Ethereum is the world’s second-largest cryptocurrency by market cap. Unlike Bitcoin, Ethereum is much more than just a digital currency. Ethereum runs a powerful blockchain that allows developers to deploy distributed apps that users can interact with.

If you’re new to Ethereum, chances are that you want to learn how it works and the best places to buy Ethereum and turn a profit. There are numerous platforms where new traders can buy and sell Ethereum with ease. Picking one is more difficult than it seems. Platforms are differentiated based on the services they offer, features, fees, and others.

In this where to buy Ethereum guide, we will show you how to buy Ethereum online and the best platforms to work with.

How to Buy Ethereum in the UK – Quick Guide

- Choose an Ethereum broker or exchange – we recommend eToro

- Create and verify your account

- Deposit funds into your account via bank transfer or debit card

- Search ‘Ethereum’ in the drop-down menu

- Click ‘Trade’, select an amount of ETH to buy then open the trade

Best Way to Buy Ethereum in the UK

These online brokers were carefully chosen and reviewed as the best brokers to buy Ethereum (as well as Bitcoin):

These platforms provide a healthy combination of low fees, quick transactions, and a broad selection of payment methods. They make it easy for investors to buy Ethereum and have high liquidity, so buying cryptocurrency and selling are never a problem.

They also have high security to safeguard your digital assets. Their crypto wallets are secure, and they conduct proper checks to comply with anti-money laundering (AML) and know-your-customer (KYC) policies.

How to Buy Ethereum in the UK – Guide to the Best Brokers in September 2024

Don’t have the time required to pour through our detailed review? Here’s a quick summary below on how to buy Ethereum with GBP.

- Open an account with eToro: Create a free account on eToro and get started.

- Upload ID: Verify your identity by submitting a copy of your passport or driver’s license.

- Fund your account: Deposit GBP to start investing in Ethereum crypto – 0.5% deposit fee applies

- Buy Ethereum: Once you have made a deposit, you can now start trading Ethereum with a 1% fee

Once you follow the steps above, you should have Ethereum in your crypto wallet. Most investors will keep their Ethereum on the eToro platform until it’s time to cash out. You can, however, also withdraw your Ethereum to the eToro mobile wallet.

eToro Tutorial

We will show you step by step how you can begin your Ethereum trading journey. We have chosen eToro to illustrate how you can get your hands on some Ethereum crypto.

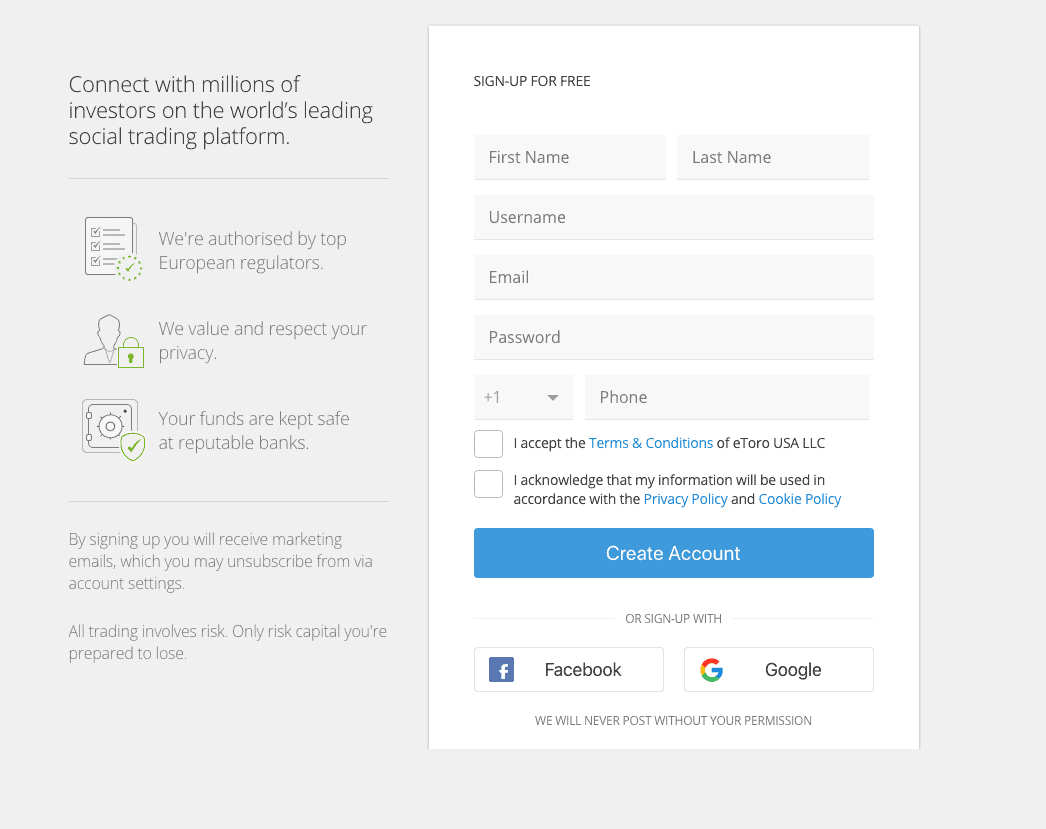

Step 1: Create an account on eToro

The first thing you need to do is create an account on the eToro trading platform.

Once you get to the sign-up page, you will be asked to supply your username and a valid email address. You will also need to create a unique and strong password.

Don’t invest unless you’re prepared to lose all the money you invest.

Step 2: Verify your identity

Verification is the next thing on the agenda. This is because eToro requires every user to undergo its know-your-customer (KYC) process. Here, you will need to submit a copy of your official passport or driver’s license. You can do this by taking a snapshot of your license and uploading it on the eToro platform.

Additionally, you will be asked to submit a utility bill to verify your residential address. When you complete this process, you should be ready to move onto the next step.

This step can be skipped for later but users will not be able to buy more than $2,000 (about £1,700) or withdraw until they complete it.

Step 3: Deposit GBP

After your account has been verified, you will need to fund your trading account to buy Ethereum stock. This needs to be at least $10 – or about £8.

Users can deposit GBP instantly with a debit card or via bank transfer, which takes up to 48 hours to process. Depositing GBP comes with a 0.5% fee.

