XRP is the cryptocurrency of the Ripple network and company of the same name. XRP has risen to become the 7th largest crypto by marketcap and Ripple is one of the most widely used blockchain-based payment systems after Bitcoin.

This guide shows you how to buy Ripple (i.e. how to buy XRP), explains where best to buy XRP, and covers whether XRP is still a good investment now in 2024.

[table_of_content]How to Buy XRP in the UK – Quick Guide

- Choose a cryptocurrency exchange – we recommend eToro

- Create and verify an account

- Deposit funds into your account

- Search ‘Ripple’ in the drop-down menu

- Click ‘Trade’, select an amount of XRP to buy, and open the trade

Best UK Exchanges to Buy Ripple in September 2024

The brokers listed below have been carefully vetted and reviewed by our experts. These crypto platforms provide a healthy mix of low fees, ease of use, and a broad selection of crypto assets:

We also selected these platforms because they make it easy to buy Ripple and also to sell Ripple.

These selected platforms offer numerous functionalities for traders, and they are also quite liquid. In addition, the platforms offer the right levels of security for your cryptocurrencies. They conduct frequent checks on their security architecture while also conducting and complying with anti-money laundering (AML) and know-your-customer (KYC) policies.

How to Buy XRP – eToro Tutorial

Want more details about how to buy XRP? We’ll walk you through the complete process using eToro.

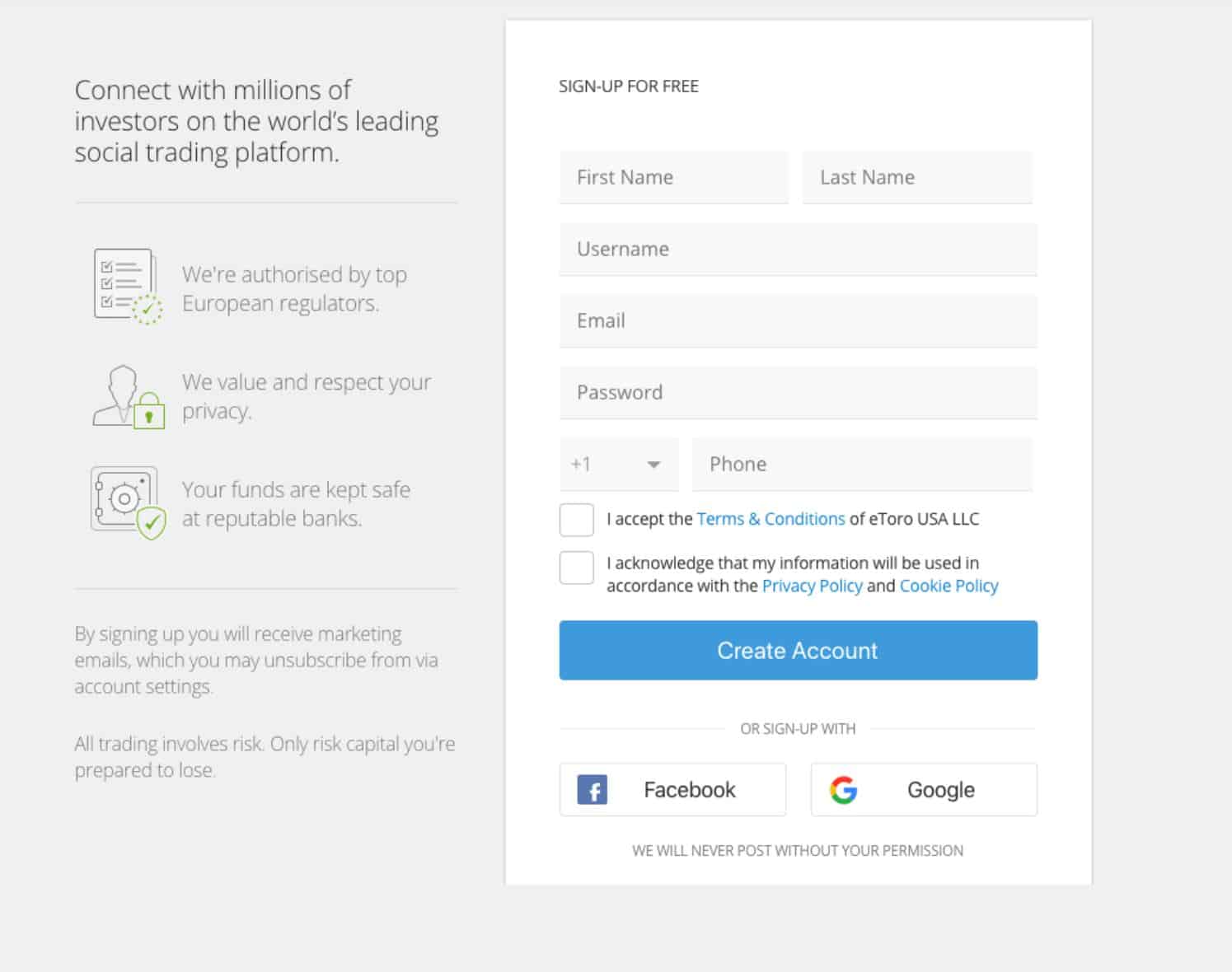

1. Open an account with eToro – To get started with eToro, head to the broker’s website and click ‘Join Now.’ You’ll need to enter a new username and password, then fill in some personal details about yourself. You can also create an eToro account by signing up with your Google or Facebook login.

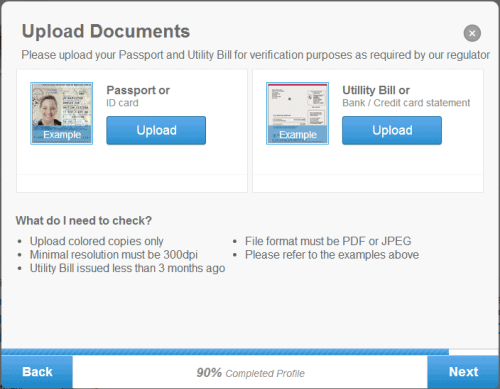

2. Upload ID – eToro requires customers to follow Know Your Customer (KYC) rules. As a result, you are required to upload a copy of your passport or driver’s license along with proof of your address – such as a bank statement or utility bill.

