The world is witnessing a huge change in the way we know and perceive money, thanks to blockchain and the decentralized finance (DeFi) revolution.

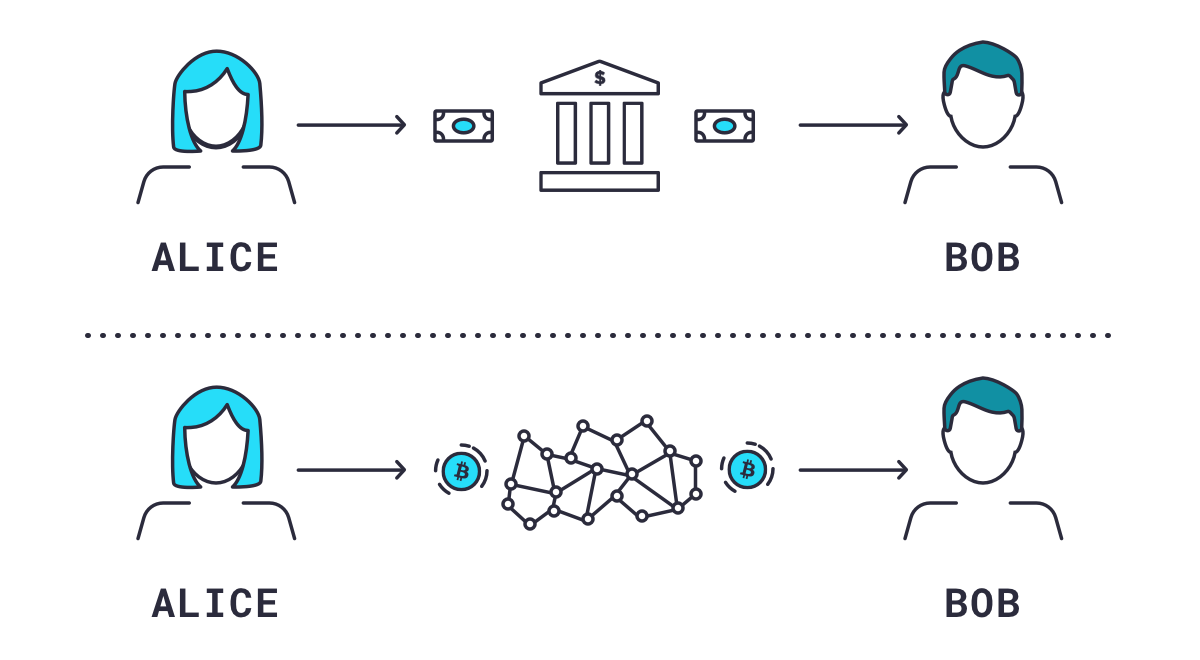

Put simply, DeFi refers to a digital financial exchange without any intermediaries between the customer and the financial service. It relies on the technology, transparency and truth of the blockchain.

Regardless of your financial goals in 2024, investing in decentralized finance over traditional financial assets can prove to be beneficial for more reasons than one. While the ‘decentralization’ factor in DeFi makes it universally accessible for all without geographic restrictions, it also brings greater transparency and security due to the underlying blockchain technology, thus preserving private personal and financial information of participants.

Read on as we explain the meaning of DeFi and discuss how you can invest in DeFi projects.

Best Platform to Invest in DeFi in September 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Investing in DeFi: A Quick Overview

DeFi is not just a new way to buy cryptocurrency, although you’ll find many DeFi tokens alongside cryptos like Bitcoin on the major crypto exchanges like eToro.

The use cases of DeFi have today expanded beyond simple lending and trading as the phenomenon becomes the best choice for those seeking investments in alternate, non-conventional channels.

What is Decentralized Finance?

As mentioned earlier, DeFi stands for Decentralized Finance, a name it has been given because of its underlying blockchain technology. Blockchains themselves are decentralized ledgers that store transactions without any involvement of central authorities, such as traditional banks.

The protocols, also called “smart contracts” built on blockchain transactions are also decentralized. These smart contracts are code-based agreements containing transaction details according to which people purchase, sell, lend, borrow, and trade cryptocurrencies without intermediary involvement. This makes transactions faster, more affordable, more transparent, and more accessible.

