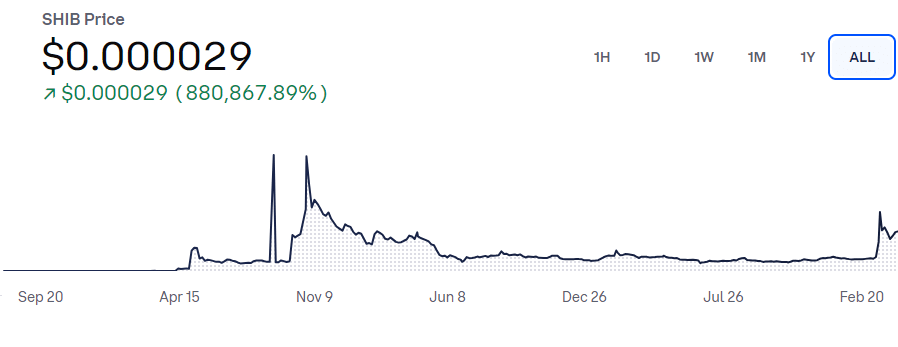

SHIB price all-time growth via Coinbase

Shiba Inu was inspired by the same dog breed as Dogecoin itself — the Shiba Inu. It launched with the intention of becoming the “Dogecoin Killer,” and it quickly gained speed and value as the community of investors was drawn in by its charm.

SHIB was launched on Ethereum, which led some to believe that its creator may have been Vitalik Buterin using a pseudonym.

However, Buterin has always denied such claims.

While these days, the meme coin sector is swarming with dog meme-based cryptos, Shiba Inu is the one that started the trend of creating Dogecoin alternatives, and as such, it is the largest non-DOGE meme coin, ranking as the 18th-largest cryptocurrency by market cap at the time of writing.

Shiba Inu price chart

Shiba Inu’s price right now is far below its full potential, as it struggled with recovery after the crypto winter of 2022.

The token traded in the flat zone throughout 2023. It was only after Bitcoin’s price crossed past its all-time high that SHIB finally went on another bull run.

At the time of writing, its price sits at $0.000022. SHIB’s ranking as the 12th-largest crypto by market cap, which sits at $17.02 billion at this time.

Like Dogecoin, the token doesn’t have a max supply, but its total supply sits at 589.59 trillion units, while the circulating supply is at 589.53 trillion SHIB.

This indicates that the asset has managed to burn some of its tokens in the pursuit of reducing the circulating supply and boosting the tokens’ value.

Where can I buy Shiba Inu Coin in September 2024?

1

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

- Easiest to deposit

- Most regulated

- Copytrade winning investors

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

Being the second-largest meme coin and one of the largest cryptocurrencies, in general, Shiba Inu is available in plenty of different markets.

You can find it on centralized and decentralized exchanges alike, and even some traditional trading platforms and brokerages, such as eToro.

In the crypto industry, some of the largest exchanges and trading platforms that offer it include:

- Binance

- Coinbase

- KuCoin

- Kraken

- Bithumb

- Uniswap

- Bitfinex

- Bitstamp

- Bittrex

- Gemini

Each of these platforms offers multiple SHIB pairs, allowing you to buy it with their native tokens, USDT, Ethereum, and more.

And, as mentioned, if you prefer using traditional markets or diversifying your portfolio with non-crypto assets, eToro is a great platform to do that.

Apart from Shiba Inu, it also features a number of other cryptos, plus traditional assets like stocks, forex, commodities, and more.

Your capital is at risk.

Shiba Inu coin price over the years

Shiba Inu launched in August 2020, just around the time when crypto prices started growing. Bitcoin was starting the bull run that eventually included the rest of the crypto market.

However, SHIB price did not get involved so soon. In fact, after it launched with a price of $0.000000001009, it spent the rest of 2020 and a good portion of 2021 barely moving at all.

The token was quickly noticed by the crypto market, but its price action was minimal. The token started seeing its first real movement in April 2021 and a first surge in early May of the same year, when it went up from $0.00000153 on May 7th to $0.00003469 on May 11th.

Unfortunately, SHIB’s surge was interrupted by Elon Musk’s announcement that Tesla will stop accepting Bitcoin payments, which disrupted the entire bull run.

The market crashed following May 11th, and it wouldn’t start a recovery until July 20th for most of the market. Shiba Inu price dropped with the rest of the market, but it did not join the recovery in July.

In fact, the price waited until October of the same year to start surging again.

Initially, it surged on October 4th, going from $0.00000855 to a resistance at $0.0000300.