3. Deposit – eToro requires you to fund your new account with a minimum deposit of at least $10. Debit card transfers are instant, while bank transfers take up to 48 hours – there is a 0.5% fee to deposit GBP.

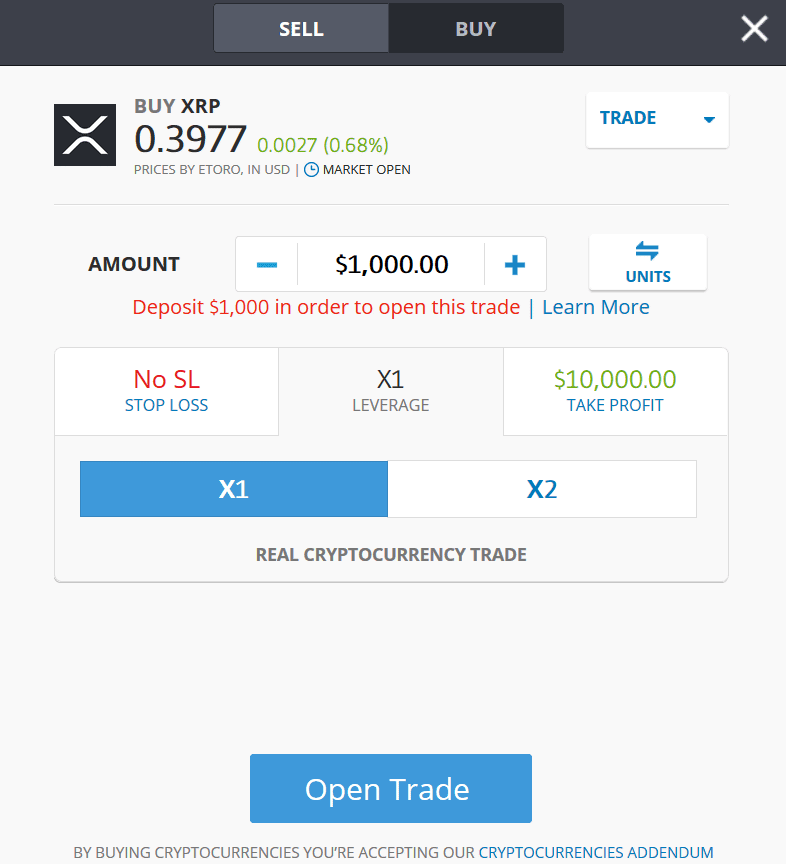

4. Buy XRP – From the eToro dashboard, use the search box at the top of the page to search for ‘XRP.’ When it appears, click ‘Trade’ to open a new order form. Enter the amount of Ripple you want to buy (in USD). When you’re ready, click ‘Open Trade’ to buy XRP stock with eToro – all crypto trades come with a 1% fee.

Cryptoassets are highly volatile and past performance isn’t an indicator of future success. Invest at your own risk.

Where to Buy XRP in the UK – Top List

Choosing where to buy XRP is an important decision. Ideally, the best place to buy XRP will offer low fees, top-tier trading tools, and a built-in XRP wallet. You’ll also want to look for a Ripple broker that accepts multiple payment methods.

With that in mind, let’s take a closer look at the best places to buy Ripple today.

1. eToro – Overall Best Place to Buy XRP

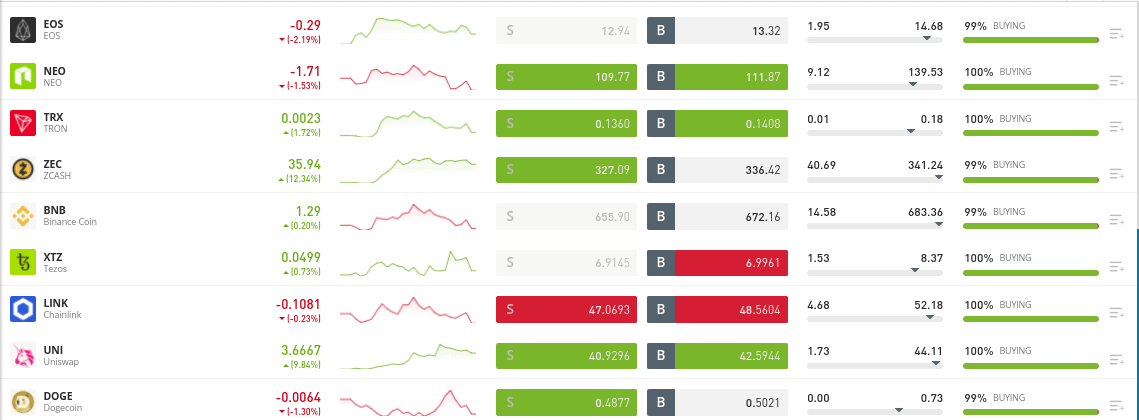

eToro is a popular financial service platform with more than 25 million global users. The platform provide exposure to different assets – not only can you buy heavyweight cryptoassets like Bitcoin, Ethereum, and Binance Coin- but Defi coins like Aave, Kyber Network, and Augur.

There is also the option to purchase other financial instruments such as shares, ETFs, CFDs, commodities, and more.

Past performance is not an indication of future results.

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

eToro also has a Copy Trading feature that lets you copy the trades of some of the top traders available, as well as a Smart Portfolio management tool.

In terms of fees, few Bitcoin brokers can compete with eToro, it charges a 0.5% fee to deposit GBP and then a 1% for all crypto trades.

Pros

- 1% crypto fee

- 70+ cryptos available

- Accepts debit cards and bank transfers

- Minimum deposit of just $10

- Over 2,400 global shares and 250 ETFs

- CFD markets also offered

- Social network with copy trading

Cons

- Withdrawal fee of $5

- The platform is denominated in US dollars

Don’t invest in crypto assets unless you’re prepared to lose all the money you invest.

