Revolut is an innovative digital banking app that allows customers to access traditional financial services without needing to ever visit a branch. The app provides users with a personal bank account in both the UK and Europe, as well as a pre-paid debit card. Revolut has since entered the cryptocurrency space by allowing users to buy and sell 5 different coins.

If you’re thinking about using Revolut to buy and sell crypto, read our in-depth review below. We cover the fees, regulation, security, supported coins, and more. Revolut is one of the easiest to use options out there.

On this Page:

What is Revolut?

Revolut is a FinTech mobile application that offers bank-like services. When you open an account, you’ll be given a bank account in both the UK and Europe. This makes it easy to transfer funds to people at the click of a button, in GBP, EUR, or any other currency at low exchange rates.

The Revolut app also comes with a pre-paid debit card. This is backed by either Visa or MasterCard, depending on where you are based. As Revolut operates as a digital bank, the platform does not have any physical branches. This means that you can perform all of your banking needs from within the application.

How does Revolut Work?

Outside of its key banking products and services, the Revolut app also allows you to invest in cryptocurrencies. The platform supports 5 different coins at the time of writing, which includes popular cryptocurrencies such as Bitcoin, Ethereum and Bitcoin Cash.

It is important to note that when you invest in cryptocurrencies via your Revolut app, you do not actually own the underlying asset. Instead, you are speculating on the price of the cryptocurrency going up or down. As such, this makes it very similar to CFD trading.

As you do not own the asset, nor are you actually in possession of the coin you buy, unfortunately, you can’t withdraw your cryptocurrencies to your Bitcoin wallets. We do consider the Revolut platform to be suitable for day trading, as the fees are limited compared to other exchanges.

If you do decide to invest with Revolut, you can purchase a CFD-like cryptocurrency at the click of a button. The money is taken straight from your Revolut bank account, which makes it super easy.

What cryptocurrencies does Revolut support?

Revolut supports a total of 5 cryptocurrencies. Don’t forget, you don’t actually own the coin, even if you go long. You’re speculating on whether the value of the coin will go up or down.

- Bitcoin

- Ethereum

- Ripple

- Bitcoin Cash

- Litecoin

Which countries does Revolut support?

Revolut is primarily suited to those located in Europe, as well as Australia. As such, you cannot use Revolut if you are from the United States.

Here’s the full list of supported countries.

- Australia

- Austria

- Belgium

- Bulgaria

- Croatia

- Republic of Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Iceland

- Ireland

- Italy

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Netherland

- Norway

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

- United Kingdom.

Revolut Payment Methods and Fees

Technically speaking, Revolut is a payment method itself, meaning that when you buy or sell coins, the money is taken from your Revolut bank account.

However, in order to fund your Revolut account, you can utilize the following options:

- SEPA bank transfer

- UK Faster Payments

- SWIFT

- Debit/credit card

Revolut does not charge users to deposit funds using the above methods. However, if you perform a SWIFT deposit, then you might be charged banking fees by the institution you used to send the funds from.

Trading fees

The trading fees on Revolut are fairly limited if we compare them with other exchanges. When you use the Revolut app to buy and sell cryptocurrencies, you will need to pay fees. Each trade that you perform will be accustomed to a 1.5% trading fee at both ends of the transaction, which is much lower than the fees charged by most other exchanges on the market.

On top of this, as liquidity levels on other exchanges are significantly smaller than they are on Revolut, meaning that trading on Revolut ends up being even more convenient if you are looking to save up some money.

How to sign up and trade on Revolut

We definitely recommend signing up on Revolut, it is a great starting point to begin your Bitcoin trading experience. We really like the app for its banking products, including its crypto side, which is why we decided to put together a step-by-step guide, it will help you get started on the crypto exchange.

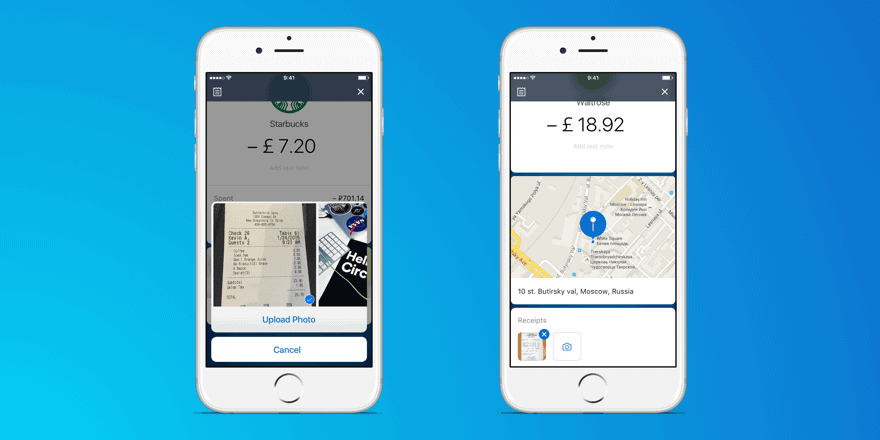

Step 1. Open an account with Revolut

First, click here to open an account with Revolut. You can download the app on either your Android or iOS device. You can’t access Revolut on a desktop computer, so you’ll need a supported mobile device.