The resistance proved to be quite strong, and it even prevented the token from heading higher up until October 23rd, when it was finally broken in one last surge.

This new spike took SHIB all the way up to $0.00007489, which was its all-time high. At the time, its daily volume climbed past $8 billion, and the asset reached this price on October 30th.

After this achievement, SHIB saw a mild correction, and on November 11th, the bull run abruptly ended. The crypto market lost its momentum, and the princes started crashing.

Eventually, this bullish wave grew into a crypto winter that lasted until the end of the year and throughout 2022.

Around June 20th, 2022, Shiba Inu price sank to its current levels, and that is where it has largely remained ever since.

There were a few attempts to spike up, but its highest was on August 15th, 2022, when its price climbed to $0.00001692.

Other than that, several strong resistance levels prevented the token from surging further up, including $0.0000100, $0.000012, and $0.000014.

In 2023, the token started seeing growth as soon as the year had started. Its price on January 1st was almost identical to the current one.

For the rest of 2023, Shiba Inu mostly traded sideways, with some spikes during small time-frames.

In 2024, the token left its sideways trend and jumped parabolically once again, trading around the $0.00002 mark.

Your capital is at risk.

How is the price of Shiba Inu (SHIB) determined?

The price of Shiba Inu is constantly changing, as this meme coin has no real-world asset backing it and giving it value.

Like most other cryptocurrencies, it is determined by multiple factors which can affect it in a positive or a negative way.

Here are some of the biggest and most influential factors that make the SHIB price move.

Supply and demand

Supply and demand are the primary factors that determine the price of any cryptocurrency, including Shiba Inu.

The supply is a term used for the amount of coins or tokens that are available for purchase. The demand determines how much people wish to purchase the available coins and tokens.

The buying pressure determines it, and when it grows, the price of the asset tends to rise.

If the supply rises and the demand stays the same, the price drops, as there is now suddenly more product but not more desire to own it.

The increase in supply makes the asset less scarce and less valuable.

This is why projects engage in token burning — by doing so, they reduce the supply, which leads to increased demand in anticipation of a price surge.

The boost in demand itself would be enough to make the price grow, but coupled with reduced supply, it makes the price growth even larger.

Alternatively, the worst-case scenario is when the supply grows while the demand drops.

This typically happens during bear markets, as people keep dumping the coins while there is little incentive to buy them. This is why the price tends to crash sharply and by a lot during crypto winters.

Supply and demand are the main drivers behind the price change, and all other aspects simply influence these two, as we are about to see.

Social Media

Social media is a tricky factor because it doesn’t affect all cryptocurrencies in the same way.

It has the strongest effect on the prices of assets that lack use cases, especially when it comes to meme coins.

Coins like Ethereum tend to be unaffected by social media. Ethereum has never surged or dropped due to the amount of Twitter mentions that it gets.

However, Dogecoin and Shiba Inu have been known to see pumps run by social media only. This is because their entire value system is based on their popularity, and the popularity of memes that they are based on.

This is why influential people can easily cause their prices to surge simply by mentioning them.

Ethereum, on the other hand, is fueled by its usefulness in accessing various DeFi protocols, launching new cryptos, powering dApps and smart contracts, and alike.

Social media mentions remind investors about a meme coin like Shiba Inu, and they make them more desirable because someone influential is talking about them.

The same is true when the community of regular social media users starts talking about a coin a lot and makes it a trend. This boosts the demand, which leads to price spikes.

Volume

Volume is another big and influential factor that can help boost the price. It shows that the token is being used, and that it is exchanging hands.

This confirms to traders and investors that there is demand for it, and with that confirmation, they also start using it.

This is often powered by FOMO, as investors see that others are using the coin, and they start doing it as well in fear of missing out. They think that others surely know something that they don’t, and they want to be included and make use of potential opportunities.

In doing so, they contribute to an even greater volume, bringing in even more investors.

All of this boosts the buy price and demand, and the price of SHIB goes up.

Broader crypto market sentiment

It is a common phenomenon that the broader crypto market sentiment includes the majority of the market.

For example, when Bitcoin leads a bull run, investors start buying other cryptocurrencies as well, expecting to follow BTC and grow alongside it. In doing so, they increase demand, and the price of their chosen asset surges, too.

This leads to great optimism across the industry, and soon enough, everyone starts buying everything, leading to a market-wide bull run. In the crypto industry, all coins and tokens are connected and join the same trend simultaneously.

It takes some powerful development for an asset to take off on its own in any direction, and especially to go against the market.

Utility and development

Speaking of powerful developments, utility and development are also huge factors in influencing crypto prices.

