From the 2022 crypto winter to environmental concerns, multiple factors were stacked against Bitcoin – the world’s largest crypto asset – last year. However, the token still remains the favorite cryptocurrency for most veteran and novice traders to this day.

That said, 2022’s bearish scenario has led people to look at Bitcoin and other cryptocurrencies in a different light. So, is it too late to buy Bitcoin? Recent charts show that an uptrend is being established. However, things can be fickle in the crypto market, considering Bitcoin is the definitive speculative asset.

This article looks to answer whether Bitcoin is a good token to invest in right now and the common question ‘is it too late to buy Bitcoin?’. We also take a look at the best place to buy Bitcoin today and present you with better alternatives to this crypto in this utility-focused era.

Is it Too Late to Buy Bitcoin? Analysis

Is it too late to buy Bitcoin? The poor performance of the flagship cryptocurrency in 2022 has put seeds of doubt in many. That said, Bitcoin has aged. It is an old asset that, to this day, maintains the highest market capitalization in the market.

Another big way that age impacts an asset is its volatility. Bitcoin went through major bearish phases in 2022 and trended for a long time in volatile zones. However, closer inspection of price charts makes it realize that Bitcoin has started to follow the trends of traditional assets. And that means only one thing – the token has started to move to less volatile zones.

And while the token reaches a stable center, it is important to note that it won’t lead to explosive growth anymore. Stability means less volatility, and that equates to fewer parabolic increases.

Another reason that we might not see many sudden upsurges, like the ones that pushed Bitcoin to its all-time high of $68k, is the mining process. It is energy-intensive, and we are seeing a massive shift toward proof-of-stake cryptos. Even Ethereum, the best altcoin in the space, has taken more environmentally friendly strides with its recent Merge upgrade.

And the third reason is the lack of utilities. Bitcoin, as powerful as it is, doesn’t have any other use cases other than being used for transaction purposes. 2022’s bearish scenario has taught us that people want more utility-based crypto assets – for they are the ones with long-term upsides.

Now, these are the arguments that can be made about this asset logically – but that’s hardly the case when cryptos are concerned. Early 2023 has seen Bitcoin blowing past its $17k resistance and nearing $23k. The price chart currently shows that most people are as bullish about this asset as they were before. And since many institutional investors have adopted BTC, whale price movements have grown prominent.

As a result, we are now seeing Bitcoin trading in the green. The massive green candles that it has recently formed may put Bitcoin in an oversold zone, but it shows that Bitcoin is still a worthy investment.

That said, remember that the speculative drive behind the Bitcoin price movement is the primary one, And since we are moving towards utility-focused assets, we must look for other assets as well – at least to diversify our crypto portfolio and hedge against this volatile space to make the most out of it.

So, overall we do believe that it is not too late to invest in Bitcoin. But the environmental concerns, the token’s current performance in the oversold zone, and the fact that Bitcoin has no discernible utility might drive investors must attempt to diversify their crypto portfolio and invest in other assets alongside Bitcoin.

A Look at the Bitcoin Price History

Bitcoin sprung into existence at the hands of the mysterious Satoshi Nakamoto. Is it a he, she, or they? – nothing of that nature is known. What is known, however, is that after releasing the Bitcoin source code in early 2009 – they disappeared.

The appearance of Bitcoin wasn’t just the unveiling of a crypto asset – but the blockchain concept. Envisioning a decentralized ledger comprised of blocks that promotes transparency and security wasn’t heard of before. As a result, when Bitcoin first landed, it was considered nothing more than a joke currency.

We still remember to this day when a man sold hundreds of his Bitcoins in return for a pizza. That folk tale-like story only came to light when Bitcoin started to show true value. And that happened when Silk Road, an underground website, started to adopt Bitcoin to transact electronically without getting the banks involved.

However, sites such as these are nefarious, and Bitcoin started as a favorite crypto among traders in the dark web – that put Bitcoin’s reputation in a bad light.

It was around 2010 that the Bitcoin price started to rise. But it was between 2013 and 2014 that Bitcoin’s value rose by 5600% and reached above the $200 mark.

From that point, the growth was steady – and continuous. The token crossed the $400 mark in 2016, and by early 2017, it blew past the $1,000 mark. However, the growth of this crypto around the time period was still pretty linear.

