Web3 Foundation’s Polkadot is a platform that allows distinct blockchain networks to interact and communicate with one other in a secure and trustworthy manner, thanks to its interoperability. Polkadot is a way for different blockchain networks to talk to each other.

The Polkadot (DOT) cryptocurrency is the network’s major token. It has three primary functions: network governance, staking, and bonding. It is native to the Polkadot platform rather than being an ERC-20 token.

As there is no maximum supply for the DOT, it is considered to be inflationary. Until now, there have been over 1 billion coins in total supply, with 687 million DOT coins that have already been staked. Polkadot has two types of Blockchains: the main network, known as the relay chain, and user-created networks known as parachains.

They are connected to the relay chain, which is the core Polkadot Blockchain. This implies that transactions in parachain networks benefit from the main chain’s security. The Relay Chain network handles the finalization of transactions, but it has only basic features. Smart contracts are not supported on the Relay Chain. Its main duty is to keep the system running as a whole, including parachains.

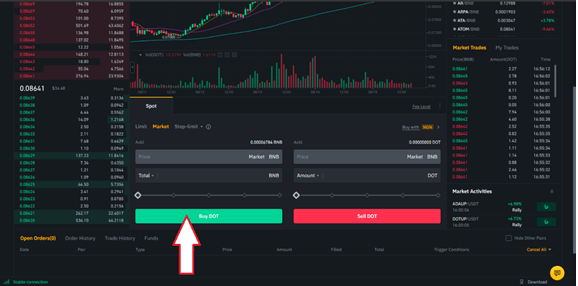

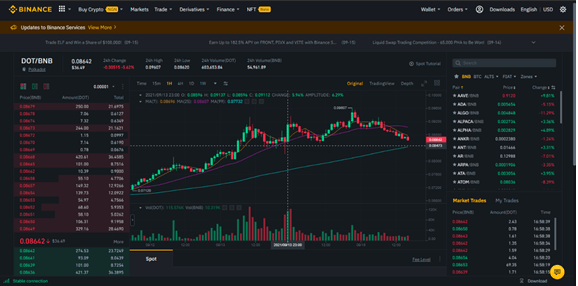

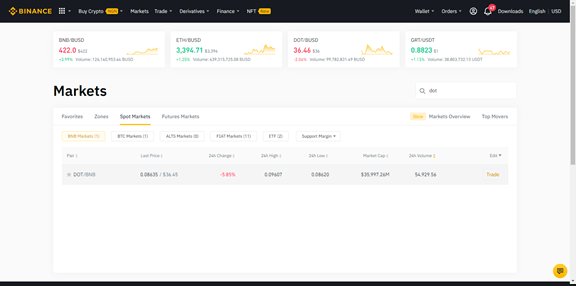

In this guide, we are going to consider why Polkadot is a must-have and how to buy Polkadot on an exchange as well as sell the tokens. You can only sell Polkadot with the help of a broker. Brokers or crypto exchanges provide liquidity to cryptocurrencies including Polkadot. This guide is aimed at guaranteeing that you settle for the right choice on a broker. We featured a few brokers below that you can always resort to whenever you need to sell your Polkadot. Note that these brokers have fulfilled de facto parameters recognized by industry experts, and are considered suitable platforms for both newbies and experienced investors to sell cryptocurrency. The above list includes firms that operate in the same sector and industry, allowing thousands of investors to acquire and sell crypto assets or even trade them to obtain a good return. They operate in various countries. They also agree to the laws of the nations where they operate while expanding their services for customers in these nations to enjoy more. Before selecting a broker, it is critical to keep certain standards in mind. If no broker has met any of these criteria, it casts doubt on the broker’s reputation. A number of these standards include a simple and pleasant user interface, quick customer service, compliance with laws, security, many trading pairs, and so on. Experts have deemed the brokers listed above to be secure. Some of these Brokers also offer features such as staking, borrowing, and even allowing customers to pay for services using their accounts on the brokers’ platforms, which is something to keep in mind. Even though this asset has one of the largest daily trading volumes on record, it is still extremely simple to locate liquidity for it. Users are occasionally permitted to trade futures. In reality, all of these brokers have become renowned not just among investors and traders, but also in the cryptocurrency industry as a whole. They’ve been able to develop a reputation for honesty over time as Brokers that sell Polkadot. The Binance website and desktop interfaces are nearly identical, with only minor variations. Both provide the same step-by-step fiat outflow processes. Log in to Binance.com using your existing Binance account. If you don’t already have one, click here to create one. Before you can withdraw your Polkadot, you’ll need to convert it into fiat currency. You have two options: trade Polkadot to fiat with Spot Trading (BTC/EUR, BTC/AUD, etc.), or use the Convert option to exchange currencies. After you’ve chosen your desired fiat currency, go back to the Fiat and Spot wallet and choose Withdraw. Click the “Withdraw” button. Binance allows you to withdraw using credit cards, debit cards, bank transfers, and local wallets. Each has its own set of advantages and drawbacks. Credit/debit card withdrawals are faster than bank transfers but cost more, whereas bank transfers take a little longer but have significantly lower fees. Fill in the required fields and then press the Redeem button. Fill in the amount you want to withdraw and choose a withdrawal method from the drop-down menu. Depending on your choice in the previous step, you will be asked to connect your debit or credit card or bank account for fiat withdrawals. Fill out the withdrawal form. confirm the withdrawal, provide your verification code (text or email, or both), and you’re done. However, depending on where you live, the payment options accessible to you may differ. Since it is absurd to expect to sell an asset that you don’t currently possess, purchasing DOT is the initial step before any selling activity can occur. Binance permits clients to purchase DOT or you can purchase from another exchange. Then after buying, you can send it to Binance to sell. Binance has several advantages over other cryptocurrency exchanges in the market. Binance provides a large number of trading pair possibilities, which is one of the most liquid assets in the cryptocurrency market. The first step is to make a Binance account. If you haven’t already, make sure to sign up for one. It is usually easy to complete. Users can start trading digital currencies on the platform by following a few easy procedures. But in order to increase your limits, you need to follow a verification procedure and it may take longer than expected. You have two choices in signing up: email or mobile phone! Before you can trade Polkadot on Binance, you must first establish an account. This is determined by how