Step 5: Buy Ethereum

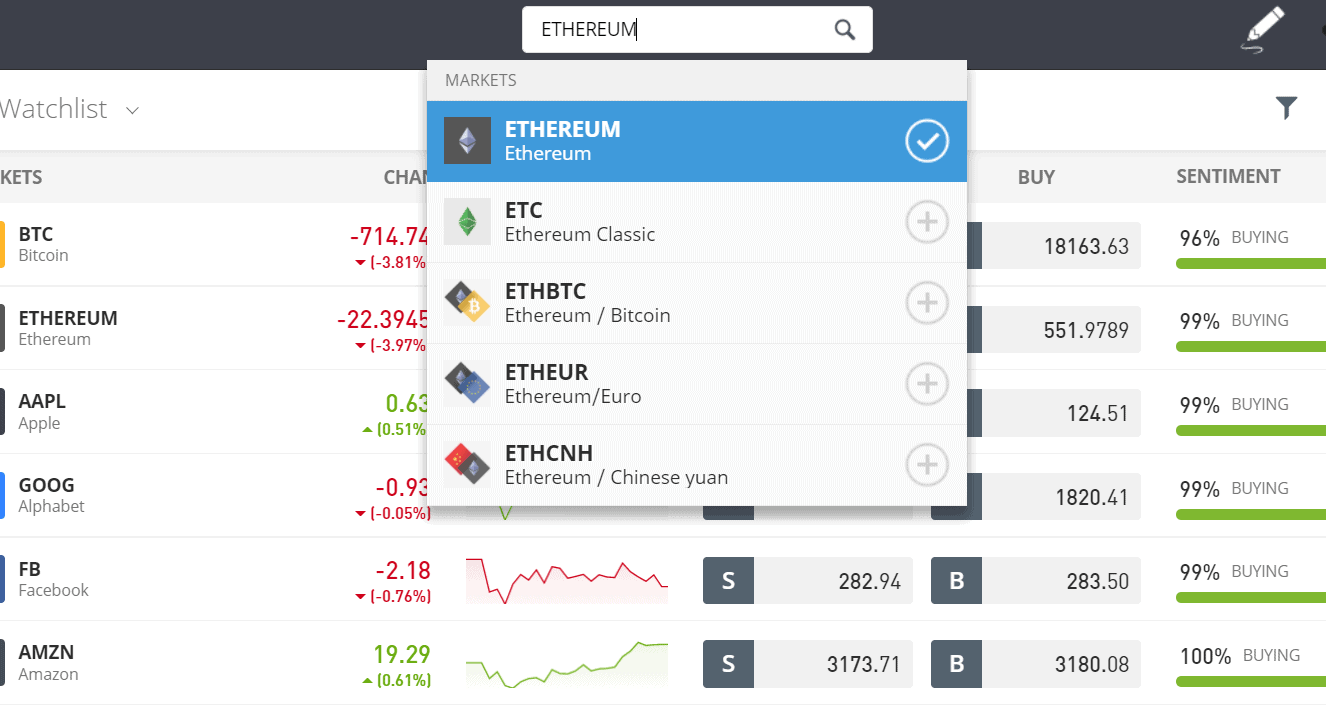

After funding your account, head down to the search bar and type in “Ethereum.” Click on it and you will be redirected to the Ethereum page.

You can briefly look at the performance of the crypto asset by clicking on the “Stats” and “Chart” button on display. Also, if you want to know what other traders feel about it, you can click on the “Feeds” button and read through their reviews of the digital asset.

When you are ready to proceed, click on the “Trade” button in the top right corner. You will be instantly taken to an order page to start trading – trading crypto comes with a 1% fee.

Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

Where to Buy Ethereum in the UK – Top List

Cryptocurrencies were available on just a few trading platforms a couple of years ago but since the recent crypto boom, many investment companies have started offering crypto trades. Although there are so many exchanges you can easily gain exposure to Ethereum crypto, only a few can be trusted. We review three of the best platforms you can easily get some Ether.

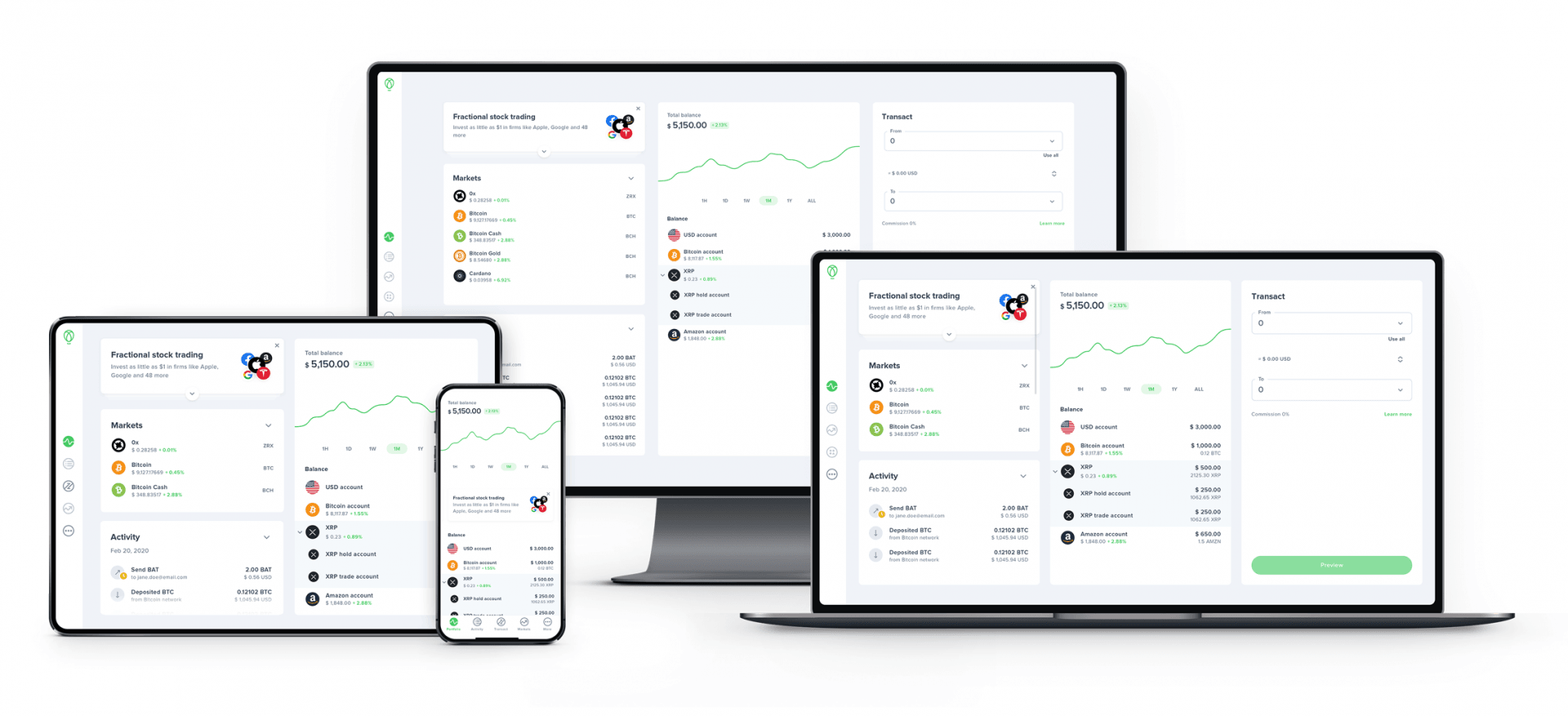

1. eToro – Overall Best Way To Buy Ethereum

eToro stands out as our top trading platform for users to buy Ethereum. The platform has a user base of over 25 million clients and counting.

eToro covers an array of investment products including stocks, commodities, and cryptocurrencies including Ethereum and Bitcoin.

eToro also has copy trading features and Smart Portfolios, as well as having its own crypto wallet to store purchased tokens. You can learn more about eToro from this guide.

Pros

- 25 million global users

- 1% fee to buy ETH

- Social and copy trading

- Smart portfolios

- Other financial assets available

Cons

- Withdrawal fee of $5

- Minimum first deposit of $200

Don’t invest unless you’re prepared to lose all the money you invest.

2. OKX – Worlds Leading Cryptocurrency Exchange Market

OKX is a leading digital asset trading platform for buying Ethereum and other cryptocurrencies. It is very beginner friendly and easy-to-use. Since its inception in 2017, the exchange has grown rapidly and now has a customer base of millions of users across 100 different countries. OKX is among the best options for traders as it offers services on low fees while employing the most efficient APIs.

OKX entered the market in 2017 launched by a Star Xu as OKCoin. It then transformed into OKExchange, and since then the legal entities have been transforming for better operations.

In addition to Ethereum, OKX offers a range of advanced trading products like spot trading, futures, perpetual swaps and options. These derivatives products enable users to trade with leverage, potentially increasing their profits. Users can also use the trading bots to prepare multiple strategies that help in trading with ease.

Pros

- Various trading options, including spot and margin trading, futures, and options.

- Advanced trading tools and order types for experienced traders.

- Passive income opportunities through staking, savings, and yield generation.

- Access to decentralized finance (DeFi) services and non-fungible tokens (NFTs).

- A user-friendly interface and mobile app for trading on the go.

Cons

- Past customers’ have mixed reviews.

- Certain currencies have low liquidity.

- USA users cannot access it.

Your capital is at risk.