Then the mid in 2017 happened, the world first witnessed a joke of crypto rising by nearly 10x, going from $2k to $19.47k. It was the first time that this crypto grew this massively.

But a retrace soon followed, and the Bitcoin price took a down-turn – but since it was towards a volatile zone, people started waiting for another massive uptick. Financial institutions started to pay attention, YouTubers started to cover it, and many exclusive stores started to adopt it. Food products like the Bitcoin pizza – costing upwards of $15k, started to make rounds.

The token traded in largely volatile zones in the next 2+ years. But when Bitcoin bounced from its $5k mark in early 2020, markets started to change significantly. It was the second and the biggest parabolic upswing Bitcoin witnessed that led to a massive 1200% increase and became worth $63k. Another upsurge happened in late 2021, and, as CoinMarketCap reports, Bitcoin became worth $68k.

Many factors can be attributed to this increase. However, the biggest reason was the pandemic. Since people were locked in and moved towards making more digital choices, Bitcoin, the latest offering of this digital economy, saw the most gains.

But like all speculative assets, Bitcoin’s value retraced as 2022 set in. The drop was slow at first. But as some of the inherent fallacies of the crypto space came to light thanks to the LUNA crash, Bitcoin’s price took a significant blow. BTC price reached its early 2022 bare bottom at below $30k.

However, the damage caused led this crypto’s price further toward a downtrend, which only aggravated after the FTX crash. As a result, the Bitcoin price dropped below $16.5k in late October 2022. And the token continued to remain in this zone until the middle of January 2023.

The recent price chart, however, shows positive signs, and the Bitcoin price is showing an uptrend. Multiple green candles have formed, and Bitcoin is now moving in a positive direction.

Here is a summary of Bitcoin’s highs and lows since its inception.

- The first major high in December 2017 pushed Bitcoin price to $19,735.

- First major retrace to $3,270 in December 2018

- Another uptrend led to a high of $13,910 in June 2019

- Retrace that led to Bitcoin reaching $3,881 again

- The all-time high was reached in November 2021. Bitcoin was valued at $68,789 – a 1644% increase.

- Low reached in 2022 $16 500.

- Current high of 2023 at $23k.

Your capital is at risk.

Bitcoin Price Analysis 2024

Is Bitcoin a worthy investment in 2024? Let us answer this question by assessing this asset’s performance in 2022 and 2023.

Bitcoin entered 2022 at around $41k, retracing by nearly 33% of its late 2021 highs. The impact of halving starts to set it, and the price of this asset dipped further.

By the time Bitcoin entered April, it had dipped below its $40k support. But the drop wasn’t steep as some retrace was still expected. However, then the LUNA crash happened – an event that evaporated a lot of trust people had in the crypto space.

That led to bears taking control of the market and pushing the value of this token closer to $30k. From that point forward, the drops became increasingly significant. And in June 2022, Bitcoin was valued at $20k. It was largely due to people realizing the volatility of the space that led to the increase of FUD. Inflation also took hold and as the Fed rate hikes started to set in, investing in cryptocurrency started to look less and less appealing with each passive day.

A lack of any other use also didn’t help Bitcoin. While many countries started to accept Bitcoin as a legal tender, individual investors wanted a sense of stability. That sentiment moved them towards more utility-based cryptocurrencies, like DeFi crypto assets and metaverse tokens.

Another blow that Bitcoin experienced was from large corporations like Tesla, who – along with others – went on massive BTC sell-offs. The increased sell-pressure to reduce the risk that comes with owning Bitcoin dropped the value of this token even further and harmed the community in numerous ways.

However, Bitcoin was still trending between $20k and $23k back then. And yes, while this range was still not great by Bitcoin’s standards, people were still betting on midterms and new announcements to reduce the pace of increasing interest rates. And after the “Septembear”, people did pin their hopes on October to show them some positive results.

But then the FTX crash happened – which was one of the most dramatic events of the crypto space, considering SBF – Sam Bankman Fried – was considered to be a crypto savior due to its “effective altruism”. The fall of FTX – exchange and the token – pushed Bitcoin’s price below $20k and to the lowest point of 2022 – $16.445.

And the price performed in the same zones till the beginning of January.

Your capital is at risk.