You will be required to go through an account set-up process. Like opening an account with a traditional bank, you’ll need to provide Revolut with some personal information. This will include full legal name, home address, date of birth, nationality and residency, email address and phone number.

Step 2. Verify your identity

As you are effectively applying to open an account with an organization that offers banking services, you will be required to verify your identity.

You’ll need to first take a selfie, and then upload a scan of your government issued ID. This can either be a passport or driving license.

Revolut uses cutting-edge technology to verify identities, which means the process usually takes no more than a few minutes.

Step 3. Fund your account

As soon as your identity has been verified, you can then proceed to deposit some funds. You can do this via a bank transfer (UK Faster Payments, SWIFT or SEPA), or with a debit/credit card. We would suggest using a debit or credit card, as the process is instant. This way, you’ll be able to start buying crypto straight away.

Step 4. Buy or sell crypto

At this stage of the guide, you should now have a fully verified Revolut account that is funded. You are now ready to invest in crypto via your Revolut app.

Within the app, click on the “MORE” button, followed by “CRYPTOCURRENCIES”.

You then need to select your preferred fiat currency from the drop-down list, as well as the cryptocurrency that you want to invest in.

Finally, enter the amount that you want to purchase to finalize the trade.

Is Revolut regulated?

Regulation is somewhat complex when it comes to Revolut. First and foremost, Revolut is registered with the FCA, meaning that they comply with the Payment Services Regulations 2017 and the Electronic Money Regulations 2011. Client funds are held in segregated accounts with UK institutions Barclays Bank and Lloyd’s. Revolut has also acquired a European banking license.

Is Revolut safe?

When it comes to safety, Revolut utilizes financial institution-like security practices. This includes a fully fledged risk management and anti-fraud team to ensure that customer funds are kept safe.

We have identified the following security features at Revolut.

- PIN number required when logging in and spending funds

- All Revolut users identified

- Email address notifications

- Requirement to enter a unique code sent to your mobile phone when performing transactions

As good as the Revolut banking app is, keep in mind that you do not have the option of withdrawing your coins out to a secure private wallet. Don’t forget, this is because the coins do not actually exist, insofar that you are only speculating on the movement of its price.

Best Cryptocurrency Exchange in September 2024

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Best Revolut alternatives

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

Does Revolut have a crypto wallet?

Revolut does not offer a wallet. You do not actually own the coins that you buy at Revolut, meaning there is technically nothing to store. You instead need to rely on Revolut to keep your funds safe.

Does Revolut have an app?

Revolut is only available via a mobile app. You can download the app free of charge on both Android and iOS devices. As a result, you won’t be able to access your Revolut account via a desktop or laptop device.

Revolut customer service

The Revolut app also offers good customer support services based on what emerged from our research. You can get in touch with a member of staff via the live chat facility and in our experience, they are quite responsive. The responses we received were always very friendly and professional and the waiting time to get a response was of around one or two hours. There are also alternatives to the live chat. You can contact customer support via email, at the address support@revolut.com or you can message them on Twitter.

Pros and cons of Revolut

Pros:

Cons:

- You don’t own the crypto asset that you buy

- Can’t withdraw your coins to a private wallet

Conclusion

In summary, Revolut is a really good application if you want to access banking products and services on the move. At the click of a button, you can send and receive funds just as you would with a traditional bank account. Moreover, as you are also given a Visa/MasterCard, you can buy goods online, and even withdraw cash at an ATM.

We also liked the cryptocurrency segment of the Revolut app. Perhaps having five cryptocurrencies to choose from may not be varied enough, but we do believe in the services that the exchange has to offer and in the efforts it seems to be making to support customers. The only thing we recommend keeping i mind is that you don’t actually own the asset when you invest on it, meaning that you can’t withdraw the coins to a private wallet. Instead, you’re speculating on the price of the crypto you buy.

Revolut is also FCA compliant, which is always an additional security considering that the FCA is one of the most trusted regulatory agencies on the market.

Read more:

Revolut supports 5 cryptocurrencies.

You can't short coins on Revolut.

Revolut does not offer telephone support. You'll need to contact support via live chat, email, or Twitter.

You can top-up your Revolut account with a debit/credit card, and then use the funds to invest in crypto. How many coins do Revolut list?

Can you 'short' Bitcoin on Revolut?

How do I contact Revolut by telephone?

Can I buy crypto with a debit/credit card at Revolut?

Bitcoin

Bitcoin