3. Bybit – Third Most Visited Cryptocurrency Exchange

From spot trading Ethereum, to margin trading, Bybit ensures the trader can trade the way they like. In order to make trading easier, Bybit has also rolled out trading bots that have benefited a lot of people. Just like OKX, Bybit also offers the ‘Copytrading’ feature, helping traders imitate and learn from the strategies of successful traders. While it might have a few downsides, it can benefit traders significantly if they use the feature wisely.

Founded in 2018, Bybit has quickly gained popularity among the crypto-trading community, becoming one of the leading cryptocurrency derivatives exchanges. With its high-speed transactions, extensive educational resources, and risk-free testnet environment, Bybit has become a popular choice for both novice and experienced traders.

Traders can also trade on perpetual and future contracts using the coin itself as a collateral through the ‘inverse contract’ feature. This is just one of the many high-tech feature provided on the platform, other being USDC contracts, derivative trading and so on.

Lastly, traders can also use the ByVotes feature to vote for their favorite listing in order to have fun and express their sentiments about the latest happenings in the crypto world.

Pros

- High-speed transactions that can handle up to 100,000 transactions per second.

- Up to 100x leverage.

- Supports a number of advanced trading options, up to 100x leverage.

- User-Friendly Platform.

- Educational resources available for even absolute beginners.

Cons

- Risk associated with leveraged trading.

- Complexity can make inexperienced traders struggle.

- Geographical restrictions.

Your capital is at risk.

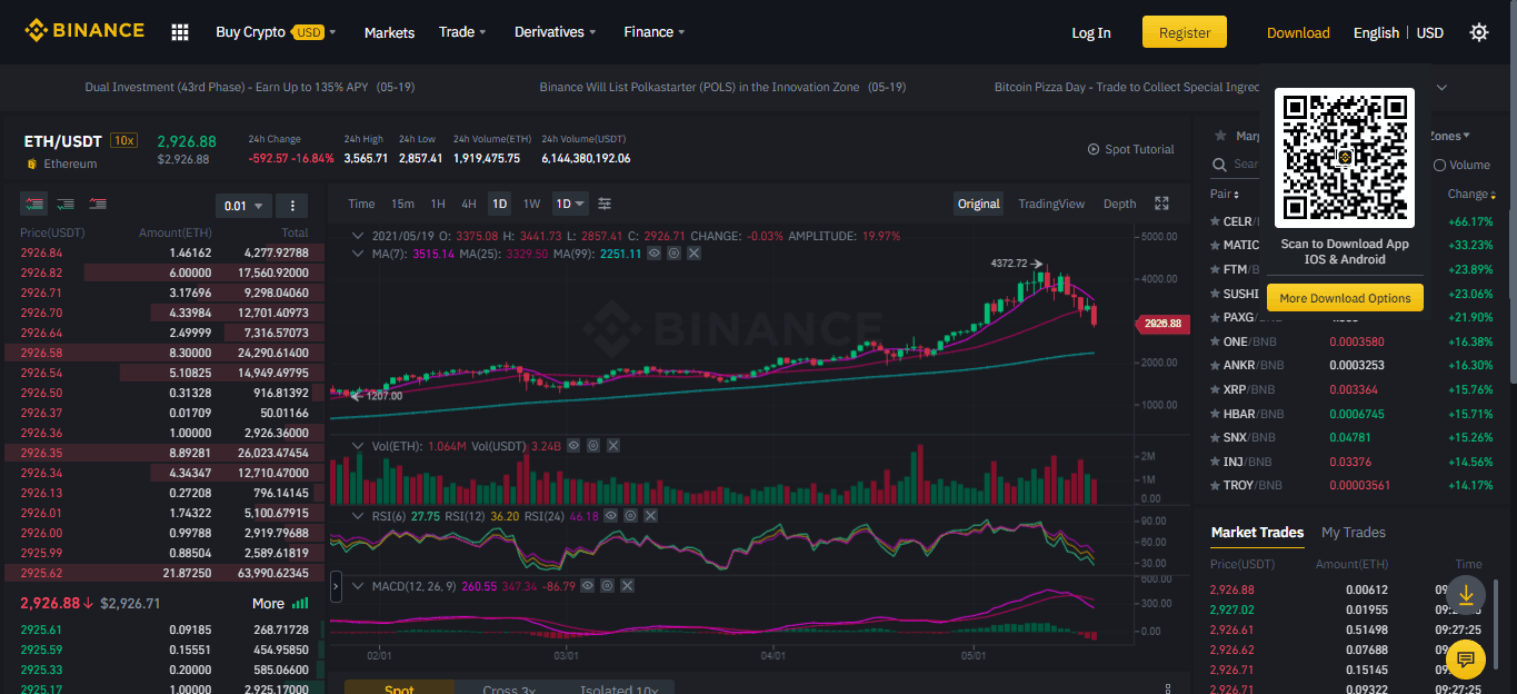

4. Binance – Popular Ethereum Exchange with Low Fees

Binance is a household name due to the large trading volume it boasts of. This popular Ethereum exchange has gradually become the go-to destination for global crypto transactions due to its low trading fees of just 0.1% maker and taker fees.

Binance boasts of a sleek and fast trading platform and processes more than $60 billion worth of crypto transactions daily. It has a similar build to major exchange Coinbase, but with more features and listings. Binance offers one of the largest trading pairs in the crypto market with over 150 crypto assets currently being traded on the platform. You also get margin trading for trading Ethereum along with Futures trading.

Buy Ethereum with USDT on Binance

Added to this is the ease, crypto investors can place their trade and the frequent addition of new services to their crypto portfolio. Binance also offers legacy-styled financial services like savings for crypto funds through its Binance Earn. It also lets users earn crypto assets if they stake their crypto funds in upcoming projects in its Binance Launchpool platform.

It also offers synthesized versions of conventional company stocks like $TSLA and $COIN.

Pros

- Hundreds of cryptocurrency pairs supported

- 0.1% Trading fees

- Supports multiple debit cards and bank transfers

- Trustworthy platform

- Ideal for professional traders that seek advanced features

- Offers synthesized stock options

- Offers legacy-backed services through its Binance Earn program

Cons

- Can be overwhelming for crypto newbies

- High debit card deposit fees

Your capital is at risk.

5. Uphold – Easy Web & App Trading

Alongside their website they also have an app on Google Play and the App Store for Android and iOS users.

Uphold charge a spread of 0.85% when buying Bitcoin, and 1% when selling.

Some of the other popular assets you can invest in with Uphold include Apple stock, Amazon, AT&T, Tesla, Gold, Silver, Platinum, Palladium and more. Their motto is ‘anything to anything’ trading.

They also open up investing to anyone through fractional stock trading – you can invest as little as $1 in companies like Google. Unlike some online stockbrokers where you are required to put up a large amount of capital to get started.

Pros

- No deposit or withdrawal fees

- Debit card pays 2% cashback for using crypto

- Also buy and trade stocks, metals, fiat currencies

Cons

- Doesn’t accept Paypal

- Less crypto assets supported than larger exchanges

Your capital is at risk.

6. Coinbase: Largest Crypto Exchange in the United States

Coinbase is the top cryptocurrency exchange in North America. In fact, the exchange is now listed on the NASDAQ exchange.

If you go to Binance and find the exchange too confusing to use, Coinbase is your next best option. It has a much better user interface than Binance, and the exchange provides comparable services.

With a $2 minimum account balance, Coinbase appeals to newbie investors and sophisticated ones alike. The exchange also provides benefits like top-notch security, broad currency pairs, and a wide array of deposit and withdrawal options. Furthermore, Coinbase has a complex fee structure. Trading and transactions cost anywhere between 0.5 percent to 4.5 percent, depending on your currency type, platform, and transaction channel. Coinbase helps by providing an overview before you go ahead with a trade or transaction, so you know what you’re paying for.

Pros

- Broad currency portfolio

- Easy-to-use interface

- Low minimum account balance

Cons

- Complex fee structure

Your capital is at risk.

7. AvaTrade – Legacy Crypto Trading Platform for Investors

AvaTrade is a forex and CFD brokerage service that has been operating since 2006. It is a part of the Avas Group, which is based in Australia.

