Celestia is a blockchain network featuring a modular architecture and tools that developers can leverage to create their own blockchains and decentralized applications. These unique attributes have allowed TIA – Celestia’s native token – to move up the price charts, reaching its all-time high within the first week of January 2024.

What is it about the Celestia token that has continued to excite the entire crypto community? What are its future prospects? This guide answers these questions along with covering how to buy Celestia (TIA) tokens from leading cryptocurrency exchanges in the market.

How to Buy Celestia – Quick Guide

Celestia arrived in the market in late October 2023 and quickly took the crypto space by storm by going live on multiple leading cryptocurrency exchanges simultaneously. Follow the steps below in order to buy Celestia from these exchanges.

- Step 1 – Select the cryptocurrency exchange

Go to CoinMarketCap and look for the exchanges that Celestia has been listed on. Choose from the options available based on the trading volume, market capitalization, and fee structure. - Step 2 – Register on the said cryptocurrency exchange

Start creating an account by clicking on the “Sign-up” button on these exchanges. Enter your email and password. Confirm your details and start using the account. - Step 3 – Verify your Account

Most leading cryptocurrency exchanges have stringent KYC measures in place in order to deter money launderers and other bad actors from the space. Upload your KYC documents and wait for the verification period to be over. - Step 4 – Deposit funds and buy Celestia

Once your account has been verified, go to your dashboard and deposit the required amount. While most exchanges allow users to buy crypto using fiat, buying with crypto is preferable due to a lower trading fee. Make sure that your wallet has the right crypto to buy the Celestia trading pair. - Step 5 – Transfer your Celestia to a Private Wallet

While most cryptocurrency exchanges have highly secure wallets, even cold wallets, it is advisable that investors park their funds in their private wallets. There are multiple DeFi wallets available that offer complete control over the holdings. These are secure wallets giving investors complete control over their assets.

Where to Buy Celestia – Top Exchanges Reviews

CoinMarketCap reports that there are over 40 cryptocurrency exchanges from which you can buy Celestia tokens. Most of them listed TIA within days of its launch. Following are the reviews of the leading cryptocurrency exchanges that were first to list this utility crypto.

1. MEXC

MEXC listed the TIA/USDT spot trading pair on 31st October 2023. While the listing didn’t have any significance on the Celestia price, it did put this unique project into the limelight.

MEXC is a Seychelles-based cryptocurrency exchange that is known for giving new cryptocurrency projects a platform. Celestia, being a unique crypto blockchain initiative, therefore, got the attention of this exchange early on.

The platform is known for its simplified approach to UI and a robust approach to trading facilities. Supporting over 2600 trading pairs, MEXC has listed a vast array of cryptocurrencies from different niches.

What makes this cryptocurrency exchange suitable for buying Celestia, however, is its trading fee. The exchange sports a spot maker and taker fee of 0%, which is highly suitable for veteran and beginner-level investors.

Security and license are also factors that MEXC pays a lot of attention to. Being active in more than 170 countries, MEXC is a cryptocurrency exchange licensed to operate in multiple regions. At press time, it has over 10 million users and employs a high-performance trading engine capable of completing 1.4 million transactions per second.

In terms of security, MEXC has added everything from two-factor authentication to cold storage in order to keep user data safe.

In addition to engaging in the spot trading facility, investors can also check on MEXC’s savings account, which offers lucrative Annual Percentage Returns (APR) for holding a certain amount of cryptocurrencies. Those who want to check out the Futures trading pairs will get access to facilities such as Copy Trade and Demo trading.

Check out our list of the best crypto savings accounts in the market.

Those wanting to learn about crypto will get access to a lot of information on the platform’s unique Learn Program, which covers all the basics about the exchange’s facilities via video tutorials.

Overall, MEXC is a suitable cryptocurrency exchange for those looking for a simple way to buy Celestia. It has a low-fee model, and it doesn’t present a lot of complex modules to complicate the trading process. The only issue is that this exchange has now been discontinued in the United States.

Explore more about this exchange in our MEXC review.

- Holds licenses to operate in the UK, Canada, Switzerland, and a handful of countries

- Does not charge any deposit fee

- Has only a 0.0% spot maker/taker fee

- Offers a venue for new cryptocurrency projects

- Not licensed in multiple countries

- Not available in the U.S.