Bitcoin Price Rise in 2024

Bitcoin experienced an upsurge in the third week of 2024 that moved it past its $42k resistance and above the $44k mark. The entire crypto community is surprised because the usability factor of Bitcoin hasn’t changed, and there haven’t been major regulatory developments in the space.

Speculations Surround Bitcoin’s Recent Price Rise

Covering speculation is most often a great way to glean the market sentiment behind a crypto asset’s price increase.

Sathvick Vishwanath, CEO of the cryptocurrency exchange, Unocoin, said that “increased” demand is pushing the Bitcoin price upwards.

“More and more individuals and businesses have started to accept Bitcoin as a means of payment”, the CEO states, further saying that “awareness and interest in Bitcoin has led people to hold their assets who still believe in its long-term gains – that is further driving more demand for this asset.”

Another speculation that is attributed to the reason behind the recent increase is the Genesis bankruptcy news. Many believe that traders have already decided how much Genesis is worth in its bankruptcy phase – which is another reason for pushing the value of this asset.

What Are Experts Saying About the Recent Price Rise?

Experts have been split about the reason behind this rally and its consequence.

On one side, there is a camp of pessimistic investors saying that the recent upsurge is a bull trap created to fool people into investing in Bitcoin.

I've been checking charts all this time, avoiding noise from Twitter. The way the upward movement is happening, the way htf resistances are being tested… it clearly looks manipulated, no real demand.

Once again, the biggest bull trap I've ever seen. But they won't trap me.

— il Capo Of Crypto (@CryptoCapo_) January 21, 2023

He has come out to say that there is no real demand for this asset, and the current bullish action might be leading to the biggest bull trap of 2023.

His many followers and many others have come out to say that this is the right stance to take because of many reasons. One of them has said that the tech industry has been going through historic layoffs, and the bank is saying that another round of inflation is coming back.

It means that there are no signs of being bullish right now, so why is Bitcoin’s price action showing so many positive rounds?

Another crypto content creator, PlanB, has put forward a more optimistic statement. He has come out and said that Bitcoin has just crossed its realized price, and the next target is 200-day moving average is $200 day moving average – $25k.

#Bitcoin crossed realized price ($20K), next target 200WMA ($25K)🚀 https://t.co/Bpdmf8CIg8 pic.twitter.com/L0V86itppN

— PlanB (@100trillionUSD) January 23, 2023

He is particularly bullish about the current price action that Bitcoin is going through and says that the bear market is over and a bull phase has started.

Another Crypto Twitter user BitQuant says that the current Fibonacci levels estimate that Bitcoin will rise upwards of $100k between $152k-$198k in 2024.

#Bitcoin top for 2021 was between $51k – $68K. Fibonacci levels!#BTC top estimate for 2023 is between $152K – $198K!

It is your choice whether or not to trust the indicator that successfully forecasted all the tops. pic.twitter.com/1jKiVPEjq0— BitQuant (@BitQua) January 23, 2023