While it is incorporated in the Republic of Ireland, AvaTrade also has offices in Australia, Japan, Canada, the British Virgin Islands, and South Africa. With AvaTrade, you get the usuals – a broad asset collection, in-depth research and abduction tools, and compatibility with different platforms. If you’re a forex options trader, you will also love AvaOptions – the service’s proprietary platform for retail forex and CFD options trading.

On AvaTrade, the minimum deposit amount is $100. You get a wide array of payment channels, ranging from bank transfers to debit cards and payment processors. However, like

Coinbase, Ava Trade also has a complex fee structure for trades – especially if you’re into CFDs. You can learn more about AvaTrade here.

Pros

- Dedicated platform for options trading

- Research and educational tools

- Competitive minimum balance

Cons

- Complex fee structure

Your capital is at risk.

8. Revolut – Personal Finance Service With Crypto Support

Revolut is a full-scale neobank and one of the most popular financial service apps in the world.

Launched in 2015, the London-based service deals more with currency transactions and banking services. So, it doesn’t have any trading support available. On Revolut, you can get up to 30 cryptocurrencies. Beyond transactions, you can also convert your cryptocurrencies to fiat currency in a matter of seconds.

Revolut comes with several impressive features, including a Revolut card for transactions and ATM withdrawals and a savings vault that lets you lock your money and earn interest. The online broker comes with different pricing tiers. So, you will need to check yours to find things like fees and minimum balances.

However, withdrawing money with your Revolut card is free for up to €200/£200 per month. Then, it costs 2 percent from there. Transferring money is free with Revolut, but you will have to pay a few to use SWIFT transfers. For currency exchanges, you get to pay no fees up to €1,000/£1,000 per month on weekdays. You can learn more about Revolut here.

Pros

- Up to 4.78% annual bonus rate in savings vault account.

- No monthly fees for the standard account

- Access to a broad range of currencies

Cons

- No cash or check deposits

- Fee for delivery of its Revolut card.

- No live customer service via telephone.

Your capital is at risk.

9. CryptoRocket – Newbie Crypto Trading and Exchange Platform

CryptoRocket is another crypto-focused trading and brokerage service. Launched in 2018, the service is based in Saint Vincent and the Grenadines. It offers different assets, including crypto, ETFs, metals, indices, stocks, and CFDs.

Users of CryptoRocket get to enjoy several benefits. The service offers various education tools, and this service has the broadest asset class of any on the list – you can even trade oil and gas instruments here.

CryptoRocket also has a demo account and an impressive customer support service. Margin trading is also available on CryptoRocket, and traders in some countries can get up to 1:1,500 leverage. There is no minimum deposit on CryptoRocket, and deposits are free. However, the service has a minimum withdrawal of 0.001 BTC. There are no hidden fees here, and trading commissions start from $6 per 1.0 lot.

Pros

- Up to 1:500 margin

- Broad asset class

- No hidden fees

Cons

- Not available in the U.S.

Your capital is at risk.

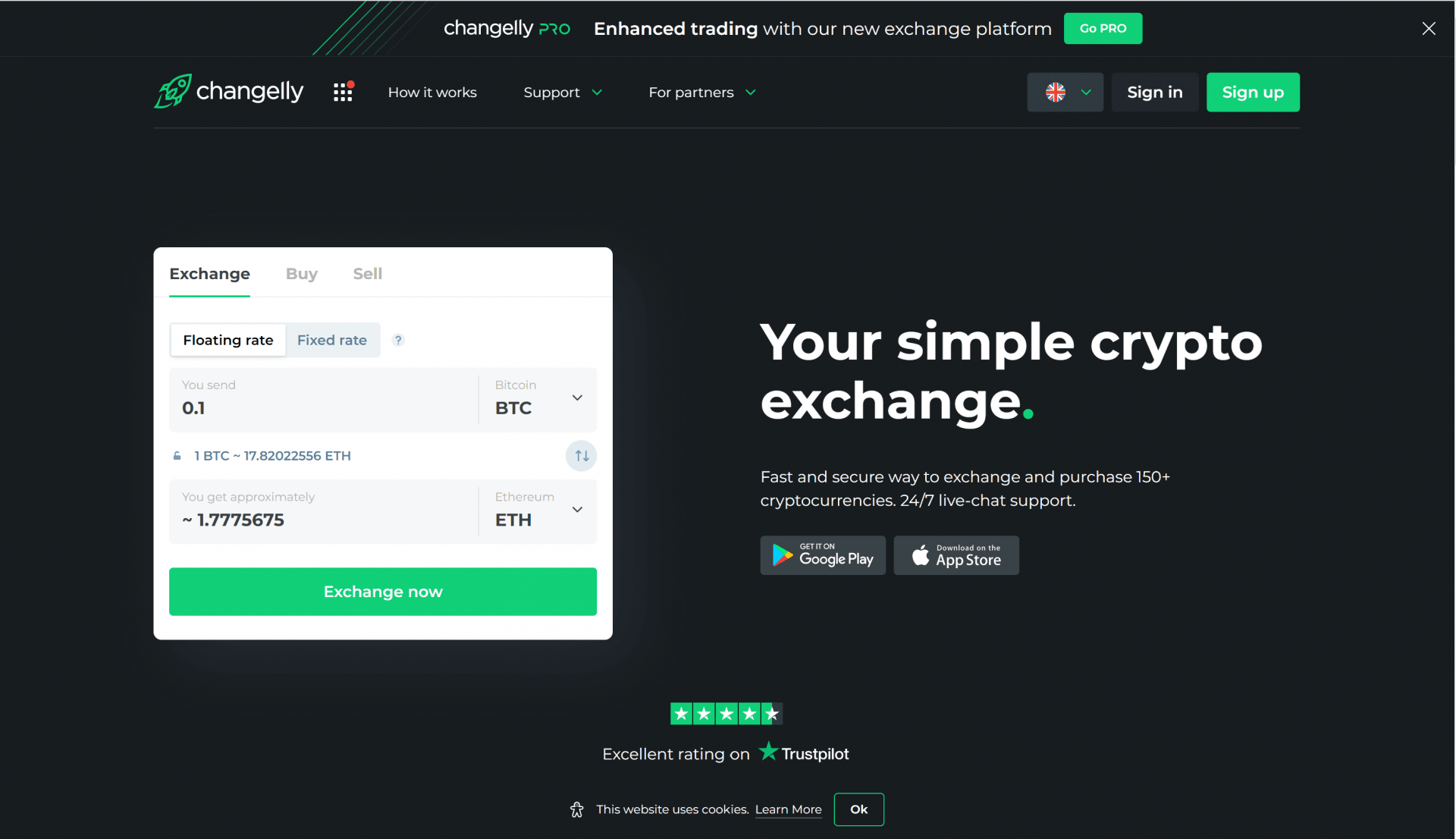

10. Changelly – Nifty Exchange for Instant Ethereum Purchases

Changelly is a non-custodial exchange for buying cryptocurrencies like Ethereum with ease.

The platform is a well-positioned platform for instant crypto purchases. Changelly also provides crypto-to-crypto exchange and supports over 140 digital assets on its platform. One of the highlights of this Ethereum exchange is privacy.

Changelly won’t require any form of personal info from you when buying Ethereum or any other crypto on their platform. Changelly’s fees are pretty competitive. The exchange charges 0.25 percent for crypto swaps. But it charges 5 percent for crypto-to-fiat conversions. There are no deposit fees, and trading fees vary between assets. Withdrawal fees stand at 0.0004 BTC.

Pros

- Broad crypto options

- Strong AML/KYC procedures

- Simplified exchange interface

Cons

- High crypto-to-fiat transfer fees

- No margin trading

Your capital is at risk.

What is Ethereum?