2. Binance

Binance also listed Celestia on 31st October 2023, offering three spot trading pairs for TIA: TIA/BTC, TIA/USDT, and TIA/TRY. The world’s biggest cryptocurrency exchange by trading volume also added TIA as a new borrowable asset against the TIA/USDT isolated margin pair.

Supporting over 90 million customers worldwide, Binance is known as the most sought-after cryptocurrency exchange in the market. While there are some views that it won’t be a leading cryptocurrency exchange for longer in terms of spot trading, to this day, it has maintained a good reputation within the market.

Founded in China, Binance stands as the primary cryptocurrency exchange that serves over 171 million users. In addition to Celestia, Binance has listed over 350 cryptocurrencies, all allowing users to diversify their investments.

In terms of fees, Binance has a tiered system in place where investors must pay the transaction fee depending on their deposited amount. The higher an investor deposits, the lower that fee will be. The basic maker/taker fee is currently 0.1%. However, those who invest in BTC and ETH enjoy fee transactions.

Buying crypto from Binance is easy. Beginners can interact with the simple “buy crypto” module and use their fiat methods to invest in cryptocurrency. Veteran users can engage with the platform’s spot, margin, and futures trading features. Those who want a non-intermediary way to buy cryptocurrency can also use P2P trading.

This cryptocurrency exchange has evolved over the years, introducing new facilities to make trading more profitable to veterans and more palatable for beginners. One of the platform’s latest additions consists of trading bots. Investors can choose between Spot Grid, Futures Grid, Rebalancing Bot, Spot Algo Orders, Auto-Invest, and other options.

Additionally, Binance also has a copy trading facility and a unique Earn program that allows investors to open a savings account, hold their tokens, and earn APY rewards from Launchpool and BNB vault.

Other unique attributes that make Binance a good cryptocurrency exchange to try out include additions like loans, NFT, fan tokens, and even charitable events. Overall, Binance is an all-in-one cryptocurrency exchange with multiple perks for veteran investors. For more information about its offerings, check out our Binance review.

Accessibilty and user-friendliness are the only issues investors may find with this platform since it was first designed for institutional investors. Thankfully, Binance has a robust tutorial in place to help investors.

Meanwhile, you can check out our list of the best Binance alternatives.

- It is the one of the most reliable cryptocurrency exchanges in the market

- Charges no fee for BTC trading

- Only has a 0.1% maker/take for trading crypto

- Supports more than 350 cryptocurrencies

- Offers NFTs, Fan Tokens, Earn Programs, and more

- Has a high liquidity

- Offers multiple Celestia trading pairs

- Also allows investors to borrow TIA tokens against the TIA/USDT isolated margin pair

- Currently under scrutiny by the U.S. SEC

- Can be difficult to navigate for new investors

3. Coinbase

Coinbase listed Celestia on 1st November 2023, a day after it went live on Binance. The Celestia price went up by 24% shortly after the listing announcement. However, the news wasn’t that significant since only a few publications covered it.

Furthermore, the only pair available to buy on Coinbase is TIA/USD, making it suitable for those who want to buy Celestia using fiat.

Coinbase is the second-leading cryptocurrency exchange in the market, garnering a lot of attention once it became the first exchange to be publicly listed on the stock market.

Based in the United States, Coinbase serves 110 million users worldwide. The platform has listed over 3000 crypto assets, including the likes of Ethereum, Bitcoin, Tether, Bitcoin, BNB, Solana, and more. Due to the wide array of cryptocurrencies it supports, Coinbase is a suitable exchange for those looking to diversify their crypto assets.

In addition to providing an avenue for trading promising cryptocurrencies, Coinbase also boasts features such as the learning program, the earning program, crypto loans, learning rewards, NFTs, and more.

One of the latest features that Coinbase has rolled out is Coinbase One. It is a subscription model that allows investors to unlock zero trading fees.

However, those who aren’t a part of this subscription model don’t have to pay much either. The platform has a maker-taker fee model, where the fee ranges from 0% to 0.4% for the maker and 0.05% to 0.6% for the taker. The fee an investor is charged depends on the trading volume for the last 30 days.

