IOTA is a cryptocurrency that works independently of Bitcoin or any other currency. IOTA is one of the few cryptocurrencies that does not use blockchain technology, it makes use of its variant of a blockchain, known as “The Tangle.” IOTA aims to provide a third data layer above the current two in the financial system, especially for the “Internet of Things” (IoT), hence the name, “IOTA.”

The IOTA Network’s native “currency” is called IOTA, which is almost identical to how Ether’s native currency is known as Ethereum. In 2015, IOTA was launched and received funding for its operations from Bitcoin, which had a total value of roughly $500,000 at the time.

IOTA aims to build a decentralized platform for prediction market predictions. Users may create their own questions about important events and profit from them by purchasing optimistic or negative shares concerning the outcome of such an event, thanks to the Ethereum-based decentralized protocol.

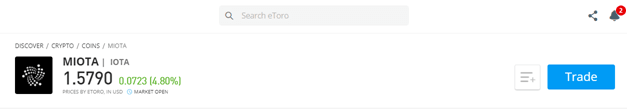

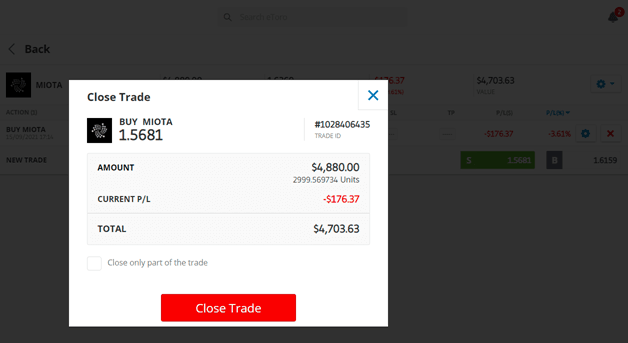

IOTA was created by a team of professionals that were looking to develop a cryptocurrency that would address many of the problems encountered by blockchain technology. IOTA aimed to improve numerous issues, such as scalability and having the capacity to increase as more users join the network. The betting system is built on IOTA’s reputation system, which signals that reporters are putting their reputations on the line. Users may buy shares in the market using Ether or a less volatile asset, DAI, which is also based on Ethereum and has a one-to-one fiat dollar peg. IOTA is a groundbreaking asset with the potential to be the foundation for a worldwide Internet of Things-wide payment network. The IOTA architecture also offers promise for blockchain development, since “The Tangle” demonstrates that blockchain architectures are not fixed and may be extended toward other forms of potentially more efficient technology. Buying cryptocurrency may appear difficult at first because of the complicated technicalities, but Binance and platforms that provide legacy system simplification make it much easier. IOTA is a revolutionary and potentially game-changing technology that, if utilized correctly, has great potential. You can only trade IOTA via a broker. Cryptocurrencies, like IOTA, need liquidity to exist. This article is intended to assist you in making an informed decision when selecting a broker. We’ve included a few firms below that you may always call on if you need to sell your IOTA. These brokers have met de facto standards recognized by industry experts and are regarded as safe platforms for both novices and experienced investors to sell cryptocurrency. The above list includes firms that operate in the same sector and industry, allowing thousands of investors to acquire and sell crypto assets or even trade them to obtain a good return. They operate in various countries. They also agree to the laws of the nations where they operate while expanding their services for customers in these nations to enjoy more. Before selecting a broker, it is critical to keep certain standards in mind. If no broker has met any of these criteria, it casts doubt on the broker’s reputation. A number of these standards include a simple and pleasant user interface, quick customer service, compliance with laws, security, many trading pairs, and so on. Experts have deemed the brokers listed above to be secure. Some of these brokers also offer features such as staking, borrowing, and even allowing customers to pay for services using their accounts on the brokers’ platforms, which is something to keep in mind. Even though this asset has one of the largest daily trading volumes on record, it is still extremely simple to locate liquidity for it. Users are occasionally permitted to trade futures. In reality, all of these brokers have become renowned not just among investors and traders, but also in the cryptocurrency industry as a whole. They’ve been able to develop a reputation for honesty over time as brokers that sell IOTA. It is relatively simple to sell IOTA, especially if you bought it. In any case, whether trading the asset or another cryptocurrency is contingent on whether there is enough liquidity for it. We mean demand when we talk about liquidity. The selling option is selected if the market value of a crypto asset is equal to or greater than its purchase price. The liquidity of IOTA stems from its position among cryptocurrencies. While attempting to sell your IOTAasset, make sure there’s a suitable withdrawal method available. eToro has been included in all of our articles, including the ‘How to Sell Bitcoin’ and ‘How to Buy Bitcoin’ guides, as a trustworthy broker you can count on at any time. you won’t miss eToro among the top 10 cryptocurrency exchanges worldwide. The eToro platform was designed with new and seasoned traders in mind. Each feature on the platform is intended to make trading and other crypto-related tasks easier. As a result, novice investors will be able to use eToro to exchange IOTA or any other cryptocurrency without making errors. New investors will find the platform easy to navigate. The eToro team also deserves credit for being among the few cryptocurrency exchanges that have a tutorial detailing how coins can be stored on their platform. These types of guides are extremely useful in instructing novices in trading and cryptocurrency in general. In the remainder of this guide, we’ll go through how to sell IOTA on eToro in five easy steps. If these steps are followed carefully, selling on the platform should be a breeze. Because it’s unrealistic to expect to sell something you don’t currently have, IOTA must be purchased