Ethereum is a decentralized, open-source blockchain with smart contract functionality. Ethereum has become the most successful crypto protocol after Bitcoin, given its extensive use in the blockchain ecosystem. It currently sits as the second most valuable cryptocurrency on the crypto chart controlling about 19% of the entire crypto market.

Ethereum was birthed in a bid to propel further the decentralization ethos espoused by Satoshi Nakamoto through Bitcoin. Through this, Buterin created a platform that performed all the same functionality as a legacy-backed financial institution without the central authority.

Ethereum has since become the home of much of the world’s decentralized projects, housing over 200 such protocols presently. Notably, most people buy Ethereum as a speculative asset. In this regard, Ethereum is more like Bitcoin. Investors buy the asset in the hope that the price increases, and they can profit from it.

A Quick History of Ethereum

Ethereum was founded in July 2015 by a group of developers following a whitepaper written by Russian/Canadian programmer Vitalik Buterin. Along with Buterin, several other people who helped to design the concept of Ethereum include Gavin Wood, Charles Hoskinson, Anthony Di Iorio, Mihai Alisie, Amir Chetrit, Joseph Lubin, and Jeffrey Wilcke.

However, the development of Ethereum didn’t start until a year later, when Ethereum Switzerland GmbH – a Swiss company – started the formal software development process.

Ethereum eventually launched in 2015, as well as its native cryptocurrency and programming language. As explained, the basis of Ethereum is blockchain technology – a type of database that stores information in groups (called blocks). Information is stored into blocks, and blocks are banded together into the main chain.

When the Ethereum cryptocurrency launched, it quickly shot up the ranks and became the second most valuable cryptocurrency. This is due in no small part to the rampant adoption that the Ethereum blockchain saw.

Ethereum allows people to organize ideas, companies, money, and services, build decentralized applications (DApps) on the blockchain. This saw Ethereum allowing transactions to be initiated through its set of computer codes called smart contracts. These line of codes are only executed when both transacting parties meet certain conditions.

However, this adoption surge also spelled trouble for Ethereum. The blockchain soon developed scalability issues and transaction fees began to surge as more people preferred to build on Ethereum. To solve this, the Ethereum developers proposed Ethereum 2.0 – an upgrade that will make the blockchain easier and more effective.

The upgrade is still in progress, and there is a great deal of excitement at the prospect of making the Ethereum blockchain better for users.

As for the Ethereum cryptocurrency, it is still seeing a lot of adoption. Besides being an impressive investment asset, several top online platforms – including Shopify and OVerstock – also accept it as a means of making payments.

Why Buy Ethereum? Ethereum Analysis

Cryptocurrencies, in particular, are now popular. But, knowing which one to choose could be a burden. To help sift through this issue, we list some of the reasons why you might want to invest in Ethereum this year.

-

Financial Returns

The value of the cryptocurrency market has risen exponentially this year, with Bitcoin leading the way. So has the value of Ethereum. In 2015 when the project was first launched, you would have paid $3 for one Etherum coin.

Two years after, the value of one Ether hit an all-time high of $1,400. This year, the price has gone to as high as $4,300. This represents an over 143,000% increase in value. This means an initial investment of £500 in 2015 would be worth over £716,000 today. Although the price of Ethereum has been corrected recently, the digital asset has performed quite well so far.

-

Smart Contracts

This is one of the reasons why Ethereum is popular. Its ability to facilitate smart contract transactions is unrivaled. A smart contract is basically a piece of code that allows two or more people to enter into a self-executing agreement. Once deployed into the blockchain, the terms of the contract cannot be amended or manipulated. This way, many people can enter into agreements without needing to trust the other party. Many of the popular apps today are built on smart contracts, including cryptocurrency exchanges. It’s a concept that’s revolutionizing how we think and see the world and gaining ground.

-

Market Capitalization

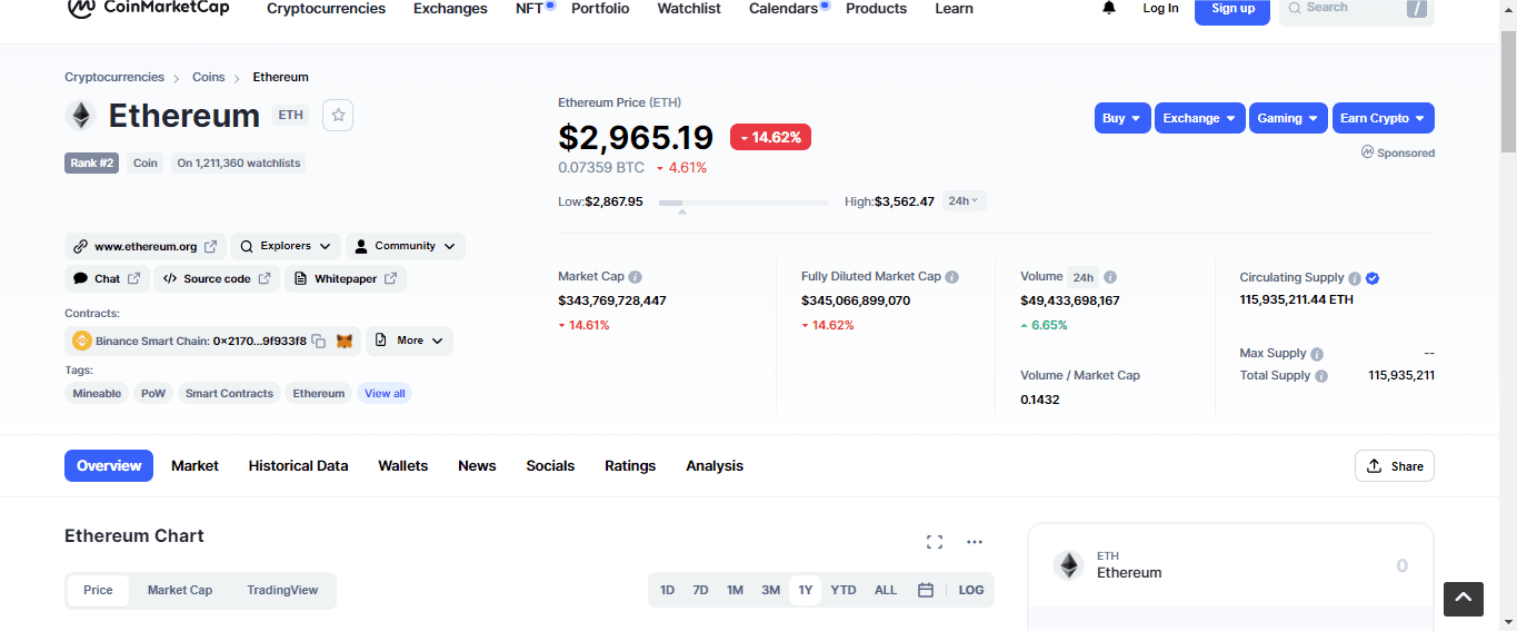

Another reason why you might want to invest in Ethereum is the small market cap. Ethereum has a market cap of $348 billion.

This is worth more than most companies listed on the New York Stock Exchange. However, when you look at the problems, the Ethereum Network is trying to solve and its market reach, you’ll realize that the valuation is still relatively small. As such, if you buy Ethereum now, you’re still getting a good deal.

-

Technology

Most of the cryptocurrencies in the market today are built on the Ethereum blockchain. This means they do not have proprietary technology–but rather, they depend on the Ethereum network. Many of these cryptocurrencies are ‘ERC-20’ tokens that require the Ethereum network to function, and many projects go this route because, unlike Bitcoin, Ethereum’s network makes it easy for anyone to create cryptocurrencies. Once these tokens are built, in turn, it drives up demand for the Ethereum coin, as users need the digital asset to function on the network.

Choosing the Right Broker When Buying Ethereum

Everyone is getting into crypto these days, and it’s understandable if you want to as well. However, like it is with investing in anything else, you have to be careful when selecting brokers. These factors should help you make the right choice:

1. Fees

You want to check the sees that a broker charges. Make sure they are competitive and see to it that you don’t end up paying too much for the service.