One such decentralized, open source blockchain is Ethereum, that comes with its own cryptocurrency Ether (or ETH). In terms of market capitalization, Ether comes only second to Bitcoin.

DeFi vs centralized finance

DeFi refers to the financial services technologies typically built on the Ethereum blockchain. In a way, we can say that that DeFi is the decentralized, blockchain-based version of traditional financial institutions like brokerages, banks, and exchanges. There are usually no minimum transaction amounts, no paperwork involved, complete transparency and auditability when it comes to DeFi transactions.

DeFi as a concept started shaping in 2013, with Mastercoin’s Initial Coin Offering where they applied a new mechanism of fundraising. By 2020, the world saw an unprecedented explosion in new centralized and decentralized financial protocols on Ethereum. Decentralized exchanges like Uniswap, interest rate protocols like Aave, lending protocols like MakerDAO, have emerged at the frontier.

The broad umbrella term DeFi encompasses a lot of different functionalities and applications void of any control by a single entity. The emerging financial technology secures investors’ money in a secure digital wallet instead of storing it with a bank. Funds can be transferred within minutes, if not seconds, that too without fees imposed by banks or financial companies.

Its user base has grown past 1 million and total value locked (TVL) has seen a 20x hike in 2020 alone. Investors all over the world are viewing DeFi as a means of diversifying their portfolio. The industry is quickly growing, and now is the right time for purchasing reputable DeFi tokens for accruing benefits over the long-term.

Your capital is at risk

Some of the Most Popular DeFi Applications Today

Stablecoins

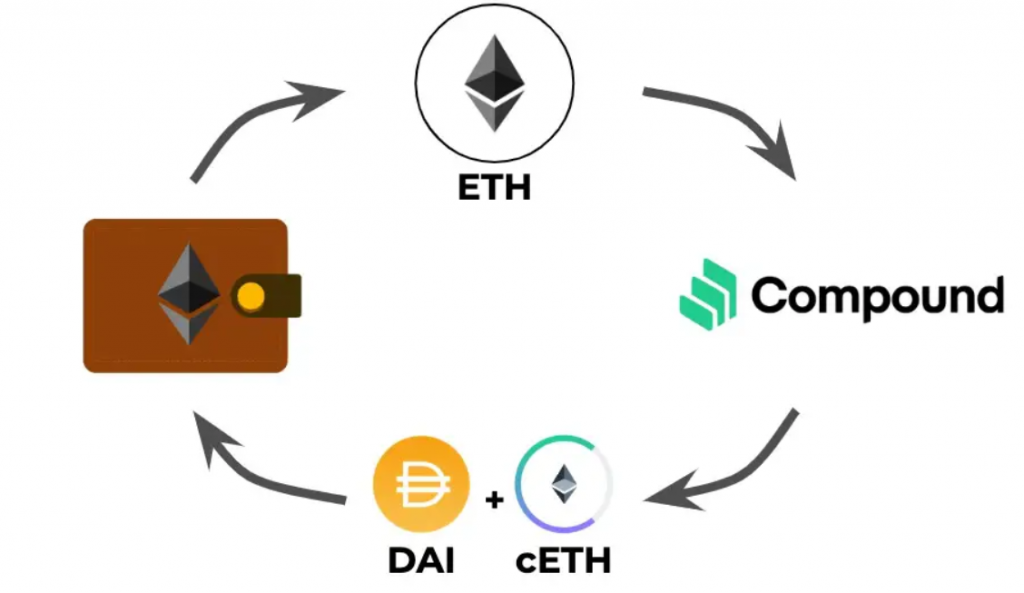

One of the earliest applications that DeFi dates back to is stablecoins – cryptocurrencies with stable values. Stablecoins much less volatile compared to conventional cryptocurrencies because they are usually pegged to fiat currencies or other stable values in finance.

For example, the stablecoin DAI issues by MakerDAO – an open-source project on the Ethereum blockchain – is pegged to the US Dollar while being collateralized by Ether. This maintains stability for DAI even though ETH is highly volatile and repetitively fluctuates.