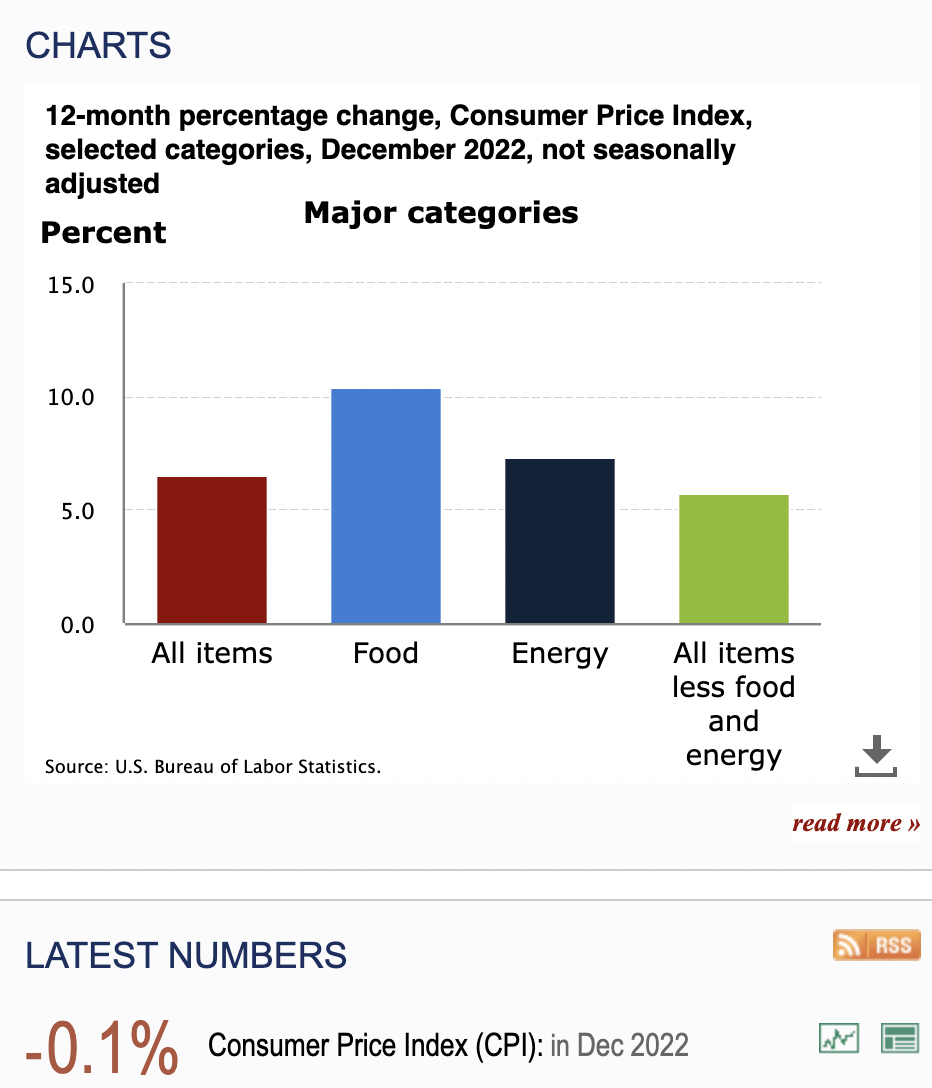

Experts believe that the recent lowering of inflation by a modest 0.1% may also be the reason. Note that slowing inflation may cause Fed to impede the speed at which it is increasing the interest rate – which is a positive for the crypto space.

Experts also believe that people are now willing to shake off the trauma caused by the FTX incident. And since more transparent and user-focused cryptocurrencies have arrived, the recent uptick might be a sign of recovery.

Rumors going Around behind the rise of Bitcoin

Since there are not a lot of comprehensive reasons given behind the recent increase in Bitcoin price, rumors have started coming around – especially from the biggest detractors of the Bitcoin space.

Tucker Carlson, a popular FOX News representative, has come out and said that the recent increase is because someone is paying Bitcoin as ransom.

He has connected Bitcoin’s recent price rise with the FAA outage (Federal Aviation Administration), saying that some criminal activity is responsible for the recent increase in Bitcoin price.

Why were flights across the USA grounded last week?

Tucker Carlson has a theory, and it may explain the recent bitcoin price pump. pic.twitter.com/on67s8A1Ra

— Daniel Sempere Pico (@BTCGandalf) January 17, 2023

Bitcoin Price Prediction from 2024 to 2030

Bitcoin price has gone up n the past few weeks, but the technical indicators put Bitcoin’s price in “massively” oversold zones.

The Bitcoin price has been way above its 200-day moving average in the past few days, and charts show that it is about to cross the 30-day moving average. Does that mean good days for this crypto are coming in the days ahead?

We can’t be certain of that. As we already stated that the RSI of this token is 85, which is 15 points into the oversold zones. And there have been reports that the current price action is due to a massive whale movement at the backdrop. While it can certainly be the case, it is too soon to speculate that this might be the sole reason.

However, as you can see from technical indicators, the demand for BTC right now is way higher than it must be. The good part about this is that it has resulted in the rise of all top 20 cryptocurrencies, including Ethereum, Dogecoin, Shiba Inu, and others.

Now, the experts are watching if Bitcoin can establish support at $23k. If that does happen, we will likely see this crypto moving up. Otherwise, it is highly likely that a retrace will happen. But since it would be the battle between bulls and bears, we believe that the drop won’t be that significant.