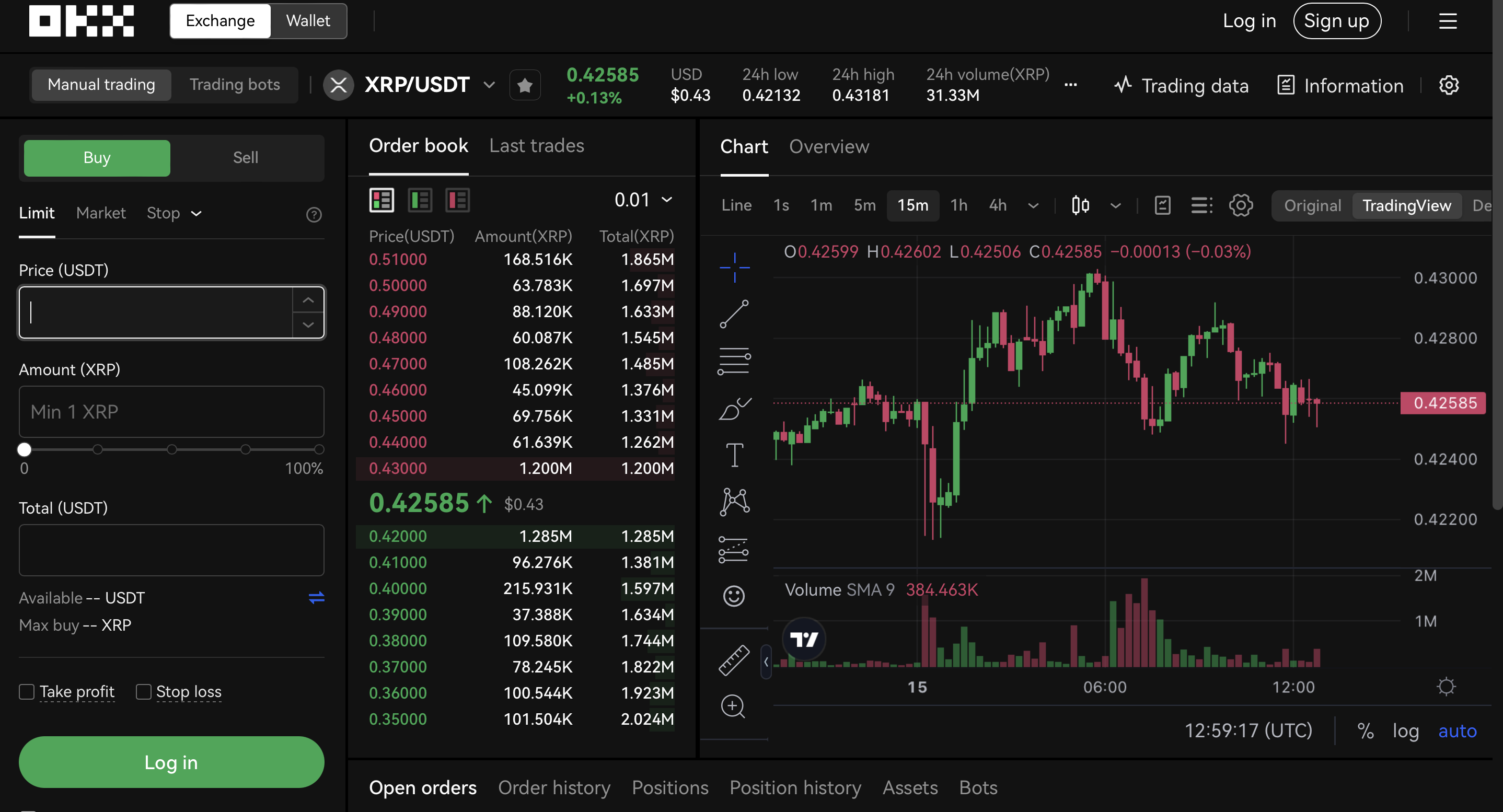

2. OKX – Crypto Exchange Featuring Copy Trading

OKX is a popular cryptocurrency exchange known for its robust features and comprehensive selection of digital assets. The platform offers a wide range of cryptocurrencies, including Ripple (XRP), allowing users in the UK to easily buy and trade XRP tokens.

OKX stands out for its competitive fee structure, providing cost-effective trading opportunities for XRP. The platform supports various payment methods, such as PayPal, Neteller, and debit cards, making it convenient for users to deposit and withdraw funds.

Additionally, OKX prioritizes security and compliance, implementing strict measures to protect user assets and personal information. The exchange adheres to regulatory standards and employs advanced security protocols to ensure a safe trading environment for XRP and other cryptocurrencies.

With its user-friendly interface and advanced trading features, OKX caters to both beginner and experienced traders. The platform offers a seamless trading experience, providing real-time market data, advanced charting tools, and various order types to suit different trading strategies.

Pros

- Buy outright or trade CFDs

- Copy Trader function

- Multiple payment options accepted

Cons

- Lack of integration with some popular third-party trading platforms

- Relatively higher fees compared to some competitors

3. Bybit – Buy & Sell XRP With Low Trading Fees

Bybit is a leading cryptocurrency exchange known for its extensive trading features and user-friendly interface. It offers a reliable platform for buying Ripple (XRP) and a range of other cryptocurrencies.

Bybit provides an effortless trading experience, allowing users to execute trades quickly and efficiently. The exchange supports various order types and provides advanced trading tools like leverage trading to enhance users’ trading strategies.

One of the standout features of Bybit is its competitive fee structure. The platform offers low trading fees, which makes it an attractive option for investors looking to buy XRP. Additionally, Bybit ensures the security of user funds through stringent security measures, including cold storage and two-factor authentication.

Bybit also has a responsive customer support team, which is available 24/7 to assist users with any inquiries or issues they may encounter. Overall, Bybit is a reliable and efficient exchange for buying Ripple (XRP) and offers a comprehensive trading experience for cryptocurrency enthusiasts.