Decentralized exchanges

Crypto exchanges like eToro and Coinbase act as centralized platforms bringing cryptocurrencies enabling buyers, sellers, borrowers, lenders and traders access to a wide variety of cryptocurrencies. Now, decentralized exchanges (DEX) like MDEX are coming up that use smart contracts to perform the same functions as centralized exchanges but with no central authority.

Put simply, users get to retain complete control over their crypto holdings without having to deposit them in wallets, which could be hacked. DEX users contributing to liquidity pools by supplying cryptos are often rewarded with portions of transaction fees as income.

Prediction markets

The prediction markets are what enable people to bet on the outcomes of certain events. DeFi prediction markets can offer better odds of winning by modifying the structures of bets. The associated fees are also lower, and market participants can bet on anything in unlimited amounts.

Prediction markets, as compared with standard sportsbooks, are much harder for central authorities to dismantle. DeFi prediction markets can provide value beyond increased access to gambling. Stock market predictions weighted by the size of the bets behind them are often fairly accurate.

What You Need to Get Started with DeFi?

DeFi investing is simple, universal and highly accessible. There are several ways to start investing in DeFi, the simplest of them being to buy a DeFi-powered coin or cryptocurrency.

If you’re wondering how to invest in DeFi and the tools you need, here’s what will get you started:

Open a Crypto Wallet

Crypto wallets are digital entities where users store their private keys or passwords to access the crypto coins they hold. A wallet can enable you to send and receive cryptocurrencies like Bitcoin and Ethereum. Your DeFi wallet gives you complete ownership over your assets, in sharp contrast to a traditional bank which retains control over them.

Most DeFi wallets today operate as Web 3.0 wallets compatible with the Ethereum blockchain, though this may differ from one wallet to another. DeFi wallets also operate with a non-custodial background, meaning only the owner will have access to funds. This makes them one of the safest solutions for storing crypto assets today.

eToro Wallet

To start investing in DeFi, the first step is to prepare a wallet of your own. It is recommended to pick only from the best wallets that provide access to exchanges for trading DeFi coins and DeFi protocols for participating.

Also make sure to pick a wallet where processes are streamlined to help users with concerns about the time, energy, and cost to use solutions. Most wallets can be downloaded as mobile apps or used as browser extensions, besides offering dedicated services through websites.

The key steps for preparing your wallet are:

- Download (or open in browser) the wallet of your choice

- Choose a wallet username/address that other users can send crypto to. Your username can remain private to you.

- Securely store the 12-word random recovery phrase you are given when you create a new self-custody wallet, preferable on a piece of paper. Do not share it with anyone. Do not lose it or you will lose access to your wallet forever.

- Go through the Ethereum network fee structure in detail.

- Proceed to purchasing ETH coins.

Your capital is at risk

Buy Crypto

DeFi can be purchased with another cryptocurrency on decentralized exchanges. Most DeFi protocols currently are built on Ethereum, so we would recommend you to first purchase Ethereum (ETH) and then use it to buy DeFi. To do this, you must create an account on a top crypto platform like FCA regulated eToro.com, if you haven’t already.

Verify your account as per the exchange’s requirements after the sign up.

Next, connect a suitable payment method for purchasing cryptocurrencies. Most crypto exchanges enable payments from bank accounts, debit/credit cards, wire transfers, and so on.

Now head over to the list of crypto options, select Ethereum (ETH) and hit ‘Buy’. You will be asked to input the amount you want to spend in your local currency, which will then automatically be converted into the equivalent ETH amount. You can preview the purchase before finalizing it and recheck all the details. Confirm your purchase and that’s it – you have successfully bought Ethereum.

What are DeFi Protocols?

A DeFi protocol, as mentioned earlier, uses open-source computer code called smart contracts running on the blockchain network. DeFi protocol users can communicate with smart contracts using DeFi wallets for purchasing, transferring, borrowing or lending crypto funds, participating in liquidity pools, engage in yield farming and access other services provided by the DeFi.

The last two years have seen significant growth of the best DeFi protocols with the total value locked in DeFi assets crossing the $12 billion mark. These autonomous programs have been tailored for complex financial ecosystems, offering liquidity and ensuring interoperability.