Additionally, Coinbase also offers one of the most secure wallets, letting Celestia investors keep their assets secure.

Overall, it is a good trading platform for Celestia investors. However, it’s fee structure is a bit more nuanced than other cryptocurrency exchanges.

Check out our Coinbase review.

- Serves more than 110 million cryptocurrency investors

- Supports a wide range of fiat payment options, including PayPal

- Features a robust learning program

- The world’s second-largest cryptocurrency exchange by trading volume

- Offers liquid ETH staking facilities

- Features Coinbase One, a subscription model to unlock zero transaction fee

- Features a higher fee than its competitors

4. KuCoin

Kucoin listed Celestia on 31st October 2023, the same day as most cryptocurrency exchanges on this list. Only one pair – TIA/USDT – is available on this spot exchange.

Kucoin is a 2017-established cryptocurrency exchange accessible across 200 countries and supporting over 300 million global investors. It supports more than 700 cryptocurrencies at press time, and its daily trading volume averages around the $2.1 billion mark. If you use KuCoin, you will be able to find some of the new cryptocurrency coins to buy right now.

In addition to spot trading services, Kucoin is also home to crypto derivatives, with investors being allowed to trade crypto futures. Risk-takers can dive into KuCoin’s leverage trading market that offers up to 3x leverage, and those seeking an autonomous trading facility can look at the platform’s autonomous trading bot.

KuCoin is one of the cryptocurrency exchanges with a dynamic fee model. Per the website, the fee is calculated using the base currency of the trading pair. Being of a tiered structure, the fee varies depending on the VIP levels, of which there are 12 in total.

The VIP levels are determined by one of two factors. One is the number of Bitcoin traded on the spot trading market in the last 30 days, and another is the number of KCS tokens held (the native token of the KuCoin ecosystem).

KuCoin also places a special emphasis on security, offering secure asset storage, strong account security, and PoR (Proof of reserves). Those who are on the move can also use KuCoin’s robust mobile app to trade Celestia or any other cryptocurrency.

If you are seeking to regularly update your portfolio with some of the cryptocurrencies with the most potential, choose KuCoin. The platform also has a robust customer support facility that lets investors engage with the team via live chat.

Meanwhile, you can read our comprehensive KuCoin review to discover other services that are delivered by this exchange.

- Offers a wide variety of advanced trading features

- Has a good customer support in place

- Supports over 700 cryptocurrencies

- Supports TIA/USDT pair

- Features a tiered fee structure

- Requires owning KCS to reduce fees

- The UI can be difficult to interact with for new users

What is Celestia?