first, even if you intend on selling anything else. You can buy IOTA on eToro or from another exchange. Then you may trade it on eToro after obtaining it. Permitted customers on eToro can buy IOTA, however only verified clients are eligible. As a result, you’ll be required to complete verification procedures after registering. You may then proceed to deposit funds into your account by providing the relevant information for verification, including your country of residence, date of birth, true name, profession, income threshold. The vast majority of crypto traders prefer to deposit USDT. eToro provides a variety of methods for you to transfer assets into your account. Sending money via your credit or debit card, as well as local bank accounts, and third-party services like PayPal, Skrill, and Neteller are all options. You may buy IOTA through a fiat currency of your choice or your preferred cryptocurrency once the money has been received via any of the aforementioned methods. The majority of people choose the latter, as USDT is a fixed currency that is not affected by price changes like other cryptocurrencies. You may select one or the other depending on your personal choice. IOTA (MIOTA) on eToro The goal of every investor is to make money. Despite understanding when IOTA should be bought, it’s crucial to know when to sell unless you wish to record unintentional losses. Investors who buy crypto assets for the long run are always aware when they’re in profit so they can sell. If you know what you’re doing, you can avoid recording losses on your investments. In addition, the prices of digital assets are frequently unpredictable. As a result, it is feasible to be in profits today and the following few days while the value of the asset invested has dropped. Furthermore, no one has control over the price of these assets. It’s a good idea to set a selling goal for your IOTA investment. If you don’t set one, you risk losing money in your portfolio. For this, eToro wanted to assist traders in making intelligent investment decisions, so it included charts for each crypto asset, such as IOTA, into its platform. Candlesticks and patterns are used to analyze an asset’s historical data, including IOTA. You can examine these graphs to see when it’s time to make a cryptocurrency purchase on IOTA or any other cryptocurrency. On eToro, clicking on IOTA takes you to where you can learn more about the asset, including the amount of volume traded on the exchange. IOTA price chart on eToro Aside from IOTA, you may have other assets in your portfolio since eToro supports a wide range of cryptocurrencies and trading pairs. nIn this article, we’re focused on the asset IOTA because we believe it’s most relevant to our readers. Along these lines, knowing the full value of your portfolio will help you determine whether the amount of IOTA you want to sell is enough. eToro has a minimum withdrawable sum of $50. So before you can sell IOTA, you’ll need that much. eToro overview image Click the top left corner where you have “Portfolio” on the platform to discover the value of your portfolio. After tapping on the “Portfolio” icon, you’ll see a list of all of your crypto assets and their values. You can also sell IOTA if you don’t like it. Simply look for other assets to exchange and click on them. Before you exchange the asset, make sure you have enough money available in your account. To sell your IOTA asset, you must first close open trades. Closing your active positions is what it means to sell the asset. In addition, if the asset is still in its original form, you won’t be able to do so. Cryptocurrencies’ volatility is something to be concerned about. It is critical to close your IOTA investment and sell for the currency you want before making a move. Because prices can swing wildly, closing your position at or below the target price after it has been hit or delaying for a while after then could result in a return and discover that prices have retreated. To protect your profits, you must act fast. Closing your open trades necessitates converting IOTA into USDT or another digital currency, as previously said. When you close these positions or sell them, the amount in your portfolio will decrease (this might happen if eToro charges withdrawal fees). When a buyer purchases the IOTA you’re selling at market rate, there’s a chance that the actual amount of IOTA sold will differ from what is displayed in USDT owing to ‘Slippage.’ Slippage happens when an asset settles at a price less than the target. There may be a favorable or unfavorable slant to slippage. When a negative slippage occurs, a trade is triggered by trading at a lower price than the designated target; whereas, when positive slippage occurs, an asset settles for a higher cost than the intended goal. Closing trade on eToro If you want to terminate an open position on IOTA using your eToro account, go to the portfolio symbol and select every asset you own. There, you can tap IOTA, and then move on to the trading section. In this area, you can choose the price at which you want to sell IOTA. Alternatively, if you only wish to sell a portion of IOTA, use the search symbol to look for a pair that suits your needs. You should then click on it and be taken to the trading area where you may sell your chosen pair. Even if you sold IOTA, the value of your portfolio is represented by whatever amount you sold. This balance can also be withdrawn to any of these three options: your bank account, PayPal account, or a credit card linked to your account. eToro is a fantastic platform for traders who want to withdraw currency from their accounts. eToro has no limits on assets withdrawal, as long as the necessary requirements