There has been a paradigm shift in the focus of investors from traditional assets to Cryptocurrencies as they have emerged as a great avenue of investment in a short span of time.

A good strategy is needed to make the most out of the investment. And designing the right crypto investing strategy needs good research and a nuanced understanding of the highly volatile crypto market.

In furtherance of this, ahead we’ve discussed the ways you could shape your crypto portfolio. By the end, you’ll be equipped with enough information to come out with the best strategy that’ll maximize returns on your crypto investment, minimize losses and optimally utilizing market trends.

How to build the best crypto portfolio

New investors often have the question in mind- “what crypto should I invest in?” Having a well-balanced crypto portfolio will help you capitalize on your investments. We all know that the cryptocurrency market is highly volatile. However, uninterrupted focus and proper asset allocation can help you have a sound portfolio. Needless to say, diversification is the key.

Here are some important points to keep in mind to have the best crypto portfolio:

- Carefully study the market and crypto trends

- Understand your risk appetite well

- Decide whether you are looking for short-term/ long-term returns

- Look for different types of crypto

- Watch out for experts’ advice on asset allocation based on risk assessment

Carefully study the market and crypto trends

Understanding the trends of cryptocurrencies will help you decide if you’re ready for the investment. Having enough capital and shifting your focus from traditional assets to cryptocurrencies need time and effort for desired returns.

Understand your risk appetite well

You must have heard this a thousand times- “invest only what you’re ready to let go in the worst-case scenario”. Your risk appetite will decide how much you’re willing to put in cryptocurrencies and how the allocation should be.

Decide whether you are looking for short-term/ long-term returns

Bitcoin, Altcoins, Stablecoins are all part of the crypto market. So, based on the returns you are expecting from your investment (short-term or long-term), you can choose the right coins to invest in.

Look for different types of crypto

There are many cryptocurrencies making their way into the market lately. The crypto you’re investing in doesn’t have to be making headlines. You will need to analyze the price movements of these coins to understand which ones will suit your investment requirements.

Watch out for experts’ advice on asset allocation based on risk assessment

Experts investors speak from experiences. If you want to be in the crypto game and sustain your endeavors, then you must watch out for the advice these experts give on coins that are dominating the market and the ones that have potential. Their advice on portfolio diversification and crypto portfolio management will be significant for your investments.

Diversifying your crypto portfolio helps you to deal with the risks and fluctuations of the crypto market. Whether you are looking for a bitcoin investment strategy or wish to allocate more funds to Altcoins, learning extensively about the cryptocurrency market will help you build your ideal investment portfolio. Identifying the right crypto and exactly how much you must invest are questions we will address further in this article.

What crypto should you invest in and how much

It is always a great idea to keep your portfolio stacked with limited cryptos. This ensures that losses from one are compensated by the returns of the others, while also not making it too much of a hassle to handle.

Your portfolio can consist of the following:

Bitcoin

Created in 2009, Bitcoin (BTC) is also known as the original cryptocurrency. Like most cryptocurrencies, it runs on a blockchain, wherein transactions are distributed across thousands of computers. Bitcoin has become synonymous with the crypto market.

Someone who invested probably a few hundred dollars in BTC in 2016 has become a millionaire now. Its value growing 11,400 %, the price of BTC went up from $500 in 2016 to $57,000 in 2021.

- Experts say that your bitcoin portfolio should include 10-15% of your crypto investment. The risk assessment being the foremost reason, the decrease in value in BTC in the future should not disrupt your investment portfolio.

- The increase in value would also bring significant returns to your investment. Considering other cryptos in your portfolio, in case you suffer a loss with your investment in BTC, they will probably compensate for the loss.

- Experts have also opined that the value of BTC will not significantly alter for at least a while. Hence, investing in it is a safe option.

Your capital is at risk

Ethereum

Ethereum or ETH is both a cryptocurrency as well as a blockchain platform. Its potential applications like smart contracts are preferred by developers. It has also become increasingly popular because of the non-fungible tokens (NFTs) that it hosts. It has witnessed significant growth just like BTC and in fact, is the second-largest crypto after Bitcoin. Its value increased 42,000%, from $11 in 2016 to around $4,700 in 2021.

- It is safe to invest 10-20% of your crypto investment in ETH. Since the growth of this cryptocurrency has been phenomenal, experts say that it has immense potential for a similar increase in value in the future.

- Another reason why many suggest investing more in Ethereum than in Bitcoin is because of the diversified scope it offers.