Pros

- Customizable indicators for advanced traders

- Low trading fees

- Occasional discounts for users

Cons

- Relatively new exchange

- Not regulated in all jurisdictions

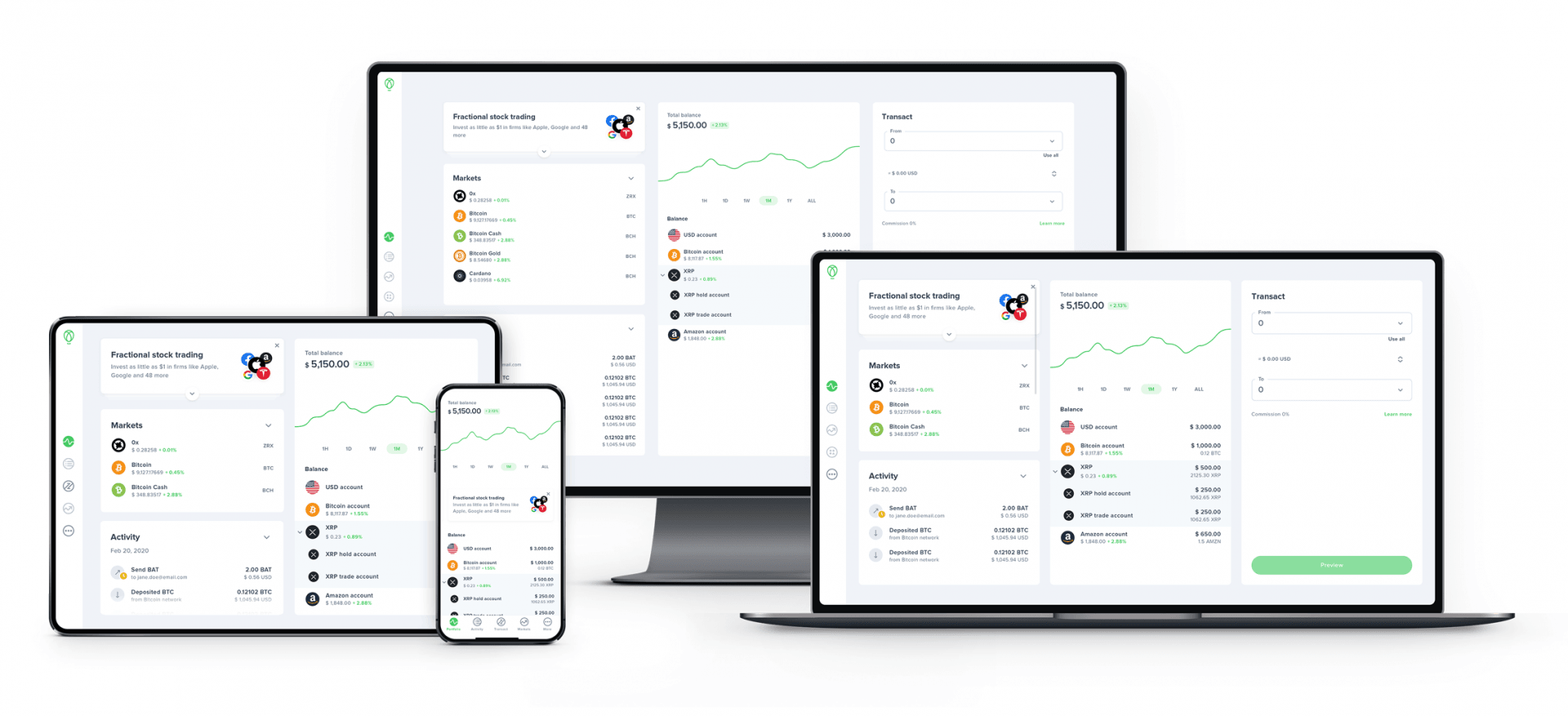

4. Uphold – Easy Web & App Trading

Alongside their website they also have an app on Google Play and the App Store for Android and iOS users.

Uphold charge a spread of 0.85% when buying Bitcoin, and 1% when selling.

Some of the other popular assets you can invest in with Uphold include Apple stock, Amazon, AT&T, Tesla, Gold, Silver, Platinum, Palladium and more. Their motto is ‘anything to anything’ trading.

They also open up investing to anyone through fractional stock trading – you can invest as little as $1 in companies like Google. Unlike some online stockbrokers where you are required to put up a large amount of capital to get started.

Pros

- No deposit or withdrawal fees

- Debit card pays 2% cashback for using crypto

- Also buy and trade stocks, metals, fiat currencies

Cons

- Paypal not yet supported

- Fewer crypto assets supported than larger exchanges

5. Binance – Top-Rated Crypto Exchange to Buy XRP

Binance is the world’s largest cryptocurrency exchange. The company handles tens of billions in daily trades, and it has hundreds of cryptocurrencies available for customers. Of course, unlike eToro, Binance doesn’t offer exposure to other asset classes.

What Binance lacks in asset diversity, it more than makes up for in its singular focus. The company offers crypto transactions and trading at incredibly competitive commissions and fees, and you’ll find that working on Binance is pretty impressive.

Beyond that, Binance offers leveraged trading to professional traders looking to take bigger bets. You get dedicated customer service, and Binance even offers a staking service for you to lock your coins and get rewards. That said, Binance’s trading platform is still too complicated. So, beginners might not find it so easy to navigate.

Pros

- Impressive customer service

- Sophisticated trading available

- Competitive trading and non-trading fees

Cons

- Complex user interface

6. Coinbase – Largest Crypto Exchange in the United States

Coinbase is the largest cryptocurrency exchange in North America and the most valuable publicly listed crypto company.

The exchange is based in San Francisco, and it controls the American crypto market pretty comprehensively.

With Coinbase, you get just about the same benefits as Binance. The exchange operates on the same scale as the latter, providing a suite of additional services that extend beyond just buying and selling. You can trade and stake, and big companies can even enjoy Coinbase’s custody service.

Coinbase also does one better than Binance by providing a much better user interface, making it easier for beginners to use the service. Sadly, it’s not all roses with Coinbase. The exchange has some confusing fees, with can vary from 0.5% to 4.5% depending on factors like the asset itself, the channel, and the transaction size.