Exchanges and brokers take different fees. These include deposit and withdrawal fees, trading commissions, inactivity fees, etc. You should also ensure that your broker of choice doesn’t impose any hidden fees on you.

2. Payment Options

The best brokers allow you to pay using different options. From bank transfers and cards to payment processors, you want to ensure flexibility when it comes to payment options.

3. Safety

Look into the broker’s safety precautions. You don’t want to suffer any surprising hacks. You can also check the broker’s history with hacks and security breaches to get more confidence.

4. Customer Support

A broker should be able to support you and should be available when you need them. No one wants emergencies, but you want to be able to call on them when these situations arise.

5. Regulatory Approval

Ensure that your chosen broker is approved by your country’s financial regulator. This way, you get to avoid any surprising crackdowns.

6. Available Platforms

A broker should have web, mobile, and desktop platforms so you get to access your funds at all times, regardless of what device you use.

Warning: Reasonable Investment is Key in Crypto

It’s important to note that cryptocurrencies can be very volatile. Ethereum is no different. Before you make an investment, take time out to study and be confident about what you’re buying. Cryptocurrencies are like every other investment – subject to price swings and trends. You want to make sure that you have your eye on the ball and do your proper research before you commit to an asset.

You should also set aside a budget for your investment. This way you only spend funds allotted for investments without running into debts. Also, try not to put all your money in one investment and be careful to hedge your bets.

Take advantage of online sources when investing too. Many review sites like ours provide valuable information on cryptocurrencies, and you can use those to check and ascertain your stance before investing. Many of these sites also have dedicated experts who work round the clock to monitor the market and make recommendations. Take their recommendations and compare them with your research. The more certain you are, the better for you.

Ethereum Mining: Create New Ethereum Tokens

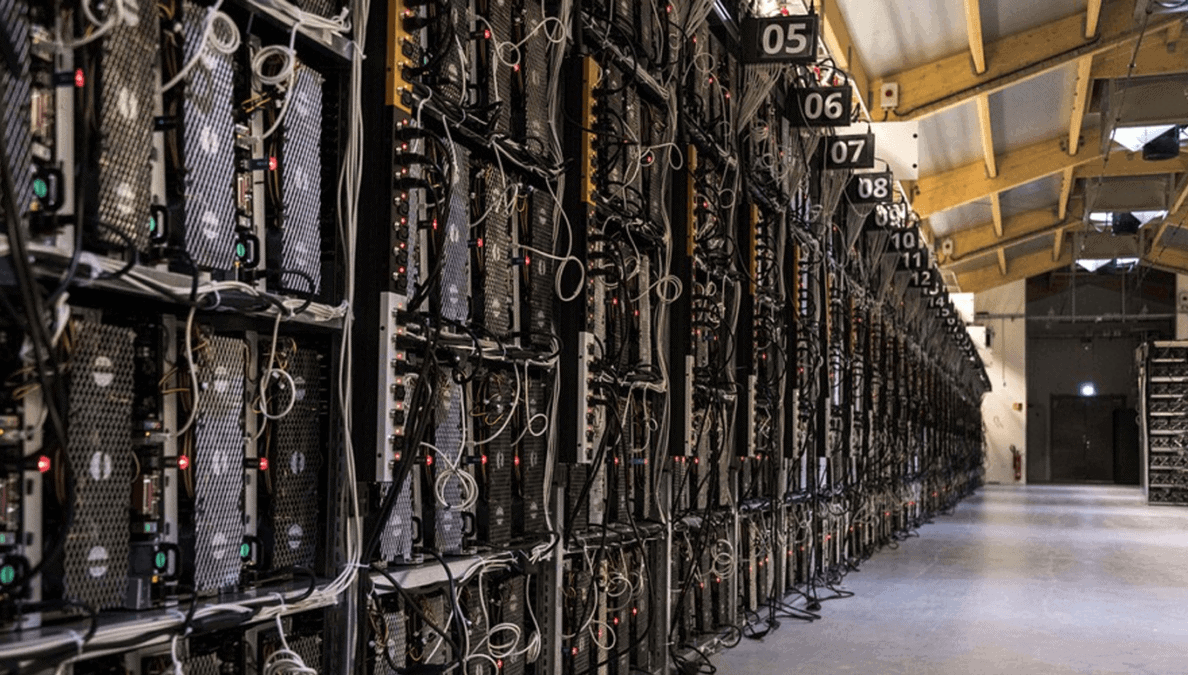

Most newbies try to acquire cryptocurrencies either by buying them directly or trading them. However, there’s a third option that tends to get left in the background a lot. That option is called crypto mining. Ethereum is no different. You can easily mine Ether. Miners engage in Ethereum mining to contribute to the smooth functioning of a blockchain and to get tokens as rewards. They do this by contributing their computing power to help add and verify transactions on the blockchain. In turn, they get a predetermined number of tokens for their hard work.

Ethereum mining remains popular – partly because Ethereum is the second-largest cryptocurrency by market cap. However, to get started, you should know that mining requires a significant financial commitment.

To start with, mining requires an Application-Specific Integrated Circuit (ASIC). These are specialized rigs that are built and designed to run the high-level calculations that mining entails. In the early days of mining, you could conduct the operation with your personal computer. However, blockchain networks have become too congested, and you will need more computing power to stand a chance. Sadly, ASICs aren’t cheap. An effective mining rig can cost you upwards of $5,000. You will also need to consider other hardware to pair it with. Let’s not forget the insane electricity costs, as mining requires a lot of power.

Investment Tip: Minimizing Risk With Cryptocurrencies

Cryptocurrencies’ volatility means that investors tend to risk a lot when working with them. To protect yourself, keep the following in mind:

- Do Your Own Research: Research is always important when investing. Never put money into an asset if you’re not sure about it. Do your independent research, then look for expert opinions. This is another area where review sites can help out.

- Avoid FOMO: The Fear of Missing Out (FOMO) grips the crypto space now and then. When people start to jump into a craze for the fun of it, you don’t necessarily have to. Carry out your research to determine if the asset is safe to invest in, then go ahead. Moreover, you can always set some cash apart to invest in an asset when people start to FOMO.

- Set a target: If you’re a day trader, it helps to have a target when trading. Once you hit this target, close your positions and start again the next period. Greed leads nowhere.

Ways of Buying Ethereum

Buy Ethereum With Paypal

PayPal now offers a cryptocurrency trading service that allows customers to buy, sell and hold digital assets like Ethereum. Notably, this service is only opened to customers in the U.S. However, that doesn’t mean you still can’t indirectly use PayPal to buy Ethereum. Many top bitcoin exchanges allow you to fund your trading account using your PayPal account.

This is the same process you would use to buy Ethereum from an exchange using a bank wire option, except that PayPal is instant and easy. You can also buy Ethereum using other payment options like Skrill and Neteller.

Buy Ethereum With Debit Card

If you are using a debit card, you can use it to purchase some Ethereum coins with them. Many trusted cryptocurrency exchange platforms support debit card payments, although they usually come with a fee attached.