However, if the token does cross the current resistance of $23k, don’t expect the move upward to be as parabolic as before. Bitcoin is an old asset, and it is slowly moving toward stability. Evidence of that can be that for the span of two months, it trended sideways in the $16k-$17k range.

So, if this token does move up further, don’t expect it to yield triple-digit growth, but you will still be able to make money from crypto if you have your expectations in order.

Case and point, Bitcoin does have the potential to bring more positive returns for the rest of the year. And while the recent uptick may have given hopes for the parabolic increase – don’t fall for that. With that in mind, here is a detailed view of Bitcoin price prediction for this year and beyond.

- Prediction for 2024 – What happened in 2022 or the beginning of 2023 won’t matter in 2024. And since more utility-based crypto will be introduced, Bitcoin will also have a higher number of owners. That factor will push the Bitcoin price, and we estimate that it may be around $37,600 by the end of 2024.

- Prediction for 2025 – Currently, Bitcoin’s price action influences other crypto assets. But since the arrival of more useful cryptocurrency projects, a reverse of that might also be true. Since Web 3 projects will likely see a major uplift in 2025, Bitcoin may also go up in price and get closer to its all-time high at the $60k mark by the end of 2025.

- Prediction for 2030 and Beyond – Bitcoin’s performance will stabilize by 2030, and it will likely be similar to traditional assets. But its price performance will decouple from traditional assets – which will push the Bitcoin price closer to its $100k goal. We estimate that by 2030, Bitcoin may be priced at $95k.

Your capital is at risk.

What Might Bitcoin Be Used for in the Future?

When Bitcoin was about the embark on its second and biggest bull run in 2021, many publications, including CNBC, reported that Bitcoin was at its tipping point in its life cycle. Citi Bank said that Bitcoin may be accepted by the mainstream or will be demolished as a speculative asset. And since we have not been able to hone in on the primary reason behind the recent price increase, it is highly likely that Bitcoin will remain a speculative asset for a long time.

While we recommend that retail investors only invest in Bitcoin if they are truly bullish, the token has been accepted by multiple financial institutions. Bitcoin ETFs are finally available for trading on different platforms, including VanEck, Valkyrie, and ProShares.

That said, if there is one factor that makes people move away from Bitcoin is the energy concern. Several countries have already decided not to adopt Bitcoin due to energy concerns. The state of New York has put a 2-year ban on Bitcoin mining due to the same reason. Therefore, if Bitcoin has to prosper in the future, it must adopt different methodologies to make Bitcoin mining greener.

However, there are also other energy-efficient cryptos that offer better upsides than Bitcoin. So, if Bitcoin mining doesn’t have an alternative method, it is likely that such crypto assets will replace it.

Now comes the use case of Bitcoin – what can it be used for? For now, the most utility this token will find will be as a medium of exchange. Over 15,000 merchants across the world already accept Bitcoin as payment. There are multiple reasons for it. One, it allows merchants to draw a crypto-centric crowd, which is getting bigger every year. Secondly, cross-border payments are easier, and transaction speeds are faster when using Bitcoin.

Keeping these factors in mind – is it too late to buy Bitcoin? While the lack of use case for this token is definitely a negative, contributing to its bearish sentiment, we must not forget that, as a financial instrument, Bitcoin still holds more value than most assets.

And the recent price increase has happened due to its value as a financial instrument. But does that mean that BTC will keep up this momentum for the remainder of 2024? Not really. Price charts do put in an oversold zone, and a retrace may happen at any moment. However, seeing that more people have started to come around and see crypto as a viable investment – Bitcoin still remains a good investment option.

Your capital is at risk.

Experts’ Opinion – It is Too Late to Buy Bitcoin?

This year and beyond will be more about assets that provide users with a great use case. However, that’s not to say that Bitcoin will lose any of its value. Experts still believe that Bitcoin will continue to be the premiere crypto investment for most people in the ecosystem. Here are some opinions from experts regarding this token.

Jack Dorsey

Co-Founder of Twitter and Block Inc – a digital payments company, Jack Dorsey has always been a big supporter of cryptocurrencies in the past and continues to do so.

In recent times, he has been noted saying that “Bitcoin changes everything”. For so long, the world has imagined the existence of a single currency, and Bitcoin may be one of them. Jack Dorsey’s bullishness about cryptocurrency and Bitcoin can be seen in Block INC – the trading platform also offers BTC trading.