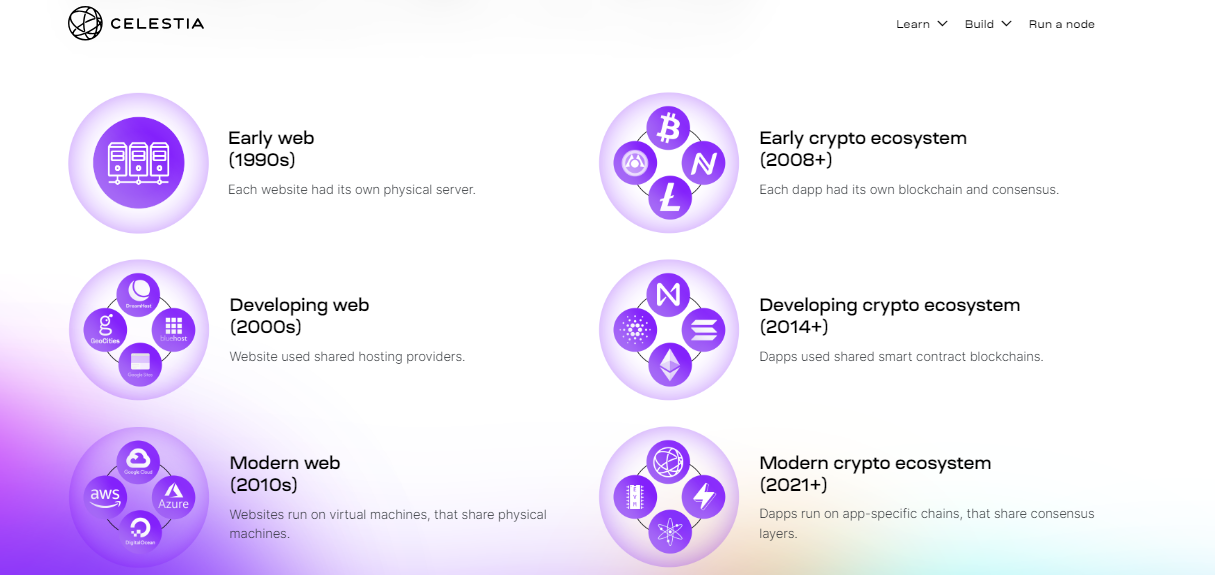

Celestia is a modular blockchain network that scales with the number of users. With its modular approach to blockchain creation, it makes it easy for everyone to create their own blockchain.

The platform makes it possible by adopting a modular blockchain architecture rather than a monolithic one. Monolithic blockchains focus on census, data availability, execution, and settlement on a single layer. While this is supposed to add flexibility, it doesn’t allow the tasks to be performed correctly.

With modular architecture, however, these tasks are undertaken by specialized layers. Celestia merges data availability and consensus layers together and provides two specialized layers for execution and settlement.

This approach allows the development of multiple execution layers – roll-ups – above the data availability and consensus layer. That is why Celestia calls itself a network that offers “roll-up as a service” or RaaS.

Celestia has made it possible by introducing a new primitive – DAS or Data Availability Sampling.

This approach allows the network to establish the validity of data by only analyzing one chunk of the data block. As a result, the blockchain becomes more scalable and fraud-proof.

That allows developers to launch a blockchain with leading Ethereum rollup frameworks quickly. The blockchain also becomes customizable, and launching it – according to Celestia – becomes as easy as deploying a smart contract.

The Origins of Celestia

Celestia was originally envisioned in a PhD paper in 2019 by a student named Mustafa Al-Bassam. The project was named LazyLedger back then. However, it highlighted a radical new architecture for the blockchain that removes the conventional monolithic architecture and adopts a modular one.

The project became Celestia after Mustafa Al-Bassam, who was also the founder of Chainspace, created it with Ismail Khoffi.

The first testnet version of Celestia was launched back in May 2022. It was called Mamaki back then. Developers originally intended to launch the Celestia Mainnet in 2023, which is why some of the leading exchanges listed the project in the third quarter of last year.

The Mainnet finally went live in late October 2023.

Celestia mainnet is live ✨https://t.co/Sj7RAfTh4W pic.twitter.com/Sd6CsU2dwL

— Celestia (@CelestiaOrg) October 31, 2023

Celestia Price

Celestia’s progress after its launch in November 2023 was slow but steady. After being listed on multiple tier-1 cryptocurrency exchanges, it formed multiple green candles on the price charts.

By the end of 2023, the TIA price rose by 514% of its initial value. Within the first week of January, the token reached its all-time high of $16.73, which led to multiple blockchain projects partnering with Celestia.

Lyra is going modular 🧙🧙🧙🧙

We’re upgrading Lyra Chain, powered by the @optimism OP Stack and @celestiaorg — the leader in modular data availability.

With Celestia underneath ✨, Lyra takes another step towards creating the largest source of crypto options liquidity. pic.twitter.com/pd3UW0w1hr

— Lyra (@lyrafinance) January 5, 2024

Lyra and Manta are one of the first to have transitioned to Celestia. These mean that the token could witness more growth in days to come.