Ethereum Price

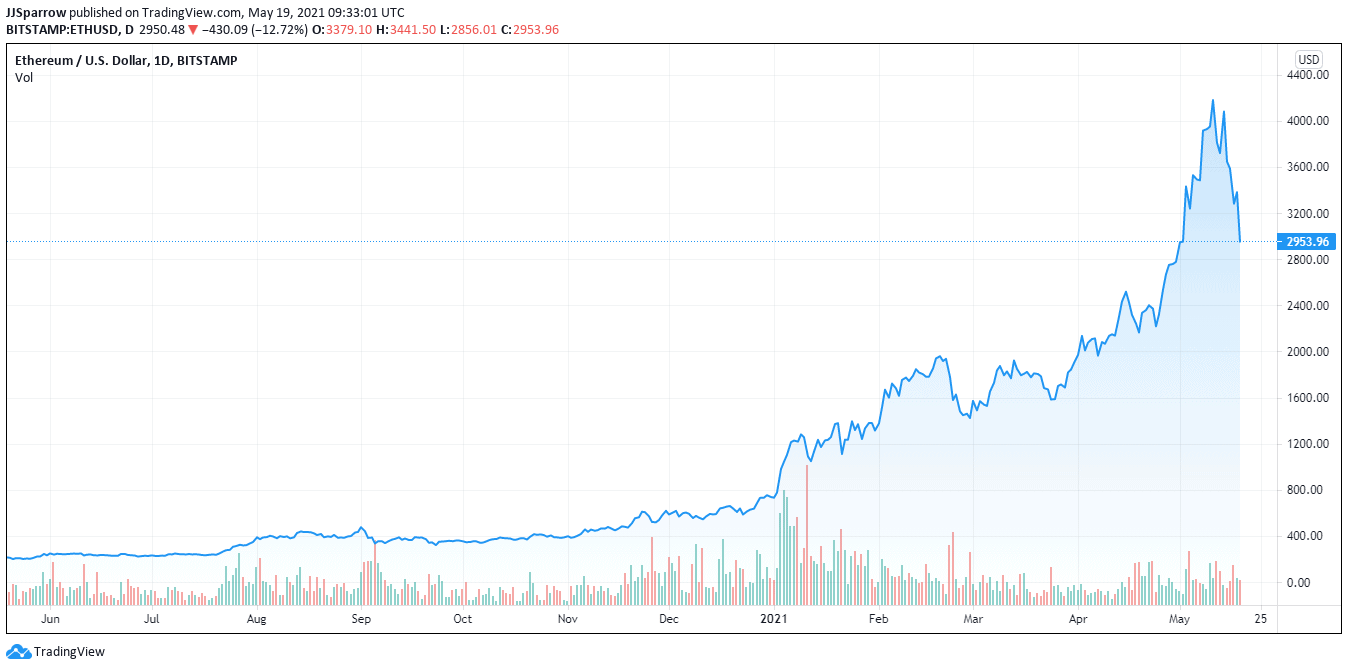

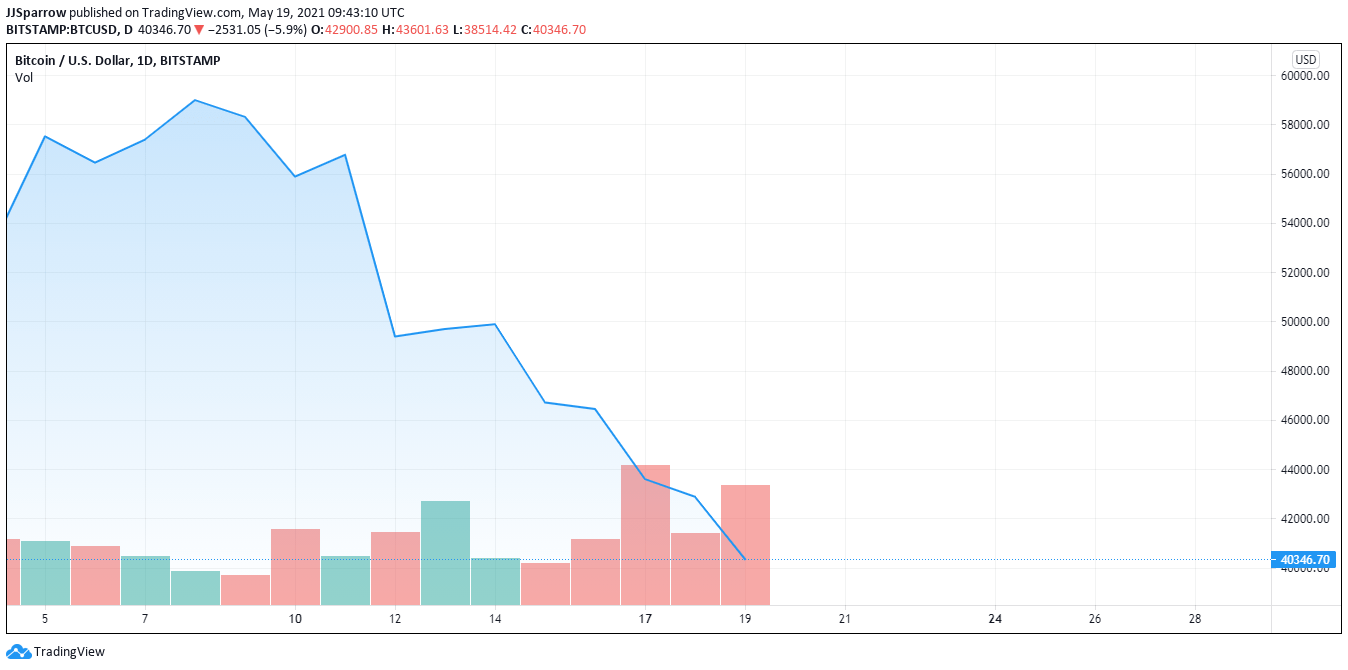

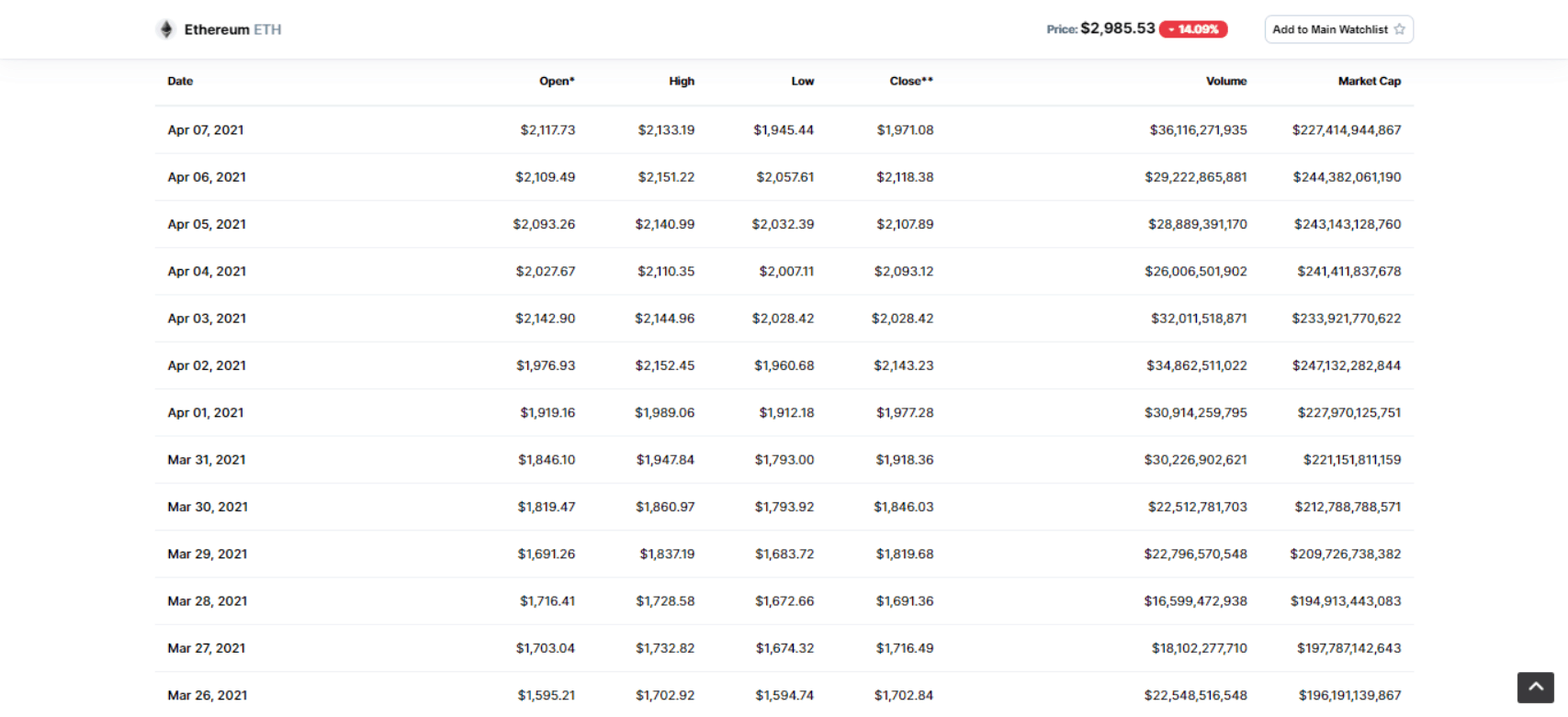

Like much of the broader crypto market, Ethereum price has seen positive movements as the crypto market has continued to gain prominence. Starting Q1 2021 at just $737.75, Ethereum price has surged over 500% in the last five months, and one Ether currently goes for over $2,990.