Pros

- Friendly user interface

- Low minimum balance of $2

- Fund insurance in the event of a hack

Cons

- Complex fee structure

7. AvaTrade – Legacy Crypto Trading Platform for Investors

AvaTrade is a forex and CFD broker that has been operating since 2006. It is regulated by several financial authorities, including the Irish Central Bank.

You get several benefits from AvaTrade. The account opening process is easy and fully digital, and AvaTrade provides several deposit and withdrawal options – all of which are free.

The user experience is also top-notch here, and AvaTrade provides a broad range of research and educational tools for you if you need some work before you make your investment.

As for cons, AvaTrade has a high inactivity fee of $50 per quarter. Its forex trading fees are also higher than those of most other brokers.

Pros

- Impressive research tools

- Easy account opening process

- Regulated brokerage tool

Cons

- High inactivity fee

8. Revolut

Revolut is a neobank based in London. The FCA regulates it, and it provides a wide array of services that anyone will find useful.

When it comes to crypto, Revolut provides the basics – transactions, payments, and trading. The service is popular for its lush user interface, making it easy for beginners to get started. Revolut provides exposure to different currency pairs, and there are also physical cards that let you spend your money at merchants worldwide.

For all of this, Revolut struggles in some areas. For one, there are no advanced trading services. The service’s customer support is also not the best, and you have to deal with many fees – trading fees, card fees, SWIFT transfer fees, etc.

Pros

- Top your account up in several currencies

- Perks for subscription options, including travel insurance and more

- Available cards to help you with payments

Cons

- Poor customer service

9. Changelly

Changelly is a cryptocurrency exchange that allows users to sell, buy, and exchange up to 170 different crypto assets.

Based in Prague, Changelly has been operating since 2013. It provides a simple-to-use platform, all the tools you need to get the job done.

And some of the best rates in the market. Changelly also accepts multiple payment methods and forms, and it supports some non-major fiat currencies as well. On the flip side, the exchange doesn’t have up-to-standard research tools, and its customer service isn’t the best.

Pros

- Straightforward exchange platform

- Best rates in the market

- Non-custodial exchange gives you control of your funds

Cons

- Inadequate customer support

10. CryptoRocket

Last but not least is CryptoRocket – a crypto-focused exchange that also provides exposure to asset classes like forex, stocks, and indices.

CryptoRocket is based in St. Vincent and Grenadines, and it provides several impressive benefits. These include no withdrawal or deposit fees and commission-free trading when using its Live Trader feature.

There are over 30 cryptocurrencies available here, and CryptoRocket gives you access to different deposit and withdrawal options. Lastly, advanced traders can enjoy up to 1:500 leverage on margin trading. However, CryptoRocket isn’t regulated, making it a risky platform.

Pros

- Commission-free trading available

- Up to 1:500 leverage

- Extensive educational materials

Cons

- No regulatory information available

What is XRP?

First, Ripple is entirely pre-mined. That means that generating new XRP tokens doesn’t require enormous mining operations like Bitcoin. Transactions on the Ripple blockchain are validated by consensus among users, and new XRP is released to users monthly based on how many transactions are taking place using Ripple.

Another important difference between XRP and other top cryptocurrencies is that the Ripple blockchain is fast. When you want to send XRP to someone, the transaction is processed on the Ripple blockchain instantly. In contrast, sending money with Bitcoin or Ethereum can take seconds to minutes and is generally quite expensive.

Ripple Labs

Unlike other cryptocurrencies, which are entirely decentralized, XRP is partially controlled by the company that created it: Ripple Labs. Ripple Labs doesn’t have control over XRP transactions, but it does work to maintain the blockchain and push for the mainstream adoption of Ripple.