Block is also Jack Dorsey’s attempt to introduce a new internet layer – Web 5 – which will be a combination of Web 3 and Web 2.0 built on the Bitcoin blockchain.

Michael Novogratz

CEO of Galaxy Investment Partners, a crypto-centric investment firm, Michael Novogratz has been quoted by Bloomberg as saying that he is not sure if Bitcoin will cross $30k anytime soon.

He attributed his apprehensions to the fact that despite the recent influx of institutional investors, the number of such investors is quite low. Bitcoin is a big cryptocurrency and is expensive – which means only large investors can deal in the bulk of BTC coins.

Furthermore, the recent pullback by Tesla during the FTX crash hasn’t done Bitcoin any favors.

That said, this statement was made before Bitcoin hit the recent uptick.

Mark Cuban

Shark Tank panelist Mark Cuban has always been a big promoter of cryptocurrencies. Although his partnership with Voyager Capital and the recent FTX crash has dwindled his interest in crypto to some extent – a recent report states that he is willing to buy more Bitcoin.

Calling those who buy gold “dumb”, Mark Cuban has said that while both “gold and bitcoin are a store of value”, with both assets maintaining their worth, Bitcoin is a much better option than buying gold.

Cathie Wood

Cathie Wood is the founder of Ark Investor – once a great investment firm but has since fallen massively due to multiple factors.

That said, Cathie Wood bought $100k worth of Bitcoin last year. An Ark investor has also stated that Bitcoin might be worth $1 million by 2030.

Your capital is at risk.

Where to Buy Bitcoin Now?

Now that you have a clear answer to the question – is it too late to buy Bitcoin? – it is time that you learn where to buy Bitcoin from.

Bitcoin is a great crypto asset to have because of its reputation and its ability to keep your crypto portfolio diversified. Therefore, Bitcoin is one asset that’s available on every crypto trading platform.

However, we believe that all investors must go to a platform that’s inclusive, offers low fees, and is user-friendly. eToro is the platform that meets all of these criteria. It has a range of assets its supports, and the platform is regulated, being licensed by the likes of FinCEN, FINRA CySEC, ASIC, and FCA.

eToro is a robust cryptocurrency trading platform that offers, in addition to Bitcoin, over 120 different cryptocurrencies. It is also one of the first platforms to offer copy trading utilities, allowing you to follow the investment strategies of more successful traders and automate market decisions in positive ways.

Other facilities, like blogs about cryptocurrencies, are also available in its extensive knowledge library.

Furthermore, those wanting to diversify their crypto portfolio can invest in multiple packages. These are bundled packs of crypto assets depending upon your niche of choice.

Now comes the trading process of this platform. It is streamlined, and an eToro wallet is also available for those who trade through their mobile phones. You will also find here all the technical indicators and charting tools to make the best investment decisions.

Also, it is easy to buy crypto on this platform, and the deposit requirement is minimal. You can start your account by only depositing $10 using your debit/credit cards or crypto wallets. Also, if you’re new to trading, eToro offers paper trading facilities as well.

Your capital is at risk.

Is it Too Late to Buy Bitcoin? Conclusion

We have now considered all the factors to answer the question – Is it too late to Buy Bitcoin?

And based on the information we have given, we have an answer – no. It is not too late to buy Bitcoin.

Yes, the token doesn’t have any utility yet, and since environmental concerns are driving people away from this asset, it is highly unlikely that we will see utilities come for this token.

However, while Bitcoin isn’t one of the best altcoins to buy right now, it still remains one of the best cryptocurrencies to be adopted by financial institutions. And the arrival of Bitcoin ETFs means that we are moving toward a more stable direction in regard to this asset.

That said, in the long-term, the environmental concerns that bitcoin mining gives us put a question on this asset’s long-term prospects. That is why it is better to look for alternative assets as well.

Crypto All-Stars (STARS) – An All-Star Meme Coin Experience

At the time of writing, Bitcoin has once again dropped below the $60k mark. The reason for this price action is the current volatility, which is supplemented by the presence of wars and other geopolitical reasons. However, a current low price presents a buying opportunity for Bitcoin.

That being said, most investors would find the current price too much. That is why cheap, beginner-friendly cryptos like Crypto All-Stars present a much better option.