Ethereum price has continued to experience growth primarily due to the boom of the decentralized finance (DeFi) space which currently has over $77 billion total value locked (TVL).

Ethereum Price Prediction

Ethereum blockchain has continued to rise, making a new all-time high (ATH) just north of $4,500 in the past week before the market correction. In speaking of the possibility of Ether being more valuable with time, there is a growing belief amongst crypto enthusiasts.

This is because of its myriad use cases in the DeFi world. The Etherum network has also been used to issue bonds, and many more institutional investors see it as the gateway to the booming DeFi space. If you did buy Ethereum in Dec. 2020, you would like to have made five times your investment by now.

Read more Ethereum price predictions here.

Investing in Ethereum vs. Trading Ethereum

Ethereum has attracted so much admiration given the number of decentralized applications it supports. And just like any hot stock, many people are considering whether to invest in it long-term or just buy low and sell high. Just like any investment vehicle, Ethereum can be invested in and traded simultaneously.

For instance, you buy Ethereum crypto when it was just $700. Now that it has risen to over $3,000, such an investor would have made over 200% in the space of five months.

Trading Ethereum is also an option if you are experienced in understanding market movements. Professional traders who held till Ether reached the $4,500 mark and sold the top would have made profits if they sold. Now that it has dropped below the $4K mark, traders can easily buy Ethereum and hold it till it rises again.

Ethereum vs. Other Cryptocurrencies

Ethereum isn’t the only cryptocurrency to enjoy worldwide appeal. Here’s a comparison with some other top assets:

Ethereum vs Bitcoin

Bitcoin remains the only cryptocurrency to be more popular than Ethereum. Bitcoin is the pioneer digital asset, although Etheruem has more functionalities than the former.

Still, the comparisons have always been there. If Bitcoin is digital gold, Ethereum is digital silver.

Ethereum vs Litecoin

Litecoin is a digital asset that was billed as the “lite version of Bitcoin.” It shares many similarities with the leading asset, but it hasn’t quite been able to catch on like Ethereum.

Litecoin used to be the third most valuable cryptocurrency. Today, it holds the 7th position.

Ethereum vs Libra

Libra is a stablecoin project that was backed by an association that includes the likes of Facebook and PayPal. It was announced in June 2019, although it is yet to launch. Regulators worldwide have questioned the motive for Libra, especially given Facebook’s history with data privacy. Libra has now rebranded its name and structure. It’s called “Diem” and the organization plans to roll out the stablecoin in 2021.

Ethereum vs Dogecoin

Dogecoin is the world’s largest meme coin by market cap. It doesn’t particularly have a use case, but it enjoys a loyal fanbase – including and especially Tesla CEO Elon Musk. These fans have banded to pump Dogecoin time and again, pushing the asset to over 12,000 percent gains in 2021 alone.

Ethereum Reddit – Keep Up to Date with Ethereum News

Reddit is a social media space that has become quickly associated with cryptocurrencies given to its heavy use by crypto enthusiasts. Given its role in the GameStop stock saga, Reddit has since grown to become the destination point for everything and anything investment opinions. The Ethereum crypto has also found a home on Reddit.

You can get a feel of what the subreddit is all about by visiting the r/ethereum site. The social community created in 2013 has become home to over 900,000 builders. There, you will be able to get the latest news concerning its upcoming Ethereum 2.0 upgrade, learn about novel projects like NFTs, track the performance of the Ether token on the broader market and connect to the members of the community. Alongside this, you will also be shown how you can complete transactions on the Ethereum network without spending too much on gas fees and learn about what progress the crypto revolution has brought.

Ethereum Regulations and Taxes in the UK

UK traders and investors are subject to capital gains tax (CGT) on their ETH profits when they sell, which need to be reported annually by self-assessment.

In October 2021, the HMRC announced it will be sending nudge letters to crypto investors to remind them to report crypto sales on their yearly tax returns. The first £12,570 of income is not taxed, and the tax rate for income above that is 10% if you are employed in the basic rate income band (up to a £50,270 salary).

Best way to buy Ethereum in the UK

Buying Ethereum online is now practically easy, convenient, and cost-effective. You should use a trusted brokerage or exchange, like those listed above, which all have different features and strengths.

Some exchanges offer lower fees, while others have higher security and other added features.

FAQs

Should I Buy Ethereum?

This is entirely left to you, but if anything is worth considering, the numbers speak for the Ethereum project. The Ethereum price has continued to grow and posted a massive growth of 470% in the last five months, and 1 ETH goes for $3,870. Many industry experts are predicting that the price of Ether will still go higher as the world migrates to the blockchain, given its varied use cases.

Is it safe to buy Ethereum?

Ethereum is a safe asset to buy. However, ensure your broker has adequate security measures to protect you against hacks. You can use any of our recommended brokers above to trade Ethereum.

How much is Ethereum?

One ethereum cost $2,270 according to current market prices on crypto market aggregator Coinmarketcap. However, the crypto market is extremely volatile. This means the prices change pretty quickly and might rise or fall at a moment's notice.

How High Will Ethereum Go?

Ethereum, just like every other cryptocurrency, is unpredictable and may experience different price actions. But with the growing dependence on blockchain technology and the strategic positioning of the Ethereum network, Ether is still going to rise much higher with time.

How much Ethereum is there?

There are 115,984,549 Ether are currently in circulation.

How does Ethereum work?

Ethereum uses distributed ledger technology or blockchain to verify and record transactions. These transactions are publicly available, and anyone can follow the trail of past transactions through this public ledger. One freshly minted Ether is created when miners solve complex mathematical equations, thereby leading to the addition of a block to the blockchain. These transactions are cryptographically encrypted, making them secure and difficult to tamper with.

How to make money with Ethereum?

You can make money by trading Ethereum. Like every asset, Etheruem is tradable against several other currencies. With enough research and practice, you should be able to make money.

What are the benefits of buying Ethereum?

Ethereum works as a payment method for several merchants. You can also trade it and use it as an investment.

What are the best payment methods to buy Ethereum with?

You can buy Ethereum using different payment methods. The best option will usually depend on the broker you choose. Watch out for fees and transaction speed when making a choice.

What are the best platforms for buying Ethereum?

We have some of the best platforms listed above. However, eToro is our top choice.

What are the taxes for trading Ethereum?

The Internal Revenue Service has guidelines on crypto taxes, both for trading and transactions. You can check them to be sure of your standing or get advice from a review site.

How can I buy Ethereum instantly?

You can buy Ethereum instantly through any of the brokers we listed above. Select an appropriate payment method and your purchase will be confirmed in seconds.

What is Ethereum Classic?

Ethereum Classic is a fork of the Ethereum project, just like Bitcoin Cash, Bitcoin Satoshi Vision, and Litecoin were forked out of Bitcoin. The project came into play after a disagreement about whether the blockchain showing the hack of a DAO project should be rolled back. Since the larger Ethereum community agreed to the disagreement, a few members split and formed the Ethereum Classic. Its native token is ETC, and allegedly, this is the original Ethereum blockchain created in 2015.