The public interest in DAO tokens has grown recently with more and more people investing in DAO crypto projects. The concept of a DAO, which stands for decentralized autonomous organization, has a lot of benefits to offer.

First and foremost, it does not rely on a single person or a group of people to make the decisions on the direction of a project – there’s no centralized entity that can abandon a project or mismanage it. Instead, the investors have more autonomy and a say on the decisions the crypto project takes – anyone holding the DAO’s tokens can vote on changes.

In this guide, we will explain in depth what DAOs are and how they work, what benefits are on offer for those that invest in them, and review some of the best DAO crypto projects to invest in for 2024.

Best DAO Crypto Coins to Buy in September 2024

Below are the top DAO crypto projects and their native tokens to buy this year:

- Shiba Shootout – Leading DAO Meme Coin of 2024

- Uniswap – Leading DAO Coin in the DEX Industry

- ApeCoin – Popular DAO Coin Supporting Ape NFT Ecosystem

- Compound – Popular DAO Coin for Crypto Lending and Borrowing Platform

- SushiSwap – Attractive DEX Platform for Passive Income Earning

- Maker – DAO Coin for Managing the DAI Stablecoin

- AAVE – Excellent Long-term Investment DAO Coin

Best Exchange to Buy DAO Coins

DAO coins are extensively traded on brokerage platforms and cryptocurrency exchanges, many of which support various DAO tokens allowing you to build a decentralized portfolio – such as eToro.

Our top suggested broker to trade DAO coins is eToro which has recently launched a DAO Smart Portfolio tool for investing in and trading different kinds of DAO tokens.

Top Crypto DAO Projects to Invest In – Full Reviews

Below you will find the detailed description for each of the DAO coins that we included in our recommendation list.

Shiba Shootout – Leading DAO Meme Coin of 2024

Shiba Shootout might be a meme coin, but its narrative and unique imagery cleverly convey a bouquet of perks hidden underneath. One of its best features is Token Governance. This DAO aspect adds to its already extensive list of use cases.

A Shiba Inu donning a cowboy costume is seen on the homepage. Known as Marshal Shiba, he has a mission: to take his posse of Shiba Sharpshooters throughout the digital wild west and become a leading crypto asset on the market. On the road, they will encounter multiple cities but will stop at Shiba Gulch, a town of outlaws, with its unique saloon acting as a hub for players.

They will engage in gunfights, conveying the presence of a P2E game, share stories, referring to the community-driven aspect of the token, and decide the future of the town, a lore-specific way to talk about the decentralized autonomous organization.

Social attributes of this crypto project are numerous, making it a major crypto to be released within the DAO niche this year. With its simplified take on voting, this will likely attract beginners interested in participating in DAOs, potentially evolving the project into something else entirely.

Uniswap – Leading DAO Coin in the DEX Industry

Uniswap is one of the pioneers in the decentralized exchange industry that are aimed to upgrade the crypto exchanging experience and enable no third-party cryptocurrency transactions. Uniswap uses the Ethereum blockchain which means that it enables swapping between all the ERC-20 tokens. All the ERC-20 tokens can be listed on the Uniswap exchange through the technology known as Smart contracts.

But how are all the processes managed on the Uniswap exchange when there is not a middleman. Everything is done through Smart contracts. They bear certain trading information about swapping between two different coins. If an ERC-20 token is yet traded on the platform and you want to trade it, first you need to create its smart contract information which is quite simple. The fact that everything is done through the code reduces the role of the third party.

This system also helps to make the platform more secure, decrease transaction fees, and improve management processes. Uniswap also has a governance token called UNI which was distributed among users (400 UNI/ per user) who have used the Uniswap platform before September 1. The UniSwap project has a circulating supply of 700 million UNI tokens, and the maximum supply of UNI tokens is 1 billion. With its market cap worth more than $2 billion Uniswap is the largest DEX coin at the moment.

See our complete guide to buying UniSwap on eToro.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

ApeCoin – Popular DAO Coin Supporting Ape NFT Ecosystem

The APE token is the native coin of the ApeCoin decentralized autonomous organization which aims to contribute to the Ape ecosystem. It is a governance token for the ApeCoin DAO and the holders can play a role in the decision-making process. Additionally, APE is used within several games, platforms, and services that build the APE ecosystem.

Among APE’s most popular use cases is within the BAYC ecosystem, and it enables access to several products and services within the BAYC. BAYC stands for Bored Ape Yacht Club which is a leading NFT collection created by Yuga Labs in 2021. It introduces 10,000 NFT drawings of bored apes that are so popular that they were even traded for a million dollars apiece. The popularity of the BAYC NFT collection is due to the fact that the ecosystem attracted many celebrities, including Timbaland, Snoop Dog, Post Malone, Eminem, Paris Hilton, and many others.