you registered previously. The first technique would be to follow the link in your email. You must enter a confirmation code that was sent to you via text if you use your phone. This code lasts for only 30 minutes. Binance has three levels: Level 1, Level 2, and Level 3. The first level is referred to as Level 1 since it allows traders to trade on the platform without having to complete KYC or identification verification processes. You may get some Polkadot(DOT) in one of three ways: You can put money into fiat or cryptocurrency, or you can use your credit card to acquire cryptocurrencies. Check that Binance has enabled 2FA for the upgrade of your security as well. After all of that, you must now trade or purchase Polkadot coins on Binance. In general, there are three options for executing this: trad, classic, and professional trading. Furthermore, under the menu selection “Trade,” all three choices are available. The initial step is to change your funds into DOT, which is the simplest way to trade on Binance, as we previously said. You can also trade USDT, BUSD, or a stablecoin (USDT, BUSD) for DOT right now without having to use the Binance trading engine interface. Finally, the basic and advanced trading screens allow you to input the amount of DOT you wish to buy at a certain price in the order book. Simply click the green “Buy DOT” button to finalize your transaction. After Binance has completed your purchase, you’re done! Polkadot on Binance Every investor buys a tradeable asset with the goal of making money. Despite knowing when to buy a crypto asset like DOT, it’s also vital to know when to sell. Indeed, even long-term crypto investors who purchase assets for the sake of profitability understand when they are in profit so that they may sell. If you know what you’re doing, you may avoid recording losses on your assets. Furthermore, the value of digital currencies is extremely volatile. As a result, it’s possible to make a gain on your investments today and over the next few days, as the price of the asset in which you have invested has plummeted. To assist traders to make well-informed investment selections, Binance added charts for each crypto asset, including DOT. These charts include candlesticks and motifs that can help you analyze the historical data of an asset like DOT. Similarly, you can study these charts to realize when to make a purchasing choice on DOT or other cryptocurrencies. On Binance, you can click on DOT and it takes you to where you can find more info about the asset including the traded volume on the exchange. DOT Chart on Binance Binance offers numerous cryptocurrencies and trading pairs, therefore there may be other assets in your portfolio aside from DOT. Aside from DOT, there may be additional assets in your portfolio since Binance offers a wide range of cryptocurrencies and trading pair possibilities. Our attention is on the asset, DOT, in this article. Knowing the complete value of your portfolio can help you determine if selling enough DOT is feasible. Binance overview To get your Binance login, go to [Wallet] – [Overview]. All of your Binance wallets may be seen here, as well as internal and external transactions. The predicted balance for each wallet may be viewed here. This is the estimated value of your Polkadot balance (by default), as well as an anticipated dollars value. Click [Show Balance] to show or hide your wallet balance. Simply click the wallet name at the left or bottom of the screen to switch between wallets. Aside from Binance’s wallets, you can also add your Binance TR, Tokocrypto, JEX, WazirX, and BPLAY accounts. To sell your DOT asset, you must first close open positions. Closing your active positions refers to selling the product. You can’t perform this if the asset is in its original condition. The volatility of cryptocurrencies is something to be concerned about. Leaving your DOT investment without going on to sell for your preferred currency- whether it’s fiat or USDT- may be a hazardous decision because you risk losing your money. Closing open positions necessitate swapping the DOT for USDT or some other digital currency as previously said. After closing these positions or selling, your portfolio reflects the same amount (or less) than it did before (this could happen if Binance has withdrawal costs. Similarly, if you sell via a market price, the actual amount of DOT sold may not be equal to that reflected in USDT due to what is known as ‘Slippage.’ When an asset reaches a price lower than the intended target, slippage occurs. There may be either a positive or negative slant to slippage. When a trade is done at a lower price than the stated goal due to negative slippage, it’s known as adverse slippage; when an asset settles for a higher price than the intended value, it’s called favorable slippage. Closing trade on Binance To finalize a trade on Binance, simply use the Close-All Positions button. The Close-All Positions tool allows traders to exit all open positions rapidly in the event of severe market volatility. Users no longer have to individually cancel many positions thanks to this new capability. To close, instead of clicking on each position separately, click on the [Close All] button. By default, all users have the function to close all positions enabled. To discover whether it’s true, check [Close All Positions] on the [Positions Preference] icon (as shown in the above screenshot). If the Close-All position’s function is enabled, a [Close All Positions] button will appear on the [PNL(ROE%)] tab. The Close-All options are set at market value and allow you to exit all open positions all at once. This option will immediately terminate any open orders and place market orders to close all positions. Binance offers a user-friendly interface that supports the