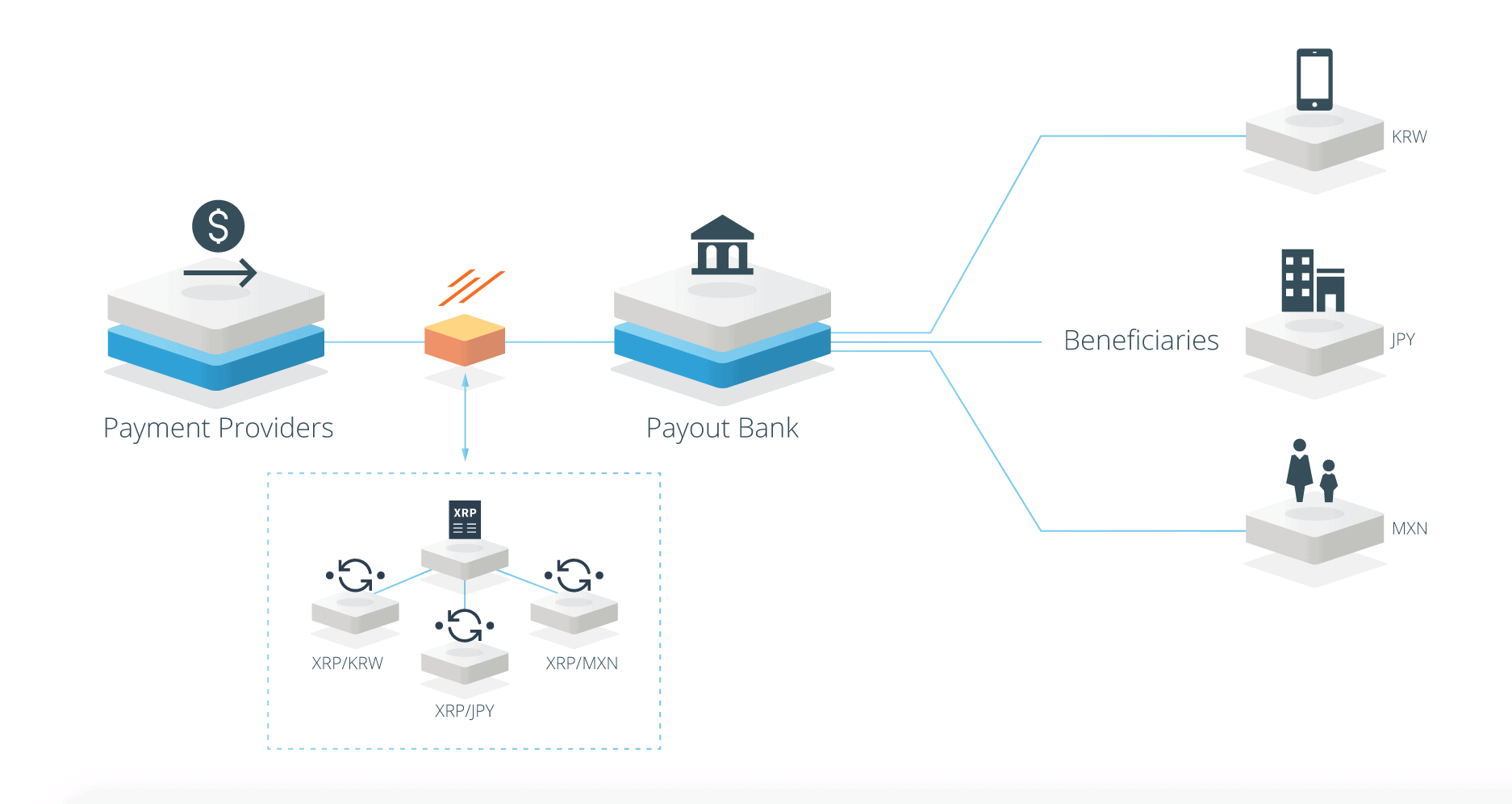

To that end, Ripple Labs has created a network of more than 200 financial institutions – including Santander, MoneyGram, Westpac, and American Express – that use Ripple to facilitate borderless payments.

It’s important to note that ‘Ripple’ refers to both XRP, the digital currency that trades over the Ripple blockchain, and Ripple Labs.

Why Buy XRP? XRP Analysis

Why should you buy XRP stock when there are so many cryptocurrencies vying for attention? This cryptocurrency was, for most of last year, the third-largest cryptocurrency behind Bitcoin and Ethereum. While it’s now fallen to the 7th largest cryptocurrency by market cap, there are still several reasons to be bullish about XRP.

Better Global Payments

One of the most celebrated aspects of Bitcoin is that it enables truly borderless payments – making it easier for anyone to send money anywhere in the world. However, it doesn’t always do this seamlessly. Bitcoin payments can take several minutes to process, and there are often high transaction fees.

Ripple offers borderless payments but without the high transaction fees or waiting times of Bitcoin. The Ripple blockchain can handle a higher volume of transactions and push them through instantly thanks to its consensus-based verification system. To put Ripple’s success in perspective, this cryptocurrency can process 1,500 transactions per second – compared to just 7 transactions per second for Bitcoin and 15 transactions per second for Ethereum.

Integration with the Financial System

Another advantage Ripple has over Bitcoin, Ethereum, and other cryptocurrencies is that major financial institutions use it. Ripple has created a global payment network that includes over 200 banks, credit card companies, and e-payment providers. That makes it easier for them to send money around the world while lowering transaction costs.

While many cryptocurrency enthusiasts look down on Ripple, for this reason, banks and credit card companies are likely to play a role in deciding which digital currencies see widespread use. So, Ripple might not be as decentralized as other blockchain-based cryptocurrencies, but it could be more widely used. Ultimately, that should be the most important thing for XRP investors.

SEC Troubles

One thing that you’ll want to note before you buy XRP is that the coin has been in trouble with the US Securities and Exchange Commission (SEC) recently. The SEC alleged that since Ripple is released regularly instead of mined, it should be listed as security. Basically, the SEC thinks that XRP is a stock, not a currency.

As a result, XRP has been delisted from several cryptocurrency exchanges, including Coinbase, the largest crypto exchange in the US. More importantly, that’s prevented any new financial companies from signing on to use XRP for payments.

Until this dispute is resolved, Ripple will remain in limbo. That hasn’t stopped the XRP price from rising along with other cryptocurrencies in recent months, but it’s worth keeping in mind when deciding whether to buy Ripple.

Choosing the Right Broker When Investing in XRP

Today, there are hundreds of options available for people who want to buy XRP online. However, you need to consider which of those is right for you. These factors will help you out:

1. Fees

There’s always a financial incentive when crypto is involved. Make sure your broker has acceptable fees for things like deposits, withdrawals, transfers, and trading.

Payment gateways: A good crypto broker will support different payment gateways, allowing you to deposit and withdraw your money however you please.

2. Customer support

If any issues arise, a customer support agent should be accessible and able to offer assistance.

Trading facilities: If you want to trade XRP, then you want a broker that has proper trading facilities like leverage and margin trading.

3. Safety

The safety of your funds is the most important thing when it comes to crypto. Don’t compromise on this.

Responsible Investing: An Important Note For XRP Investors

All cryptocurrencies carry risk. The crypto market is admittedly more volatile than most others, and you will need to be very careful as you navigate it. To wit, keep the following tips in mind:

- Always research: The market changes at will, and you need to be ready for that. Before investing, research to know when to enter and exit the market. This will give you the confidence you need to proceed.

- Choose a strategy: Some people buy and HODL, some people are day traders. Whatever works for you, stick to it and be patient.

- Seek expert opinions: Always ask for opinions before investing. You can check on review sites and more to get this. They have experts who monitor the market and give their takes to corroborate their work with your personal research.

- Set a target for your investment: Be disciplined to know when you’ve hit a short or long-term investment goal. Don’t get greedy.

XRP Mining: Is It Possible to Mine XRP?