Of course, utilities for meme coins are rather limited. They were made to be funny and popular, not particularly useful.

Most meme coins’ utilities end with day trading and speculative investing. However, it is possible for meme coins’ communities to vote for new developments and utilities that the developers might then implement.

It is important for the community to see that their project of choice is growing and developing.

As long as it progresses in any way, this is a bullish signal for many, and it tends to positively impact the price. In that sense, token burns can have a similar impact since they reduce the supply, as mentioned earlier.

In Shiba Inu’s case, the project has launched its own NFT collection, it has a governance token, a metaverse, it offers staking, a Doggy DAO, and more, so there are definitely use cases worth exploring, which gives it a much greater chance at growing and surviving the harsh crypto market.

Compare Cryptocurrency Brokers

Binance

Visit SiteAs with any asset, the values of digital currencies may fluctuate significantly....

Libertex

Visit Site74% of retail investor accounts lose money when trading CFDs with this provider....

How often does the price of Shiba Inu (SHIB) change?

Unlike stocks, forex, and other traditional markets, cryptocurrency trading never stops.

Not at night, not during the weekends, and not during the holidays.

Since people continue to buy and sell around the clock, the prices themselves get influenced by the mentioned factors all the time.

On a micro-scale, you could likely see the impact of each trade on the token’s value.

On a larger scale, the dominating trend influences price performance. However, there are no periods when the price is not influenced in any way, which means that it changes all the time.

Your capital is at risk.

Investing in Shiba Inu coin

Shiba Inu has grown to be one of the biggest and most popular cryptocurrencies while also being the second-largest meme coin.

With that being the case, it is not surprising that a lot of people are investing in it or trading it around the clock.

Furthermore, the crypto industry gets new arrivals every day and from all over the world. Some of these newcomers will like the idea of Shiba Inu and want to join the ranks of its investors and community members.

However, before they make an investment and actively engage with the token, they need to get into a habit of asking themselves certain questions, which could go a long way in protecting them from unnecessary losses and risks. For example:

Is it worth buying Shiba Inu in September 2024?

The first question you must ask yourself is whether buying the asset you are interested in is worth buying.

We know that SHIB is a massive cryptocurrency that is currently ranked as the 18th largest coin in an industry that currently numbers 1.8 million+ cryptocurrencies.

It is legitimate, it has been around for years now, so it is also well-established, and it surely has potential, given that it even managed to outperform DOGE once.

So, from that side, SHIB is an investment that will not result in a rug pull. You can be assured that it is not a scammy project.

However, as far as price is concerned, the token is not performing great as of right now. It did start growing in January, which lasted for about a month, and after that, its price crashed to where it is now.

This level is a strong support, given the fact that it prevented SHIB from heading further down in the past and also over the last few months.

So, while SHIB is not growing at the moment, it is likely that it does sit at its bottom and that the chances of it sinking deeper are low.

With that being the case, you could consider buying it now and then, just waiting for the price to start a recovery.

However, before you do anything, you should research it yourself and come up with your own investment plan.

Never follow other people’s advice when it comes to crypto investments. Hearing them out can be useful, but your plan and your decision must remain yours to make always.

Who should invest in Shiba Inu?

As a meme coin, Shiba Inu was created primarily to target meme enthusiasts and speculative investors.

It is not a token that specializes in metaverse real estate or issuing loans Rather, it is open and inviting to everyone who appreciates its sense of humor and simply likes memes and the meme culture.

Nothing is stopping you from investing in SHIB even if you are not a huge fan of its or other memes, assuming that you expect its price to go up at some point.

There are no rules and limitations in regard to who can or can’t invest in it.

With that said, becoming a member of its community will likely be a more enjoyable experience if you relate to them as a fellow meme enthusiast.

How to get started with Shiba Inu investments?

In order to get started with SHIB, you will first have to decide on a platform where you will purchase some of its tokens.

As mentioned, the platform is available on a number of cryptocurrency exchanges, some centralized and some decentralized. It is even available on the world’s largest crypto platforms, like Binance and Coinbase.

However, you don’t have to go to a crypto exchange if you feel like this is a too new and alien environment for you.

If you are more familiar with and prefer traditional trading platforms, eToro also offers SHIB tokens on its trading app.

In order to buy Shina Inu on eToro, all you need to do is follow the next few steps:

- Open account with eToro

- Verify your identity by uploading your ID and potentially other information that the platform needs

- Deposit your funds to the platform’s wallet via one of the available payment methods

- Use the search feature to find SHIB tokens, enter the amount you wish to buy, and click Trade

No matter where you buy your SHIB tokens, remember that the safest way to manage them is to withdraw them from the platform’s wallet into your own private wallet.