Some of the notable DeFi protocols to have gained the most popularity include Aave, yEarn, Synthetix, Compund, Uniswap, Curve, and Maker. Once you have chosen the DeFi protocol, head over to its website or app, connect your wallet to enable access to crypto coins, and follow the instructions mentioned on the protocol to start trading, yield farming, and so on.

Keep Tabs on your DeFi Investment

While the technicalities of starting a DeFi investment portfolio have already been achieved in the previous step, the most important step that cannot be missed is tracking your investments on the chosen platform.

You can do this directly from the protocol, if it has the facility, or take help of an online portfolio tracker for monitoring DeFi assets from the same dashboard as your assets.

Alternative: Buy DeFi Coins Directly

Decentralized exchanges (DEX) such as Pancakeswap and MDEX allow users to directly purchase DeFi without the involvement of a central agency or the need for wallets, like mentioned above.

A relatively new concept, DEX is enabling decentralization in buying, selling, trading and investments in DeFi by removing the intermediate centralized exchange that is otherwise facilitating the above in the current climate.

In doing so, these peer-to-peer marketplaces are helping eliminate possibilities of hacking. There can be various types of DEXs – on-chain and off-chain order books, automated market makers (AMMs) and more. Chiefly, DEXs are lauded for the enhanced privacy, stronger security and greater control that they offer to digital asset owners.

Best DeFi Projects to Invest In

With the interest around DeFi and smart contracts growing significantly, several companies have already started investing heavily in the field. Below is a list of some of the best DeFi projects so far that you can choose to invest in. The inclusions here have grown a solid user base besides going through numerous rounds of successful funding. Also see our longer review of the best DeFi coins.

Lucky Block

Lucky Block is a up and coming UK based decentralized crypto lottery project. It aims to create a worldwide lottery format not bound to any geographical area, traditional financial institutions or local governments.

It launched on Pancakeswap DEX on Jan 26th 2022 and its native token LBLOCK has achieved a return on investment of over 40x for investors so far, making it one of the best new cryptos to buy in 2022, and overall an interesting DeFi project to follow as many UK investors are growing disillusioned with the traditional National Lottery format, an industry valued at over £80 billion.

Find the latest updates on the official website LuckyBlock.com.

Your capital is at risk

Aave

Initiated in 2017 under the name ETHLend, Aave is one of the first few DeFi platforms in the market. The decentralized liquidity platform enables borrowing of assets and earning rewards on deposits.

Lenders and borrowers come together on the decentralized marketplace with an underlying equal opportunity lending system in place. Staking AAVE tokens on the dedicated DeFi platform is yet another source of earnings for investors.

Your capital is at risk

Alpha Finance Lab

Alpha Finance Lab is already considered a DeFi giant, providing a cross-chain DeFi platform that supports numerous blockchains and decentralized applications.

Several new projects are currently in the pipeline on Alpha Finance Lab, including Alpha Hamora for yield farming. The platform has its native ALPHA token instead of third-party tokens, which enhances its in-house security further.

Cardano

One of the world’s largest blockchain projects, Cardano or the “Green Blockchain” stands out of the crowd because of its ready provisions such as energy use reports and proof of stake protocol.

The platform has recently announced an investment of a massive $100 million in DeFi, NFTs and blockchain education, alongside plans for a Metaverse – a virtual world built on the Cardano blockchain.

Your capital is at risk

Polkadot

Polkadot (DOT) is known specially for its trustless ecosystem via the in-house relay chain, which makes Polkadot and the projects built on it faster and easily scalable. The platform has emerged as a strong foundation for DeFi projects to build upon and is steering the growth of the entire industry as of now.

Your capital is at risk

Polygon

One of the most renowned and rapidly growing Ethereum Layer-2 scaling solution and decentralized application ecosystem, Polygon is known for features like interoperability, scalability and security.

Most of the world’s best DeFi projects are currently housed on the Ethereum blockchain, and Polygon offers new traffic lanes to this Ethereum Layer 1 channel with its Ethereum Layer 2. In this way, Polygon is enabling clearing up of Ethereum for faster speeds and wider benefits.

Your capital is at risk

Solana

The proof of history concept of Solana is of particular note, which is helping revolutionize consensus mechanisms. Users no longer need to mine or stake on the platform to validate transactions, because all of them are proven true by a time stamp on the blockchain. Solana is a Layer 1 platform just like Ethereum, and does not need another platform’s support for transactions.