assets withdrawal process. Even for novices, Binance’s withdrawal procedure is simple to use. The exchange provides an easy approach to make withdrawals. There may be times when withdrawal difficulties occur, but they are quite rare. It’s possible that a client is utilizing an account from a blacklisted nation. Incomplete verification, mistakes while creating withdrawals, and failure to add withdrawal routes are other examples. Binance is dedicated to making withdrawals from its eWallet as simple as possible. As a user, this makes it easier for you to sell your DOT without any hassles. Binance ensures that each crypto asset kept in its e-wallet may be readily exchanged. You’ll be able to convert your DOT into fiat whenever you choose. When you’re not trading, it’s a smart idea to shift your coins out of an exchange and into a secure wallet that you own. As opposed to being at the mercy of the exchange’s security precautions, your funds will be in your hands rather than theirs. To do this, you’ll need a wallet that supports DOT tokens. The imToken mobile software wallet is feature-rich and available on iOS and Android. Alternative choices for the Desktop include the Windows and Mac Atomic desktop wallet. For maximum protection, I recommend using a hardware wallet like the Ledger Nano X instead. After you’ve created a wallet on Binance, you may withdraw your tokens there. From the top menu, go to “Funds” > “Withdrawals.” Select DOT from the dropdown box. Fill in the Dot Withdrawal Address of your Polkadot wallet as a destination. Click Send after double-checking the address and amount you wish to withdraw. When your transfer has been completed, Binance will notify you. Cryptocurrencies are treated as property in the United States for tax purposes. When you trade, sell, or otherwise dispose of your cryptocurrency holdings, capital gains and losses will be generated. For example, if you spent $10,000 on bitcoin in October and sold it for $12,000 two months later, you would have a $2,000 capital gain from the sale (12,000 – 10,000). The capital gains tax in the United States is determined by your marginal tax rate and the length of time you kept the gain. Tax rates differ depending on your personal tax rate and how long you’ve owned the asset (more later). If you make profits in cryptocurrencies—whether through a job, mining, staking, airdrops, or interest earned from lending activities—outside of the United States and sell them for USD value in the United States, you are responsible for paying income taxes on your crypto ROI. The tax rate you pay on your crypto profits is determined by your personal income tax bracket and the length of time you’ve kept the coins (short-term vs. long-term). This is dependent on each investor’s situation. A short-term capital gain would be generated if you sold cryptocurrency for less than a year after obtaining it. For example, if you bought Ethereum for $400 and sold it five months later for $600, your $200 profit would be considered a short-term capital gain. Short-term capital gains are not eligible for any tax perks. They are taxed as income and have the same personal income tax rate as your employment earnings, which is 28 percent. Long-term capital gains apply to cryptocurrencies that have been kept for 12 months or longer. The government wants investors to invest for the long term by providing tax incentives for doing so. Capital gains taxes are lower than short-term profits, as seen in the chart below. Long-term capital gains taxes If you keep your bitcoin for more than a year, you may save a lot of money in taxes. Your long-term capital gains tax will be 20% rather than 37% if you are in the highest income tax bracket (the highest rate for short-term profits). Binance can help you determine whether or not your cryptocurrency portfolio qualifies for long-term capital gains treatment quickly. This might save you hundreds of dollars in taxes over time. For free, sign up here to get started. Most people can now buy and sell cryptocurrencies on crypto exchanges, which is remarkable. Despite their shared objective, you may find a variety of services on these platforms. Except for cryptocurrency trading, these businesses may provide a variety of services. As a result of this, your decision is determined by your demands. Some crypto exchanges have been able to stand out and appeal to a broad audience due to their excellent client service. This isn’t because their products are distinct from those of others; it’s because they’re eager to go above and beyond in defending customer interests. The finest cryptocurrency exchanges are determined by a number of factors. These characteristics include security, a user-friendly interface, responsive customer service, and instructions on how to use the platform. On Binance, you’ll discover all there is to know about selling or trading DOT tokens. The platform is straightforward and easy to navigate. You may deposit money in a variety of ways, including through fiat currencies, bank accounts, cryptocurrencies, wire transfers, and credit cards. You can trade bitcoin by choosing the amount of money you want to trade or the proportion of your DOT holdings that must be changed for it. Traders who are hesitant to manually execute transactions may instead use a robot trader to automate the trade process. Below, we have a list of high-ranking and industry-recognized cryptocurrency exchanges: What’s the best wallet for a DOT? Many groups are presently creating wallets for DOT tokens, including offline (cold) storage alternatives. Some are already available, while others are still under development. Because the Polkadot network is so young, any of your preferred wallet providers may choose to list and support DOT. However, this is not a good idea since these assets