Celestia Price Prediction

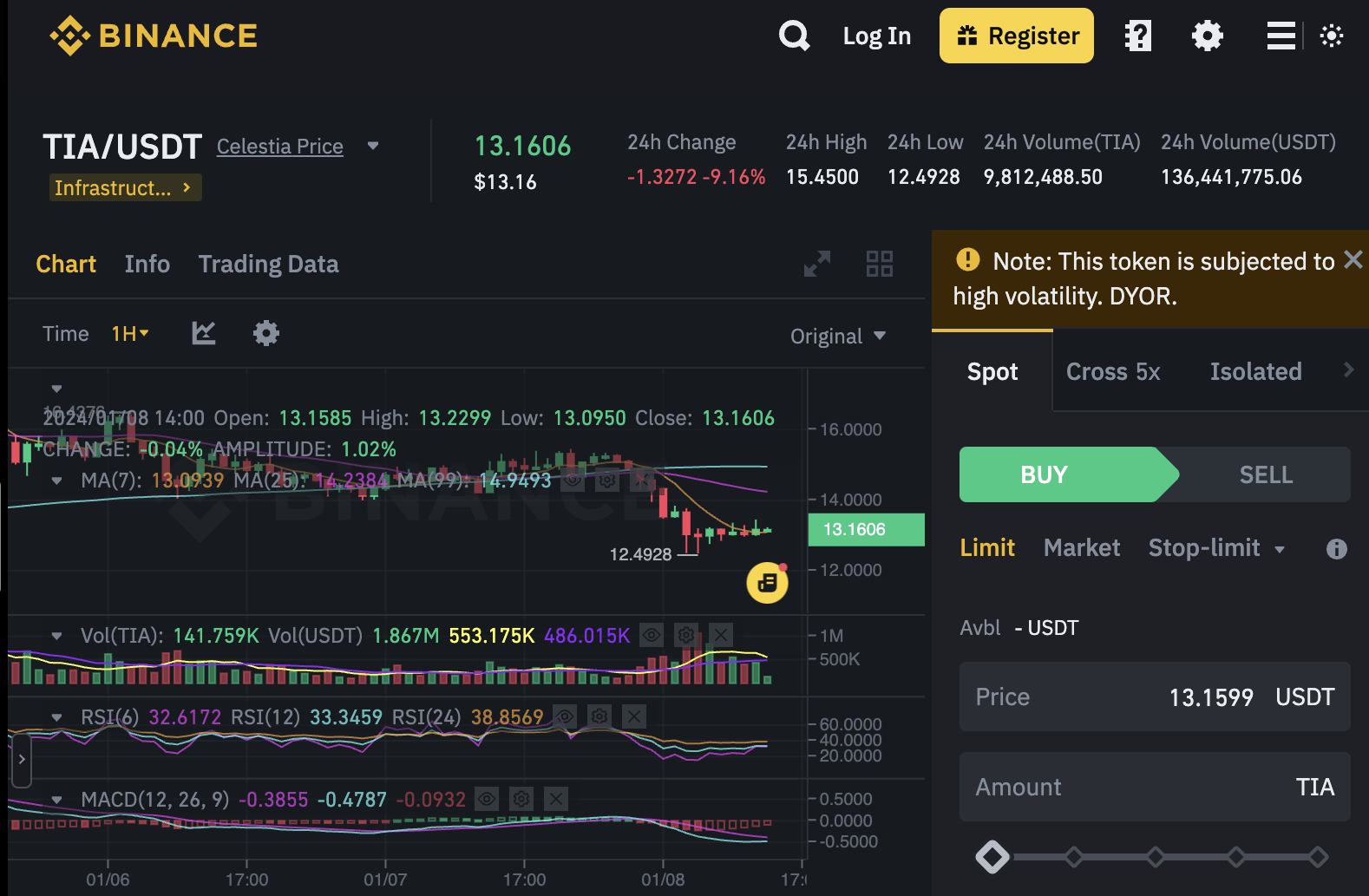

Celestia’s growth has subsided after it reached its all-time high. The daily chart shows a dip of 25%. However, this may not be the case in the next few months. The project has been riding the wave of Bitcoin’s resurgence and the growing popularity of modular blockchain. Don’t forget that Bitcoin is expected to shoot up following the approval of all spot ETF filings by the U.S. SEC. It is possible for Celestia to leverage these factors to become the next cryptocurrency to fly to the moon.

Upon viewing the graph more comprehensively, we found that TIA is accumulating on the daily chart, with multiple greens being painted. The token’s RSI shows that it is getting closer to the 30 mark, which could mean that the token may bounce once it drops even further.

The MACD histogram shows a light red and negative point, which indicates that investors must prepare for another drop. If it does, investors will have the opportunity to buy the dip.

Crypto expert Jacob Crypto Bury also predicts the price action for the TIA token.

For more information, read our detailed price prediction guide for Celestia.