Another famous use case of the APE token is that of the Benji Bananas game. Collecting APE tokens will enable you to get a passing ticket within the game. You can also use APE tokens to swap between in-game tokens, etc. APE has a maximum supply of 1 billion APE tokens and almost 30% of the tokens are in circulation. The current value of the token is $3.66 making it the#44 largest crypto asset by market cap.

See our full guide on how to buy ApeCoin on eToro.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

Compound – Popular DAO Coin for Crypto Lending and Borrowing Platform

Founded in 2017, Compound is an Ethereum-based platform that enables people to borrow and lend cryptocurrencies in the liquidity pools. It is a type of decentralized exchange that works through the principle of the automated market maker so users do not need any third-party involvement to borrow or lend cryptocurrencies.

As an AMM, Compound has two major parties in the whole process- borrowers and lenders. Lenders lock their assets in the liquidity pools which creates liquidity for the borrowers who can access those assets. By providing their tokens to the pool, lenders get incentivized cTokens that represent the assets they lock in the pool. Through those cTokens lenders get rewards for their services. Additionally, they can use the cTokens to withdraw their funds at any time.

Apart from cTokens, Compound also has its native token – COMP. The latter has various use cases within the ecosystem, including governance and staking chances. COMP is also used to reward people every time they interact with Compound’s platform. Lenders are also rewarded with COMP tokens when they lock their assets in the liquidity pools. COMP token is #108 by its market capitalization. It has a circulating supply of 7 million COMP tokens (10 million is the maximum supply) and is valued at $32.29 currently.

We also wrote a detailed guide on how to buy COMP.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

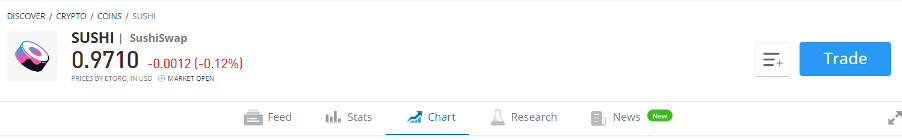

SushiSwap – Attractive DEX Platform for Passive Income Earning

Sushiswap is an AMM pretty much similar to Uniswap as it originated from Uniswap and is similarly based on the Ethereum blockchain. The project is currently in the process of being rebranded as Sushi. It is a decentralized exchange that was forked from Uniswap with an aim to create more earning ways and offer more DEX services.

Sushiswap enables swapping, earning, borrowing, yield farming, and staking several ERC-20 tokens. Additionally, the DEX offers multiple tools for earning and Sushi Bar is among those tools that enable SUSHI staking. By staking SUSHI tokens, users can earn 0.05% of all the swapping fees. SUSHI is the native token of the platform and acts as a governance token. SushiSwap has a total supply of 250 million SUSHI tokens, half of which are circulating already. It is the 153th largest cryptocurrency by market cap.

SUSHI is also listed on eToro and we wrote a guide on how to buy SUSHI.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

Maker – DAO Coin for Managing the DAI Stablecoin

Maker is one of the earliest Defi projects that was founded in 2015 by a group of people managed by Rune Christensen. The project consists of two components – Maker Protocol and Maker DAO both of which are based on the Ethereum blockchain. The Maker Protocol was created to manage the DAI coin which is a USD-pegged stablecoin meaning that the protocol is designed in a way to keep the DAI value equal to one USD.

Maker DAO is the body managing the protocol and it has a native governance token – MKR. The token is used to manage the changes on the Maker protocol and enable users to decide the ways DAI can be used. Users usually lock their cryptocurrencies in order to create DAI tokens and those holding MKR tokens can decide which cryptocurrencies can be locked to create DAI. Currently, the Maker protocol enables locking more than 10 crypto assets for generating DAI.

MKR is part of eToro’s DeFi coin portfolio and their DAO crypto project portfolio – see our guide on how to buy Maker.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

AAVE – Excellent Long-term Investment DAO Coin

As a decentralized cryptocurrency exchange system, the Aave protocol enables people to lend, borrow and earn interest on multiple crypto assets. Being an Ethereum-based project the Aave protocol works through the Smart Contracts meaning that it does not have a third party to manage the process.

The principle of the protocol is based on the lending pools where users can lock their funds or borrow crypto assets. Currently, Aave supports lending and borrowing almost 20 cryptocurrencies, including ETH, MANA, DAI, etc. To lend their funds in the lending pool, special aTokens are created which are given to the lenders so that the latter can generate rewards through the aTokens. The lending pools are used to give tokens to those who want to borrow them.