- Being both a cryptocurrency and a blockchain platform, its future is definitely one that investors are interested in. So, to have a good crypto portfolio, ETH should cover a substantial allocation.

Your capital is at risk

Meme coins

Meme coins are another category of crypto coins that have garnered the likes of many investors. As the name suggests, these are created as a joke owing to the obsession of crypto enthusiasts.

Dogecoin is the first meme coin created and many others surfaced thereafter. These coins gain popularity within a short time span and are great for retail investors looking for short-term gains.

Tesla Inc. CEO Elon Musk has been on the news for often talking about meme coins. His tweets have mentioned cryptos like Dogecoin and Shiba Inu. This has led to a sudden rise in the price of both of these cryptos. Shiba surged 91% in October 2021, within 24-hours of Musk tweeting a picture of Floki, the Shiba Inu pet he owns.

As far as investment is concerned, you can put up 4-7% of your crypto capital on these coins. As they are gaining more popularity, many might consider switching over to these coins for short-term profits.

Your capital is at risk

Surging and stable altcoins

Altcoins are becoming quite popular in today’s time and have quickly grabbed the attention of investors, both old and new. Investing in Altcoins demands a thorough study of the whole crypto market and strategizing your investment approach. It is important that you educate yourself on the fundamentals of Altcoins and the patterns before diving in.

Blockchain technology has the potential of dominating a variety of functions in the future. In this regard, the value of Altcoins will definitely go up. With the recent surging trend, there are numerous Altcoins that have taken the entire market by surprise.

Stable Altcoins include Tether (USDT), USD Coin (USDC), Binance USD (BUSD), Dai (DAI), TerraUSD (UST).

Experts suggest an investment of 6-9% of your crypto collocation in these coins. There are uncertainties and concerns regarding the longevity of these coins. Hence, keeping the investment low-key is advised by top investors.

Your capital is at risk

ICOs

Many investors are enthusiastic about ICOs as they have become an integral part of the blockchain industry. Although there are a number of challenges and risks involved in the investment in ICOs, yet they promise tremendous investment returns.

If the value of tokens goes up during the ICO, it results in huge profits for the investors. In 2017, a total of 435 successful ICOs raised $5.6 billion. Many investors became millionaires with their investments.

Experts say that your investment in ICOs depends solely on your risk appetite. Some say investing 10-13% on ICOs is a safe bet, whereas some recommend investment as high as 20%. When you invest in ICOs, you should see whether the project developers have clarity in their whitepapers along with well-defined goals.

You should also seek 100% transparency from the company. Invest in ICOs that are legitimate and you should always choose a wallet that ensures maximum security while storing your ICO funds.

Your capital is at risk

Stablecoins

Investors thinking about how to invest in blockchain often prefer Stablecoins. These coins are created to reduce the volatility of the crypto market since they are attached to other entities like fiat currencies, other cryptos, precious metals, etc. In this way, in case the cryptocurrency ever fails, the loss of investors could be minimized with other assets included in the basket. Stablecoins go through price fluctuations within a range.

Some of the most important Stablecoins include Tether’s USDT, USD coin (USDC), MakerDAO’s DAI, etc. You may invest 10-30% of your crypto investment on Stablecoins. Since they are built to withstand volatility, you are not in for huge losses. The decentralized nature of cryptocurrencies makes them stable.

Investors also prefer Stablecoins because they allow smoother and faster transfer of money, maintain privacy regarding financial data, and enable users to cut down on financial service fees.

Your capital is at risk

Mixing crypto with other assets

People looking for crypto investment tips to structure a diversified portfolio can mix cryptocurrencies with other assets like stocks, index funds, forex, etc. You have to structure your portfolio in a way that takes care of your investment-return timeline, maximizes profits, and minimizes risks/ losses. Considering crypto investor reviews and other trends, price predictions, etc. are also important before you start with your investment.

With the kind of risks involved in cryptocurrency, allocate between 1-5% of your overall investment capital. Experts say that even if you lose the entire crypto investment, it is not going to harm your financial status. Sometimes, even small portions of crypto investment bring unimaginable returns. Risk appetite and time are also important factors in this allocation.

Some investors say that if your risk appetite is high, then you may allocate as much as 20% of your investment to cryptocurrencies. The allocation for stocks should be more if you are looking for short-term high returns. Since short-term investment calls for lesser risks, the more volatile the asset, the greater timeline you should allocate to the same.