Ways to Buy TIA

With the sudden rise in interest for Celestia, multiple exchanges have listed it, providing numerous ways to buy TIA. The following are the best methods that investors can follow:

Debit/Credit Cards

Beginner-level investors will find buying TIA using fiat a better option. It is possible since TIA has been listed on multiple CEXs that support this facility. The best exchange to buy Celestia using debit or credit cards, according to our opinion, is Binance. It has a simplified layout for buying crypto using fiat, and it has an affordable transaction fee.

Trading Pairs – Cryptocurrency

Another good way to buy TIA is through swapping. MEXC is a suitable exchange in this regard. With a spot trading maker/taker fee of only 0.01%, it is suitable for investors of all levels.

GooglePay, PayPal

For those who don’t want to provide their card-related details but still want to use fiat options to buy Celestia tokens, Google and PayPal are good options. Most exchanges, like Binance, make it possible to buy crypto using GPay. Coinbase supports PayPal. While PayPal can also be used as a mode of transaction on a P2P – Peer-to-Peer network – Celestia is yet to be added to any P2P exchange.

Meanwhile, you can also read our guide on how to buy cryptocurrency safely in 2024.

Which Wallets Support TIA?

Celestia operates on the Ethereum network, which is why it is available on most Ethereum wallets. While multiple soft wallets, such as Metamask may be the right fit, we recommend sticking with cold wallets to securely store your TIA tokens.

Is Celestia a Good Investment?

Celestia is a utility token that grew steadily and flew under the radar ever since its listing on multiple exchanges in November 2023. So far, it has continued to show signs of growth. Recent partnerships have also bolstered its value in the market. Furthermore, the market’s adoption of a modular blockchain architecture may also boost the Celestia price.

However, the token’s value has started to correct after reaching its all-time high. That said, there is a strong utility in keeping this project together, giving it potential long-term upsides.

Bitcoin Minetrix – A Better Alternative to Celestia

While it is nice to see an already-listed token getting a lot of traction, Bitcoin Minetrix is a presale token that has also been getting a lot of attention in the market. The platform leverages a unique Stake-to-Mine utility to make Bitcoin mining more accessible to all types of investors.

Essentially, the project alters the paradigm of cloud mining and brings it to a decentralized arena. Investors can stake their tokens and earn mining credits. Mining credits are non-transferable tokens that could be burned in order to buy mining time. Once the mining is complete, Bitcoin will be transferred to an investor’s account.

Bitcoin Minetrix’s approach to mining and staking has proven to be a blessing for the project. Ever since it arrived as a presale, it has raised more than $8.2 million, bringing even more investors as days go by.

With the huge upsides associated with this project, it is definitely one of the hottest coins to buy now.

Currently, the BTCMTX token is priced at $0.0128, giving users a good buying opportunity. Investors like Jacob Crypto Bury also finds potential in this token.

You can also visit its official website through the affiliate link that has been provided in this guide.

Conclusion

Celestia has shown from its performance on the price charts that it is a persevering asset. Even though the interest in it has subsided to a minor degree, social media is still full of support for this cryptocurrency.

However, even though there are multiple partnerships that this project has started, we have yet to see something significant. Therefore, it is better for investors to consider new cryptocurrencies such as Bitcoin Minetrix. It has a stake-to-mine utility that brings mining to the staking space and makes it more accessible for investors looking for low-cap tokens.

New Crypto Mining Platform - Bitcoin Minetrix

- Audited By Coinsult

- Decentralized, Secure Cloud Mining

- Earn Free Bitcoin Daily

- Native Token On Presale Now - BTCMTX

- Staking Rewards - Over 50% APY

FAQs

What is Celestia?

Celestia is a modular blockchain network that features a framework allowing developers to create blockchains in a simple fashion. The project is powered by TIA - an ERC-20 token with an inflationary attribute.

Where can I buy Celestia?

After the launch of the Celestia mainnet on October 31st, 2023, it went live on multiple exchanges at the same time. The leading exchanges that listed it include MEXC, Binance, Coinbase, and KuCoin.

Why is Bitcoin Minetrix a better alternative to Celestia?

We consider Bitcoin Minetrix to be a better alternative to Celestia because of its innovative features. You can stake BTCMTX to earn mining credits which can be used to mine Bitcoin. With this, it has put the control of cloud mining into the hands of its token holders