are met. The majority of eToro’s withdrawal reviews are positive. Even newbies can use the exchange’s withdrawals with ease. There are times when problems with withdrawing occur, but they are rare. It’s conceivable that a consumer is using an account from a blacklisted nation. Incomplete verification, mistakes while initiating withdrawals, and failure to include withdrawal channels are among the examples. eToro is committed to making IOTA withdrawals as simple as possible. This makes it easy for you, the user, to sell your IOTA without difficulty. eToro ensures that every crypto asset stored on its foundation can be exchanged. You may immediately exchange your IOTA since they have a USD value. The withdrawal limit on eToro is somewhat lower than other exchanges, but the quality of its services has not been reduced. The minimum IOTA withdrawal amount on eToro costs 0.5%. eToro’s minimum withdrawal fee is $1, while the maximum is $50. This shows that eToro is thoughtful about its fees. Cryptocurrencies like IOTA are considered property in the United States for tax purposes. When you sell, trade, or otherwise dispose of your cryptocurrency holdings, you incur capital gains and losses, just like with other forms of property such as stocks and bonds. For example, if you purchased $10,000 worth of IOTA in October and sold it two months later for $12,000, you would have a $2,000 capital gain from the transaction (12,000 – 10,000). You will pay a different amount of tax on this capital gain depending on your tax bracket. Tax rates vary based on your personal tax bracket and the length of time the gain was held (more later). You are responsible for paying income taxes on the US Dollar value of your crypto earnings if you earn cryptocurrencies either through employment, mining, staking, airdrop, or interest-bearing lending activities. The percentage of tax you pay will be determined by your personal income tax bracket and the holding period of your crypto assets (short term vs. long term). This varies from person to person. Short-term capital gains tax events: Any crypto transaction that took place in a shorter time period than a year will be subject to short-term capital gains tax. For example, if you purchased Ethereum for $400 and sold it 5 months later for $600, your $200 profit would be considered a short-term capital gain. Short-term capital gains are simply taxed as earned income (much like your wage) and, as a result, you must pay taxes on them at your personal income tax rate. Long-term capital gains tax events: Any crypto that has been held for 12 months or more is eligible for long-term gains. The government wants investors to invest in cryptocurrency for the long term, therefore they provide tax incentives for doing so. Long-term capital gains taxes are lower than short-term gains. Long-term capital gains tax rates As you can see, retaining your crypto for more than a year may provide significant tax savings. If you are in the highest income tax bracket, your long-term capital gains taxes will be 20% rather than 37% (the highest rate for short-term profits). You may discover which cryptocurrencies in your portfolio qualify for long-term capital gains, as well as assist you in planning future trades. In the long term, this might save you tens of thousands of dollars in taxes. There are more than 100 cryptocurrency exchanges around the world. Some are based in different nations. Traders used to have a difficult time buying and selling cryptocurrencies previous to now. This isn’t due to the fact that their offerings are unique from those of others; rather, it’s due to their willingness to go above and beyond in safeguarding client interests. The greatest cryptocurrency exchanges are defined by a variety of criteria. These features include security, a user-friendly design, responsive customer service, and instructions on how to use the platform. On eToro, you’ll learn all there is to know about selling or trading IOTA tokens. The site is simple and clear to use. You may deposit money in a variety of ways, including by using fiat currencies, bank accounts, cryptocurrencies, wire transfers, and credit cards. You can buy cryptocurrency by choosing the amount of money you wish to trade or the percentage of your IOTA holdings that must be transformed for it. Users can trade with as little as 0.5% of their entire portfolio under such circumstances, implying that they have the freedom to do so. In light of what you’ve learned, some exchanges have been able to achieve this by following these rules. Some exchanges haven’t met these standards and don’t have as many people signing up or trading their coins because they didn’t meet them. Some exchanges, on the other hand, provide superior services to their customers by allowing them to utilize copy trading or trading bots. Traders who are uncomfortable with manually executing transactions may instead use bot trading to automate the trade process. Below, we have a list of high-ranking and industry-recognized cryptocurrency exchanges: It’s critical to keep IOTA. Cryptocurrencies, like IOTA, are kept in digital wallets. Different methods of crypto investment and holding are used by investors and holders. Some people save their funds in hot wallets while others move them to hardware wallets, often known as cold wallets. Alternatively, they may store their coins in exchange after purchasing them. However, this is not a smart idea because these funds may be stolen. On centralized exchanges, there have been several incidents in the past when investors’ cryptocurrency assets were stolen. This does not imply that decentralized exchanges are any more secure than centralized ones. Although this is the case, you may