Knowing the true potential of the cryptos that you want to invest in would require extensive research and analysis. You should always reach out to experts on the matter for a worthy investment. With the crypto market taking the world by a storm, investors are leaning more towards cryptocurrencies than traditional stocks/ assets. However, it is not always a choice between the two. A well-structured portfolio is one that includes both in a balanced way.

General Crypto Investment Advice for a Solid Portfolio

A solid diversification strategy demands a thorough analysis of high-performing cryptocurrencies. Since all cryptocurrencies have been founded with different principles and operate on a variety of technologies, you must adopt the right strategies to have a portfolio that helps you to optimize your investment goals.

Looking at prevailing trends, crypto price predictions, future potential, influential people’s interest in specific cryptos, etc, are a few ways to give an edge to your portfolio. What should you keep in mind while designing an effective crypto portfolio?

Diversify

You can diversify your investment based on time, industry, or geography. When you diversify your allocation by time, you basically acquire crypto assets at the right time by timing the market well. It is an interval-based strategy and you can select specific times to invest in cryptocurrencies and when the value is high, you call sell them off.

Choosing the right industries to invest in cryptocurrency is another diversification strategy. Choose both stable and surging industries. Diversifying by geography means that you invest in blockchains projects from all over the world. This is a great way to balance your portfolio and protect you from volatile markets.

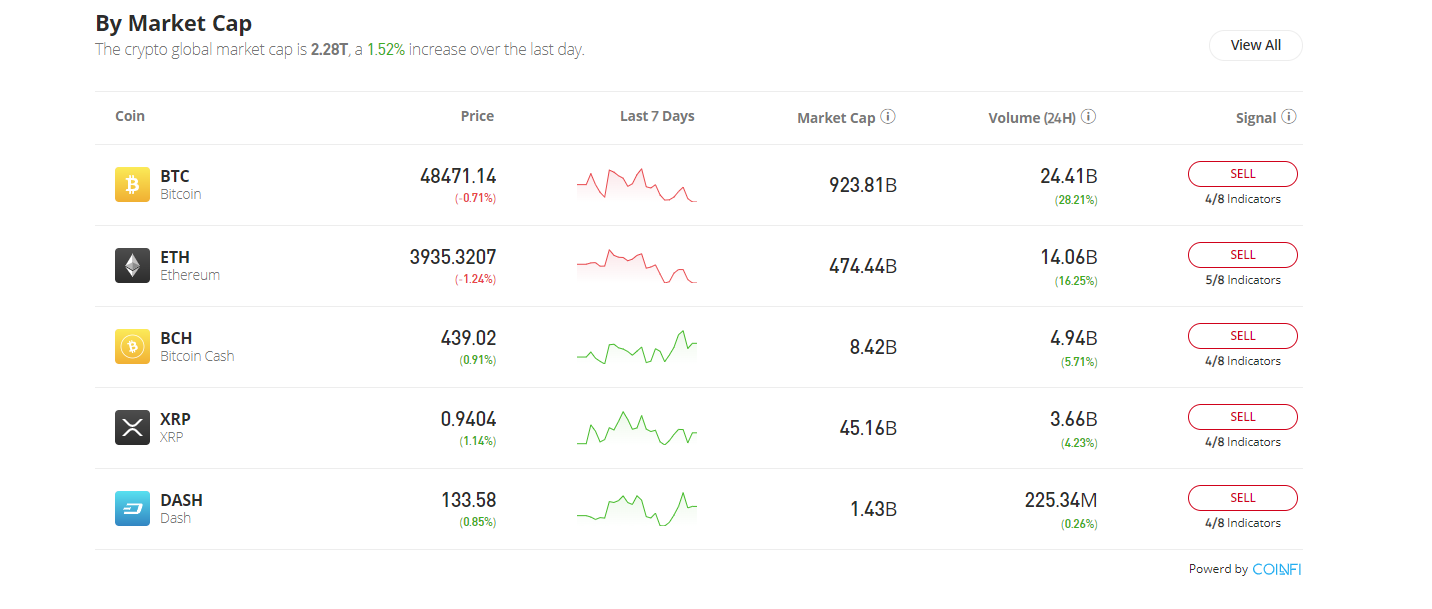

Follow news and live prices

You must regularly follow the news and live prices of all the cryptocurrencies you’re investing in and the ones you are planning to explore. There are innumerable platforms that are constantly tracking and offering insights on various cryptocurrencies. The values of these currencies fluctuate all the time and you must keep a track of them to make the right decision. Staying updated with the price predictions should be a common practice of investors looking to leverage investment opportunities.