Your capital is at risk

Uniswap

The decentralized exchange (DEX) allows investors to buy crypto and contribute directly to its liquidity, thus enabling robust traffic and faster trading. Uniswap is quite popular in DeFi circles and its native token UNI can be found on other investment platforms as well.

Now that you know about the hottest DeFi projects to invest in at the moment, let us move on towards discussing the best investment strategies when talking DeFi.

Your capital is at risk

DeFi Investment Strategy

There are a few key strategies to choose from when investing in DeFi, depending on your risk tolerance and expected outcomes.

Depositing DeFi Coins

Depositing crypto with a trusted DeFi lending platform directly will help you earn interest on your holdings, the value of which depends on how much and how long you have invested for. Interest rates on DeFi deposits could be either fixed or variable depending on market conditions.

Borrowing and Lending

Investors must only provide collaterals when borrowing or lending crypto assets in DeFi. There are no credit checks like traditional banks for loan approvals. Instead, a smart contract acts as an automatic digital intermediary setting rates based on the coins available in the liquidity pool. Lenders supplying tokens to this pool can expect profits via the interest rate.

The borrower, on the other hand, must provide a collateral worth more than the actual loan. Interest rates can be extremely favorable. For example, while the average savings rate offered by US banks is only 0.09% per year, DeFi deposits offer up to 5% on average, accruing interest every 15 seconds.

One option for beginning DeFi investors is to open a crypto savings account and earn crypto interest as a secondary way to invest in DeFi – you earn while the underlying DeFi assets you own increase in value, and also earn an APY (annual percentage yield) over time to compound your investment.

Yield Farming and DeFi Staking

An alternative practice called yield farming has also emerged, allowing individuals to deposit funds on the platform that pays the highest interest rate or most attractive incentives while keeping a close eye on the benefits provided by other platforms.

If and when they find the interest rates and incentives of another platform more profitable, the yield farmer can move their deposits to that platform for maximizing their profits.

It is natural for incentives to fluctuate repeatedly, which means yield farmers frequently move their funds from platform to platform, farming higher ‘yields’.

Binance staking – Provides upto 13.49% returns

Crypto staking is a simple way of contributing to market liquidity using crypto and helping ensure safe operation of decentralized financial services. Several DeFi projects today offer staking rewards in the form of governance tokens.

They help investors establish a more important relationship with DeFi than just investing for profits. Investing in Uniswap’s UNI tokens, for example, gives investors decision-making authority in proportion to their holdings.

More and more people become participants in the decision-making process for DeFi coins, and their future becomes of greater interest to them. This is in line with the underlying objective of decentralization and democracy.

Your capital is at risk

DeFi Indexes

One of the easiest ways to diversify your portfolio, DeFi indexes help track prices of multiple crypto tokens at once. These tokens are often selected based on strict criteria, such as size or volatility. Investors enjoy the benefit of flexibility because analysis and research that they would have to undertake themselves can now be outsourced.

Where to Buy DeFi Crypto?

Most of the top crypto exchanges enable buying and selling of DeFi on their platform besides making available a wide variety of ready-to-use resources.

These exchanges make it possible for DeFi enthusiasts to trade anywhere, anytime, in a secure manner. Of the numerous choices currently available, our top pick would be eToro. Other examples include Huobi and Crypto.com.

eToro: Best Overall and Recommended DeFi Exchange

One of the best crypto exchanges that investors can completely rely on for investing in DeFi, eToro.com has an impressive investor base of over 17 million.

The crypto platform has some of the best reviews in the industry, and also allows trading of ETFs, CFD, stocks and more on a consolidated marketplace.

Crypto trading on eToro does require a nominal fee, but this is low compared to other exchanges.

With a minimum deposit of just $10 in the US and UK, trading on eToro is highly suitable for beginners who are not willing to risk too much.

eToro comes with a free-of-charge Copy Trading tool, which simply means that traders get to select an experienced and profitable trader of their choice whose trades and positions they can straightaway copy all, like-for-like.