choose to keep your IOTA in any wallet of your choosing as long as you take the required precautions to safeguard your assets. You must also be willing to accept the losses if anything goes wrong. We’ve identified some of the greatest crypto wallets for storing IOTA in another article Here. If you are taking the invest-and-sit-back approach, you will likely have to actively monitor the price of IOTA, especially if you don’t have a target price. Keeping track of the price of an asset might be difficult since you must stay up to date on developments in the cryptocurrency market in order to know whether or not you should sell off your IOTA holdings. Essentially, your IOTA investment strategy determines whether you are allowed to sell your tokens. If you follow a short-term approach, you must wait until the moment is right before swapping your IOTA. There is no such thing as a specific date to sell your IOTA since it is determined by your investing technique. Given that the crypto market is unpredictable, a variety of things might occur during the time between your investment reaching its intended goal and when it does. A negative news story may have an impact on your open position or assets. This is why it’s critical to conduct analysis whenever you want to invest. Even when a trade is going poorly, your activities are kept in check by the study. You may have to wait longer than required before hitting your goal at times. The cost of IOTA has been volatile. Given that the market is unpredictable, the crypto asset’s price isn’t constant. When the market changes, it indicates that costs will rise on specific occasions before declining later on. The price fluctuations of REP may be seen on charts using candlesticks and recognizable patterns. IOTA has a fixed supply of 6.6 million tokens, with no more being produced, resulting in a circulating supply of 6.6 million. The native token reached an all-time high of $341 in 2016 and is currently trading at its peak value. Since 2016, the price has plummeted to $25. IOTA, on the other hand, is a valuable cryptocurrency; most native coins are like this, especially when they facilitate network transactions. Aside from the cash they usually have to put, crypto trading requires traders as well as their own time and dedication. Traders will normally stay up to date on significant market events through news announcements. Automated trading bots allow traders to focus on other activities. Cryptocurrency trading robots are programmed using algorithms. To be precise, they require a little bit of human input to function properly. Trading ranges must be activated by a trader since these bots are incapable of operating on their own. A trader must activate a trading range based on his strategy in order for these bots to function. Because they are built to react to market opportunities faster than humans, trading bots are essential. Bot programs can involve risk – those interested should only deposit a small amount at first to test them out and avoid bots we’ve blacklisted on our trading robot page. These are some bots we’ve reviewed: These days, everyone seems to be touting that they have invested in cryptocurrencies. To whom wouldn’t it be appealing? Many people have made enormous earnings investing in cryptocurrencies. Of course, you may be feeling the strain to do the same thing, but you are concerned about how it will turn out. The problem is that crypto is not a good idea to get into without first gaining knowledge. It’s beyond the realm of possibility for new investors to have money to invest. Any would-be investor should see a volatile market as a flashing neon light. In addition, there are other characteristics that a crypto investing candidate must possess. Patience, risk management, good trading psychology, emotional stability, technical and fundamental analysis skills all come together to form a competent trader in the end. The market is not under anyone’s control; as a result, it must be well-traveled. The crypto market has had to endure the ups and downs of both rallies and volatilities, which have endeared and frightened away several investors. You could still be unsure if you should invest in Stellar. Experts believe that, as the sector matures, prices will be more stable and less volatile than in traditional markets. To sell IOTA on eToro and similar platforms, you must first close positions. You can trade the asset against USDT or your home nation’s fiat currency before withdrawing funds to your regular bank account. IOTA may be kept in a wallet, whether hardware or software-based. If you’re thinking of purchasing any cryptocurrency, do so only after fully understanding it and not because it appears to be a good investment. Invest what you can afford to lose, as they say. The cryptocurrency market is a volatile one, and it may not be traded on in the hopes of obtaining profits or speculations. This handbook can serve as a reference when you want to invest in IOTA again. Many investors get caught up in the glamour of cryptocurrency trading, thinking that it’s their ticket to getting rich quickly. The truth is that they will fall into some common traps that cause them to lose money or reduce their earnings through trades. There are several types of mistakes that investors make while having fun with cryptocurrencies, but there are also ways to avoid these mistakes and keep safe while investing in cryptocurrencies. It’s also important for traders to stay away from crypto on days when its volatility is at its highest. Our recommended best exchange to sell IOTA in 2024 is eToro as they are regulated internationally and support withdrawals by bank wire, VISA, Skrill, Neteller and a range of other methods.