This cryptocurrency project presents a unique ecosystem that blends the best attributes of the top meme coins.

On top of that, it offers a unique staking utility that could benefit multiple meme coin investors. Known as MemeVault, this perk allows top meme coins to be staked in return for STARS tokens.

Since it is a meme coin, Crypto All-Stars is not beholden to the same attributes as other assets, which makes it a better alternative to Bitcoin.

The Meme Games (MGMES) – Leading Meme Coin Project with Olympic Themes

Since Bitcoin is currently inching closer to reclaiming its highs, investing in low-cost cryptos like The Meme Games ($MGMES) might be a better option.

This project presents an interesting prospect for investors, offering early-bird gains and the chance to participate in sporting events to earn more tokens.

However, don’t mistake it for a traditional betting ecosystem. It doesn’t create an environment where you can bet on real Olympic games. Instead, it creates a virtual ecosystem with meme athletes who are top characters from major meme coin ecosystems like Dogecoin, Dogewifhat, Pepe, Brett, and even Turbo.

Presale investors can bet on these meme athletes who race across a 169-meter track inside a virtual arena. Winners will allow their backers to earn a 25% bonus.

This unique feature changes the paradigm of the cryptocurrency ecosystem, making the presale process more thrilling than traditional methods. Additionally, since the project also comes with staking perks, users will also have passive earning opportunities.

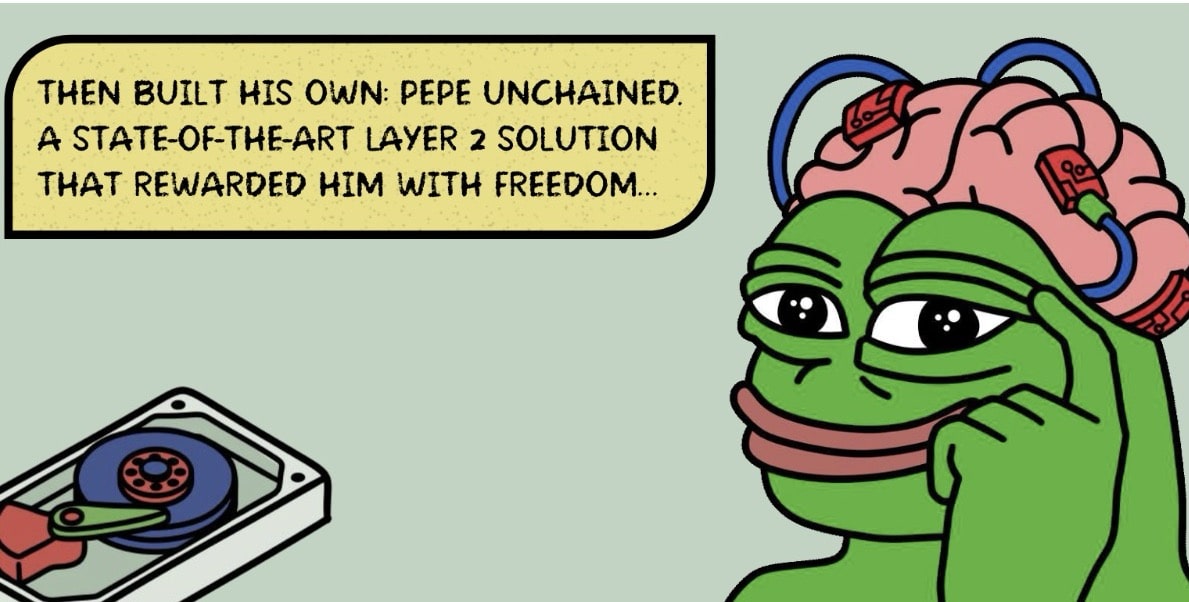

Pepe Unchained (PEPU) – Leading Memecoin Presale With a Pepe Mascot

Pepe Unchained is a brand new cryptocurrency project gaining attention for its innovative approach and strong potential. The project features Pepe, the well-known meme mascot, breaking away from its original blockchain and adopting a more advanced Layer 2 solution. This shift not only enhances the meme’s narrative but also boosts the token’s functionality and efficiency.