Charts and other info for trading on eToro

Considering that not all traders are too familiar with trading platforms or vehicles, this feature gives both newbies and veterans an upper hand in terms of emulating the best market strategies.

Ethereum, which many DeFi projects are built on, can be bought and staked on eToro, alongside many coins related to DeFi such as AAVE, COMP, UNI and more.

ETH had a return on investment of several hundred percent for holders in 2021, and investors predict the bull market will continue in 2024. Read our full review of eToro.

Your capital is at risk

What are the Risks of Investing in DeFi?

With DeFi being a relatively new technology, investors have a lot of questions in mind before investing in it right away. Several new companies, especially start-ups, are emerging at the fore providing DeFi services, and there are concerns about their performance.

DeFi relies on the strength of underlying programs, or smart contracts, instead of central policies and human decisions. While this is one of DeFi’s biggest strengths, there’s still room for errors in programming, leaving loopholes for cyberattacks. Thankfully, DeFi insurances like Nexus Mutual are on the rise, assuring protection to tokens and transactions.

Taxation in crypto is already widely considered complicated and fast-moving. A large portion of the investor’s time is spent in tracking, consolidating, reporting and complying with accurate taxation requirements. DeFi currently seems to be further enhancing this complication as tax treatments are variable from one application to another.

Rug pull scams are common in DeFi, specially considered the novelty of the technology. It is always recommended to stick to DeFi tokens with high liquidity and large amounts of cryptocurrencies staked on the platform to steer clear of such scams.

The moment you spot a token offering high returns for nothing, also referred to as frictionless yield farming, you should be able to grasp the pyramid scheme of the token with no long-term potential.

Currently, DeFi applications only to a smaller group of individuals who are aware of the technology and how to use them. The smaller user base leads to lesser documentation compared to traditional financial services. Readily available custodians of assets are not yet on the horizon. The silver lining is that several developments around decentralized insurance are gradually coming up.

Individuals are pooling their cryptocurrencies as collaterals for those seeking some security against losses from other smart contracts. Premiums are charged by contributing individuals from those who are insured.

What are the Benefits of Investing in DeFi?

No matter what your initial or ultimate goals are of using DeFi, it is certain that decentralized finance offers certain advantages over traditional finance. Some of these are:

Accessibility: DeFi is easier to access especially for underbanked populations who are unable to open banks accounts or receive loans. All it takes is an interne connection to access a DeFi platform, and there are no geographic restrictions or credit scores involved.

Low Fees and High Interest Rates: With DeFi systems, the intermediary is completely chalked out. Thus, two parties can transact directly without involving a third. This helps in greatly reducing transaction fees besides enabling both parties themselves to negotiate interest rates. Lenders enjoy much better interest rates over DeFi compared to those on traditional financial networks for the same reason.

Greater transparency and security: DeFi functions on the underlying smart contracts which are published on the blockchain. All records of completed transactions are publicly available for anyone to review. At the same time, the immutable nature of the blockchain ledger means that no information can be tampered with.

Thus, DeFi platforms offer the twin benefits of security and transparency. Smart contracts are executed in a way to ensure the privacy of platform participants without revealing your personal or sensitive financial information.

Functional autonomy: DeFi platforms are free from the influence or control of centralized financial authorities. This means they are also free from the interconnected nature of banks and governments.

The fall of the latter imposes no risk on DeFi systems. Neither can it be corrupted, nor over-leveraged, nor reach the point of bankruptcy. It is because of the decentralized nature of DeFi protocols that this is made possible.

Conclusion

DeFi is already counted among the topmost impactful financial revolutions of our times set to shape the future of money. It will continue to transform traditional finance as we know it. Besides helping reduce functional and transactional costs due to widespread automation, DeFi is also helping innovators work out new possibilities in the world of finance.

Such massive potential is sure to be reflected in the form of successful returns on investments. As the trust and understanding of DeFi continues to grow, and the effectiveness of smart contracts reaches more and more investors, DeFi can soon become the future of finance. It would be prudent to start investing in it today lest you should run out of the opportunity to be part of something big.

You can get started on FCA, ASIC and CySEC regulated crypto platform eToro, which has educational material available on how to invest in DeFi.

Bitcoin

Bitcoin