In this post, we propose selling IOTA on an exchange since you know you'll be safe and get real currency. There are several alternatives for selling your assets. P2P trading is another choice, although it comes with a number of risks. To sell your IOTA for USD, EUR, GBP or other fiat currencies, you’ll need an exchange that allows you to send money directly to your bank. The most popular alternatives are eToro, Coinbase, AvaTrade, and Binance.

With a broker such as eToro, selling your IOTA may be finished in minutes after only a few clicks. The exchange also offers withdrawal choices.

IOTA can be sold by a number of brokers. However, expert traders consider the options below to be the finest. eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly are among the most popular brokers for trading IOTA.

Consult your local govt website information as taxes for selling cryptocurrencies vary by jurisdiction.

You must have an exchange that supports payments to your local bank or third-party payment service in order to sell IOTA for USD. eToro, Coinbase, AvaTrade, and Binance are some of the finest options.

IOTA can be purchased on eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly.

To sell your IOTA as quickly as possible, you'll need to create an account with eToro or one of the other exchanges listed above. It only takes a few minutes to set up an account. You may send your IOTAs to the exchange's wallet and sell them right away if you have them already.

You'll need a withdrawal channel on eToro or another exchange listed above in order to sell IOTA for cash. Choose your preferred currency. After your withdrawal, the exchange converts the money to money and delivers it to the correct sender.

Only four cryptocurrencies are supported by PayPal: Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), and Litecoin (LTC).

Some wallets enable you to sell your IOTA straight from the app. You must connect a payment method and follow the necessary selling IOTA procedures in order to sell them on the wallets.

On eToro and Coinbase, you may exchange your BTC for other cryptocurrencies. The actual value of BTC sold will be revealed in the cryptocurrency you pick after you've completed the trade. On this Page:

How to Sell IOTA in September 2024

Step 1: Buy IOTA

Step 2: Always Know When to Sell

Steps 3: Know the Total Value of Your Portfolio

Steps 4: Close All Active Positions

Steps 5: Withdrawal Requirements and Exchange Rates

Crypto Taxation in the US

Best Crypto Exchanges to Sell IOTA

Storing IOTA in the Best Wallets

When is the Best Time to Sell my IOTA?

Price of IOTA

Guide to Automated Trading

How to Invest Responsibility in Crypto

Summary

FAQs

How to Sell IOTA

How Easy is it to Sell IOTA?

What Are The Best Brokers For Selling IOTA?

What Are The Taxes For Selling IOTA?

Where to Sell IOTA for USD

What Are The Best IOTA Exchanges?

How to Quickly Sell IOTA

How to Sell IOTA For Cash

How to Sell IOTA For Paypal

How to Sell IOTA From a Wallet

How to Sell IOTA For Other Cryptocurrencies