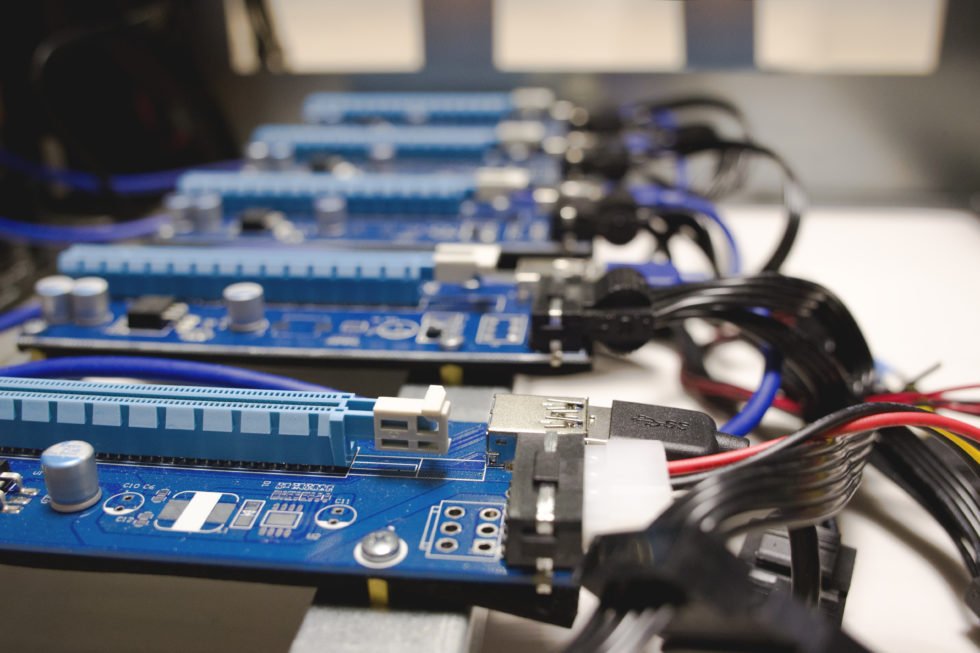

Mining is a system where validators verify transactions in order to release more cryptocurrencies and keep a specific blockchain functional. It serves a dual role, facilitating transactions and providing a framework for introducing a new currency into circulation.

However, XRP operates quite differently. The asset is pre-mined, with the XRP Ledger initially creating 100 billion tokens. Every now and then, some of these tokens are released into circulation.

While it is impossible to mine XRP, you could mine other assets like Bitcoin or Ethereum and exchange them for XRP. However, the process is usually capital intensive as you will need to pay for specialized mining equipment (GPUs and ASICs) and deal with a high electricity cost.

Minimizing Risk in XRP Investment

With so much talk about its volatility, it’s important to stay safe when investing in XRP. These tips should help you out:

- Keep researching: Remember that investment is a continuous journey. You have to keep researching to know how to react to market trends. Also, check out review sites and their expert predictions.

- Use a stop loss: In case of a market downturn, a stop loss will help to minimize your losses. This is very important.

- Watch the market: The crypto market turns on a dime. You want to keep checking the news to see what is happening with XRP, so you can make moves when sentiment turns sour.

- Diversify Investments: Instead of focusing on just one investment, you should diversify. As the saying goes, do not put all your eggs in one basket. A diversified crypto portfolio refers to investing in different digital assets to reduce the risk factor in case one or more fails to perform.

- Avoid FOMO: FOMO means the Fear of Missing Out. This term is popular in the crypto space and refers to the craze people have in rushing to invest in an asset. When people jump into investment only for its fun or because it is trending, then that is FOMO. You do not have to do this. You should carry out your research to determine if the asset is safe to invest in before going ahead.

Ripple Trading Robots

Another way of minimizing risk when investing in cryptocurrency is to take advantage of trading robot software. These bot programs automate your trades and open and close positions faster than a human investor can.

However, the technology is unregulated, meaning you should only deposit funds you can afford to lose. Our review team has a vetting system to help filter out genuine trading software from the rest. Some of the notable trading robots that we’ve reviewed include:

Ways of Buying XRP

There are several different ways for how to buy XRP. Let’s take a look at some of the most popular XRP payment methods.

Buy XRP with PayPal

You can buy Ripple with PayPal by using an exchange that accepts PayPal payments. Alternatively, you can use PayPal to buy Bitcoin and then use any cryptocurrency exchange to buy Ripple with Bitcoin.

Buy XRP with Credit Card

You can also buy XRP with a credit card. Capital.com, and Binance all allow you to fund your trading account with a Visa or Mastercard credit card.

Buy XRP with Debit Card

If you want to buy XRP with a debit card or bank transfer, you can do that, too. All of the brokers we highlighted accept Visa or Mastercard debit cards as well as electronic bank transfers.

XRP Price

The XRP price, like the prices of many cryptocurrencies, has been highly volatile over the coin’s history.

After trading at a fraction of one cent for many years, Ripple exploded to over $3.34 between December 2017 and January 2018. This coincided with the 2017-2018 high in Bitcoin and Ethereum, which marked the first time that many investors became interested in cryptocurrencies.

Ripple soon crashed, however, following the same pattern as Bitcoin. For much of 2018, the XRP price was below $0.50 per token, and the coin was valued at just $0.19 at the start of 2020. Despite this, Ripple was the 3rd-most valuable cryptocurrency, after Bitcoin and Ethereum, for much of this period.

When the COVID-19 pandemic hit, XRP initially fell to a multi-year low of less than $0.14 per coin. The price rebounded to $0.30 by August but remained relatively stable for most of the year.

Then, in November 2020, more than doubled in value to $0.65 per coin. However, the bullish momentum was cut short by the SEC’s charges that Ripple failed to register XRP as a security. XRP fell to $0.22 per token, only to spring back upwards in February 2021.

After Elon Musk sparked renewed interest in cryptocurrency in April, Ripple shot upwards to $1.81 per coin. The XRP price has bounced up and down violently over the past month and currently sits at $1.62. Ripple has a total market cap of $56.3 billion.

XRP Price Prediction

It’s difficult to say with any certainty where the price of XRP is headed next. Although the recent jump in Ripple’s price is encouraging, investors had seen this same price action before in December 2017. That time, the price of Ripple was twice as high, and the enthusiasm was followed by a three-year period of bearish activity.

While history could repeat itself, it won’t necessarily. The price of XRP would almost certainly be buoyed if Ripple can settle its argument with the SEC since that would allow more financial institutions to start using Ripple for international payments. In the meantime, the currency is in limbo – it cannot attract new financial firms and it’s unclear if it will face further regulatory action in the US.