By incorporating Layer 2 technology, Pepe Unchained builds on the Ethereum blockchain to address common issues like slow transaction speeds and high costs. This integration ensures faster and cheaper transactions, making it a more practical and scalable option for users and investors.

A key feature of Pepe Unchained is its staking mechanism. During the presale phase, investors can stake their PEPU tokens to earn high APY rates, providing an attractive opportunity for passive income. This encourages early investment and helps foster a committed and engaged community around the project.

In just under two weeks, Pepe Unchained has raised over $400k, highlighting significant investor interest and confidence. With a presale price of $0.008 per token, it offers an appealing entry point for those looking to invest early in a potentially high-growth project.

Pepe Unchained’s engaging storyline, cutting-edge technology, and promising financial incentives set it apart in the crypto market. As the project progresses, its potential for substantial returns and continuous development makes it a compelling option for investors eager to capitalize on the current market scenario.

Shiba Shootout (SHIBASHOOT) – Meme Coin with Many Cowboy-Themed Perks

Bitcoin has shown more volatility than most meme coins lately, turning crypto into a Wild West frontier where to survive, a project needs more supporters and more benefits. This is why Shiba Shootout is the perfect token that matches this theme.

However, the Wild West that Shiba Shootout produces is a bit more literal. Featuring a Shiba Inu in a cowboy costume, this particular project uniquely focuses on bringing the shootouts, the stories, the town, and the saloon to the digital realm.

This project lives up to its name and aims to create a robust ecosystem where, much like cowboys hunt for treasures and become rich, investors can engage with the community and generate wealth. It also crafts its perks to mirror different things that are common in a frontier, like a saddlebag to save water (or in this case, crypto), a lottery system that rewards the lucky—known as the Lucky Lasso Lottery—and a campfire where the warmth of the fire is complemented by shared stories, essentially a community program that rewards sharing memes and investment stories.

The play-by-play mirroring of Western themes and crafting use cases around them makes this token an ideal replacement for Bitcoin. While being a meme coin doesn’t exactly give it the same appeal as high-cap cryptos, if you are a beginner, this is a perfect asset to park your funds and diversify your investments.

Mega Dice (DICE) – Leading Casino Crypto in its Presale Phase

Mega Dice leverages the power of blockchain to offer a dynamic and transparent gambling experience with its native token, DICE. As a pivotal element of the platform, DICE facilitates every in-game transaction and bet, ensuring fluid gameplay and user engagement.

With a relatively low supply of 420 million tokens, the platform ensures that DICE remains scarce, potentially increasing its value as the platform gains traction. This scarcity, combined with the token’s utility within the platform, has garnered significant attention during its presale phase, attracting investors looking for both entertainment and investment potential.

Beyond its primary use in betting, DICE token holders are rewarded with a variety of perks including exclusive access to NFTs, special rewards, and a portion of the platform’s daily profits. This creates a compelling reason for players to not only participate in the ecosystem but to stay engaged long-term.

The adoption of the Solana blockchain underscores Mega Dice’s commitment to utilizing advanced technology to enhance transaction speeds and reduce costs, setting a new standard in the crypto gambling industry. With its innovative approach to integrating gambling with blockchain technology, Mega Dice is poised to redefine online gambling, making it more accessible, transparent, and rewarding for users around the globe.

Most Searched Crypto Launch - Pepe Unchained

- Layer 2 Meme Coin Ecosystem

- Featured in Cointelegraph

- SolidProof & Coinsult Audited

- Staking Rewards - pepeunchained.com

- $10+ Million Raised at ICO - Ends Soon

FAQs on BTC

Is it too late buy Bitcoin this year?

The answer to this question depends on the trading goals of investors. For those looking to make the same profit BTC made during its biggest pump, it is too late to invest. But for those who are looking to diversify their crypto portfolios, Bitcoin remains a great token.

Is Bitcoin going to go up in value soon?

The latest price charts show that Bitcoin has already gone up massively in value and crossed the $50k barrier. However, reports say that it might be FOMO. So, it is hard to say whether this crypto will go even further upwards this year

How many years will Bitcoin last?

The last bitcoin will be mined in 2140. After that, mining fee will be removed, but it will also drop Bitcoin's value in the next 100 years.

Can you still mine Bitcoin?

Yes, Bitcoin can still be mined. However, the hardware required to facilitate this process is expensive.