations that place the conventional markets out of the ordinary traders reach. Benefits of trading CFDs and not traditional markets also touch on fast capital liquidation and access to the markets from any part of the world on the mobile trading platforms.

CFD trading is highly versatile and can be traded on multiple platforms including MT4, MT5, ZuluTrade, cTrader, and WebTrader. These are also accessible on PC and mobile phones.

Risks and demerits of operating a CFD account

How much do you need to start CFD trading?

What to look for in a CFD trader

FAQs

Are profits from CFD trading taxable?

Must I use leverage when CFD trading and is it flexible?

Can I lose more than my deposits in CFD trading?

How does CFD copy trading work?

Why should I trade CFDs and not conventional markets?

Where can I trade?