For now, it looks as though the XRP price will continue to experience volatility. The coin has experienced swings of nearly 40% from one day to the next in recent weeks, and that pattern is likely to remain.

Read our longer article on Ripple price predictions.

Investing in XRP vs Trading XRP

Ripple is suitable for both trading and investing, although both carry a significant amount of risk.

For long-term investors looking to buy Ripple, a clear bull case is to be made for the coin. Financial institutions are adopting it over Bitcoin and Ethereum, which can pave the way for widespread adoption. Even if XRP becomes a coin primarily used by financial institutions for international payments, that would be an enormous win for Ripple investors.

On the other hand, the SEC’s regulatory action against Ripple poses an existential threat to the coin’s adoption. If you believe that XRP can prevail over the SEC, now could be a good time to invest. However, if you think that the SEC could force changes to the way the Ripple blockchain is structured, then it may be best to wait.

The current volatility also presents a lot of opportunities for trading XRP. The coin’s wild price swings mean that successful day trades can earn upwards of 20% in a single position. However, be careful to protect your downside. The same volatility means that it’s possible to lose a significant amount if a Ripple trade goes against you.

XRP Reddit – Keep Up to Date with XRP News

One of the best ways to stay on top of the XRP market is to follow the XRP Reddit group. This online message board is a hub for Ripple investors and one of the first places that breaking XRP news is shared. If you’re interested in trading or investing in XRP, the XRP Reddit group is worth watching.

XRP vs. Other Cryptocurrencies

XRP vs. Bitcoin

Bitcoin is the most popular cryptocurrency. The asset fills multiple roles, working as an investment option, a base for transactions, and means of payment.

It should be noted that XRP is quite more effective than Bitcoin when it comes to payments and transactions. But, Bitcoin’s greater popularity means that most businesses would prefer to have it than XRP.

XRP vs. Ether

Ether is the second most valuable cryptocurrency. Like XRP, Ether’s value is primarily tied to something- the adoption of the Ethereum blockchain. With sub-industries like decentralized finance (DeFi) and non-fungible tokens (NFTs) using the Ethereum blockchain, Ether is in a pretty strong place.

XRP vs. Litecoin

Litecoin is also a payment-focused cryptocurrency. It was developed to be the “lite” version of Bitcoin, focusing on payment efficiency and transaction speed.

Mostly, however, Litecoin functions as a speculative investment like many other cryptocurrencies. XRP remains a superior tool for transfers.

XRP vs. Libra

Libra is the stablecoin project developed by social media giant Facebook. The company announced the asset in June 2019, and it planned to launch the asset in June 2020.

So far, Libra is yet to join. Regulators worldwide have been concerned about its implications on financial stability and Facebook’s sketchy record on data privacy.

UK Taxation on XRP Earnings

UK traders and investors are subject to capital gains tax (CGT) on their profits when they sell, which need to be reported annually by self-assessment.

In October 2021, the HMRC announced it will be sending nudge letters to crypto investors to remind them to report crypto sales on their yearly tax returns. The first £12,570 of income is not taxed, and the tax rate for income above that is 10% if you are employed in the basic rate income band (up to a £50,270 salary).

Conclusion – eToro – Best Crypto Broker to Buy XRP

XRP is one of the most popular cryptocurrencies in the world. In addition to being used by individual cryptocurrency investors, this digital currency is used by over 200 financial institutions to facilitate international payments. Although an SEC investigation has recently cast a cloud over Ripple, the coin could still become one of the leading tokens for blockchain-based payments in the future.

Now that you know how to buy XRP stock and where to buy XRP, it’s time to get started. We recommend eToro as the best broker to purchase XRP.

FAQs

Should I buy XRP?

XRP is a highly volatile cryptocurrency, so it should be considered a high-risk investment. That said, the coin has the potential to be one of the main cryptocurrencies used for international payments.

Where can I buy XRP?

You can buy XRP at a cryptocurrency exchange like eToro or Binance. You can also speculate on the price of XRP with CFDs using a trading platform like Capital.com.

What is XRP worth?

As of July 2021, a single XRP token is priced at $0.559. The entire Ripple project has a market cap of $25.6 billion.

What is XRP stock?

XRP is a cryptocurrency, much like Bitcoin. There is no XRP stock. That said, the US Securities and Exchange Commission has alleged that XRP is a stock and not a currency. The case remains unresolved.

What is Ripple Labs?

Ripple Labs is a San Francisco-based company that developed Ripple in 2012. Today, Ripple Labs manages the Ripple blockchain and coordinates a network of financial institutions that use XRP for international payments.

Is Ripple a good investment?

While the financial market is unpredictable, Ripple is still a good investment opportunity. The continuous rate at which financial institutions are adopting Ripple means it is headed for growth. Ripple also has a chance of prevailing in the US Securities and Exchange Commission lawsuit. Although we think XRP is a good investment overall, investors still need to weigh the pros and cons before going in.

Why is Ripple Cryptocurrency so cheap?

There have been some reasons why Ripple's price is lower compared to other major cryptocurrencies. One of them is Ripple's pending lawsuit with the US SEC. The case had caused many exchanges to delist XRP, and this caused the price to drop by over 50%. Since the SEC filing in December, XRP has also shed a lot of weight.

Is XRP a good investment in 2021?

Given its low price and increasingly mainstream adoption, XRP is a good investment. It has a potential for massive gains in the future.

Can you still buy XRP on Coinbase?

Coinbase is one of the exchanges that delisted XRP due to the ongoing SEC lawsuit. Therefore, you cannot buy XRP directly from Coinbase until the exchange relists the token.

What will XRP be worth in 2030?

Analysts and crypto enthusiasts have made several predictions of what XRP would be worth in years from now, but only a few forecasts include the year 2030. One of the few predictions that did not stop in 2025 is Trading Education. According to this website, XRP would trade at $22.90 by 2030.

Is XRP a good Cryptocurrency?

XRP is a highly volatile token and should be considered a high-risk investment. However, the coin has the potential to be one of the main cryptocurrencies used for international payments.