That will protect your funds better from any potential security breaches and make you the sole owner of those coins.

As long as they remain in the exchange’s wallet, the exchange has as much control over them as you do — likely even more.

Investing in Shiba Inu coins responsibly

Investing in Shiba Inu — or any cryptocurrency — comes with certain risks.

These risks could result in you experiencing losses if you do not prepare yourself adequately.

The risks vary, and they don’t always mean that you will lose your cryptocurrencies to a hacker. In order to best protect yourself and your investment, we recommend following these tips:

- Don’t invest all of your money into Shiba Inu; the first rule of responsible investing is to diversify your portfolio with other assets, be they crypto or traditional

- After purchasing your SHIB tokens, store them in a private wallet. Ideally, you should store them on a hardware wallet that you can disconnect from the internet and limit online criminals’ access to them

- Research the token as much as possible and ensure that you know everything there is to know about it before you invest

- Research exchanges and trading platforms are available in your area, as they don’t offer identical terms and deals. Find the one that has the lowest fees, the best price, a good reputation, etc.

- Conduct technical and fundamental analysis to try and predict the SHIB price movement. This could tell you when is the right time to invest and potentially prevent you from buying right before a price crash

- Listen to experts and other SHIB investors and traders, but only so you would get a clearer picture of what the investment community thinks of the token. Do not follow anyone’s investment advice blindly; simply use their opinions to try to educate yourself further by learning from more experienced traders and investors.

- Use a VPN to secure your connection and mask your traffic. Trading in the crypto industry is already risky enough, so use all available tools to secure your connection and prevent others from monitoring it

Your capital is at risk.

Shiba Inu coin taxation

After cryptocurrencies started attracting the attention of investors, it wasn’t long before the governments started paying attention.

To this day, most of them are still not interested in regulating the crypto industry, but almost every government in the world has made an effort to tax cryptocurrencies and claim a share of investors’ profits.

That means that any money that you earn while trading or investing in SHIB, or any other cryptocurrency, is subject to taxes.

Since each country has its own tax laws, the tax you must pay on crypto profits differs from nation to nation.

There is no universal rule regarding how much you need to pay, so everyone has to research their country’s laws and calculate what they owe on their own.

This is important to do because some countries have rather high crypto taxes. Also, calculating crypto taxes itself is quite challenging, as you must know the exact time and date of each trade, the exact price of the asset at the time of making profits, and alike.

You should even keep an eye on your losses, as that might help lower your taxes in some countries, depending on the laws. So, as complex as crypto trading is, dealing with taxes in the aftermath of earning is even more complicated.

It is best to learn all you can on the matter before you start profiting from digital currencies, as some traders might even learn that it is not worth it.

The best Shiba Inu alternative

Even though Shiba Inu is going up, its price action is still volatile. Even though it is a good thing for degen investors, there should still be some investment that allows users to make parabolic gains within a short span of time but without much hassle.

Therefore, the best crypto to invest in right now is Dogecoin20. Presenting users with a greener, more utility-focused variant of Dogecoin, Dogecoin20 launched its presale recently and raised over $10 million in record time.

This multi-staged presale still got people interested, which is why the makers decided to extend its date.

Dogecoin20 presents users with a deflationary version of Dogecoin. While mimicking the original Doge’s total supply, DOGE20 is limited to only 140 billion tokens. Furthermore, it has also established a mirror-play on Doge’s emission schedule by blending it with its staking mechanics.

A certain portion of the tokens will be released to presale investors of Dogecoin20 over the next 2 years. This attribute gives Dogecoin20 a long-term value setting it apart from most meme coins.

Day-Trading Shiba Inu (SHIB) vs Long-Term Shiba Inu (SHIB) Investments

Trading cryptocurrencies and investing in them are two very different things, with different skill sets and mindsets required.

Both are equally legitimate ways of working with crypto, but they differ in everything apart from the fact that you work with digital assets.

Trading is generally considered to be harder and it requires more work.

Traders need to pay attention to a lot of aspects of the crypto market, from charts and trading signals to news and new developments, market sentiment, price movements, sudden, unpredictable twists that might open up new opportunities, and more.

They also need to be cool-headed and not give in to emotional trading, so FUD and FOMO represent big issues that could draw them into making a wrong move.

On top of all that, traders only make small profits per trade, especially when it comes to day traders. The trick is to have as many successful trades as possible so that these profits would build up over time.

To make sure that their trades are successful, they also need to be experienced in risk management.