might be stolen. In the past, centralized exchanges have experienced several instances of investors’ cryptocurrencies being hacked and stolen. This does not discount the importance of decentralized exchanges. You may store your DOT, nevertheless, no matter what wallet you choose as long as you take the required precautions to safeguard your assets. In the event of a catastrophe, you must be prepared to bear the losses. We’ve compiled a list of some of the greatest crypto wallets where you can keep your DOT and backup your coins here. If you’re doing it the hard way, monitoring the price of DOT will almost certainly be required, especially if you don’t have a target price. Keeping track of changes in the cryptocurrency market may be time-consuming since you’ll need to stay informed about current events in order to decide whether or not to sell off your DOT holdings. It’s time to sell when your investment method informs you so. Given that the cryptocurrency market is unpredictable, a lot of things can happen during the gap between when your investment reaches its goal and the end of the period. A bad piece of news could have an impact on your open position or holdings. This is why conducting research before investing is always a good idea. Even if the trade goes against you, analysis keeps your actions in check. You might have to wait longer than planned until achieving your objective at times. The Polkadot price is $37.02 USD as of this writing, with a 24-hour trading volume of $3,772,610,065 USD. We provide real-time DOT to USD conversions. The price of the crypto asset has been unpredictable. Given that the market is volatile, the expense of the crypto asset isn’t consistent. Candlesticks and identifiable patterns can be used to track DOT’s price changes on the charts. The Polkadot price has shot up by 3.47 percent in the last 24 hours alone. It is currently ranked #8 on CoinMarketCap, with a live market cap of $36,562,038,682 USD and a circulating supply of 987,579,315 DOT coins (no maximum supply has been published). Several vital elements are required to trade cryptocurrencies successfully. The most important thing is knowledge and expertise, which will help you maximize the market. Other criteria like money and time are extremely relevant, though. Timing is an essential element that can also be a useful tool. To overcome this difficulty and make crypto trading accessible to everybody, automated trading has become a possibility. Trading bots are computer programs that can be used to execute trading instructions without direct human involvement. Trading bots are clever software capable of functioning on their own to achieve a financial objective. Traders with varying levels of expertise may use them. The desire for increased trade efficiency is one reason why traders have started to embrace trading bot technology. Because trading bots analyze the market thoroughly according to predetermined rules before acting, they can operate round the clock. Through automated trading, the game of cryptocurrency trade has taken a more creative and democratic approach. Because they’re programmed trading machines that are accessible to both novices and experts, everyone may take part in the financial market. You may now let a trading bot trade on your behalf rather than hiring someone to trade for you or putting your money in a hedge fund. Trading bots can be integrated into trading platforms, where they will analyze the current market and execute the predetermined orders as API requests. These instructions are evaluated by the exchanges, which allows them to run the method in real-time. Bot programs can involve risk – those interested should only deposit a small amount at first to test them out and avoid bots we’ve blacklisted on our trading robot page. These are some bots we’ve reviewed: There’s no need to butter up the truth; cryptocurrencies are speculative by nature, and they never lack doubt. Nobody knows with certainty when it comes to trading decisions. A profitable trade with many green candles may reverse in the following minute due to new thinking. The sentiment is said to be an important aspect of the cryptocurrency market today, according to the views of several experts. An investor’s emotions might cause prices to plummet or rise dramatically. Cryptocurrency is a rapidly changing market that grows more complicated with time. If you want to invest in it, you should know what you’re doing. Aside from learning about blockchain technology, you should also study how the asset you intend to purchase works. There are hundreds of cryptocurrencies, many of which were created to address a variety of needs. It’s critical that you research the asset that interests you, analyze its price history, and decide whether or not it’s worth investing in. You may be thinking about selling your DOT in 2024 if you are happy with your profits. Since May 2021, as with other digital currencies, DOT has been declining. When Bitcoin fell by more than 50% in May 2021, numerous cryptocurrencies had losses of 70 percent or more. While this is bad news for some investors, many others resolved to ride out the bear market till the market recovers gradually. Here are some key things to note before selling DOT: Polkadot is a protocol that was created by Parity Technologies to improve blockchain efficiency. The technology addresses issues with scaling, interoperability, governance, and more. It creates a heterogeneous tangle between blockchains through the use of relay chains. The Polkadot Network allows for the creation of several kinds of technologies on top of it. Our recommended best exchange to sell Kyber Network in 2024 is eToro as they are regulated internationally and support withdrawals by bank wire, VISA, Skrill, Neteller and a range of other methods.