Along with the aTokens, Aave also issues AAVE token which is a utility token for the ecosystem and a governance system for the Aave DAO. The crypto asset is currently worth more than $810 million which makes it the $51 largest crypto project by market cap. The maximum supply of AAVE tokens is 16 million coins and almost 14 million tokens are already issued with each being traded at above $58.

AAVE is also part of eToro DeFi portfolio – see our guide on how to buy Aave on eToro.

Cryptocurrency is offered by eToro USA LLC (“the MSB”) (NMLS: 1769299) and is not FDIC or SIPC insured. Investing involves risk, and content is provided for educational purposes only, does not imply a recommendation, and is not a guarantee of future performance. [website domain name] is not an affiliate and may be compensated if you access certain products or services offered by the MSB.

How We Reviewed the Best DAO Coins to Invest in

When we recommend certain DAO coins to invest in 2024, we actually pick those coins after evaluating them through particular metrics. The latter is important to analyze in DAO projects if you want to invest in trustworthy projects that promise to bring you good returns in the future. Security is one of the essential features to consider when reviewing DAO coins. Before you invest in a DAO project make sure it is safe enough and offers reliable technology and an ecosystem that is hard to hack.

The next significant factor to take into account is its potential growth. You can understand this by conducting a market analysis of the coin you want to buy. By exploring its price history, demand and supply correlation, and other similar factors you can have a certain understanding of the future price movements of the project. But it is not enough for guessing the right signals. You need to add to this also the fundamental analyses of the coin.

Use cases are another good indicator if the project is worth investing in or not. The more and more significant use cases the coin has, the more demand it can generate. And if the coin gets popular and attracts several investments, its value will increase as a result of it. DAO coins usually have other use cases apart from being a tradable asset. Governing rights, staking opportunities, and yield farming, are some of the most popular use cases of DAO tokens.

Are DAO Coins a Good Investment?

Whether DAO coins are a good investment or not depends primarily on your investment goals and budget. DAO projects seem to be quite promising in the cryptocurrency market. They bring a new method of the decision-making process to the project. Recently DAO projects are getting more attention and are often purchased as long-term investments.

One of the best things with DAO tokens is that they are not just a means of trading but offer several other futures. By getting DAO tokens, holders have the right to take part in the decision-making process about the DAO. Most DAO projects also grant rewards to their holders. Additionally, DAO token holders can just stake them for generating rewards or use them for yield farming.

Still, before investing in any DAO project, you need to do your detailed research and make sure it won’t crash in the near future. You can take a look at the technology it offers, discover what plans the project wants to bring into reality in the future, what are the chances of winning the attention, what competition it will face in the future, and several other factors which can influence your final decision.

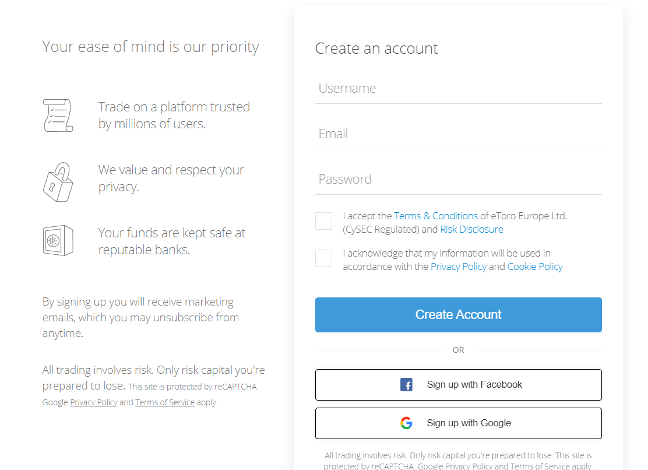

Where to Buy and Trade DAO coins?

One of the best methods to purchase or trade DAO coins is through brokerage platforms and cryptocurrency exchanges. But when looking for a good cryptocurrency broker to trade you may confront several of them. So, how to make the decision and make sure you have made a good choice. There are multiple things to consider when picking a good brokerage platform, including its safety mechanisms, privacy policy, regulations, prices, trading tools, etc.

Our team of specialists conducted comprehensive research and checked these functions with multiple brokers. As a result of it, we have chosen eToro as our most recommendable online broker to buy DAO coins. See our full eToro review.

In brief, eToro is a very safe platform empowered with top-notch mechanisms to protect your account from hackers.

When it comes to trading, eToro offers a cost-effective pricing structure with low spreads and commissions that differ depending on the volume and asset. As for the non-trading fees, eToro does not charge management fees either for having an account or for its social trading tools. There is also no deposit fee (only a small conversion fee is charged for non-USD transactions). A small withdrawal fee of $5 is taken every time you withdraw money from your exchange wallet.