All of this can lead to very stressful experiences, many traders have to go through a trial-and-error process in order to identify strategies that work best for them.

Comparatively, investing is much simpler. Investors need to pick a coin or token, do the research to ensure that it is legitimate, and then try to predict whether it has the potential to grow in the future.

Investing comes from the assumption that cryptocurrencies will grow over time, assuming that they have what it takes to survive the volatile market.

After that, they simply buy the tokens, lock them up in a private wallet, and forget about them for months and even years.

Once the price grows enough, they just sell them and make major profits, assuming that everything went according to plan. So, all that investors need to do is do some initial research and then patiently wait for a time.

Of course, they need to make sure that their cryptos are properly secured and that their portfolio is adequately diversified, but this is still much less work compared to traders.

Traders have the advantage of getting the money first, but only in small amounts, Investors don’t get their returns for a long time, but when they do, they get a sizable amount.

Your capital is at risk.

Future Predictions for Shiba Inu Coin Price

A lot of traders are interested in hearing what the experts have to say regarding crypto prices and their performance in months and years to come.

While most of the predictions are fairly unreliable, traders still wish to hear the experts’ general feelings about specific coins and tokens.

Regarding WalletInvestor, it believes that SHIB will struggle over the next year and that its price will drop to $0.000000576 in 1-year time.

CoinCodex is bullish about the future of the token, expecting SHIB to go up to anywhere between $0.00001972 to $0.00005921 in 2024.

The platform’s experts are also bullish about the token’s performance in 2025 and 2026, but not so much for the near future.

As for Changelly, it expects the asset’s average price to go to $0.0000111 later in 2023, with strong growth over the next several years.

Changelly even expects SHIB to hit $0.00030 in 2032. Of course, it is impossible for anyone to accurately predict such long-term price performance, so take these lengthy predictions with a grain of salt.

Conclusion

Shiba Inu is one of the largest cryptocurrencies and the second-largest meme coin in the crypto industry. It became extremely popular very quickly, forming a strong and loyal community since it was created.

Some call it the DOGE Killer, but whether or not this is true, Shiba Inu can still be a pretty decent investment. However, we still recommend you do your own research before making any move.

By learning everything about it and researching it yourself, you will have the best idea of what to expect and how to proceed.

eToro is a regulated exchange to buy Shiba Inu. It’s a social trading platform where traders share their predictions for the Shiba Inu price.

Key Takeaways

- Shiba Inu coin is one of the best-performing cryptos in 2021

- Shiba Inu (SHIB/USD) is an Ethereum-based cryptocurrency whose mascot is the Shiba Inu, a Japanese breed of hunting dog.

- Shiba Inu now has one quadrillion coins in circulation

- Shiba Inu tokens are not a hoax, but they serve no meaningful use in the cryptocurrency world.

- Trading or investing in Shiba Inu is riskier, and one must take due diligence before entering the market.

eToro - Our Recommended Crypto Platform

- 30 Million Users Worldwide

- Buy with Bank transfer, Credit card, Neteller, Paypal, Skrill, Sofort

- Free Demo Account, Social Trading Community

- Free Secure Wallet - Unlosable Private Key

- Copytrade Professional Crypto Traders

FAQs

What is Shiba Inu?

Shiba Inu is a meme coin inspired by Dogecoin and its popularity and success. At this time, it is the second-largest meme coin, ranking as the 15th-largest crypto by market cap. It even managed to outperform and outrank DOGE once in the past, revealing its true potential.

Where to buy Shiba Inu coin?

Shiba Inu tokens can be purchased on multiple CEXes and DEXes, but you can also find it on eToro’s platform. There, you can benefit from rich analysis tools, but also things like copy-trading and social investing. In addition, eToro offers zero-fees for crypto trading, which is another great benefit of the platform.

Is Shiba Inu coin dead?

No, Shiba Inu has seen rather decent price performance in early 2024, but the market is still unstable and dealing with the consequences of the year-long crypto winter. As such, it has seen some bullish waves that have pushed the price of SHIB low to its strongest support.

How many Shiba Inu coins are there?

At the time of writing, SHIB has a circulating supply of 589.53 trillion tokens, while its total supply sits at 589.59 trillion. The token has no max supply, meaning that it is not capped

Is Shiba Inu coin legit?

Shiba Inu has been around for nearly three years now, with no red flags or signs of being a fraudulent or problematic cryptocurrency. With that said, the fact that it has no supply cap might not make it the best asset for long-term investments. On the other hand, the token has burned some of its tokens in an attempt to limit and even reduce its supply.

Bitcoin

Bitcoin