In this post, we propose selling Polkadot on an exchange since you know you'll be safe and get real currency. There are several alternatives for selling your assets. P2P trading is another choice, although it comes with a number of risks.

To sell your Polkadot for dollars, you'll need an exchange that allows you to send money directly to your bank. The most popular alternatives are eToro, Coinbase, AvaTrade, and Binance.

With a broker such as Binance, selling your Polkadot may be finished in minutes after only a few clicks. The exchange also offers withdrawal choices.

Polkadot can be sold by a number of brokers. However, expert traders consider the options below to be the finest. eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly are among the most popular brokers for trading Polkadot.

Consult your local government website as taxes on selling cryptocurrencies vary by country.

You must have an exchange that supports payments to your local bank or third-party payment service in order to sell Polkadot for USD. eToro, Coinbase, AvaTrade, and Binance are some of the finest options.

Polkadot can be purchased on eToro, Capital, Libertex, Plus500, Coinbase, Binance, AvaTrade, Revolut, Cryptorocket, and Changelly.

To sell your Polkadot as quickly as possible, you'll need to create an account with eToro or one of the other exchanges listed above. It only takes a few minutes to set up an account. You may send your Polkadot to the exchange's wallet and sell them right away if you have them already.

You'll need a withdrawal channel on eToro or another exchange listed above in order to sell Polkadot for cash. Choose your preferred currency. After your withdrawal, the exchange converts the money to money and delivers it to the correct sender.

Only four cryptocurrencies are supported by PayPal: Bitcoin (BTC), Bitcoin Cash (BCH), Ethereum (ETH), and Litecoin (LTC).

Some wallets enable you to sell your IOTA straight from the app. You must connect a payment method and follow the necessary selling Polkadot procedures in order to sell them on the wallets. On this Page:

How to Sell Polkadot in September 2024

Step 1: Buy Polkadot

Step 2: Always Know When to Sell

Step 3: Know The Total Value of Your Portfolio

Step 4: Close All Active Positions

Steps 5: Withdrawal Requirements and Exchange Rates

Crypto Taxation in the US

Best Crypto Exchanges to Sell Polkadot

Storing DOT in the Best Wallets

When is the Best Time to Sell Polkadot?

Polkadot Price

Guide to Automated Trading

How to Invest Responsibly in Crypto

Should I Sell DOT in 2024?

Summary

FAQs

How to Sell Polkadot

Where to Sell Polkadot

How Easy is it to Sell Polkadot

What Are The Best Brokers For Selling Polkadot

What Are The Taxes For Selling Polkadot?

Where to Sell Polkadot For USD

What Are The Best Polkadot Exchanges?

How to Quickly Sell Polkadot

How to Sell Polkadot For Cash

How to Sell Polkadot For Paypal

How to Sell Polkadot From A Wallet