Invest only what you are comfortable losing

Investing in cryptocurrencies or any other assets should be strategized in a way that minimizes risks/ losses. However, it is hard to predict the future of any asset. Hence, experienced investors advise that you should be prepared to lose whatever you are investing. In case the asset you’re investing in witnesses unprecedented loss, it should not distort your financial planning.

Investors including the ones who have gained huge returns from their investment also recommend that one should be ready to lose the funds kept for investments.

Use only regulated and established exchanges

If you’re looking to buy or sell cryptocurrencies, you’ll need to use a cryptocurrency exchange. These online services often work similarly to a stockbroker, giving you the tools to buy and sell digital currencies like Bitcoin, Ethereum, and Dogecoin. The best cryptocurrency exchanges make it easy to buy and sell the currencies you want with low fees and strong security features.

When choosing the best cryptocurrency exchange, it’s important to look at some important features like supported currencies, pricing, withdrawal options, security, etc. Compare UK crypto platforms in the table below.

Use technical analysis

Taking advantage of technical analysis of these cryptocurrencies is that you get valuable insights regarding them. Platforms like CoinMarketCap are among the best ones to get details about cryptocurrencies. Predicting a possible surge, market performance, the crypto’s trends in comparison to others are all details that you get in these platforms. If you are a new investor, plan out a strategy for your investment and work on your portfolio by using these analyses.

Inquire about the coin developer and the general use of the coin

There are white papers or reports that crypto platforms publish. For instance, Bitcoin published a white paper in 2008, generating remarkable attention of investors and others towards the crypto market.

You should be aware of how a cryptocurrency works, what are the fundamentals behind it, and so on. Some cryptocurrencies do not serve any significant purpose and may not yield any value in the future. Technical advancement and innovation are factors that always create more value for a cryptocurrency.

Be aware of scams

There have been reports that suggest losses amounting to $80 million due to crypto scams. Experts recommend being aware of the scams that have occurred and ways in which you can get tricked into these. The crypto market is witnessing an unbelievable rush and scammers are looking for ways to extort money.

Do not provide any private information/ security codes etc, for any unauthorized digital transactions. Giveaways, phishing, extortion emails, etc, are some ways in which scammers take advantage of the increasing number of people investing in cryptocurrencies.

How to manage your crypto portfolio

Technology has significantly contributed to helping investors manage their crypto portfolios effectively. There are many apps and websites that are specially designed for portfolio management with intuitive features. Some of them are listed as under:

BlockFolio

BlockFolio is one of the best crypto portfolio management apps having a user base of more than 5 million people.

Some top features include:

- Real-time Blockfolio Signal updates

- Notification alerts on changing prices

- Data recovery and transfer feature

- News-feed from crypto publications and social media

- Multiple portfolios divided into separate categories

- Automatic updates between your portfolio and crypto exchanges

- User-friendly interface

CoinTracking

This app is one of the most trusted cryptocurrency tax and portfolio managers. The unified 360-degree dashboard helps you make an informed decision by offering the following features-

- Interactive charts

- Connection to popular exchanges through API

- Tax calculation made easy

- Availability of Historical price data

- Eight supported wallet imports

- Real-time trade profitability

- Price alerts through notifications

Delta

Yet another app that has made a name in the list of best ones. Some top features include:

- Charts with coin analysis, volume, market cap, etc.

- Watchlist for your favorite cryptos

- Price action alerts

- Integration with social media and news channel

- Easy Account Recovery feature in case theft or loss of device

eToro

Though there are a plethora of online tools that could help you manage your crypto portfolio, eToro ranks quite highly.

Some of the benefits include:

- Charting tools to facilitate technical analysis of price movement

- Educational information relating to trading

- Facilitates interaction between traders within the app

- Access to trading in stocks, indices, forex, commodities, crypto

- Price action alerts

- Integration with social media and news channels

Your capital is at risk

Conclusion

If you are a crypto enthusiast, then it is high time you started your investment in crypto assets. Crypto experts and investors who have profited from crypto investments speculate that the crypto market will witness exponential growth in the coming years. So, if you start investing today, you are in for good returns in the future.

Make sure you use the best crypto portfolio app to structure your portfolio. Diversifying it, including assets from various industries, making your investment global, targeting for the right time, carefully studying the trends, and price predictions of various cryptocurrencies are some fundamental ways to build a solid portfolio. Make sure your investment is worthy and it serves your financial goals well.

Your capital is at risk