The broker is also highly functional and offers a good selection of trading tools and varieties. It not only supports cryptocurrencies but several kinds of assets – stocks, and ETFs. eToro also stands out with the social trading platform it offers. You can have your personal account on this platform and communicate with different other traders. Its CopyPortfolio and CopyTrader tools enable you to mirror any portfolio in a couple of minutes.

If you’re interested in decentralized exchanges and their native tokens, also see our guide to the best DEX coins.

How to Buy DAO Coins Step by Step with eToro

If you are a newbie in the crypto market, you may be curious about how to buy DAO coins. This section will explain the step-by-step process with one of the leading online brokers – eToro.

Step 1. Register for an Online Account with eToro

Visit the eToro website and create a free account. On the registration window that will spring up on your screen, you must correctly fill in the details required by the broker. After providing the necessary information about your identity, you must verify your account through some steps.

The first two stages of verification are extremely simple – all you need to do is to provide an email and a phone number. The other two are identity and address verification which you can undergo through a passport, ID, or driver’s license, and through a bank document or a utility bill, respectively.

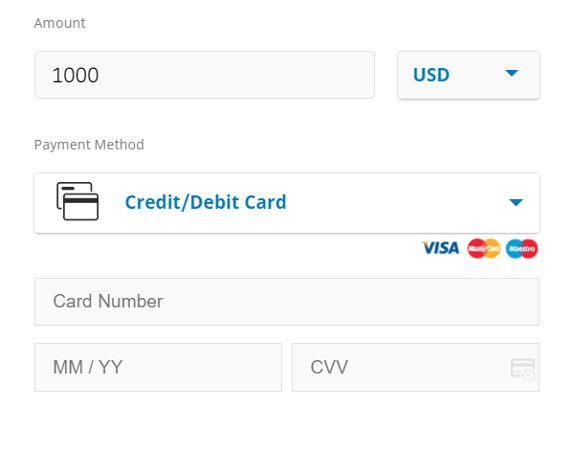

Step 2. Fund Your Account

Once you get done with the verification process, you can get to charge your account, which is a must to process a contract. For doing this, visit the deposit section of the website and click on the available payment method for you. After that, you need to register the information about your bank card, or e-wallet. Once you link your account with the payment method, you can fill in the amount of money you want to deposit and finish the transaction.

Step 3. Search for a DAO Coin

When you have a funded account, you can finally get to buying the DAO coins you want. In the upper part of eToro’s website, you will find the search toolbar where you need to type the DAO token name to find it on the platform. Alternatively, you can visit the cryptocurrency market of eToro and browse to find what DAO coins it supports buying.

Step 4. Buy DAO Coin

eToro not only enables you to buy the coin but also has separate pages dedicated to various coins. The pages will appear once you search the DAO coin name. Here you will be provided with multiple research tools, graphs, charts, and news to conduct research about the token before you invest in it. When you are ready, click on the “Trade” button and type the amount of DAO coin you want to invest in it. Check out once again if everything is filled out correctly and finalize the transaction to get the coins on your exchange account.

Where to Trade DAO coins?

If you want to trade some DAO coins and generate rewards from price movements, you will definitely need a suitable trading platform. Some of the most crucial things to pay attention to when selecting a brokerage platform are security, quick-to-operate platform, and trading fees. Below we have provided the list of the best brokers to trade DAO coins which have been chosen after a detailed analysis.

Conclusion

To conclude, DAO projects seem to be profitable investments both in the long term and in the short term. However, there are so many options when it comes to the selection process that it can be a challenging task to find the right DAO projects worth investing in. It means that you must carefully scan the market and pick up the ones that have a word to say in the industry.

It is also important to consider what platform to select for buying DAO coins. Our top recommended broker is eToro due to its beginner-friendly interface and competitive trading fees. Due to these features, it is a quick process to buy DAO coins through some simple steps.

Our pick for the best DAO project is Shiba Shootout token. This is because it shows the signs of being a successful memecoin.

Related

FAQs

What is a DAO coin?

DAO is an acronym that stands for Decentralised autonomous organization and the DAO coin is the native token of a certain DAO. These tokens are also known as governance tokens and give governing rights to the holders meaning they can take part in the decision-making.

What are the best DAO coins to buy right now?

Our top list above includes many of the most popular DAO coins to invest in, from ApeCoin to SushiSwap.

How do I buy DAO tokens?

To buy a DAO token you must register for an account with the broker of your choice and deposit money in it.

What can happen to a DAO coin that is listed on CEX?

DAO coins listed on the centralized cryptocurrency exchanges can lose or gain value depending on the demand for them and their token supply.

Should you invest in DAO crypto projects?

Investing in DAO tokens can grant you multiple benefits from voting powers to staking, to speculating on price movements. Meanwhile, you will need to consider your budget and invest only as much money as you can afford to lose.